Radiopharmaceuticals Market Size

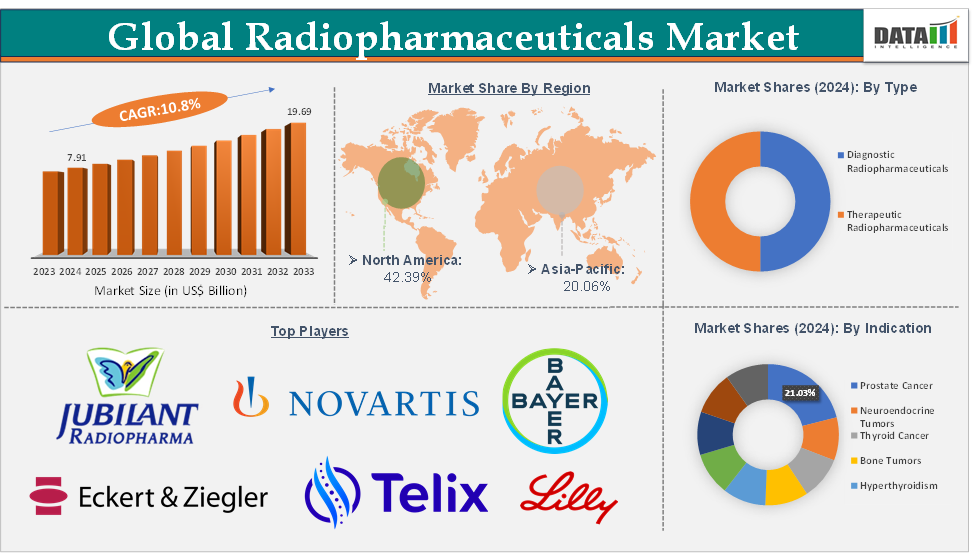

The global radiopharmaceuticals market size reached US$ 7.91 billion in 2024 from US$ 7.20 billion in 2023 and is expected to reach US$ 19.69 billion by 2033, growing at a CAGR of 10.8% during the forecast period 2025-2033.

Market Overview

The global radiopharmaceuticals market is experiencing rapid expansion, driven by a surge in demand for precision diagnostics and targeted radioligand therapies. Key industry players such as Novartis, Bayer, and Eli Lilly are capitalizing on this growth through strategic acquisitions, R&D investments, and integrated product development. Geographically, North America leads the market in terms of revenue and innovation, while Asia-Pacific is registering the fastest growth, fueled by expanding healthcare access and regulatory support. Looking ahead, the continued convergence of diagnostic and therapeutic agents, alongside improvements in isotope generation, regulatory pathways, and combination regimens, is poised to further propel the market.

Executive Summary

Market Dynamics

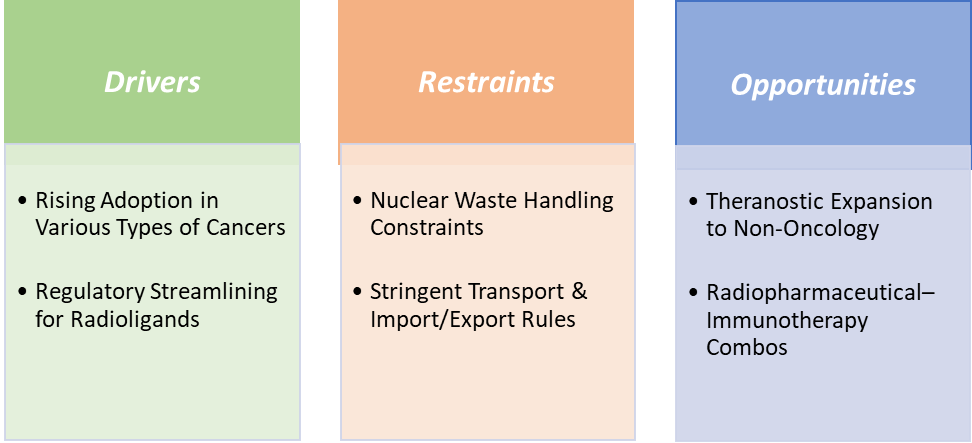

Drivers:

Rising adoption in various types of cancers is significantly driving the radiopharmaceuticals market growth

The rising adoption of radiopharmaceuticals in multiple cancer types is a significant driver of market growth, as these agents uniquely combine high diagnostic accuracy with targeted therapeutic potential. In prostate cancer, PSMA-targeted PET tracers such as ^68Ga-PSMA-11 and ^18F-DCFPyL have become pivotal in staging and recurrence detection, while the paired therapy ^177Lu-PSMA-617 (Pluvicto) has demonstrated significant survival benefits in metastatic castration-resistant cases.

Neuroendocrine tumors (NETs) similarly benefit from the theranostic pairing of ^68Ga-DOTATATE for imaging and ^177Lu-DOTATATE (Lutathera) for peptide receptor radionuclide therapy (PRRT), offering both precise localization and effective tumor control. In thyroid cancer, ^131I remains a gold-standard therapy, especially in differentiated subtypes, providing a decades-long proof of clinical and commercial viability. Liver cancers have seen growing use of ^90Y microspheres for selective internal radiation therapy (SIRT), which delivers high-dose beta radiation directly to hepatic tumors while sparing healthy tissue.

Additionally, radiopharmaceutical use is expanding into breast cancer, where agents such as ^89Zr-trastuzumab are in trials for HER2-positive tumor imaging, and into glioblastoma, with iodine- and lutetium-labeled agents targeting LAT1 transporters. The broadening spectrum of cancer applications is not only increasing patient volumes eligible for radiopharmaceutical-based management but also encouraging oncologists to integrate these agents earlier in treatment algorithms.

Combined with precision medicine trends, this multi-cancer adoption is catalyzing sustained demand, prompting pharmaceutical majors and isotope suppliers to expand capacity, diversify pipelines, and accelerate R&D collaborations ultimately propelling the global radiopharmaceuticals market toward robust growth in the coming years.

Restraints:

Nuclear waste handling constraints is hampering the growth of the radiopharmaceuticals market

Nuclear waste handling constraints are a significant barrier to radiopharmaceutical market growth because every stage of production, transport, and clinical use generates radioactive byproducts that require specialized disposal. For instance, spent generator columns from ^99Mo/^99mTc systems, unused doses of short-lived isotopes, and contaminated consumables (syringes, vials, shielding) must be treated as radioactive waste. This necessitates licensed storage facilities, trained radiation safety personnel, and compliance with stringent national regulations, which can be costly and time-consuming.

Smaller hospitals and imaging centers, especially in emerging markets, often lack the infrastructure for proper waste containment and decay storage, forcing them to rely on centralized facilities, slowing turnaround times and limiting access to time-sensitive tracers like ^18F and ^68Ga. These challenges can discourage new entrants, restrict the number of approved radiopharmacy sites, and increase overhead costs for existing providers. Ultimately, inefficient or costly nuclear waste handling systems reduce scalability, limit geographical reach, and dampen investment in new radiopharmaceutical production facilities, thereby constraining overall market expansion.

For more details on this report – Request for Sample

Segmentation Analysis

The global radiopharmaceuticals market is segmented based on type, radioisotope, indication, end-user, and region.

The prostate cancer segment from the indication is dominating the radiopharmaceuticals market with a 21.03% share in 2024

The prostate cancer segment is the dominant indication in the radiopharmaceuticals market due to the rapid global adoption of PSMA-targeted theranostic approaches. Imaging agents like ^68Ga-PSMA-11 and ^18F-DCFPyL have revolutionized disease staging and recurrence detection by offering superior sensitivity compared to conventional imaging, enabling earlier and more precise treatment planning. On the therapeutic side, ^177Lu-PSMA-617 (Pluvicto) has gained regulatory approvals in multiple regions after demonstrating significant improvements in overall survival and quality of life for patients with metastatic castration-resistant prostate cancer in the VISION trial. This success has prompted its integration into standard oncology workflows, leading to high prescription volumes in the U.S., Europe, and Australia.

Moreover, prostate cancer’s high global prevalence over 1.6 million cases expected to occur in 2025 according to the World Health Organization, which creates a large and recurring patient pool, especially in aging male populations. The strong clinical evidence, large addressable market, and increasing reimbursement coverage have solidified prostate cancer’s position as the largest revenue-generating segment in the radiopharmaceuticals industry, outpacing other cancer indications such as neuroendocrine tumors and thyroid cancer.

Geographical Share Analysis

North America is expected to dominate the global radiopharmaceuticals market with a 42.39% in 2024

North America is the dominant region in the radiopharmaceuticals market due to its advanced healthcare infrastructure, strong research ecosystem, and early adoption of cutting-edge nuclear medicine technologies. The U.S. hosts a dense network of cyclotrons, PET/SPECT facilities, and radiopharmacies, enabling efficient production and distribution of short-lived isotopes like ^18F, ^68Ga, and ^99mTc.

Regulatory support from the FDA, including accelerated approval pathways for theranostic agents such as ^177Lu-PSMA-617 (Pluvicto) and ^177Lu-DOTATATE (Lutathera), has fast-tracked commercialization. Leading companies like Novartis, Bayer and Eli Lilly have significant operational bases in the region, ensuring robust supply chains. High per-capita healthcare spending and broad insurance reimbursement encourage adoption of costly but effective radiopharmaceutical therapies, particularly in oncology.

Additionally, a large and growing patient pool for prostate cancer, neuroendocrine tumors, and cardiovascular conditions sustains demand. The presence of top-tier academic and research institutions such as the Mayo Clinic supports continuous clinical trial activity, further driving innovation. Combined with a mature regulatory framework, strong investment climate, and widespread clinical expertise, these factors solidify North America’s leadership in global radiopharmaceuticals market share.

Competitive Landscape

Top companies in the radiopharmaceuticals market include Novartis Pharmaceuticals Corporation, Bayer Corporation, Jubilant DraxImage Inc., Eckert & Ziegler, Telix Pharmaceuticals Limited, and Eli Lilly and Company, among others.

Report Scope

Metrics | Details | |

CAGR | 10.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Diagnostic Radiopharmaceuticals and Therapeutic Radiopharmaceuticals |

Radioisotope | Technetium-99m, Fluorine-18, Gallium-68, Gallium-67, Iodine-131, Lutetium-177, Yttrium-90 and Others | |

Indication | Prostate Cancer, Neuroendocrine Tumors, Thyroid Cancer, Bone Tumors, Hyperthyroidism, Myocardial Perfusion, Pulmonary Perfusion, Vascular Perfusion and Others | |

End-User | Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Academic & Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global radiopharmaceuticals market report delivers a detailed analysis with 58 key tables, more than 70 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here