Plasmid Purification Market Size and Trends

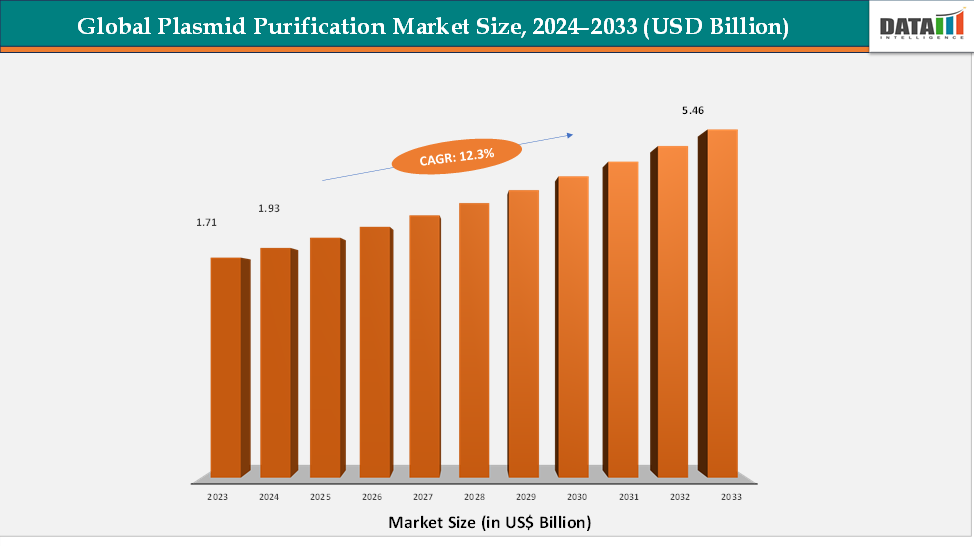

The global plasmid purification market reached US$ 1.71 billion in 2023, with a rise to US$ 1.93 billion in 2024, and is expected to reach US$ 5.46 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033. The global plasmid purification market is experiencing strong growth, driven by the expanding applications of plasmids in gene therapy, DNA vaccination, and recombinant protein production. The rising demand for high-quality plasmid DNA in cell and gene therapy development, along with the rapid advancement of mRNA-based therapeutics and vaccines, is significantly boosting market expansion. Continuous biopharmaceutical R&D investments, coupled with increasing adoption of advanced purification technologies such as anion exchange chromatography and automated systems, are improving yield, purity, and scalability. Additionally, the growing number of clinical trials utilizing plasmid DNA vectors, favorable regulatory support for genetic medicines, and the emergence of contract manufacturing organizations (CMOs) specializing in plasmid production are driving sustained growth. Together, these factors are positioning plasmid purification as a critical component in the evolving landscape of advanced biologics and gene-based therapeutics.

Key Market highlights

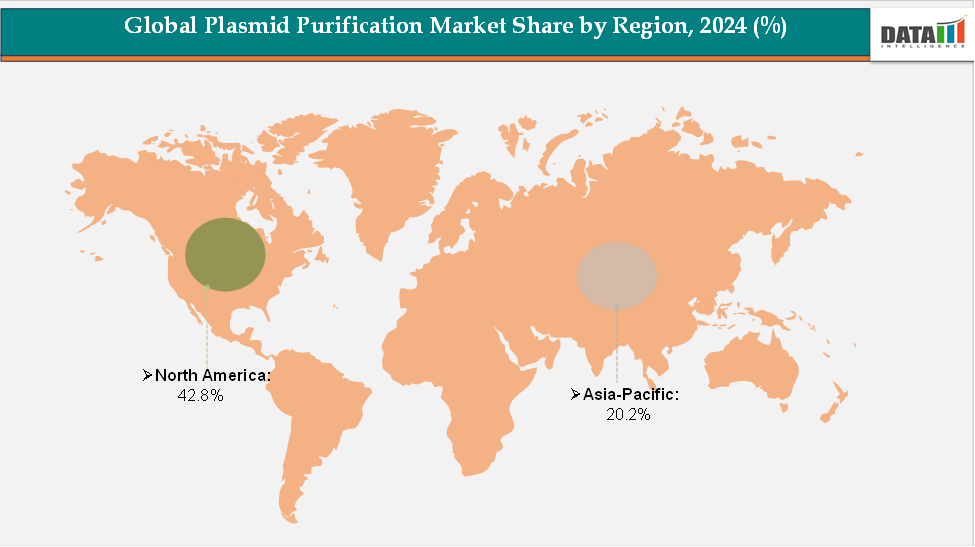

- North America dominates the plasmid purification market, accounting for 42.8% of global revenue. The region’s leadership is driven by strong biopharmaceutical manufacturing capacity, extensive gene therapy research, and the presence of major players investing in advanced plasmid production technologies.

- Asia-Pacific holds around 20.2% of the global share and represents the fastest-growing region, fueled by expanding biotechnology sectors in China, Japan, and India, rising demand for genetic medicines, and increasing government support for local biomanufacturing.

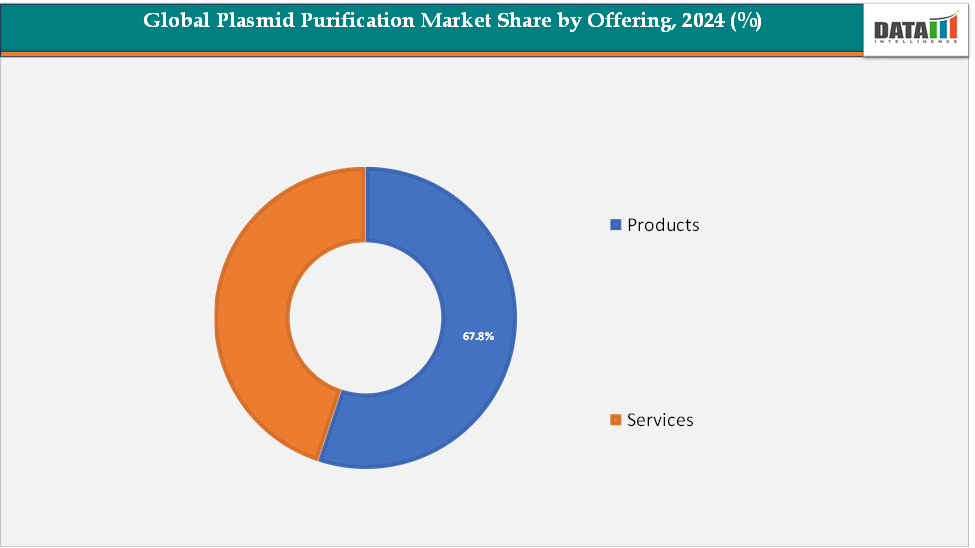

- By offering, the Products segment leads the market with approximately 67.8% share, supported by high demand for plasmid DNA kits, reagents, and purification systems essential for research and clinical applications, while Services are gaining traction through growing outsourcing to specialized CDMOs

Market Size & Forecast

- 2024 Market Size: US$ 1.93 billion

- 2033 Projected Market Size: US$ 5.46 billion

- CAGR (2025–2033): 12.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

For More Detailed information, Request for Sample

Market Dynamics

Driver: Rising Demand for Gene and Cell Therapies

The rising demand for gene and cell therapies is expected to significantly drive the Plasmid Purification market, as plasmid DNA serves as a fundamental building block in these advanced therapies. Plasmids are essential for delivering therapeutic genes, producing viral vectors, and enabling CRISPR-based gene editing, making high-quality plasmid purification critical for both research and clinical applications. With the rapid expansion of gene therapy pipelines targeting rare genetic disorders, cancer, and other complex diseases, the requirement for high-purity, scalable plasmid DNA is increasing. Moreover, the growing number of clinical trials and regulatory approvals for gene and cell therapies is intensifying the need for reliable purification processes that ensure safety, efficacy, and reproducibility. This surge in demand positions plasmid purification as a key enabling technology, driving market growth and stimulating investment in advanced purification solutions and automation technologies.

Restraint: High Production Costs

High production costs are expected to restrain the growth of the plasmid purification market, as the process of producing high-quality plasmid DNA is complex, resource-intensive, and requires stringent compliance with Good Manufacturing Practice (GMP) standards. The use of specialized reagents, advanced purification systems, and skilled personnel significantly increases operational expenses, making it challenging for smaller laboratories and emerging biotech companies to adopt these solutions at scale.

For more details on this report, Request for Sample

Plasmid Purification Market, Segmentation Analysis

The global plasmid purification market is segmented by type, application, distribution channel and region.

Offering: The products segment is estimated to have 67.8% of the plasmid purification market share.

The products segment holds the dominant position in the global plasmid purification market. This segment’s leadership is primarily driven by the extensive use of plasmid purification kits, reagents, and instruments across biopharmaceutical companies, contract manufacturers, and academic research institutions. Plasmid purification products, particularly high-throughput kits and automated systems, have become essential tools for producing high-quality plasmid DNA used in gene therapy, DNA vaccines, recombinant protein expression, and molecular diagnostics.

The increasing reliance on ready-to-use kits that offer reproducibility, scalability, and time efficiency is strengthening the demand for these solutions. Moreover, the continuous development of advanced magnetic bead–based and silica column–based technologies has enhanced yield and purity, further improving research productivity and clinical application outcomes. Major market players are also investing heavily in product innovation and automation to streamline plasmid isolation processes, making the Products segment the cornerstone of the global plasmid purification market.

The services segment is estimated to have XX% of the plasmid purification market share.

The services segment is emerging as the fastest-growing category in the plasmid purification market, propelled by the surging demand for large-scale, GMP-compliant plasmid DNA production. With the rapid growth of the cell and gene therapy industry, many biopharmaceutical companies are outsourcing plasmid manufacturing and purification activities to specialized Contract Development and Manufacturing Organizations (CDMOs) to meet stringent regulatory and quality requirements. This shift is largely driven by the need for scalability, cost efficiency, and expertise in complex purification processes required for clinical-grade plasmid DNA.

Service providers are expanding their capabilities to include high-throughput purification, quality testing, and customized plasmid design to support therapeutic and vaccine development pipelines. Additionally, the increasing number of collaborations and strategic partnerships between therapy developers and CDMOs is accelerating this segment’s expansion. As global investment in advanced therapies continues to rise, the Services segment is poised to record the highest growth rate, transforming from a support function into a critical pillar of the plasmid purification market ecosystem.

Plasmid Purification Market, Geographical Analysis

The North America plasmid purification market was valued at 42.8% market share in 2024

North America dominates the global plasmid purification market, driven by its strong biotechnology and pharmaceutical ecosystem, high R&D expenditure, and extensive adoption of advanced gene therapy and vaccine development platforms. The United States, in particular, accounts for the largest share due to the presence of major biopharmaceutical companies, contract manufacturers, and academic research institutions actively engaged in plasmid DNA–based therapeutics and mRNA vaccine production. The region’s early regulatory approvals for cell and gene therapies, coupled with the rapid expansion of GMP-certified plasmid manufacturing facilities, are further boosting market growth. Government funding for genetic research, ongoing clinical trials, and technological innovations in purification kits and automated instruments continue to reinforce North America’s leadership position. Moreover, growing partnerships between biotech firms and CDMOs for large-scale plasmid production are expected to sustain the region’s market dominance in the years ahead.

The Europe plasmid purification market was valued at 23.1% market share in 2024

Europe represents a significant and rapidly advancing market for plasmid purification, supported by strong academic research networks, expanding biomanufacturing capabilities, and favorable regulatory frameworks for advanced therapy medicinal products (ATMPs). Countries such as Germany, the U.K., and France are leading contributors, driven by robust investments in gene and cell therapy research as well as public–private collaborations aimed at strengthening plasmid DNA production capacity. The European Medicines Agency (EMA) has been proactive in facilitating approvals for gene therapies, creating a supportive environment for plasmid-based research and manufacturing.

In addition, the growing adoption of high-purity plasmid DNA in vaccine development, particularly after the success of mRNA platforms, has accelerated regional demand. The emphasis on sustainable bioprocessing technologies and GMP-compliant plasmid purification facilities is further enhancing Europe’s competitive position in the global market.

The Asia-Pacific plasmid purification market was valued at 20.2% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing market for plasmid purification, fueled by expanding biotechnology industries, rising investments in life science research, and increasing government support for biopharmaceutical innovation. Countries such as China, Japan, South Korea, and India are rapidly strengthening their plasmid DNA manufacturing capabilities to support local and international gene therapy, vaccine, and biosimilar production. The surge in R&D activity, lower manufacturing costs, and the establishment of new CDMOs across the region are attracting global partnerships and outsourcing contracts. In China and India, several biotechnology firms are scaling up GMP-grade plasmid purification facilities to meet rising global demand.

Furthermore, growing adoption of personalized medicine, academic–industry collaborations, and a focus on mRNA vaccine and viral vector development are propelling Asia-Pacific’s remarkable growth trajectory, positioning it as a key future hub for plasmid purification and production.

Competitive Landscape

The major players in the plasmid purification market include Merck KGaA, QIAGEN, Thermo Fisher Scientific, Inc., Takara Bio Inc., Promega Corporation, Zymo Research Corporation, MP BIOMEDICALS, New England Biolabs, MCLAB, Applied Biological Materials Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Offering | Products, Services |

| Grade | Molecular Grade, Transfection Grade | |

| Application | Cloning & Protein Expression, Transfection & Gene Editing, Others | |

| End-User | Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global plasmid purification market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here