Pharma and OTC Supplements Market Size

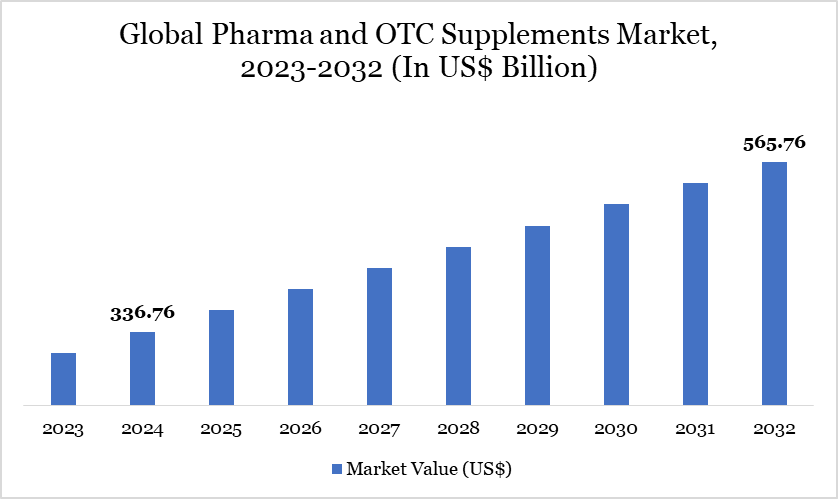

Global Pharma and OTC Supplements Market Size reached US$ 336.76 billion in 2024 and is expected to reach US$ 565.76 billion by 2032, growing with a CAGR of 6.70% during the forecast period 2025-2032.

The global pharmaceutical and OTC supplements market continues to experience robust growth, driven by rising health awareness, aging populations, and increased consumer preference for preventive healthcare. The market benefits from expanding healthcare access, greater consumer demand for preventive care, and innovations in drug and supplement formulations.

Pharmaceutical companies are increasingly entering the OTC and supplement space, blurring traditional category lines. Regulatory frameworks are evolving to support safe and effective cross-category products. Digital health platforms and e-commerce are accelerating global reach and consumer engagement.

Pharma and OTC Supplements Market Trend

Personalized nutrition is becoming a dominant trend in the global pharmaceutical and OTC supplements market as consumers seek tailored solutions for their unique health needs. Advancements in AI and data analytics allow for the development of individualized supplement regimens based on genetic, lifestyle, and biomarker information.

Companies are increasingly responding to the personalized nutrition trend by leveraging advanced technologies such as AI, machine learning, and genomics to create customized supplement solutions. In February 2025, Simon Ourian M.D, ventured into the wellness industry with the launch of personalized nutrition supplements, blending advanced AI technology with premium natural ingredients. This new product category aligns with the luxury skincare brand’s commitment to holistic wellbeing, offering consumers tailored solutions that cater to their individual wellness goals.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

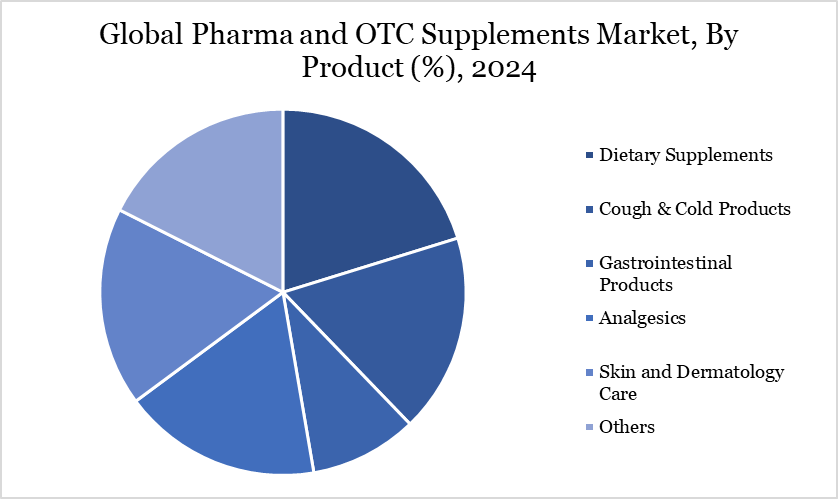

| By Product | Dietary Supplements, Cough & Cold Products, Gastrointestinal Products, Analgesics, Skin and Dermatology Care, Others | |

| By Form | Tablets, Capsules, Powders, Liquids, Softgels, Ointments, Others | |

| By Consumer Group | Infants, Children, Adults, Seniors | |

| By Application | Digestive Health, Immune System Support, Cardiovascular Health, Bone and Joint Health, Cognitive and Mental Health, Skin, Hair & Nail Health, Eye Health, Sports & Fitness, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Pharma and OTC Supplements Market Dynamics

Rising Prevalence of Chronic Diseases and Shift Toward Preventive Healthcare

The rising prevalence of chronic diseases, coupled with the increasing shift toward preventive healthcare, is significantly driving the global pharma and OTC supplements market. According to the National Library of Medicine 2022, globally, approximately one in three adults suffer from multiple chronic conditions, with six in ten adults in the US affected. In India, around 21% of the elderly population lives with at least one chronic disease.

Thus, consumers are increasingly seeking proactive health solutions to manage and prevent conditions such as diabetes, cardiovascular diseases, and obesity. This growing demand for wellness-focused products is fueling the development of both pharmaceutical treatments and OTC supplements designed to improve long-term health outcomes. As a result, the market is experiencing accelerated growth, driven by the need for accessible and effective health solutions.

Concerns Over Safety and Efficacy

Concerns over the safety and efficacy of both pharma and OTC supplements are significant restraints on the global market. Many supplements lack robust clinical evidence to support their health claims, leading to skepticism among consumers and healthcare professionals. This uncertainty can limit consumer adoption, particularly in markets where regulatory oversight is weak.

Additionally, the potential for adverse side effects or interactions with prescription medications raises concerns about product safety. As a result, manufacturers face increased pressure to ensure transparency, rigorous testing, and compliance with regulatory standards, which can delay product development and increase costs.

Pharma and OTC Supplements Market Segment Analysis

The global pharma and OTC supplements market is segmented based on product, form, consumer group, application and region.

Dietary Supplements Lead the Global Pharma and OTC Market Due to Rising Demand for Preventive Health Solutions

Dietary supplements hold a significant share in the global pharma and OTC supplements market due to the growing consumer demand for preventive health solutions. As more individuals seek to improve overall wellness, boost immunity, and manage chronic conditions, dietary supplements such as vitamins, minerals, probiotics, and herbal products have become increasingly popular. These products are easily accessible over the counter, offering convenience and affordability compared to prescription medications.

Companies are launching new products that address specific health concerns, such as cognitive function, sleep support, and immune health. For instance, in March 2025, Emcure Pharmaceuticals expanded its OTC portfolio with the launch of three new products under its Arth supplement range, marking its entry into the daily wellness market. The new offerings include supplements for intimate care, sleep support, and cognitive health, combining traditional Indian herbs like Brahmi with modern scientific formulations.

Pharma and OTC Supplements Market Geographical Share

North America's Dominance in the Global Pharma and OTC Supplements Market: Driven by Robust Healthcare, High Demand, and Health Awareness

North America holds a significant share in the global pharmaceutical (pharma) and over-the-counter (OTC) supplements market, driven by high consumer demand, well-established healthcare infrastructure, and increasing awareness of wellness and self-care. The region benefits from a robust healthcare system, strong regulatory frameworks, and advanced research and development capabilities, all contributing to the widespread availability of both pharma products and OTC supplements.

An estimated 129 million people in the US have at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the US Department of Health and Human Services. This highlights the widespread prevalence of chronic health conditions in the country. This is fueling innovation in the supplement industry, with a focus on natural ingredients, personalized health solutions, and products that complement traditional medical treatments.

Sustainability Analysis

The trend towards natural, plant-based, and clean-label products is a key driver in the growth of the global OTC supplements and pharmaceutical excipients market. As consumers increasingly prioritize health, sustainability, and transparency, there is a rising demand for products made from natural-origin, vegan, allergen-free, and sustainably sourced ingredients. This trend influences OTC supplement formulations by encouraging brands to use plant-based ingredients, minimize artificial additives, and offer cleaner labels that consumers can easily understand.

For instance, in January 2023, Nutricia launched its first plant-based medical nutrition drink, oral supplement Fortimel PlantBased Energy, designed to meet the nutritional needs of individuals at risk of malnutrition due to illness. The ready-to-drink supplement, made with pea and soy protein, is suitable for vegan, vegetarian, and flexitarian diets, as well as for patients with cow’s milk protein allergies.

Pharma and OTC Supplements Market Major Players

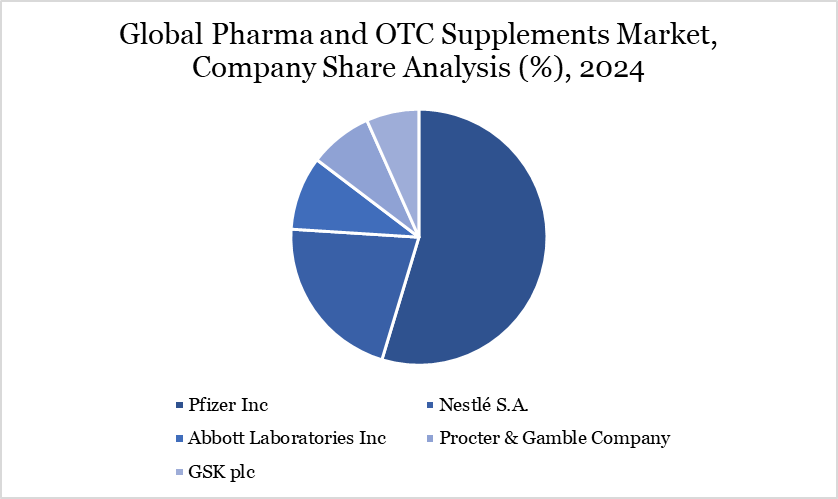

The major global players in the market include Pfizer Inc., Nestlé S.A., Abbott Laboratories Inc., Procter & Gamble Company, GSK plc, Johnson & Johnson Ltd., Sanofi S.A., Bayer AG, Merck & Co. Inc., Church & Dwight and others.

Key Developments

- In April 2025, Mushrooms Inc. launched a new line of health supplements featuring ingredients like Organic Lion's Mane for cognitive function and Pomegranate for heart health, aiming to support overall wellness and healthy aging.

- In September 2024, Kourtney Kardashian launched a new over-the-counter supplement, GLP-1 Daily, as a plant-based alternative to GLP-1 medications like Ozempic. The product, available through her wellness brand Lemme, contains three key plant extracts: Eriomin lemon fruit extract, Supresa saffron extract, and Morosil red-orange fruit extract.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies