Orthopedic Surgical Robots Market Size and Trends

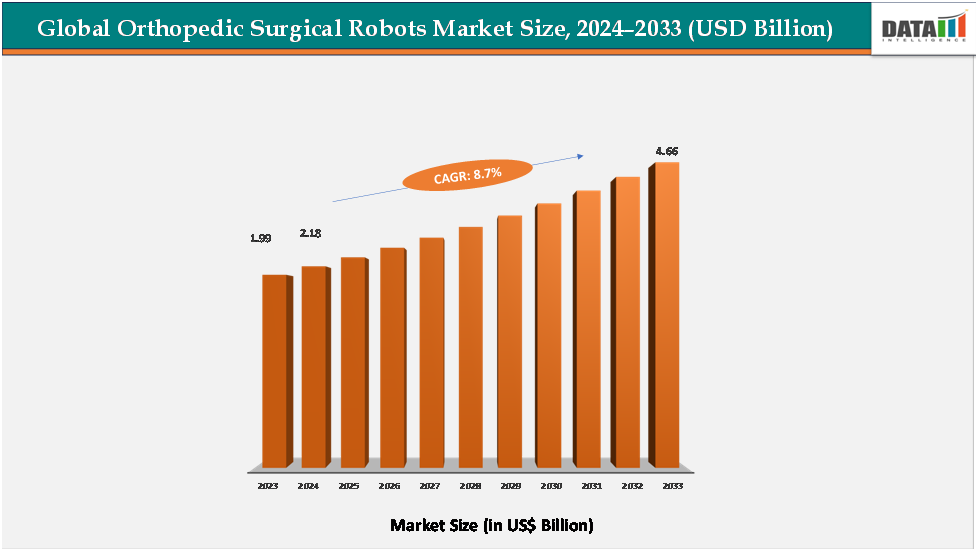

The global orthopedic surgical robots market reached US$ US$ 1.99billion in 2023, with a rise to US$ 2.18billion in 2024, and is expected to reach US$ 4.66billion by 2033, growing at a CAGR of 8.7%during the forecast period 2025–2033.

The global orthopedic surgical robots market is witnessing robust expansion, driven by the rising volume of joint replacement surgeries, the growing prevalence of musculoskeletal disorders, and the increasing demand for precision-driven surgical interventions. As populations age and the incidence of osteoarthritis and bone degenerative diseases continues to climb, the need for accurate and minimally invasive orthopedic procedures has become more pronounced.

Robotic-assisted systems are transforming traditional orthopedic surgeries by enhancing surgical precision, reducing intraoperative errors, and improving patient recovery times. The integration of AI-based preoperative planning, advanced imaging, and haptic feedback technologies is further optimizing surgical workflows and implant alignment. Increasing hospital investments in automation and the shift toward value-based healthcare are accelerating the adoption of these systems across orthopedic centers and high-volume surgical facilities. Major players such as Stryker, Zimmer Biomet, Smith+Nephew, and Johnson & Johnson MedTech are leading innovation through next-generation platforms offering real-time analytics and multi-joint application capabilities.

Key Market highlights

- North America accounted for approximately 42.3% of the global Orthopedic Surgical Robots market in 2024 and is expected to maintain its leading position throughout the forecast period. The region’s dominance is attributed to the strong presence of established medical device companies, advanced healthcare infrastructure, and a high rate of adoption of technologically advanced surgical systems.

- The Asia-Pacific region held around 18.9% of the global market in 2024 and is projected to be the fastest-growing region over the forecast period. The rapid expansion is driven by rising healthcare expenditure, growing awareness of advanced orthopedic procedures, and increasing investments in hospital infrastructure.

- By product type, the Instruments & Accessories segment dominated the global Orthopedic Surgical Robots market, accounting for approximately 59% of total revenue in 2024. This dominance is driven by the recurring use of instruments and accessories in every robotic-assisted orthopedic procedure, generating consistent revenue for manufacturers.

Market Size & Forecast

- 2024 Market Size: US$2.18Billion

- 2033 Projected Market Size: US$4.66Billion

- CAGR (2025–2033): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

source : datam intelligence Email : [email protected]

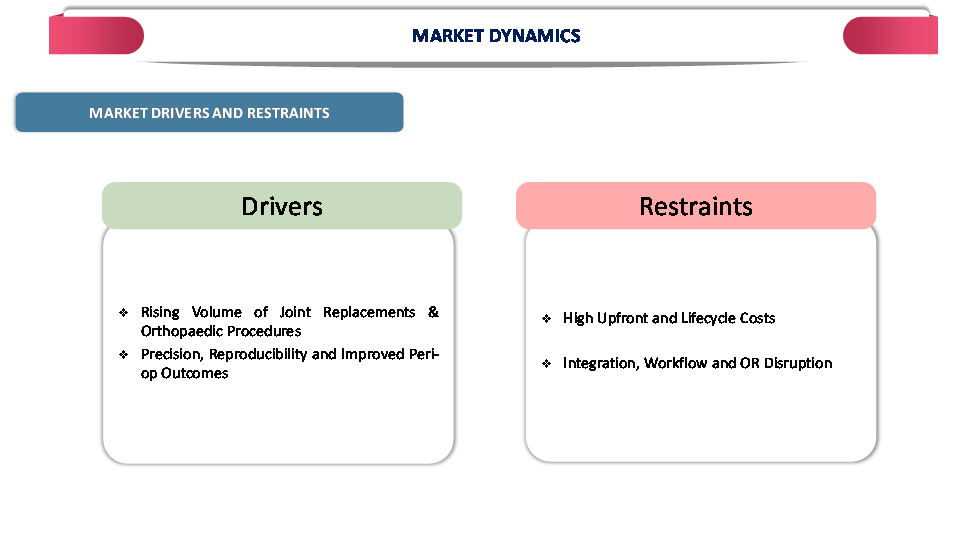

Market Dynamics:

Global Orthopedic Surgical Robots Market Dynamics: Drivers & Restraints

Driver:

Rising Volume of Joint Replacements & Orthopedic Procedures

The growing number of joint replacement and orthopedic procedures worldwide is a major factor propelling the growth of the orthopedic surgical robots market. As populations age and the prevalence of musculoskeletal disorders such as osteoarthritis continues to rise, the demand for total knee and hip replacements has increased sharply. In the United States alone, approximately 790,000 total knee replacements and 544,000 hip replacements are performed each year, with projections indicating continued growth due to longer life expectancy and higher activity levels among older adults. This surge in surgical volume places greater emphasis on precision, consistency, and postoperative outcomes.

Robotic platforms enhance the accuracy of bone preparation, optimize implant alignment, and reduce variability in surgical performance, which is particularly important when procedure volumes are high. As hospitals and surgical centers face increasing caseloads, robotics help streamline workflows, shorten recovery times, and improve implant longevity. Moreover, with joint replacements recognized as one of the most reliable and durable treatments, often lasting 20 years or more, surgeons are seeking technologies that can sustain such longevity through precision execution. Major manufacturers such as Stryker, Zimmer Biomet, and Smith+Nephew are responding to this rising procedural demand by expanding robotic capabilities for knee, hip, and spine surgeries. For instance, Stryker’s Mako Smart Robotics platform has seen widespread adoption across hospitals to meet growing arthroplasty volumes, while Zimmer Biomet’s ROSA® Robotics and Smith+Nephew’s CORI™ System are being deployed in both primary and revision procedures. Consequently, the rising global volume of orthopedic surgeries directly amplifies the need for surgical robots, driving continuous system installations and procedure-linked accessory sales across major healthcare markets.

Restraint:

High Cost of Advanced Digital Otoscopes

The high cost of foot and ankle implants and surgical procedures is expected to hinder market growth, particularly in developing regions. Advanced implants made from premium materials like titanium and bioresorbable polymers, along with the use of navigation-assisted or robotic surgical systems, significantly increase treatment expenses. Additionally, post-operative rehabilitation and follow-up care further add to patient costs, making these procedures less accessible to those without comprehensive insurance coverage. This cost barrier limits adoption rates and restrains the overall expansion of the Orthopedic Surgical Robots market.

For more details on this report, Request for Sample

Market Segmentation Analysis

The global orthopedic surgical robots market is segmented by product type, application, end user and region.

Product Type:

The instruments & accessories segment is estimated to have 59% of the orthopedic surgical robots market share.

The instruments & accessories segment currently dominates the orthopedic surgical robots market, accounting for the largest share of total revenue. This dominance is primarily due to the recurring nature of these products, which are required for every surgical procedure. Each robotic-assisted joint replacement or spine surgery involves the use of specialized instruments, disposable components, and calibration tools that ensure surgical precision and sterility. As procedure volumes continue to increase globally, the demand for these accessories has grown proportionally. Hospitals and surgical centers consistently procure new sets for every operation, creating a continuous revenue stream for manufacturers.

Furthermore, as robotic systems expand into additional orthopedic applications such as partial knee, hip resurfacing, and spine procedures, the number of compatible instrument kits has multiplied. Companies like Stryker, Zimmer Biomet, and Smith+Nephew have introduced procedure-specific consumables designed for their respective robotic platforms (such as Mako SmartRobotics, ROSA Knee, and CORI Surgical System). These expansions not only reinforce the dependence on instruments and accessories but also strengthen customer retention through recurring purchases. Hence, the instruments & accessories segment remains the core revenue generator of the market, underpinning steady growth through consumable demand and rising surgical volumes.

The systems segment is estimated to have 41% of the orthopedic surgical robots market share.

The systems segment, comprising robotic platforms, consoles, and navigation hardware, is emerging as the fastest-growing segment of the orthopedic surgical robots market. This growth is fueled by the increasing adoption of robotic technology across hospitals and orthopedic centers that aim to enhance precision, reduce revision rates, and improve patient outcomes. With the steady rise in total joint replacement surgeries and minimally invasive orthopedic procedures, healthcare providers are investing heavily in advanced robotic platforms to improve surgical efficiency and accuracy.

Recent technological advancements are accelerating system installations. Leading players are expanding their product portfolios and partnering with hospitals to scale adoption. For instance, Zimmer Biomet’s collaboration with THINK Surgical to distribute the TMINI Handheld Robotic System and Stryker’s continuous upgrade of the Mako Smart Robotics platform exemplify the ongoing surge in system deployments. Although the initial capital investment for robotic systems is high, the long-term benefits are encouraging more institutions to adopt these systems. Consequently, the systems segment is expected to record the highest growth rate in the coming years as hospitals increasingly integrate robotics into routine orthopedic practices.

Geographical Analysis

The North America orthopedic surgical robots market was valued at 42.3%market share in 2024

North America holds the dominant share in the orthopedic surgical robots market, driven by its high procedure volumes, early technological adoption, and strong presence of leading manufacturers. The U.S. performs more than 1.3 million knee and over 790,000 hip replacements annually, creating a large base for robotic-assisted procedures. Hospitals across the U.S. and Canada are increasingly integrating robotic platforms to enhance precision and surgical consistency in total joint arthroplasty. The region also benefits from favorable reimbursement frameworks, advanced healthcare infrastructure, and continuous innovation from key companies such as Stryker, Zimmer Biomet, and Smith+Nephew, all of which are headquartered or have major operations in North America. For instance,

Widespread deployment of systems like Mako Smart Robotics and ROSA Robotics in orthopedic centers across the U.S. has reinforced the region’s leadership. Furthermore, strong surgeon awareness, training programs, and clinical evidence supporting robotic outcomes continue to sustain high adoption rates, making North America the largest contributor to global market revenue.

The European Orthopedic Surgical Robots market was valued at 20.8% market share in 2024

Europe maintains a significant position in the orthopedic surgical robots market, supported by the region’s robust orthopedic surgery volume, growing geriatric population, and rapid digitization of healthcare practices. Countries such as Germany, the U.K., France, and Italy are at the forefront of robotic-assisted orthopedic adoption, with hospitals increasingly investing in robotic systems to meet the demand for precision-driven joint replacements. The region’s emphasis on improving surgical efficiency and reducing revision rates aligns well with the clinical advantages of robotics.

Moreover, the European Union’s focus on advanced medical device integration, coupled with supportive regulatory pathways for innovative surgical technologies, has encouraged widespread system approvals and installations. Leading European healthcare providers such as Nuffield Health (U.K.) and Asklepios Kliniken (Germany) have incorporated robotic platforms like CORI and Mako, highlighting a steady, structured adoption trend. Although price sensitivity remains higher compared to the U.S., strong healthcare infrastructure and government-supported modernization programs sustain Europe’s solid market share.

The Asia-Pacific Orthopedic Surgical Robots market was valued at 18.9%market share in 2024

Asia-Pacific is the fastest-growing region in the orthopedic surgical robots market, supported by the rising incidence of orthopedic disorders, growing healthcare expenditure, and expanding adoption of advanced surgical systems. Countries such as China, Japan, South Korea, and India are witnessing a notable rise in total knee and hip replacement procedures as ageing populations and higher demand for minimally invasive surgeries increase the need for precision-driven technologies.

Healthcare companies across the region are investing in robotic-assisted platforms to enhance surgical accuracy and consistency while improving patient recovery outcomes. For instance, in December 2022, MicroPort NaviBot (Suzhou), a subsidiary of Shanghai Micro Port MedBot (Group) Co., Ltd., became the first China-developed joint replacement robot to receive European CE certification after testing and certification by the British Standards Institution (BSI). This milestone demonstrates the region’s growing technological competence and regulatory advancement in orthopedic robotics. In addition, supportive government programsare accelerating infrastructure improvements and promoting technology integration. With both international manufacturers and domestic innovators expanding operations, the Asia-Pacific is expected to register the highest growth rate in the orthopedic surgical robots market during the forecast period.

Competitive Landscape

The major players in the orthopedic surgical robots market include Stryker, Zimmer Biomet, Micro Port Scientific Corporation, Medtronic, and Globus Medical, among others.

Key Developments:

- In September 2024, Johnson & Johnson MedTech announced that its orthopedics division, DePuy Synthes, had launched the TriLEAP Lower Extremity Anatomic Plating System. The TriLEAP system provides procedure-specific plates tailored to support a wide range of forefoot and midfoot reconstructive and trauma procedures, enabling precise fixation and fusion of bones and bone fragments in both adult and adolescent patients.

Global Orthopedic Surgical Robots Market: Scope

| Metrics | Details | |

| CAGR | 8.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Systems, Instruments & Accessories |

| Application | Spine Surgery, Knee Surgery, Hip Surgery, Trauma and Fracture Surgery, Others | |

| End User | Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global orthopedic surgical robots market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here