Oncology Molecular Diagnostics Market Size & Industry Outlook

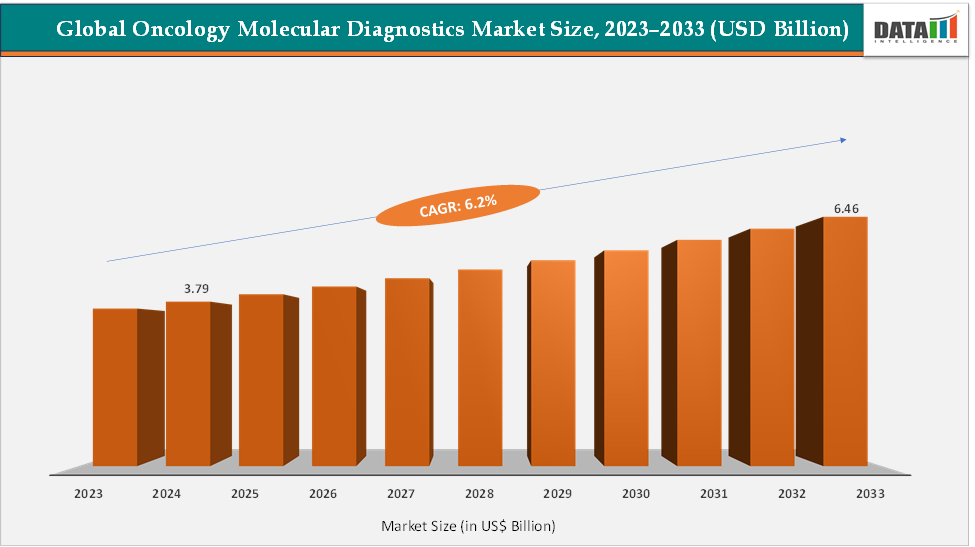

The global oncology molecular diagnostics market size reached US$ 3.79 Billion in 2024 from US$ 3.59 Billion in 2023 and is expected to reach US$ 6.46 Billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025-2033. The market is witnessing rapid growth, driven by the rising prevalence of cancer, the increasing demand for personalized medicine, and continuous advancements in diagnostic technologies. Key players such as Abbott Molecular offer Vysis FISH assays and RealTime PCR tests, while Foundation Medicine provides FDA-approved Foundation One CDx and Liquid CDx tests for comprehensive genomic profiling. These technological advancements are enhancing diagnostic accuracy, guiding targeted therapies, and improving overall patient outcomes, solidifying molecular diagnostics as a critical component of modern cancer care.

Key Market Highlights

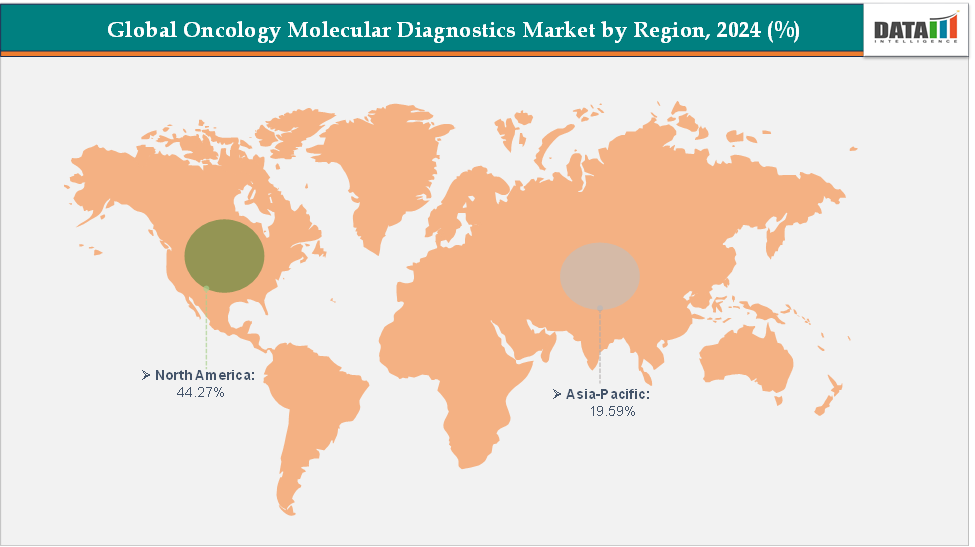

- North America dominates the oncology molecular diagnostics market with the largest revenue share of 44.27% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.7% over the forecast period.

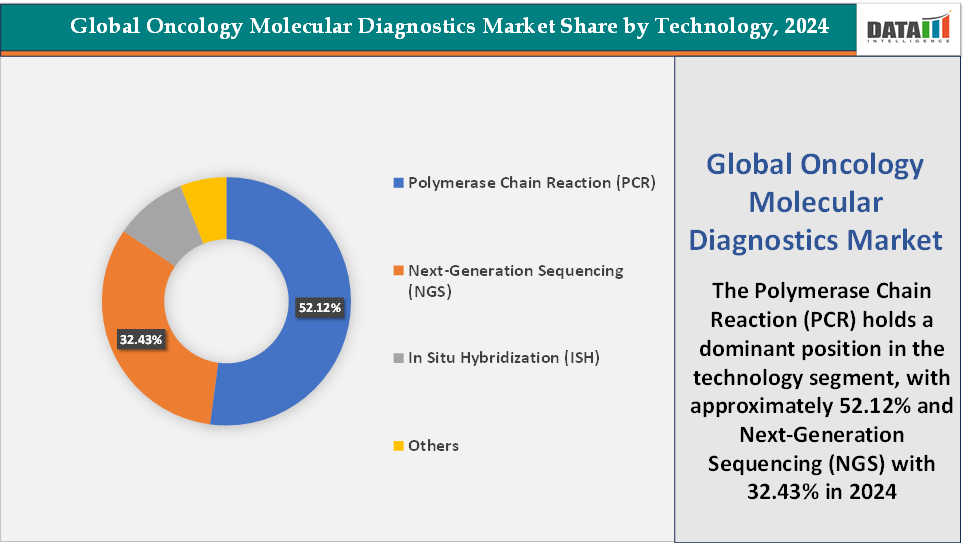

- Based on technology, the Polymerase Chain Reaction (PCR) segment led the market with the largest revenue share of 52.12% in 2024.

- The major market players in the oncology molecular diagnostics market are Abbott, QIAGEN, F. Hoffmann-La Roche Ltd, BD, Cepheid, Hologic, Inc., Sysmex Corporation, Bio-Rad Laboratories, Inc., Foundation Medicine, Inc., and ASURAGEN, INC., among others

Market Dynamics

Drivers: Rising prevalence of cancer is significantly driving the oncology molecular diagnostics market growth

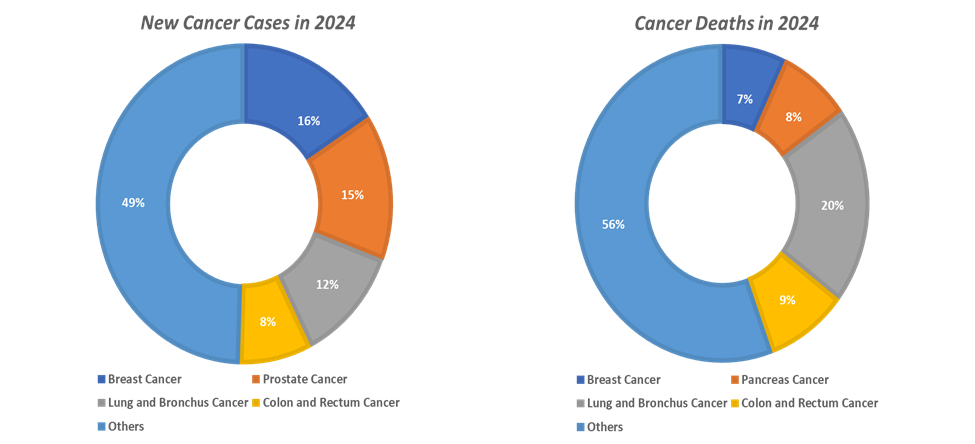

The rising global prevalence of cancer is one of the most powerful forces driving the growth of the oncology molecular diagnostics market, fundamentally reshaping how cancers are detected, classified, and treated. According to the National Institute of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. According to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million.

Cancers such as lung, breast, colorectal, and prostate dominate the global incidence rates, each requiring distinct molecular diagnostic assays to identify actionable mutations and guide precision therapies. With the rising prevalence, the need for accurate and continuous disease monitoring through molecular diagnostics has never been greater. Molecular diagnostic technologies like Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and liquid biopsy enable earlier and more precise detection of tumor-specific biomarkers, helping clinicians tailor therapies such as targeted inhibitors and immunotherapies to individual patient profiles.

Restraints: Complex logistics for sample collection and handling is hampering the growth of the market

The complex logistics of sample collection, storage, and handling represents a major restraint on the growth of the oncology molecular diagnostics market, particularly given the sensitivity of molecular assays to pre-analytical variables. Unlike conventional pathology tests, molecular diagnostics require high-quality DNA, RNA, or circulating tumor DNA (ctDNA) from tissue or blood samples, which must be collected, preserved, and transported under tightly controlled conditions to avoid degradation.

For instance, delays in sample transport, improper temperature maintenance, or contamination during processing can lead to false-negative or inconclusive results, undermining diagnostic accuracy and clinical confidence. This challenge is especially acute in low-resource or decentralized healthcare settings, where limited access to cold-chain logistics and standardized biobanking infrastructure hampers reliable testing.

Moreover, molecular assays for minimal residual disease and liquid biopsies depend on ultra-low analyte concentrations, making even minor handling errors impactful. These logistical constraints not only increase operational costs but also prolong turnaround times for test results, reducing clinical utility in time-sensitive oncology decisions. Consequently, many hospitals and diagnostic centers rely on centralized laboratories, which limits scalability and accessibility, especially in emerging markets. Therefore, the intricate and fragile logistics of sample collection and handling continue to pose a significant barrier to the widespread adoption and efficiency of oncology molecular diagnostics worldwide.

For more details on this report – Request for Sample

Segmentation Analysis

The global oncology molecular diagnostics market is segmented based on product type, technology, application, end-user, and region.

Technology: The Polymerase Chain Reaction (PCR) segment is dominating the oncology molecular diagnostics market with a 52.12% share in 2024

The Polymerase Chain Reaction (PCR) segment has maintained its dominance in the oncology molecular diagnostics market due to its high sensitivity, specificity, rapid turnaround time, and cost-effectiveness. PCR has long been the clinical standard for detecting cancer-specific genetic mutations, making it a cornerstone for both diagnosis and treatment guidance, particularly for targeted therapies in cancers such as breast, lung, colorectal, and hematologic malignancies. The technology’s ability to detect low-frequency mutations in minimal DNA or RNA samples has made it indispensable in applications like liquid biopsy, minimal residual disease (MRD) monitoring, and companion diagnostics.

Recent product developments underscore its continuing relevance. For instance, in September 2024, QIAGEN N.V. announced the launch of the QIAcuityDx Digital PCR System, a pivotal addition to its digital PCR portfolio expanding into clinical diagnostics. The instrument and accessories are 510(k) exempt in the U.S. and IVDR-certified for diagnostic use in Europe. QIAcuityDx streamlines clinical testing by providing highly precise, absolute quantitation of target DNA and RNA, supporting applications with less invasive liquid biopsies.

The continued expansion of PCR into digital PCR platforms, multiplexed assays, and high-throughput systems further enhances its clinical utility, enabling laboratories to detect multiple mutations simultaneously with minimal sample input. Its dominance is thus reinforced not only by historical adoption and regulatory approvals but also by ongoing innovations that extend its applications in precision oncology, early detection, and real-time patient monitoring, cementing PCR as the backbone of molecular diagnostics in cancer care worldwide.

The Next-Generation Sequencing (NGS) segment is fastest-growing in the oncology molecular diagnostics market with a 32.43% share in 2024

The Next-Generation Sequencing (NGS) segment is currently the fastest-growing in the oncology molecular diagnostics market, fueled by its unparalleled ability to provide comprehensive genomic profiling that goes far beyond traditional PCR or FISH-based methods. NGS enables the simultaneous analysis of hundreds of genes and mutations, allowing for the identification of actionable biomarkers critical for precision oncology, particularly in companion diagnostics where therapy selection depends on a patient’s specific mutational profile.

For instance, the FoundationOne CDx test, developed by Foundation Medicine, is an FDA-approved NGS-based companion diagnostic that detects alterations in over 300 genes to guide treatment decisions across multiple cancer types. Technological advancements have significantly reduced sequencing costs, increased throughput, and improved accuracy, making NGS more accessible to a broader range of healthcare settings, including emerging markets in the Asia-Pacific, which are expected to witness the fastest growth in adoption.

Furthermore, the integration of NGS with liquid biopsy techniques allows for non-invasive detection of circulating tumor DNA (ctDNA), enabling real-time monitoring of tumor dynamics, early detection of resistance mutations, and minimal residual disease (MRD) assessment, particularly beneficial for patients with metastatic or hard-to-biopsy tumors. The versatility of NGS also supports multi-gene panels, whole-exome, and targeted sequencing applications, providing clinicians with a holistic understanding of tumor biology to guide individualized therapy.

Geographical Analysis

North America is expected to dominate the global oncology molecular diagnostics market with a 44.27% in 2024

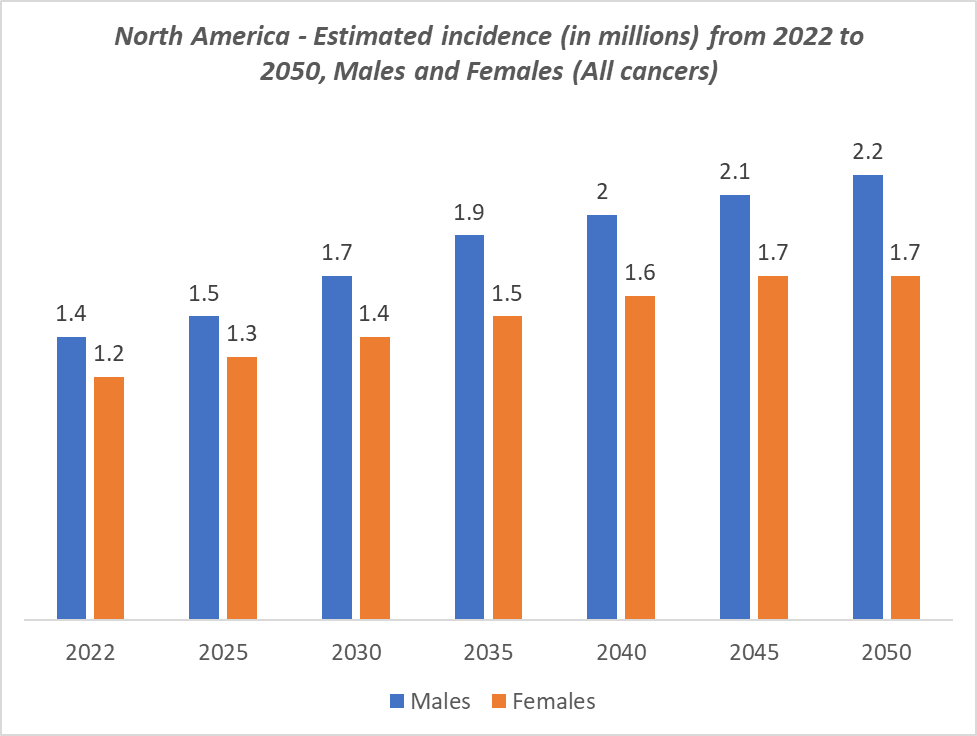

North America is expected to dominate the global oncology molecular diagnostics market, owing to the rising prevalence of cancer in North America, especially in the United States, high adoption of advanced diagnostic technologies, and proactive regulatory support.

US Oncology Molecular Diagnostics Market Trends

The rising prevalence of cancer in the United States is a major driver of the oncology molecular diagnostics market, as increasing case numbers create greater demand for early detection, accurate diagnosis, and personalized treatment. With rising new cancer cases, especially breast, lung, and colorectal cancers being the most common, clinicians increasingly rely on molecular diagnostics to guide targeted therapies. This growing patient population, combined with advancements in precision medicine, fuels adoption of innovative molecular tests and supports market expansion.

A key driver of the US dominance is the US Food and Drug Administration’s (FDA) proactive role in approving innovative molecular diagnostic assays and companion diagnostics, which has accelerated the adoption of precision oncology. The presence of leading diagnostic companies further strengthens the region’s market position. The US dominance is also supported by widespread reimbursement policies, advanced laboratory networks, and strong clinical trial infrastructure, which enable rapid deployment of new assays and integration of cutting-edge technologies such as NGS, liquid biopsy, and multi-gene panels.

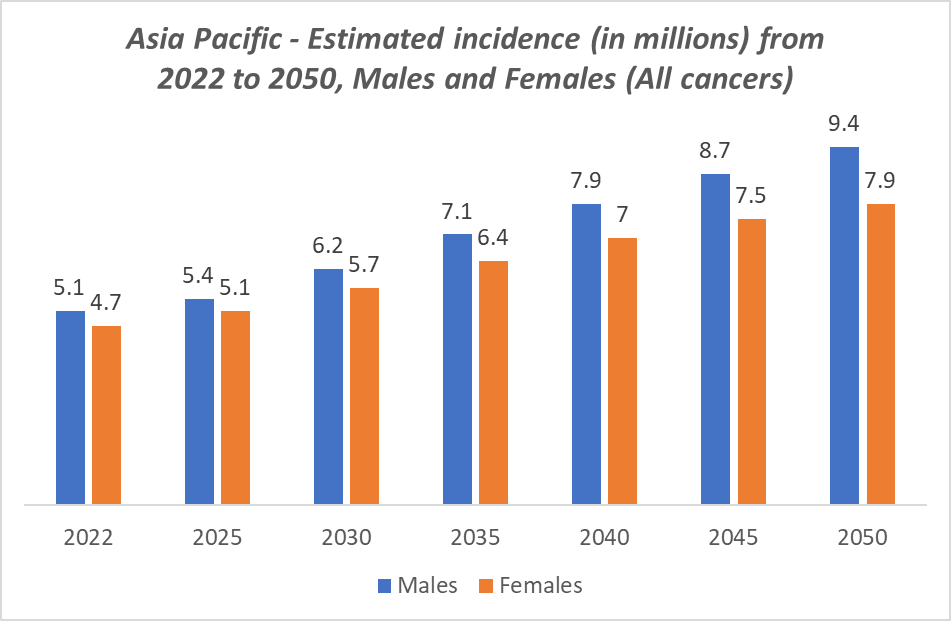

The Asia Pacific region is the fastest-growing region in the global oncology molecular diagnostics market, with a CAGR of 6.7% in 2024

The Asia Pacific region is emerging as the fastest-growing market in the global oncology molecular diagnostics landscape, driven by a combination of rising cancer prevalence, improving healthcare infrastructure, and increasing awareness of precision medicine. Countries such as China, India, Japan, and South Korea are witnessing a surge in cancer cases due to aging populations, urbanization, lifestyle changes, and environmental risk factors. This rising prevalence is creating strong demand for early detection and molecular profiling, including PCR-based tests, NGS panels, and liquid biopsies, to guide targeted therapies.

Additionally, increasing government initiatives, such as national cancer control programs and investments in molecular diagnostic laboratories, are improving accessibility and affordability of advanced testing. The region also benefits from a growing number of private diagnostic providers, collaborations with global pharmaceutical companies, and adoption of cutting-edge technologies like NGS, digital PCR, and multi-gene panels. Rising awareness among physicians and patients about the benefits of personalized cancer treatment further fuels market adoption.

Europe Oncology Molecular Diagnostics Market Trends

Europe's oncology molecular diagnostics market is witnessing robust growth, driven by rising cancer prevalence, technological advancements, and supportive healthcare policies. The increasing incidence of cancers such as breast, lung, and colorectal is a key factor, with the European Union alone expecting around 1.27 million cancer deaths in 2024, and age-standardized rates of 123.2 per 100,000 men and 79.0 per 100,000 women.

Breast cancer remains the leading cancer type in both incidence and mortality, driving demand for advanced molecular diagnostic tools. Innovations such as next-generation sequencing (NGS) and liquid biopsy enable earlier detection of genetic mutations and alterations, facilitating personalized treatment approaches and improving patient outcomes. Additionally, healthcare systems across Europe are increasingly integrating molecular diagnostics into routine clinical practice, supported by reimbursement policies and national cancer control programs. Collectively, rising cancer incidence, technological innovations, and favorable healthcare policies position Europe as a key growth region for oncology molecular diagnostics, enabling more personalized and effective cancer care.

Competitive Landscape

Top companies in the oncology molecular diagnostics market include Abbott, QIAGEN, F. Hoffmann-La Roche Ltd, BD, Cepheid, Hologic, Inc., Sysmex Corporation, Bio-Rad Laboratories, Inc., Foundation Medicine, Inc., and ASURAGEN, INC., among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Reagents, Instruments, and Software |

| Technology | Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), In Situ Hybridization (ISH), and Others | |

| Application | Breast Cancer, Prostate Cancer, Colorectal Cancer, Cervical Cancer, Liver Cancer, Lung Cancer, Blood Cancer, and others | |

| End-User | Hospitals, Clinical Laboratories, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global oncology molecular diagnostics market report delivers a detailed analysis with 70 key tables, more than 68 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here