Oligonucleotide Therapy Market Size & Industry Outlook

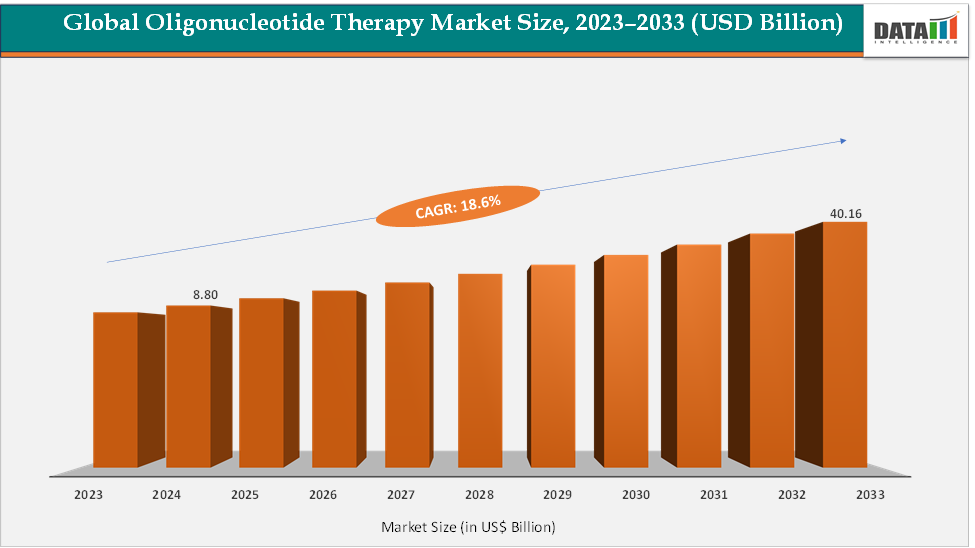

The global oligonucleotide therapy market size reached US$ 8.80 Billion in 2024 from US$ 7.51 Billion in 2023 and is expected to reach US$ 40.16 Billion by 2033, growing at a CAGR of 18.6% during the forecast period 2025-2033. The market is being driven by the rising demand for precision medicine and targeted genetic treatments. Advancements in antisense oligonucleotides (ASOs) and siRNA therapies have enabled effective treatment of rare genetic disorders, such as Spinraza for spinal muscular atrophy and Onpattro for hereditary transthyretin-mediated amyloidosis.

The increasing prevalence of neurodegenerative diseases, cancers, and cardiovascular disorders is pushing the adoption of these therapies. Additionally, ongoing R&D investments, favorable regulatory approvals, and the expansion of biopharmaceutical infrastructure in regions like North America and Asia-Pacific are accelerating market growth. Companies are also developing novel delivery systems and conjugates, such as antibody-oligonucleotide conjugates, to enhance efficacy and safety. This combination of unmet medical needs and technological innovation is positioning oligonucleotide therapies as a key component of the future of personalized medicine.

Key Market Highlights

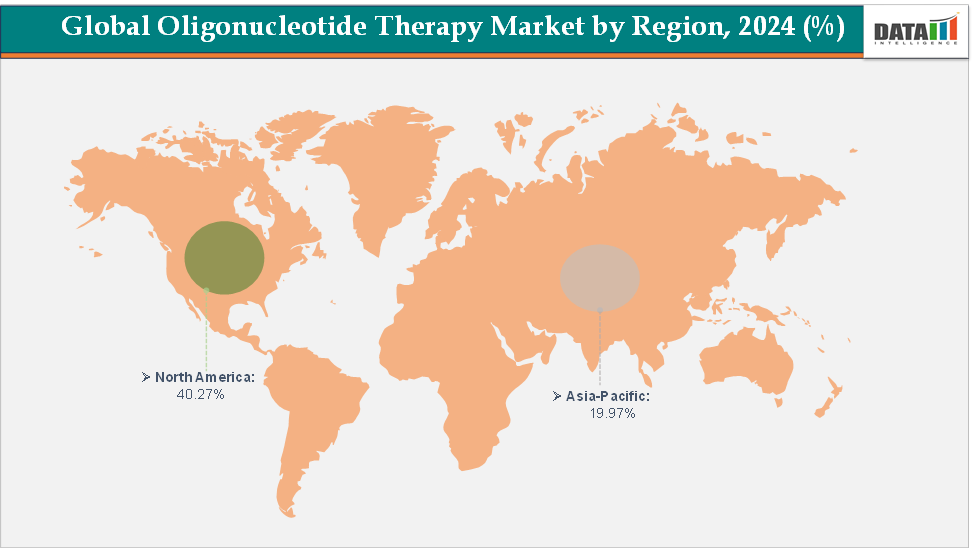

North America dominates the oligonucleotide therapy market with the largest revenue share of 40.27% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 17.8% over the forecast period.

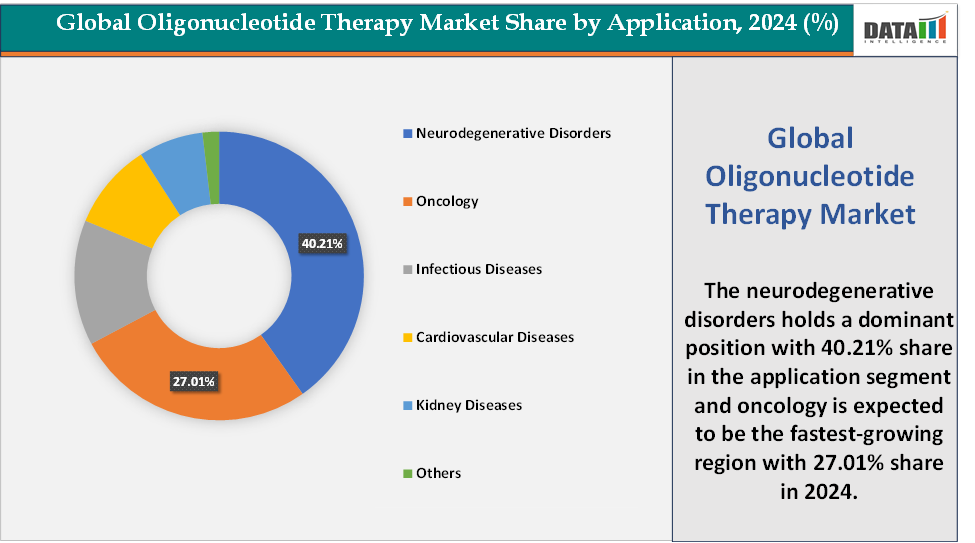

Based on application, the neurodegenerative disorders segment led the market with the largest revenue share of 40.21% in 2024.

The major market players in the oligonucleotide therapy market are Sarepta Therapeutics, Inc., Ionis Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Wave Life Sciences, Novartis AG, Biogen, Regeneron Pharmaceuticals Inc., and Avidity Biosciences, among others

Market Dynamics

Drivers:The rising prevalence of genetic and rare diseases is significantly driving the oligonucleotide therapy market growth

The rising prevalence of genetic and rare diseases is a significant driver of the oligonucleotide therapy market's growth. Rare diseases collectively affect approximately 3.5% to 5.9% of the global population, equating to over 400 million individuals worldwide. Notably, around 80% of these rare diseases have a genetic origin, and nearly 95% lack approved treatments. This substantial unmet medical need has spurred the development of targeted therapies, including antisense oligonucleotides (ASOs) and small interfering RNAs (siRNAs), which can precisely modulate gene expression to treat these conditions.

For instance, Spinraza (nusinersen), an ASO, has been approved for spinal muscular atrophy, a rare genetic disorder. Similarly, Onpattro (patisiran), an siRNA therapy, addresses hereditary transthyretin-mediated amyloidosis, another rare genetic disease. These therapies exemplify the potential of oligonucleotide-based treatments to address previously untreatable conditions.

Restraints:Competition from alternative therapies is hampering the growth of the market

Competition from alternative therapies is a notable restraint on the growth of the oligonucleotide therapy market. Gene-editing technologies like CRISPR/Cas9 and TALENs offer the potential for permanent correction of genetic defects, which can be more attractive than oligonucleotide therapies that often require repeated administration. Similarly, monoclonal antibodies and small-molecule drugs are well-established, widely available, and often less expensive options for conditions such as cancers and autoimmune disorders, creating significant competition.

For instance, in oncology, monoclonal antibodies like Keytruda and small-molecule kinase inhibitors such as Imatinib are preferred for certain cancer types, limiting the adoption of oligonucleotide therapies. In rare genetic disorders, CRISPR-based therapies in clinical trials for sickle cell disease and beta-thalassemia promise potentially curative outcomes, whereas therapies like Spinraza require ongoing dosing.

For more details on this report – Request for Sample

Oligonucleotide Therapy Market, Segment Analysis

The global oligonucleotide therapy market is segmented based on type, application, end-user, and region.

Application:The neurodegenerative disorders segment is dominating the oligonucleotide therapy market with a 40.21% share in 2024

The neurodegenerative disorders segment is currently the dominant force in the oligonucleotide therapy market, primarily due to the high unmet medical need, aging populations, and significant advancements in RNA-targeted therapeutics. This segment encompasses a variety of debilitating conditions, including spinal muscular atrophy (SMA), amyotrophic lateral sclerosis (ALS), Parkinson’s disease, Huntington’s disease, and Alzheimer’s disease, all characterized by progressive neuronal degeneration and limited treatment options. Several approved therapies exemplify the transformative potential of oligonucleotides in this field.

For instance, Spinraza (nusinersen), approved in 2016, was the first FDA-approved therapy for SMA, functioning by modifying SMN2 gene splicing to produce functional SMN protein critical for motor neuron survival. Qalsody (tofersen), approved in April 2023, addresses ALS patients with SOD1 gene mutations by reducing the production of the toxic SOD1 protein, directly targeting the genetic cause of the disease. In December 2023, eplontersen (Wainua) received approval for hereditary transthyretin-mediated amyloidosis, an antisense oligonucleotide that reduces TTR protein accumulation in tissues. Additionally, Brineura (cerliponase alfa), approved in 2017, provides enzyme replacement for CLN2, a form of Batten disease, slowing progression in pediatric patients.

In April 2025, Biogen Inc. announced that the U.S. Food and Drug Administration (FDA) granted Fast Track designation to BIIB080, an investigational antisense oligonucleotide (ASO) therapy targeting tau, for the treatment of Alzheimer’s disease. Fast Track designation is intended to facilitate the development and expedite the review of investigational drugs that treat serious conditions and address unmet medical needs. These reflect regulatory encouragement for innovative RNA-targeted therapies.

The oncology segment is the fastest-growing segment in the oligonucleotide therapy market, with a 27.01% share in 2024

The oncology segment is currently the fastest-growing segment in the oligonucleotide therapy market, fueled by the rising global prevalence of cancer, rapid advancements in RNA-targeted therapeutics, and increased regulatory support for innovative treatments. The growth in this segment is evident from the significant rise in FDA approvals for RNA-based therapeutics, including antisense oligonucleotides (ASOs), small interfering RNAs (siRNAs), and aptamers, which increased from 14 ASOs and 7 siRNAs in 2024 to 23 approved nucleic acid drugs by 2025.

A landmark approval in 2024 was Rytelo (imetelstat), an oligonucleotide telomerase inhibitor for myelodysplastic syndrome, demonstrating the clinical potential of oligonucleotides in hematologic cancers. Innovations in delivery technologies, such as antibody-oligonucleotide conjugates, have further enhanced specificity and efficacy, particularly in targeting solid tumors, overcoming previous limitations of RNA therapies.

Geographical Analysis

North America is expected to dominate the global oligonucleotide therapy market with a 40.27% in 2024

North America is the dominant region in the global oligonucleotide therapy market, driven by robust regulatory frameworks, substantial research and development investments, and a high concentration of leading pharmaceutical and biotech companies. Strong regulatory support, substantial financial backing, a concentration of innovative companies, advanced manufacturing infrastructure, and strategic collaborations collectively position North America as the leading region in the global oligonucleotide therapy market, enabling rapid adoption of therapies, expansion of clinical pipelines, and sustained market growth.

US Oligonucleotide Therapy Market Trends

The United States has been at the forefront of oligonucleotide-based drug approvals, with the FDA having approved 22 oligonucleotide therapies as of April 2025, providing strong regulatory support that facilitates the commercialization of innovative therapies. Notable approvals in recent years underscore this leadership, for instance, in August 2025, Ionis Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) approved DAWNZERA (donidalorsen) for prophylaxis to prevent attacks of hereditary angioedema (HAE) in adult and pediatric patients 12 years of age and older. DAWNZERA is the first and only RNA-targeted medicine approved for HAE, designed to target plasma prekallikrein (PKK).

Additionally, the region dominates the oligonucleotide contract development and manufacturing organization (CDMO) market, capturing a significant share in 2024, highlighting its capability in large-scale production and commercialization. Strategic partnerships and investments further reinforce this dominance; for instance, Avidity Biosciences, headquartered in San Diego, received FDA Breakthrough Therapy Designation for its lead program, delpacibart etedesiran, aimed at treating myotonic dystrophy type 1.

The Asia Pacific region is the fastest-growing region in the global oligonucleotide therapy market, with a CAGR of 17.9% in 2024

The Asia Pacific region is emerging as the fastest-growing market in the global oligonucleotide therapy sector, driven by substantial investments in biotechnology, expanding healthcare infrastructure, and increasing adoption of RNA-based therapeutics. The region’s growth is further bolstered by the increasing number of clinical trials and approvals for oligonucleotide therapies targeting rare genetic disorders, oncology, and neurodegenerative diseases. In addition, Asia Pacific is strengthening its position in oligonucleotide synthesis and contract development and manufacturing organization (CDMO) services, which are critical for large-scale production and commercialization.

With increasing awareness of personalized medicine, the adoption of oligonucleotide therapies is gaining traction among healthcare providers and patients, particularly in urban centers with advanced healthcare infrastructure. The combined effect of government incentives, strong manufacturing capabilities, and rising prevalence of target diseases is driving the Asia Pacific to become the fastest-growing region, making it a key focus area for global pharmaceutical companies seeking to expand their oligonucleotide therapy pipelines.

Europe Oligonucleotide Therapy Market Trends

Europe is experiencing significant growth in the oligonucleotide therapy market, driven by several key factors. The European Medicines Agency (EMA) has approved multiple oligonucleotide-based therapies, such as Qalsody (tofersen) for ALS and Spinraza (nusinersen) for spinal muscular atrophy, highlighting the region's commitment to advancing RNA-based treatments.

Additionally, the European Union's investment in synthetic biology and genomics is fostering an environment conducive to the development of personalized medicine. Collaborations between academic institutions and biotech companies are accelerating the discovery and commercialization of novel oligonucleotide therapies. Countries like Germany are leading this growth, supported by a robust healthcare infrastructure and a strong emphasis on research and development. These developments position Europe as a pivotal player in the global oligonucleotide therapy landscape.

Competitive Landscape

Top companies in the oligonucleotide therapy market include Sarepta Therapeutics, Inc., Ionis Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Wave Life Sciences, Novartis AG, Biogen, Regeneron Pharmaceuticals Inc., and Avidity Biosciences, among others.

Market Scope

Metrics | Details | |

CAGR | 18.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Antisense Oligonucleotides, Small Interfering RNA (siRNA), MicroRNA (miRNA), Aptamers, Ribozymes, and Others |

Application | Oncology, Neurodegenerative Disorders, Infectious Diseases, Cardiovascular Diseases, Kidney Diseases, and Others | |

End User | Hospitals, Academic and Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global oligonucleotide therapy market report delivers a detailed analysis with 56 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here