North American Plastic Surgery Market Size & Industry Outlook

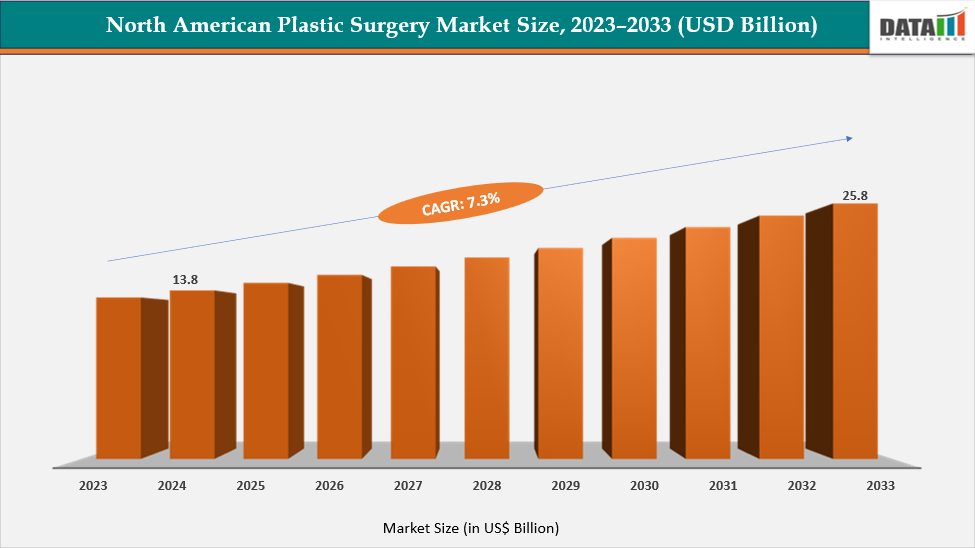

The North American Plastic Surgery market size reached US$ 13.8 Billion in 2024 from US$ 13.0 Billion in 2023 and is expected to reach US$ 25.8 Billion by 2033, growing at a CAGR of 7.3% during the forecast period 2025-2033. The market is experiencing robust growth, primarily driven by the rising demand for minimally invasive and non-surgical procedures, technological advancements, collaborations and partnerships, increasing disposable incomes, and growing awareness of aesthetic treatments. Patients are increasingly opting for procedures such as Botox, dermal fillers, laser therapies, and HIFU due to their reduced recovery times, lower risks, and minimal scarring compared to traditional surgeries.

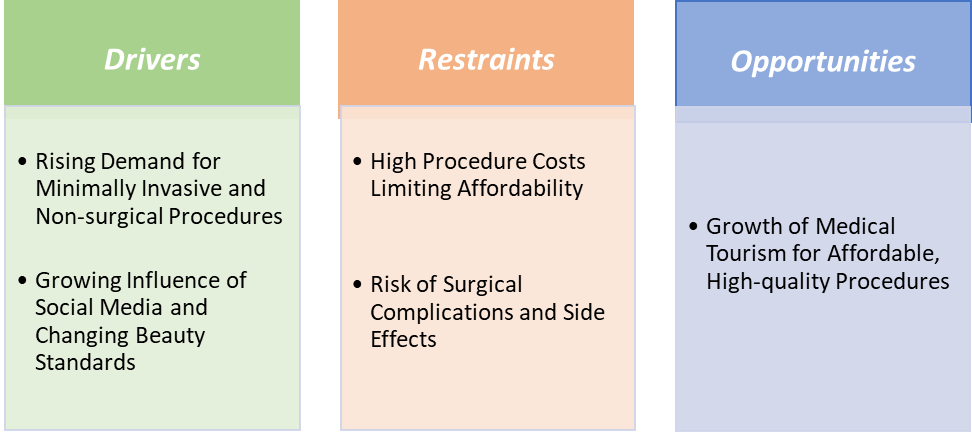

However, the market faces challenges, including high procedure costs, potential surgical complications, and the prevalence of unregulated providers, which can limit adoption in certain regions. Significant opportunities exist in the expansion of medical tourism, the development of advanced non-invasive technologies, and the growing demand in emerging markets.

Among regions, the US dominates the market, driven by high patient awareness, accessibility to advanced technologies, and strong regulatory frameworks supporting safe cosmetic interventions. Overall, these factors collectively support sustained growth and innovation across the North American plastic surgery landscape.

Key Market Highlights

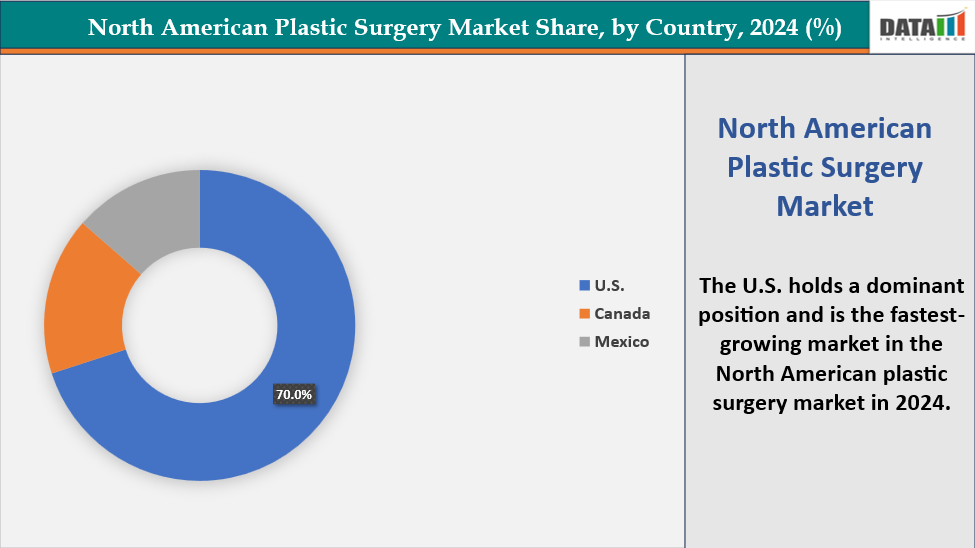

- The U.S. holds a dominant position and is the fastest-growing market in the North American plastic surgery market in 2024.

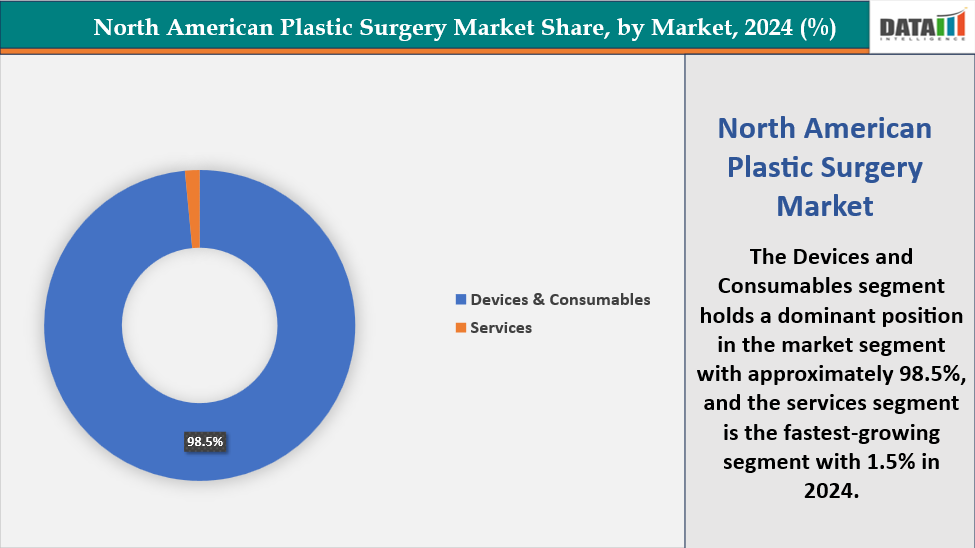

- Based on the market type, the devices and consumables segment led the market with the largest revenue share of 98.5% in 2024.

- Based on the technology type, the minimally invasive devices segment led the market with the largest revenue share of 68.2% in 2024.

- The major market players in the North American Plastic Surgery market are Allergan Aesthetics (AbbVie), Galderma S.A., Johnson & Johnson, Integra Life Sciences, Revance Therapeutics Inc., Merz, Stryker Corporation, Evolus, Bausch Health (Solta Medical), InMode, Cynosure, Cutera Inc., B. Braun, Alma Lasers, KLS Martin Group, among others.

Market Dynamics

Drivers: Rising Demand for Minimally Invasive and Non-surgical Procedures is significantly driving the North American Plastic Surgery market growth

The rising demand for minimally invasive and non-surgical procedures is a key driver of growth in the North American plastic surgery market. Procedures such as Botox, dermal fillers, laser treatments, and HIFU offer patients effective aesthetic improvements with reduced recovery times, lower risks, and minimal scarring compared to traditional surgeries.

For instance, minimally invasive procedures experienced significant growth of 7% in 2023, outpacing traditional surgical procedures by 2%. Within this category, neuromodulator injections and hyaluronic acid fillers saw remarkable increases in their application, with more than 9 million neuromodulator injections and over 5 million hyaluronic acid filler treatments performed during the year.

This trend has broadened the patient base, attracting individuals who were previously hesitant to undergo surgical interventions due to fear, cost, or downtime. Moreover, the 2024 statistics indicate an overall 1.5% increase in minimally invasive injectable treatments, well over the 1% increase seen in surgical cosmetic procedures.

Additionally, the growing availability of advanced technologies and FDA-approved non-surgical treatments has further fueled adoption, making these procedures a significant contributor to the overall expansion of the plastic surgery market.

Overall, the increasing preference for minimally invasive and non-surgical procedures is poised to remain a dominant growth driver, reinforcing the shift toward safer, more accessible, and convenient cosmetic solutions in the North American plastic surgery market.

Restraints: High Procedure Costs Limiting Affordability are hampering the growth of the market

One of the major challenges in the North American plastic surgery market is the high cost of procedures, which limits affordability and restricts access for many potential patients. Elective cosmetic and reconstructive surgeries often involve substantial expenses, including surgeon fees, anesthesia, hospital charges, and post-operative care. These costs can be prohibitively high, especially in developed countries, making it difficult for a large portion of the population to pursue such treatments.

For instance, the cost of plastic surgery in the United States varies widely depending on the type of procedure, geographic location, and individual patient needs. According to CareCredit, average costs for common cosmetic surgeries include facelifts ranging from $4,130 to $18,866 (average $8,584), rhinoplasty between $7,350 and $9,153, breast augmentation around $7,149, abdominal liposuction at $4,874, tummy tucks averaging $8,205, Brazilian Butt Lifts at $8,686, arm lifts around $6,732, and thigh lifts averaging $8,715.

The high cost of plastic surgery procedures limits affordability for many potential patients, reducing the overall demand for elective treatments. This financial barrier slows market growth, especially in regions where disposable income is lower. As a result, the market sees increased interest in alternatives like medical tourism or minimally invasive, lower-cost procedures.

Thus, the high costs associated with plastic surgery remain a key challenge in the North American market, restricting access for many patients and limiting overall growth. While expensive procedures in developed countries drive demand for more affordable options like medical tourism and minimally invasive treatments, affordability continues to be a major factor shaping market trends and patient decisions.

For more details on this report – Request for Sample

North American Plastic Surgery Market, Segmentation Analysis

The North American Plastic Surgery market is segmented based on market, technology, procedure, surgical procedure, non-surgical procedure, gender, end user, and region.

Market: The Devices & Consumables segment is dominating the North American Plastic Surgery market with a 98.5% share in 2024.

The devices and consumables segment dominates the North American plastic surgery market, driven by continuous product innovation, rapid technological advancements, and the growing preference for minimally invasive procedures. Cutting-edge technologies such as laser systems, energy-based devices, cryolipolysis machines, and advanced injectable delivery tools are enhancing treatment precision, safety, and speed factors that significantly boost patient satisfaction and clinical efficiency. Moreover, the rising adoption of non-surgical aesthetic treatments and the increasing focus on improved procedural outcomes across clinics and hospitals are further propelling the demand for high-performance devices and consumables in the region.

For instance, in April 2025, ASPS members at Cedars-Sinai in Los Angeles successfully performed the first robot-assisted microsurgical head and neck cancer reconstructive surgery in the United States earlier this year. Led by Victor Chien, MD, the procedure utilized the Symani Surgical System, featuring wristed robotic arms with seven degrees of flexibility. The system received FDA approval for microsurgery last year, marking a significant advancement in robotic-assisted reconstructive surgery.

Additionally, expanding healthcare infrastructure and increasing investments by device manufacturers in research and development are supporting the growth of the devices & consumables segment regionally.

Geographical Analysis

U.S. dominates in the North American Plastic Surgery market with a 70% in 2024

The United States continues to be the leading force driving the North American plastic surgery market, supported by a combination of societal, technological, and economic factors that strengthen its dominant position. High public acceptance of cosmetic enhancements, continuous technological progress, economic prosperity, and an advanced healthcare infrastructure collectively sustain its leadership in this domain.

Also, Industry growth is further driven by increasing procedures, ongoing mergers, acquisitions, and product diversification, contributing to greater consolidation and innovation. A supportive regulatory environment and stringent healthcare standards promote safety and the adoption of new technologies.

For instance, in March 2025, Tiger Aesthetics Medical, a division of Pennsylvania-based tissue engineering company Tiger Biosciences, revealed plans for building a new $50 million facility in Franklin, Wisconsin, to support its breast implant business. The company had acquired Sientra, a California-based breast implant business, last year, which included a manufacturing facility in Franklin.

Moreover, in the U.S., liposuction (349,728) and breast augmentation (306,196) are the leading cosmetic surgeries, followed by abdominoplasty (171,064), breast lift (153,616), and blepharoplasty (120,755). The strong demand for these body-enhancing and rejuvenation procedures reflects rising aesthetic awareness, advanced technology, and high healthcare standards, reinforcing the U.S.’s leading role in driving growth and innovation within the North American plastic surgery market.

Competitive Landscape

Top companies in the North American Plastic Surgery market include Allergan Aesthetics (AbbVie), Galderma S.A., Johnson & Johnson, Integra Life Sciences, Revance Therapeutics Inc., Merz, Stryker Corporation, Evolus, Bausch Health (Solta Medical), InMode, Cynosure, Cutera Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 7.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Market | Devices & Consumables, Services |

| Technology | Minimally Invasive Devices, Regenerative Techniques, Robotics | |

| Procedure Type | Surgical Procedure and Non-Surgical Procedure | |

| Surgical Procedure | Breast Augmentation, Liposuction, Rhinoplasty, Abdominoplasty (Tummy Tuck), and Others | |

| Non-Surgical Procedure | Botox Injections, Dermal Fillers, Laser Hair Removal, Chemical Peels, Skin Rejuvenation, and Others | |

| Gender | Male and Female | |

| End-User | Hospitals, Ambulatory Surgical Centers, Cosmetic & Plastic Surgery Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The North American Plastic Surgery market report delivers a detailed analysis with 103 key tables, more than 97 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Medical Devices-related reports, please click here