Global Non-Fat Dry Milk Market is Segmented By Type(High-heat, Moderate-heat, Lower-heat), By Application(Confectionery, Ice-creams and Snacks, Nutritional supplements, Bakery, Dairy products), By End-User(Residential, Commercial), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Online Stores, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023 - 2030

Market Overview

Global Non-Fat Dry Milk Market reached USD 7.1 billion in 2022 and is expected to reach USD 12.0 billion by 2030 growing with a CAGR of 6.8% during the forecast period 2023-2030. The non-fat dry milk Market is witnessing a trend toward plant-based and lactose-free options.

Manufacturers are offering soy, almond, and oat-based non-fat dry milk to cater to diverse dietary preferences. Almond-based non-fat dry milk has gained popularity among lactose-intolerant and vegan consumers seeking nutritious milk substitutes.

The non-fat dry milk market is a significant segment within the dairy industry, offering low-fat and versatile dairy powder. Produced through an intense heat process, it has a longer shelf life and is used in various food applications, including bakery, confectionery, and dairy products. The market is driven by increasing health consciousness among consumers seeking nutritious alternatives, and its growth is further fueled by the expanding food industry's demand for convenient and sustainable dairy ingredients.

The driving factor for nonfat dry milk is its low-fat content, with 1.5% or less milkfat, making it a health-conscious choice. Its low moisture content of 5% or less ensures concentrated nutrients. Additionally, nonfat dry milk contains no standardized protein level, providing dietary flexibility. With regulations adhering to quality standards, nonfat dry milk caters to health-conscious consumers, constituting a significant share of the dairy market.

Market Scope

|

Metrics |

Details |

|

CAGR |

6.8% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

By Type, Application, End-User, Distribution Channel, and By Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

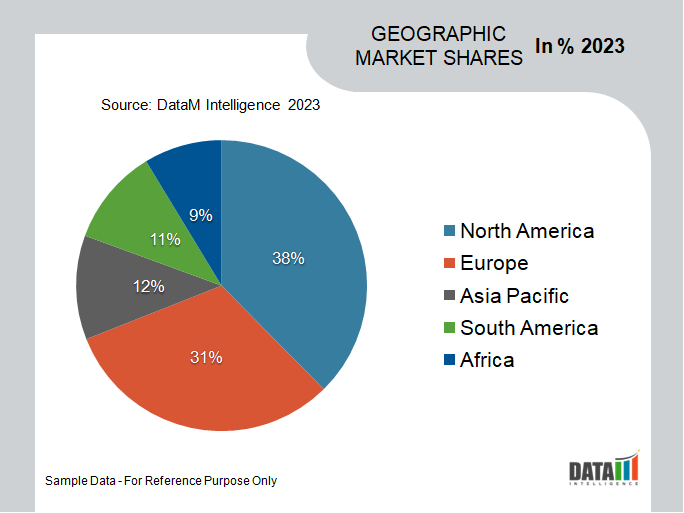

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

Market Dynamics

Growing Health Consciousness and Expanding Food Industry Propel Non-Fat Dry Milk Market

The non-fat dry milk market trend is driven by the increasing health consciousness among consumers, who are actively seeking nutritious and low-fat dairy alternatives. As more individuals opt for healthier dietary choices, the demand for non-fat dry milk products rises, contributing to the market's growth. As consumer preferences continue to prioritize health and convenience, the non-fat dry milk market share is expected to expand in response to these driving factors.

Additionally, the market for non-fat dry milk is significantly influenced by the growing food business. Non-fat dry milk is a preferred ingredient in a variety of culinary applications, such as baked goods, confectionery, dairy products, and ready-to-eat meals, due to its adaptability and longer shelf life. The food industry's ongoing innovation and product development have a beneficial influence on the non-fat dry milk market size, further solidifying the product's position in the market.

Sustainable Practices and Technological Advancements Fueling Non-Fat Dry Milk Market Growth

Non-fat dry milk market trend is driven by the increasing focus on sustainable practices in the dairy industry. Consumers are becoming more environmentally conscious, seeking products with reduced carbon footprints and ethical sourcing. Non-fat dry milk's long shelf life and efficient transportation contribute to its eco-friendly appeal, attracting environmentally conscious consumers and propelling market growth.

Furthermore, technological advancements in dairy processing and packaging are driving the non-fat dry milk market size. Advanced drying technologies and improved packaging materials ensure better product quality, extended shelf life, and enhanced convenience for consumers. These innovations cater to the evolving needs of modern consumers, driving increased adoption of non-fat dry milk products across diverse applications in the food industry.

Regulatory Challenges Pose Restraints on Non-Fat Dry Milk Market Growth

One of the key restraints facing the non-fat dry milk market is the stringent regulatory landscape governing dairy products. Compliance with food safety standards and quality regulations can be demanding for manufacturers, particularly those operating in multiple regions. Navigating these complex regulations may result in increased operational costs and potential delays in product approvals, impacting market share expansion.

Furthermore, the non-fat dry milk market size can be influenced by fluctuations in milk production and supply chain disruptions. Variations in raw milk availability and processing capacity may limit the market's growth potential, affecting the overall supply and distribution of non-fat dry milk products.

Segment Analysis

The global non-fat dry milk market is segmented based on type, application, end-user, distribution channel, and region.

High-Heat Non-Fat Dry Milk Dominating the non-fat dry milk Market with Versatility and Strong Flavor Profile

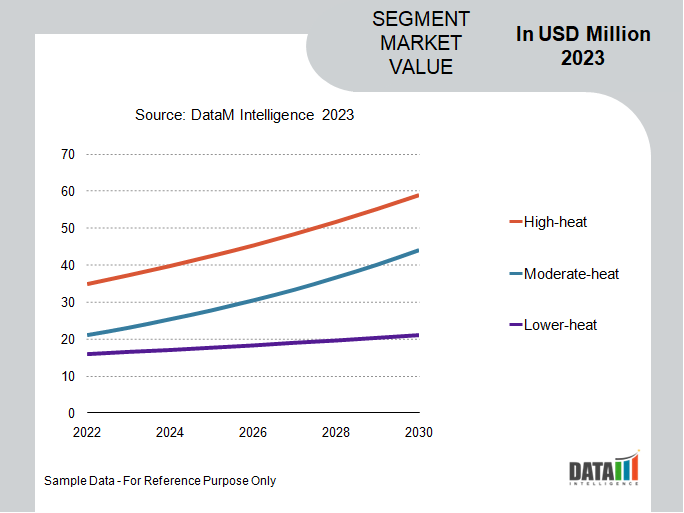

The global non-fat dry milk market has been segmented by type high-heat, moderate-heat, and lower-heat.

The high-heat segment of non-fat dry milk is estimated to hold approximately 60% of the market share within the non-fat dry milk market. The high-heat segment of non-fat dry milk, also known as skimmed milk powder or low-fat dry milk, is a significant and robust segment within the dairy powder market. It is obtained through an intense heat process, resulting in a darker color and stronger flavor compared to other varieties.

High-heat non-fat dry milk offers numerous advantages, including extended shelf life, easy storage, and convenient transportation due to its low moisture content. This makes it a preferred choice for food manufacturers and processors in various applications. The segment's versatility and ability to blend well with other ingredients make it an essential component in the food industry, used in products like bakery items, confectionery, soups, and sauces.

Geographical Penetration

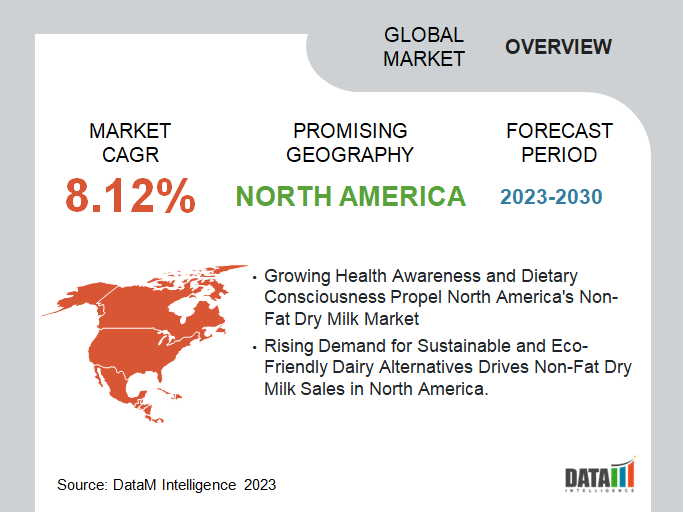

Growing Demand for Nutritional Benefits Drives Non-Fat Dry Milk Market in North America

The North America region's non-fat dry milk market is witnessing substantial growth due to increasing awareness of its nutritional benefits. Non-fat dry milk, also known as milk solids, spray-dried milk, or instant skim milk, is a convenient dairy product widely used in various applications. The market's expansion is attributed to the rising demand for milk powder production, driven by the dairy processing industry's evolving needs.

North America holds a significant market share of approximately 45% in the global non-fat dry milk market. Non-fat dry milk offers multiple nutritional advantages, making it a popular choice among consumers seeking healthier alternatives. Its long shelf life and versatility in food processing further contribute to market growth. As the demand for dairy products continues to rise in North America, the non-fat dry milk market is projected to witness significant growth in the coming years.

Major Key Players

The major global players in the market include Nestlé, Danone, Fonterra Co-operative Group Limited, Arla Foods, Saputo Inc., Dean Foods Company, Dairy Farmers of America (DFA), FrieslandCampina, Amul, and Lactalis Group.

COVID-19 Impact

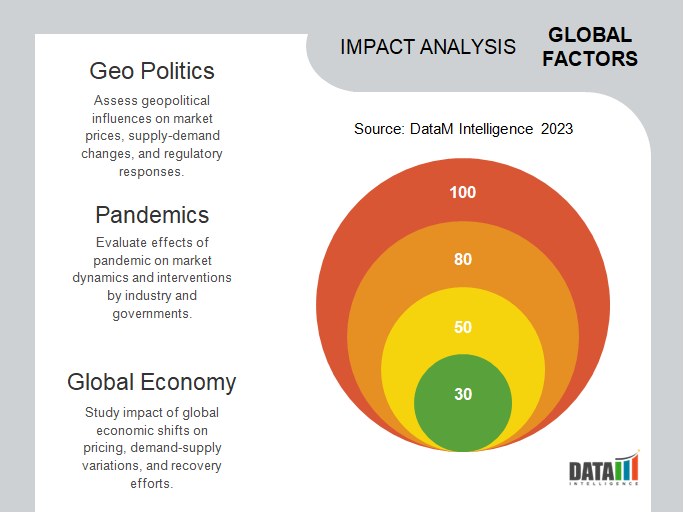

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The COVID-19 pandemic had a mixed impact on the nonfat dry milk market. During the initial stages of the pandemic, there was a surge in demand for dairy products, including nonfat dry milk, due to stockpiling and increased at-home consumption. However, disruptions in supply chains, transportation, and labor shortages affected production and distribution.

As food service establishments faced closures and reduced operations, the demand from this sector declined, impacting the market. Additionally, economic uncertainties and financial constraints among consumers affected purchasing behavior. Despite these challenges, the nutritional benefits and longer shelf life of nonfat dry milk continued to drive demand, leading to gradual recovery and growth as the pandemic subsided.

By Type

- High-heat

- Moderate-heat

- Lower-heat

By Application

- Confectionery

- Ice-creams and Snacks

- Nutritional supplements

- Bakery

- Dairy products

By End-User

- Residential

- Commercial

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 05, 2021, Lactalis Ingredients, France based company launched an organic whole milk powder, expanding its portfolio of milk powders, amid rising consumer interest in health and food quality issues. The powder is suitable for a range of functional food applications spanning from chocolate to bakery.

- On September 07, 2020, TATA, Indian based company, entered into milk products under the brand name Tata NQ by launching Tata NQ Skimmed milk powder. To begin with, this pack is available for institutional customers only in 25 Kg.

- On April 25, 2023, Valio launches a new infant-grade skimmed milk powder, Valio Prime SMP. It meets the strictest dry blending requirements in infant nutrition. Valio Prime SMP is a unique new product built on decades of award-winning research and development. Valio Prime SMP is manufactured in Valio’s new ultraclean facilities using only fresh Finnish milk that is ranked among the cleanest in the world.

Why Purchase the Report?

- To visualize the global non-fat dry milk market segmentation based on type, application, end-user, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of non-fat dry milk market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global non-fat dry milk market report would provide approximately 69 tables, 69 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies