Non-Dairy Frozen Dessert Market Size

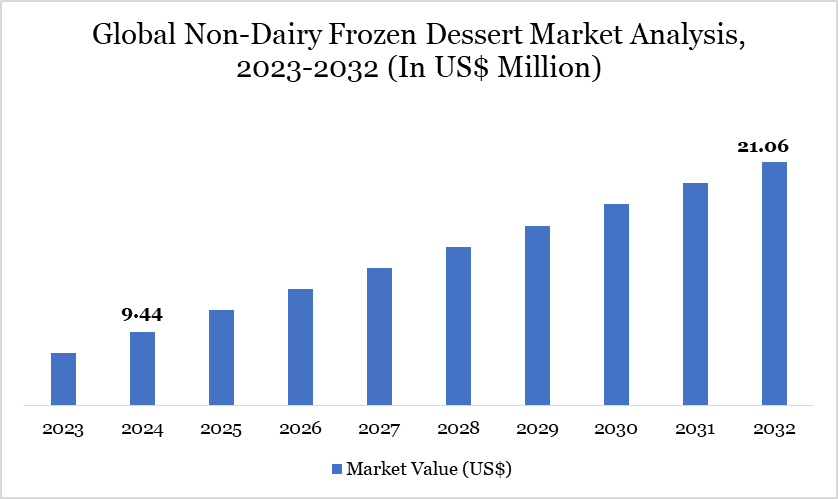

Non-Dairy Frozen Dessert Market Size reached US$ 9.44 billion in 2024 and is expected to reach US$ 21.06 billion by 2032, growing with a CAGR of 10.55% during the forecast period 2025-2032.

The non-dairy frozen dessert market in North America is experiencing notable growth due to increasing lactose intolerance and plant-based diet adoption. According to the US National Institutes of Health (NIH), approximately 36% of Americans are lactose intolerant, driving demand for dairy-free alternatives. Major food producers like Nestlé and Unilever have expanded their non-dairy portfolios in response, launching oat milk- and almond-based ice creams across mainstream retail channels.

Government dietary guidelines and school nutrition standards are also shifting toward plant-based options. The USDA’s 2020–2025 Dietary Guidelines encourage greater intake of plant-based foods, influencing both institutional procurement and consumer habits. Companies such as So Delicious (Danone North America) have seen increased distribution in public school and hospital vending networks, reinforcing mainstream access to non-dairy frozen desserts.

Non-Dairy Frozen Dessert Market Trend

The non-dairy frozen dessert market is uniquely positioned at the intersection of health, sustainability, and innovation. Driven by shifting dietary needs and environmental awareness, companies are leveraging oat, almond, and coconut bases to meet demand. FDA-recognized allergen labeling and school-friendly formulations are accelerating mainstream adoption. This evolution reflects a deeper cultural shift toward conscious consumption.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

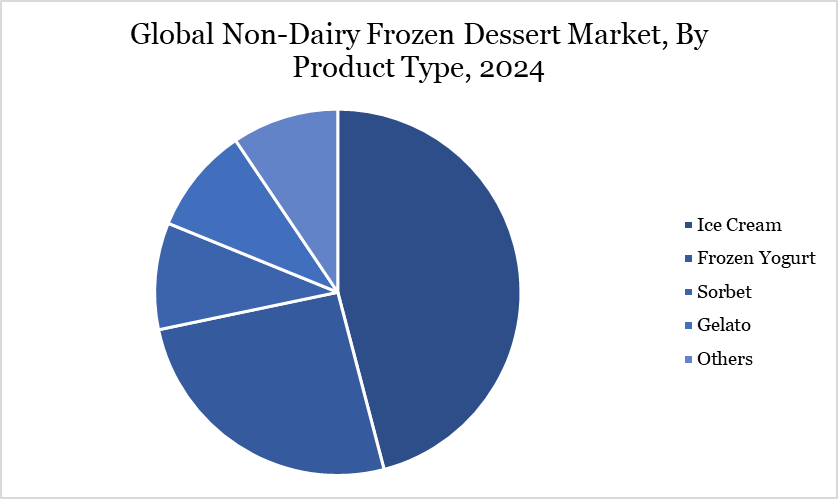

| By Product Type | Ice Cream, Frozen Yogurt, Sorbet, Gelato, Others |

| By Source | Almond Milk, Soy Milk, Coconut Milk, Oat Milk, Cashew Milk, Rice Milk, Others |

| By Packaging Type | Tubs, Cups, Bar/sticks, Multi-Packs, Others |

| By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Online Channel, and Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Non-Dairy Frozen Dessert Market Dynamics

Growing non-dairy frozen dessert market with a great focus on veganism

The rise of veganism significantly supports the growth of the non-dairy frozen dessert market. According to a 2023 report from the USDA, plant-based milk consumption rose by over 15% between 2020 and 2022 in the US, indicating a dietary shift that also boosts demand for vegan frozen products. Major companies like Unilever have responded by expanding their vegan Magnum and Ben & Jerry’s lines across North America.

The FDA’s Total Diet Study shows increasing consumer preference for dairy alternatives, especially among Gen-Z and millennials, who drive vegan consumption trends. Nestlé USA reports a double-digit growth in its plant-based dessert category, attributing it to higher demand for vegan and allergen-free products. This momentum reflects a broader trend toward ethical and plant-forward eating habits in North American households.

Limited Consumer Awareness and Acceptance of Plant-Based Seafood Alternatives

Limited consumer awareness of plant-based seafood alternatives is indirectly affecting the broader non-dairy frozen dessert market by tempering the overall adoption of plant-based diets. According to a 2023 USDA report, fewer than 30% of US adults are familiar with plant-based seafood options, compared to over 70% awareness of plant-based dairy. This hesitancy to adopt a full plant-based lifestyle can reduce crossover consumption of related categories like non-dairy frozen desserts.

FDA consumer behavior insights show that taste, unfamiliar ingredients, and unclear labeling are among the top barriers to acceptance of newer plant-based foods, including frozen desserts. While companies like Nestlé have introduced dairy-free frozen options under brands like Häagen-Dazs, they report that consumer education remains a challenge. As long as overall plant-based food literacy remains low, segments such as non-dairy frozen desserts face a slower pace of mainstream adoption.

Non-Dairy Frozen Dessert Market Segment Analysis

The global non-dairy frozen dessert market is segmented based on product type, source, packaging type, distribution channel and region.

Ice Cream Segment Driving Non-Dairy Frozen Dessert Market

The ice cream segment is at the forefront of growth in the North American non-dairy frozen dessert market. According to the US Department of Agriculture (USDA), per capita consumption of frozen desserts remains high, and plant-based ice creams have become a significant contributor to this trend. Major food companies like Nestlé and Unilever have expanded their portfolios with non-dairy ice cream options, citing strong consumer uptake in their annual ESG and sustainability reports.

In June 2024, McDonald’s announced the launch of a new dairy-free ice cream-style frozen dessert. The Vegan Scoop is available in two flavors, Choco and Strawberry, and both have been certified as vegan by The Vegetarian Society. The product has been described as “smooth and creamy,” and it costs US$ 1.78 for a tub.

Non-Dairy Frozen Dessert Market Geographical Share

Demand for Non-Dairy Frozen Dessert Demand in North America

The North American non-dairy frozen dessert market is witnessing robust growth, fueled by increasing consumer awareness of health, dietary sensitivities, and sustainability. According to the US Department of Agriculture (USDA), plant-based alternatives are steadily gaining shelf space in retail stores as consumer demand grows. The rise in lactose intolerance and dairy allergies has also pushed more consumers toward plant-based frozen desserts, such as those made with almond, coconut, oat, or soy milk.

The US National Institutes of Health (NIH) reports that about 36% of Americans experience lactose malabsorption, further underscoring the demand for non-dairy options. In Canada, data from Health Canada shows that the shift toward plant-based eating is being reflected in national dietary guidelines, which recommend lower consumption of saturated fats often found in dairy products.

The surge in vegan and flexitarian lifestyles has prompted both startups and established food companies to introduce innovative frozen dessert options that are dairy-free, low in added sugars, and free from artificial additives. The US Food and Drug Administration (FDA) has seen an uptick in new product registrations under the plant-based category, signaling industry responsiveness to changing consumer preferences.

Supermarkets and hypermarkets remain the primary sales channels, but online grocery sales of non-dairy frozen products are growing rapidly, driven by improvements in cold-chain logistics and e-commerce access. This shift in retail dynamics mirrors broader trends in consumer food choices, with North Americans increasingly favoring clean-label, environmentally friendly dessert options that align with both personal health goals and sustainability concerns.

Sustainability Analysis

The sustainability of the non-dairy frozen dessert market is reinforced by its significantly lower environmental footprint compared to traditional dairy ice cream. According to the Food and Agriculture Organization (FAO), dairy livestock accounts for over 4% of global greenhouse gas emissions. Non-dairy alternatives such as oat, almond, and soy bases require significantly less water, land, and energy. For instance, the US Geological Survey (USGS) reports that almond milk uses approximately 80% less water than cow’s milk per liter of production. This shift is aligned with growing governmental pressures to reduce emissions from the food sector.

Further, consumer preference is increasingly shaped by sustainability labelling and government initiatives promoting plant-based alternatives. The USDA, under its Climate-Smart Agriculture initiative, encourages innovation in plant-based food systems to reduce agricultural emissions. Companies like Oatly Group AB report a 49% lower carbon footprint for their frozen dessert products compared to dairy equivalents. These factors suggest strong alignment between environmental policies and market demand, positioning the non-dairy frozen dessert industry for long-term growth and resilience.

Non-Dairy Frozen Dessert Market Major Players

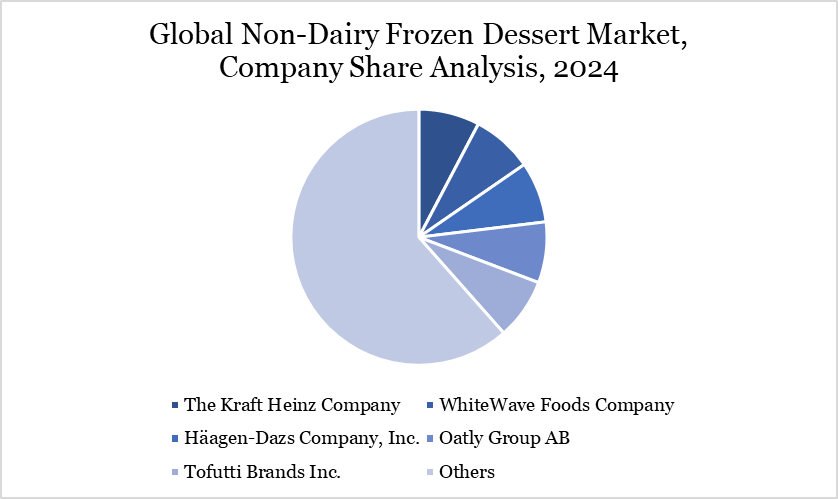

The major global players in the market include The Kraft Heinz Company, WhiteWave Foods Company, Häagen-Dazs Company, Inc., Oatly Group AB, Tofutti Brands Inc., Wicked Foods, Inc., Arctic Zero, Inc., The Booja-Booja Company Ltd., The Hain Celestial Group, Inc., and Eclipse Foods, Inc.

Key Developments

In April 2025, Kraft Heinz has launched a plant-based JELL-O chocolate pudding, its first vegan dessert. The JELL-O Oat Milk Chocolate Pudding features the “signature” taste of the brand’s traditional version along with an entirely lactose-free, gluten-free, and vegan recipe. The new plant-based product is a first for both the JELL-O brand and its parent company, Kraft Heinz.

In February 2024, Perfect Day, the leading precision fermentation innovator and supplier, has partnered with Unilever’s Breyers, a family favorite since 1866, to launch Breyers Lactose-Free Chocolate made with Perfect Day’s dairy protein from fermentation. Perfect Day uses a decades-old process of precision fermentation to create its highly functional whey protein that offers the same indulgent experience consumers have loved for decades without any lactose and with a reduced environmental footprint. Breyers Chocolate is available in a 48-ounce tub available nationwide starting this month.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies