Global Nitrification Inhibitors Market is segmented By Type (Nitrapyrin, Dicyandiamide, DMPP, Others), By Crops (Cereals, Millets & Oilseeds, Cotton, Fruits & Vegetables, Plantation Crops, Pulses), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Nitrification Inhibitors Market Size

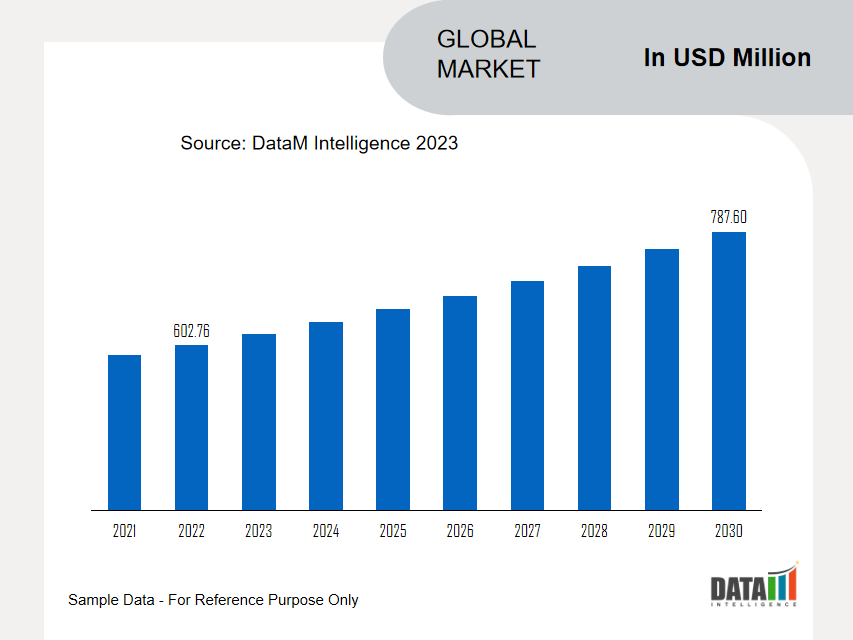

Global Nitrification Inhibitors Market reached US$ 602.76 million in 2022 and is expected to reach US$ 787.60 million by 2031, growing with a CAGR of 3.4% during the forecast period 2024-2031.

The global nitrification inhibitors market has witnessed significant growth over the years, as nitrification inhibitors are chemical compounds that are used to reduce the nitrification of ammonia, ammonium-containing, and urea-containing fertilizers. which can help in improving the crop yield, hence, such factors can help in driving the global nitrification inhibitor market.

Furthermore, as the demand is increasing for these products manufacturers are highly investing in this product. For instance, in December 2023, Fertiberia company launched NSAFE, a microbiological development that acts as a nitrification inhibitor, retaining nitrogen in the soil and preventing it from leaching out in the soil or air. Hence, such products can help in increasing the market growth.

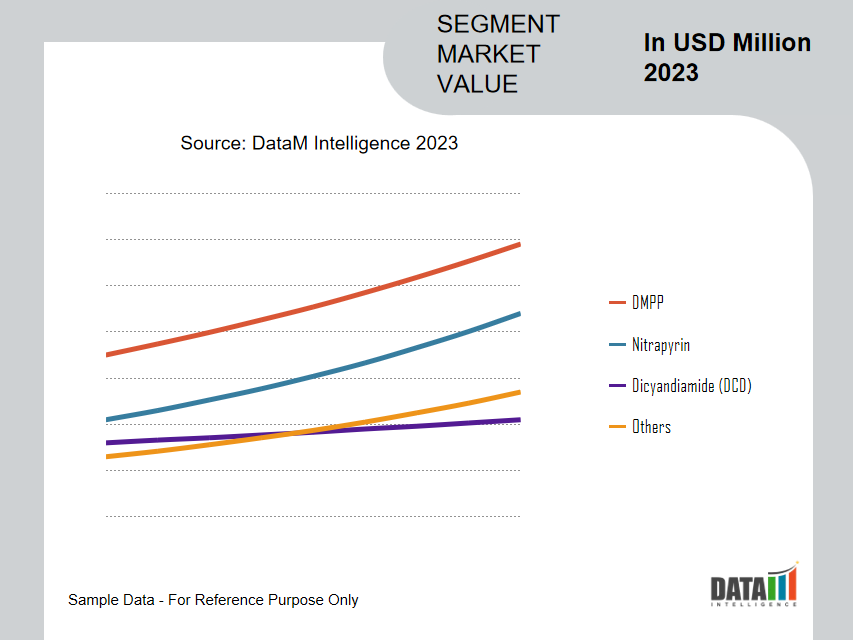

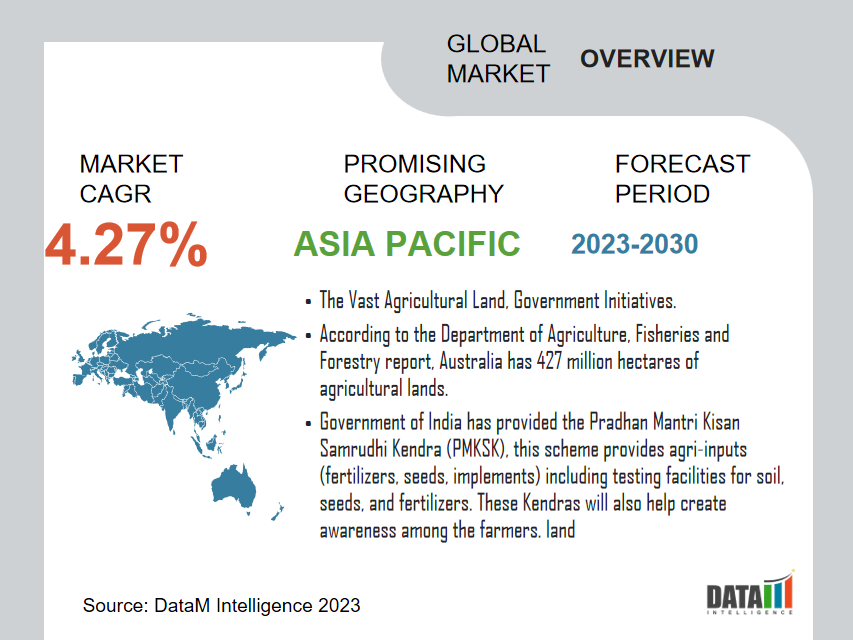

The DMPP nitrification inhibitor accounts the largest share in global market, as well as Asia-Pacific region showa the dominance in global nitrification inhibitor market, as the region have a presence of vast agricultural lands, and government suupport, which can help in increasing the market for global nitrification inhibitors.

Nitrification Inhibitors Market Summary

|

Metrics |

Details |

|

CAGR |

3.4% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Distribution Channel, Crop Type, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

North America |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights about the Market Request Free Sample

Nitrification Inhibitors Market Dynamics

Growing Concern About the Negative Affects Associated Nitrate

The growing concerns about the adverse effects associated with nitrates. For instance, according to the British Heart Foundation side effects of nitrates include headaches, dizziness or light-headedness, flushing, or a warm feeling in the face. Hence such adverse effects can help increase the adoption rate of nitrification inhibitors

Furthermore, as the concerns related to nitrates are increasing among customers, many farmers are highly adopting these nitrification inhibitors as they delay the conversion of ammonium to nitrate, also nitrification inhibitors can help reduce the leaching of nitrate into groundwater. Hence, such factors can help in increasing the market growth.

Increase in Demand for High Crop Productivity

The demand for higher crop productivity is increasing, for instance, according to the Ministry of Agriculture & Farmers Welfare report of 2022, an increase in the production of Fruits and vegetables. fruit production is estimated to be 107.10 Million Tonne compared to 102.48 Million Tonne in 2020-21. and Vegetable production is estimated to be 204.61 Million tonnes, compared to. 200.45 Million Tonne in 2020-21.

Furthermore, as the demand for crop production is increasing, farmers are showing more willingness to adopt these nitrification inhibitor products, as they slow down or inhibit the nitrification process in soil. and helps in increasing the availability of ammonium nitrogen to crops, potentially improving nitrogen use efficiency. which can help in enhancing crop productivity.

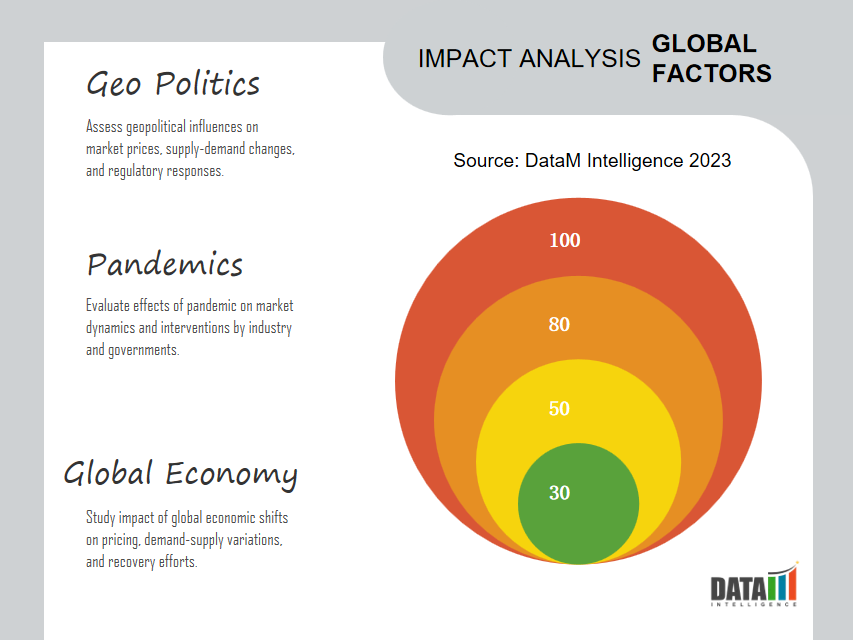

Government Regulations

Government regulations can indeed have an impact on the global nitrification inhibitors market. Regulatory measures are often implemented to address environmental concerns, promote sustainable agriculture, and ensure the responsible use of agricultural inputs. Which could affect the growth of the global nitrification inhibitors market.

Furthermore, the government of Canada has provided some regulations, for instance, T-4-127 – Regulation of nitrification and urease inhibitors under the Fertilizers Act and Regulations. As a result, regulated parties, including all manufacturers, importers, distributors and sellers of fertilizers and supplements must adhere to the amended fertilizers regulations.

Nitrification Inhibitors Market Segments Analysis

The global Nitrification Inhibitors market is segmented based on type, distribution channel, crop type, application and region.

Increase in Demand for Effective Crop Nutrition

The DMPP nitrification inhibitors show dominance in the global nitrification inhibitor market, farmers are highly adopting these inhibitors to help improve NUE by inhibiting the conversion of ammonium to nitrate in the soil. This, in turn, allows for a more prolonged availability of ammonium nitrogen for plant uptake, also, they can applied for a wide range of crops which can help in increasing the adoption rate. Hence, such factors can help in increasing the market growth.

Furthermore, manufacturing companies are producing innovative products to attract larger consumer bases. For instance, the ICL company produces Nova Complex Optima. It contains a state-of-the-art nitrification inhibitor (DMPP) to reduce nitrogen loss from leaching and to improve the supply of nitrogen, also designed to let you control the risk of nitrate leaching, which is vital in preventing groundwater contamination. Hence, such products can help in gaining popularity for nitrification inhibitors.

Nitrification Inhibitors Market Geographical Share

Vast Agricultural Land, Government Initiatives in Asia-Pacific

Asia-Pacific region shows the dominance in global nitrification inhibitors market, due to the presence of vast agricultural lands and government support, farmers in this region are highly adopting these nitrification inhibitors, also they can help slow the process of nitrates and improve the availability of nitrogen to crop which can help in improving the crop yield, hence, such factors can help in driving the market growth in this region.

Furthermore, the presence of vast agricultural lands in this region, for instance, according to the Department of Agriculture, Fisheries and Forestry report, Australia has 427 million hectares of agricultural lands, hence, such presence of vast agricultural lands can help in increasing the adoption rate for nitrification inhibitors.

Additionally, the government in this region also provides some initiatives to help the farmers to adopt the fertilizers. For instance, the government of India has provided the Pradanmantri Kisan Samrudhi Kendra (PMKSK), this scheme provides agri-inputs (fertilizers, seeds, implements) including testing facilities for soil, seeds, and fertilizers. These Kendras will also help create awareness among the farmers. Hence, such schemes can help in increasing the market growth.

Market Key Players

The major global players in the market include Koch Industries, Inc., COMPO EXPERT GmbH, BASF SE, EuroChem Group, Corteva., Nico Orgo, Solvay, Zhejiang Aofutuo Chemical Co., Ltd., Agrichem, and Arclin, Inc.

COVID-19 Impact Analysis

The pandemic has brought unprecedented challenges for industries worldwide, including the global nitrification inhibitors market. Also, during a pandemic, many manufacturing companies are shut down which has brought a distribution in the supply chain of the products, which can hamper the availability of products in the market which can affect the global nitrification inhibitors market.

Key Developments

- In December 2023, Yara acquired the organic-based fertilizer business of Agribios Italiana,. This signifies Yara’s commitment to further expand its offering in this sector as a complement to its mineral fertilizers to help promote regenerative agriculture and improve soil health.

- In November 2023, A pilot project has been initiated in China by BASF and Yunnan Yuntianhua Co., Ltd., a chemical fertilizer manufacturer based in China, to confirm that using Yuntianhua's stabilized urea fertilizer, which contains BASF's urease inhibitor Limus®, reduces CO2 emissions. It is anticipated that the outcomes will help China's climate smart agricultural activities as well as potential for program development worldwide.

- In September 2023, Nouryon acquired ADOB Fertilizers. This acquisition will enable Nouryon to expand its product portfolio and broaden its offerings for customers in the crop nutrition market.

Why Purchase the Report?

- To visualize the global nitrification inhibitors market segmentation based on type, distribution channel, crop type, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of nitrification inhibitors market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global Nitrification Inhibitors market report would provide approximately 68 tables, 69 figures and 186 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies