Herbicide Market Size

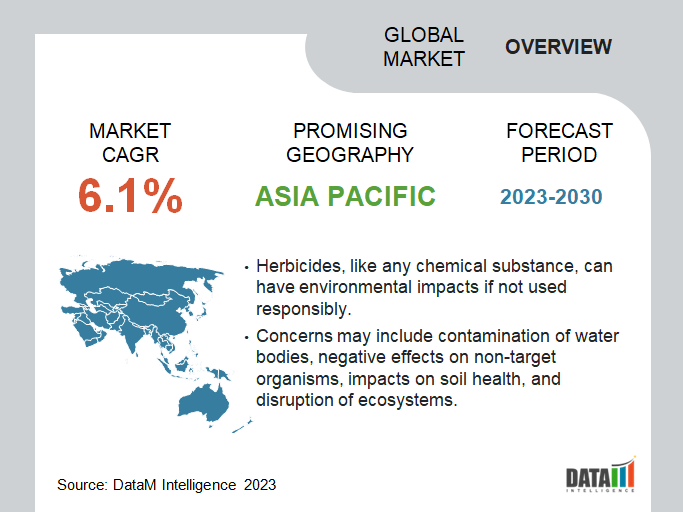

The Global Herbicides Market reached USD 32.5 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 52.1 billion by 2031. The market is growing at a CAGR of 6.1% during the forecast period 2024-2031. The growing demand for food is majorly driving the Global Herbicides Market growth. For instance, the estimated demand for global cereal equivalent (CE) food is 10,094 million tonnes in 2030 and 14,886 million tonnes in 2050.

Integrated weed management, which combines multiple weed control strategies, is gaining traction in the agricultural industry. Farmers recognize the importance of diversifying weed control tactics to manage herbicide resistance, reduce chemical inputs, and promote sustainable weed management.

The herbicide market is responding to this trend by offering herbicides that can be used as part of comprehensive IWM programs, incorporating cultural practices, biological controls, and mechanical or physical weed control methods.

The herbicides market is witnessing ongoing research and development efforts to discover and develop new active ingredients. These new molecules offer improved weed control efficacy, novel modes of action, and enhanced selectivity to minimize damage to crops.

The introduction of new active ingredients provides opportunities for market growth by expanding the range of herbicide options available to farmers and addressing challenges posed by herbicide-resistant weeds.

Market Scope

| Metrics | Details |

| CAGR | 6.1% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Product Type, Selectivity, Time of Application, Crop Type, and Region |

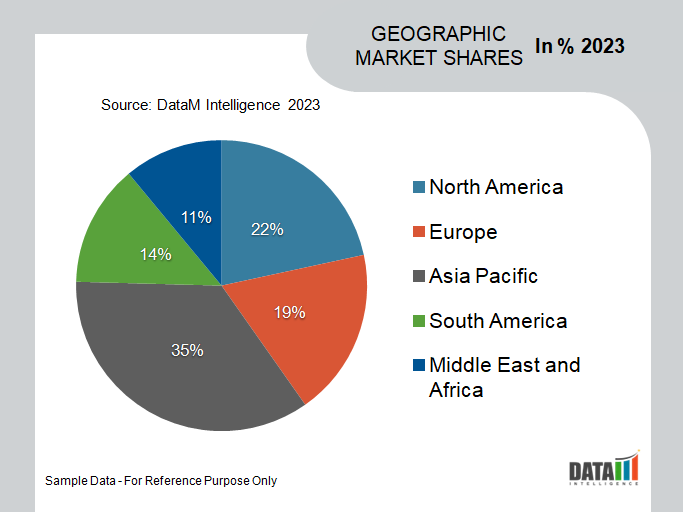

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For more insights - Download the Sample

Market Dynamics

The Growing Need to Improve Agricultural Yield due to Surging Food Demand is a Major Factor Driving the Global Herbicides Market

According to AGRIVI, global food demand is anticipated to increase by 35% by 2030. Herbicides play a crucial role in enhancing crop productivity. By effectively controlling weeds, herbicides enable crops to access essential resources without competition, leading to improved growth and higher yields. As arable land becomes scarcer, farmers are under pressure to maximize the productivity of their existing land, and herbicides provide an effective means to achieve this.

Herbicides are substances specifically designed to control or eliminate unwanted plants, commonly known as weeds. Weeds compete with crops for essential resources such as water, nutrients, and sunlight, which can significantly reduce crop yields. As the demand for food increases with the growing global population, farmers need effective tools to manage weed infestations and maximize crop production.

Decreasing Arable Land Availability is Driving Herbicides Market Growth

Arable land is constantly declining with urbanization, soil degradation, climatic changes, and some other factors. For instance, according to Statista, in Hungary, organic lands made up 5.8% of the nation's total agricultural land area as of 2021, a decline from the previous year when this percentage peaked at 6%.

Farmers are under pressure to intensify their agricultural practices to maximize productivity with a limited amount of arable land. This involves growing crops more efficiently and effectively on the available land. Herbicides play a crucial role in this intensification process by controlling weeds, which can significantly reduce crop yields.

Weeds are unwanted plants that compete with crops for essential resources such as water, nutrients, and sunlight. As arable land availability decreases, the competition between crops and weeds intensifies. Weeds can quickly spread and dominate agricultural fields, reducing crop yields.

Herbicides provide an effective solution to control weed infestations, enabling crops to access resources without competition. This ensures efficient utilization of limited arable land and contributes to market growth for herbicides.

Stringent Government Regulations and Adverse Environmental Effects are the Major Factor Hindering the Growth of the Global Herbicide Market

Herbicides must undergo rigorous testing and evaluation before being registered and approved for use. Regulatory authorities set strict guidelines and criteria to ensure the safety of human health, wildlife, and the environment. The registration process can be time-consuming and costly for herbicide manufacturers.

The stringent requirements may limit the number of new herbicides entering the market, reducing options for farmers and restraining market growth.

Herbicides, like any chemical substance, can have environmental impacts if not used responsibly. Concerns may include contamination of water bodies, negative effects on non-target organisms, impacts on soil health, and disruption of ecosystems.

Heightened environmental awareness and concerns about sustainability have led to increased scrutiny of herbicide use and the demand for more environmentally friendly alternatives. This can restrain the market growth of conventional herbicides, prompting manufacturers to invest in developing safer and more sustainable herbicide formulations.

Market Segment Analysis

The Global Herbicides Market is segmented based on product type, selectivity, time of application, crop type, and region.

Broad Effectiveness of Glyphosate

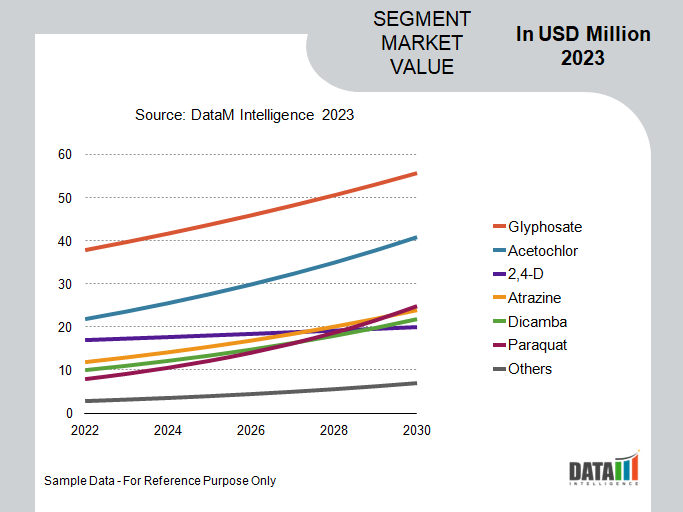

Based on the product type, the herbicides market is segmented into various glyphosate, 2,4-D, atrazine, dicamba, paraquat, diquat, and others

In 2022, the glyphosate segment dominated the global market due to its extensive agricultural production usage and its advantages, such as low cost and high efficiency over other herbicides. Glyphosate was extensively used to produce corn, soybean, and wheat crops. According to the United States Environmental Protection Agency, on a yearly average of 298 million acres of cropland, glyphosate is applied in amounts of about 280 million pounds. It can be applied pre-planting, pre-emergence, or post-emergence to control weeds in a wide range of crops and in non-crop areas such as roadsides, industrial sites, and gardens.

The introduction of glyphosate-tolerant genetically modified (GM) crops, particularly glyphosate-tolerant soybeans, corn, cotton, and canola, further increased the demand for glyphosate. According to FOE (Friends of the Earth Europe), introducing GM glyphosate-resistant sugar beet, maize, and soybean might increase glyphosate usage by 800% between 2017 and 2025. The combination of glyphosate-tolerant crops and glyphosate herbicides simplifies weed management and contributes to glyphosate's dominance in the market.

Market Geographical Share

Vast Agricultural Industry in Asia-Pacific

In 2022, Asia-Pacific had the highest share of the Herbicides market. Many countries in the Asia Pacific region have agrarian economies where agriculture plays a crucial role. The region is home to some of the world's largest agricultural producers, including China, India, and Indonesia.

For instance, according to International Labor Organization, in 2021, a total of 563 million people were employed in agriculture in the Asia–Pacific region. The reliance on agriculture for food security and economic development drives the demand for herbicides to ensure high crop yields and control weed infestations.

The Asia Pacific region is characterized by diverse cropping systems and a wide range of crops grown. These crops include rice, wheat, corn, soybeans, sugarcane, vegetables, fruits, and more. Each crop has specific weed challenges, and herbicides play a critical role in managing weeds effectively. The diverse cropping systems contribute to the higher demand for herbicides in the region.

Market Key Players

The major global players in the market include Syngenta AG, BASF SE, Bayer AG, Dow AgroSciences, Atanor SCA, FMC Corporation, Nufarm, Arysta Lifesciences, Sumitomo Chemical, Nissan Chemical Corporation

COVID-19 Impact on Market

The pandemic caused disruptions in global supply chains due to lockdowns, travel restrictions, and reduced workforce. This could have affected the production and distribution of herbicides, potentially leading to supply shortages or delays. The pandemic and subsequent lockdown measures led to changes in consumer behavior and spending patterns.

With restrictions on movement and reduced agricultural activities in some regions, there might have been a decrease in demand for herbicides in certain sectors. However, increased focus on home gardening and agriculture in some areas might have partially offset this decline.

By Product Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Dicamba

- Paraquat

- Diquat

- Others

By Selectivity

- Selective Herbicides

- Non-Selective Herbicides

By Time of Application

- Pre-Plantation

- Pre-Emergent

- Post Emergent

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In May 2023, FMC Corporation, a leading agricultural sciences company introduced Galaxy NXT herbicide for soybean crops. The company also launched drone spray services in the state.

- In January 2023 Herbicide Technical, which is just for export markets, has been successfully launched by India Pesticides at the company's Sandila Plant. One more selective systemic herbicide for the pre- or early post-emergence management of grass and several broad-leaved weeds has been introduced by the company. For the most part, crops like maize, soybeans, tomatoes, potatoes, sunflowers, wheat, and rice are treated with this herbicide.

- In June 2022, FMC introduced an herbicide for sugarcane with 2 molecules. The method offers a unique formulation to manage weeds with broad and narrow leaves by combining sulfentrazone and tebuthiuron.

Why Purchase the Report?

- To visualize the Global Herbicides Market segmentation based on product type, selectivity, time of application, crop type, and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the herbicides market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Herbicides Market Report Would Provide Approximately 69 Tables, 73 Figures, and 200 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies