Naphthalene Market Size

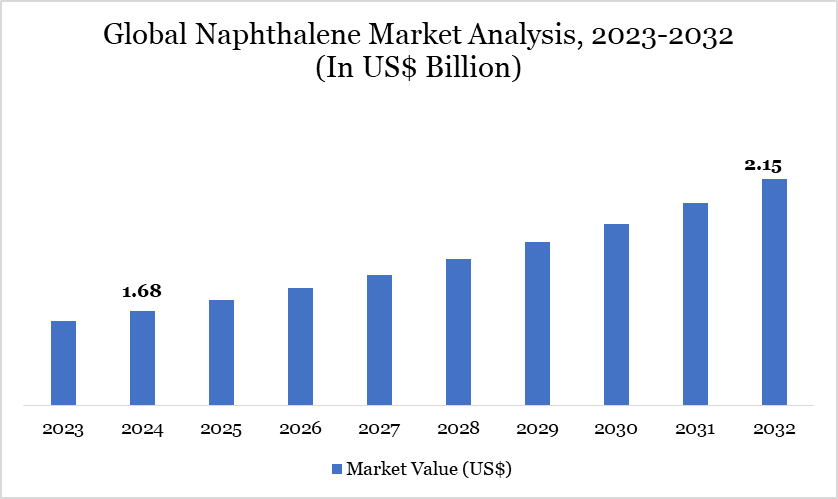

Naphthalene Market Size reached US$ 1.68 billion in 2024 and is expected to reach US$ 2.15 billion by 2032, growing with a CAGR of 3.12% during the forecast period 2025-2032.

Naphthalene exhibits a pronounced coal-tar smell in its white crystalline volatile solid state. The solid has a higher density than water and so cannot dissolve in water. Combustible, albeit potentially challenging to ignite. Being in the molten state, it is extremely hot. Avoidance of skin contact is necessary. Moreover, the release of fumes from the substance could be hazardous. Utilized as a moth deterrent, fumigant, lubricant, raw material for chemical synthesis and several more applications.

The increasing usage of naphthalene in the synthesis of phthalic anhydride, a compound employed in the production of plasticizers, dyes and resins, has substantially contributed to the expansion of the market. The textile industry's growth, propelled by increasing population and evolving fashion trends, has also stimulated the need for naphthalene-based products such as moth repellents and dye intermediates.

Naphthalene Market Trend

The market for items such as mothballs, surfactants and herbicides containing naphthalene is growing even more. At ambient temperature, naphthalene undergoes a direct conversion from a solid to a gas, resulting in the emission of fumes that deter moths and other insects, therefore safeguarding textiles and furnishings. Consequently, there has been an increase in the demand for naphthalene.

Naphthalene is a polycyclic aromatic hydrocarbon (PAH) derived from coal tar and mineral oil. Coal-tar processing: Thus, it is acquired as a secondary product of the coal carbonization process. The production of coke, coal gas and coal tar involves the heating of coal tar in the absence of air. Once distilled, it yields several components, one of which being naphthalene. The crude naphthalene is refined by the processes of crystallization, distillation, or sublimation in order to eliminate contaminants.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Source | Coal Tar, Petroleum |

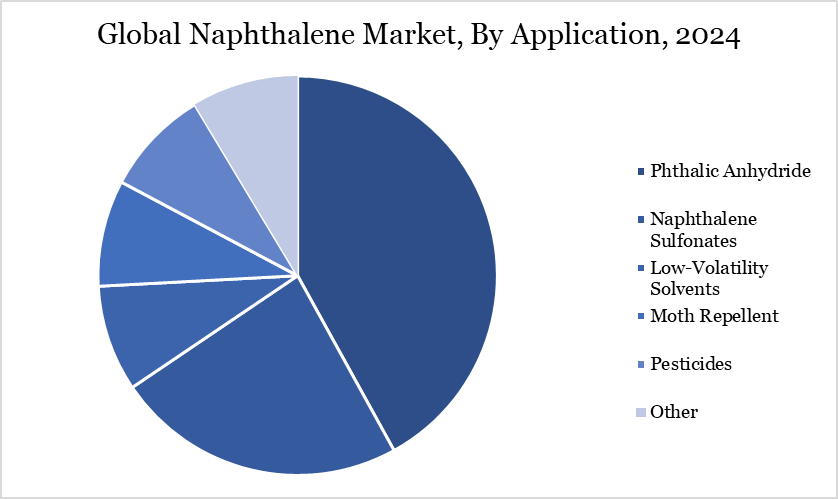

| By Application | Phthalic Anhydride, Naphthalene Sulfonates, Low-Volatility Solvents, Moth Repellent, Pesticides, Other |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Naphthalene Market Dynamics

Infrastructure Advancement and Industrial Growth

The continual expansion of the global building and industrial sectors is a primary catalyst for the growth of the naphthalene market. The growing trend is particularly pronounced in high-growth nations like China, where the National Bureau of Statistics reports that building activities contributed roughly US$ 4.5 trillion to GDP in 2023 an 11% rise from the prior year. This statistic underscores the magnitude and progress of infrastructure development in the region.

The commencement of substantial commercial ventures, exemplified by the US$ 900 million CommerzIII Office Complex expected to be completed in 2027, underscores the ongoing commitment to long-term infrastructure investment. This, consequently, is driving the need for naphthalene, an essential component in construction materials including plasticizers, resins, and insulation. The consistent expansion of the industrial sector in key global economies bolsters a positive forecast for naphthalene consumption in the forthcoming years.

Increasing Regulatory Obstacles

The global naphthalene market is progressively restricted by a complicated and evolving regulatory framework that jeopardizes its long-term sustainability. The Environmental Protection Agency (EPA) in North America is set to publish a draft IRIS Assessment for Naphthalene in 2025, anticipated to impact federal and state laws.

In September 2023, the EPA identified naphthalene as one of 15 chemicals submitted for pre-prioritization under TSCA, although it was not classified as a high-priority substance in December 2023. The chemical is under vigilant scrutiny. Industry parties, such as the American Chemistry Council (ACC) and the American Petroleum Institute (API), have established a Naphthalene Workgroup to oversee and address changing laws.

Naphthalene is classified as a Substance of Very High Concern (SVHC) under REACH in Europe, requiring comprehensive safety evaluations and stringent adherence to regulations. In June 2024, the FDA of Ghana strengthened limitations and labeling rules to mitigate health risks. These layers of regulation collectively hinder market expansion and elevate operational burdens.

Naphthalene Market Segment Analysis

The global naphthalene market is segmented based on source, application and region.

Expanding Role of Naphthalene Sulfonates in Advanced Cleaning and Construction Applications

The primary application of naphthalene is the synthesis of naphthalene sulfonates, which has a wide range of applications due to their ability to induce wetting and spreading mechanisms. Naphthalene sulfonates are an essential component in the synthesis of naphthalene sulphonate formaldehyde (NSF). NSF is employed in polymer-concrete admixtures to counterbalance the surface charge on cement particles, therefore enhancing the water molecular bonding in cement agglomerations and reducing the viscosity of the paste and concrete.

These compounds are employed in the manufacturing of surfactants that find application in a diverse range of personal care items. Furthermore, naphthalene sulfonates find application in water-based cleaning agents, including shampoos, automatic dishwashing detergents and industrial detergents.

An estimated 1.2 million tons of cleaning detergents would be sold in Japan in 2021, according to the Japan Soap and Detergent Association (JSDA). Synthetic blends will constitute the bulk of the market. Moreover, over 50% of the total 641 thousand tons of cleaners sold consisted of synthetic liquid laundry detergents. By comparison, the entire sales of soap amounted to around 25.7 thousand tons. Consequently, this will be advantageous for the naphthalene market.

Naphthalene Market Geographical Share

North America’s Regulatory Framework Leading Market Trends

The naphthalene market in North America is significantly impacted by regulatory changes and environmental oversight. The EPA's draft IRIS Assessment, set for publication in 2025, is pivotal in influencing forthcoming risk management and utilization strategies. Regulatory control is implemented by the EPA, OSHA and the Department of Transportation, encompassing all phases from manufacturing to disposal.

The formation of a specialized Naphthalene Workgroup by the ACC and API highlights the market's proactive approach to mitigating regulatory risk. The ATSDR's toxicological profile, released in May 2024 and available for stakeholder feedback until August 1, 2024, is expected to impact public health evaluations and may result in more rigorous regulations. Naphthalene, although not designated as high priority in December 2023, is on the September 2023 pre-prioritization list, indicating it may soon encounter heightened regulatory scrutiny, influencing investment and usage choices in the region.

Sustainability Analysis

The sustainability perspective for the naphthalene market is growing more intricate due to the intensification of environmental and health restrictions worldwide. Within the European Union, the categorization of the chemical as a Substance of Very High Concern (SVHC) under REACH necessitates stringent registration, risk assessment and the delivery of extensive safety information throughout its lifecycle.

On June 4, 2024, the FDA in Ghana issued a directive underscoring the necessity of accurate labeling and the prevention of exposure, particularly in proximity to food and children, reflecting global apprehension about the health effects of naphthalene. Regulatory bodies are aggressively promoting the transition of companies towards environmentally friendly alternatives, particularly in the construction and textile sectors.

This initiative is propelled by increasing pressure to diminish carbon footprints and mitigate detrimental industrial consequences. These changes are instigating a gradual yet unmistakable transition from conventional naphthalene-based inputs, as sustainability factors increasingly dominate procurement and material sourcing decisions within global value chains.

Naphthalene Market Major Players

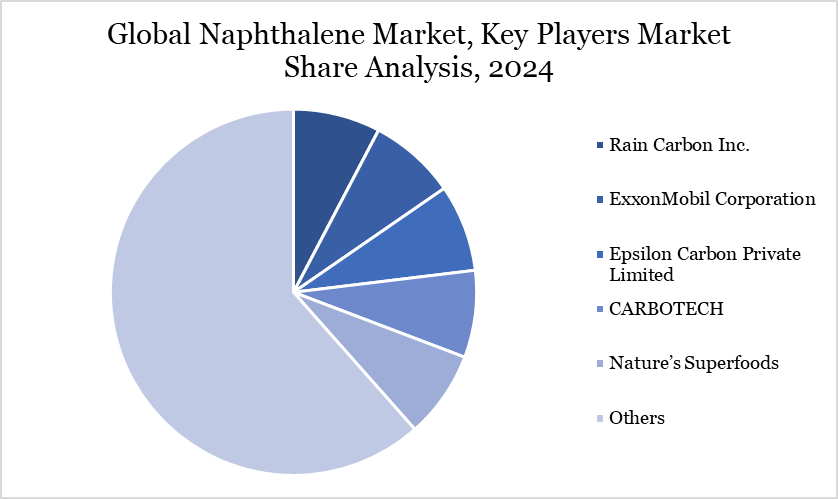

The major global players in the market include Rain Carbon Inc., ExxonMobil Corporation, Epsilon Carbon Private Limited, CARBOTECH, DEZA a.s., JFE Chemical Corporation, Koppers Inc., PCC Rokita SA, Gautam Zen International and Dong-Suh Chemical Ind. Co., Ltd.

Key Developments

In July 2023, Kazuhito Tsukagoshi, the Group Leader of the Thin Film Electronics Group and a research team from the Chemistry Department at Tokyo Institute of Technology achieved the successful identification of a single dimer of naphthalene molecules within a nano-gap structure.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies