Nanomedicine Market Size & Industry Outlook

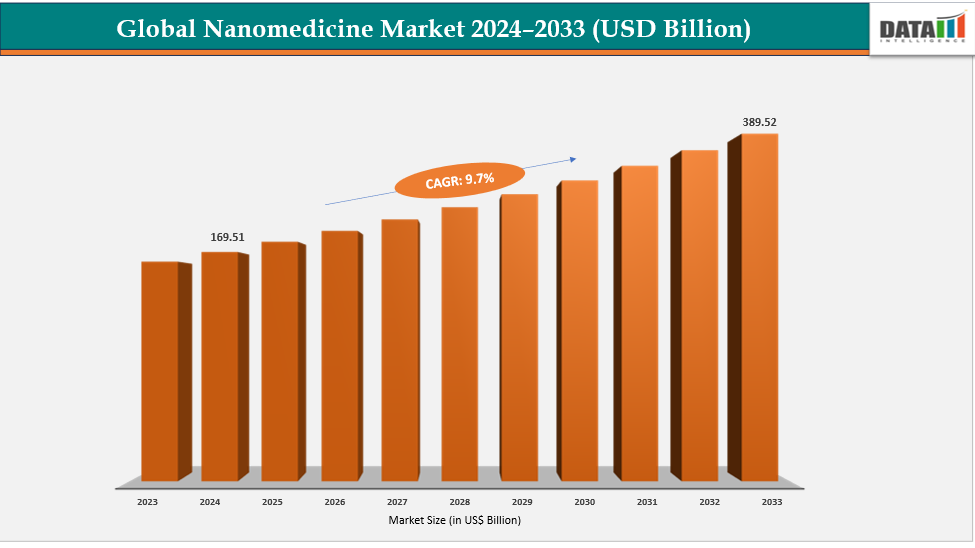

The global nanomedicine market size reached US$ 155.51 Billion in 2023 with a rise of US$ 169.51 Billion in 2024 and is expected to reach US$ 389.52 Billion by 2033, growing at a CAGR of 9.7% during the forecast period 2025-2033.

Advancements in nanotechnology and drug delivery technology are driving the rapid growth of the nanomedicine market by enabling precise, targeted, and controlled therapeutic delivery. Drugs can be molecularly tailored using nanotechnology, increasing their stability, solubility, and bioavailability while reducing their adverse effects. Drug transport across biological barriers is improved by innovations like lipid nanoparticles, polymeric carriers, and nanoshells, which guarantee effective delivery to certain tissues or cells. Additionally, prolonged and stimuli-responsive release is made possible by smart nanocarriers, which enhances patient outcomes in conditions including infections, cancer, and cardiovascular illnesses.

Key Highlights

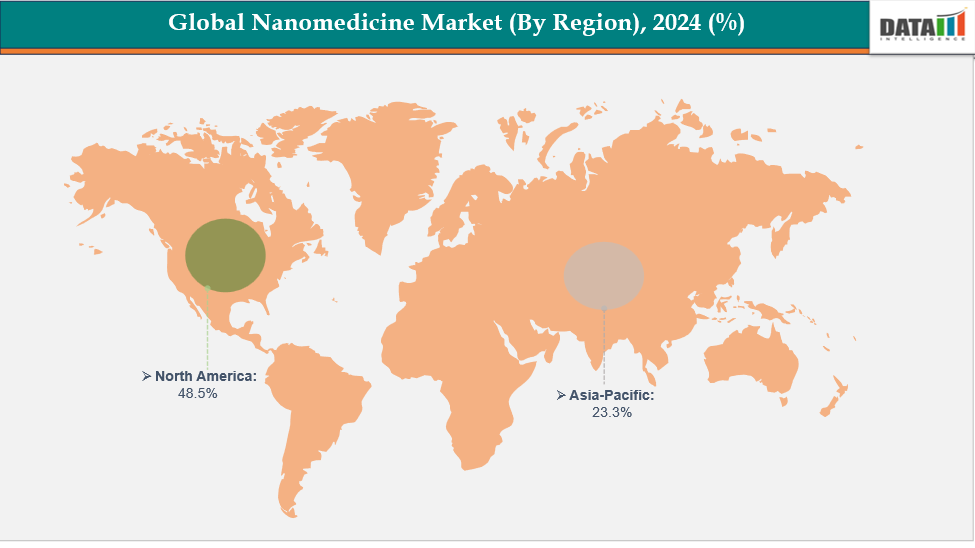

- North America is dominating the global nanomedicine market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

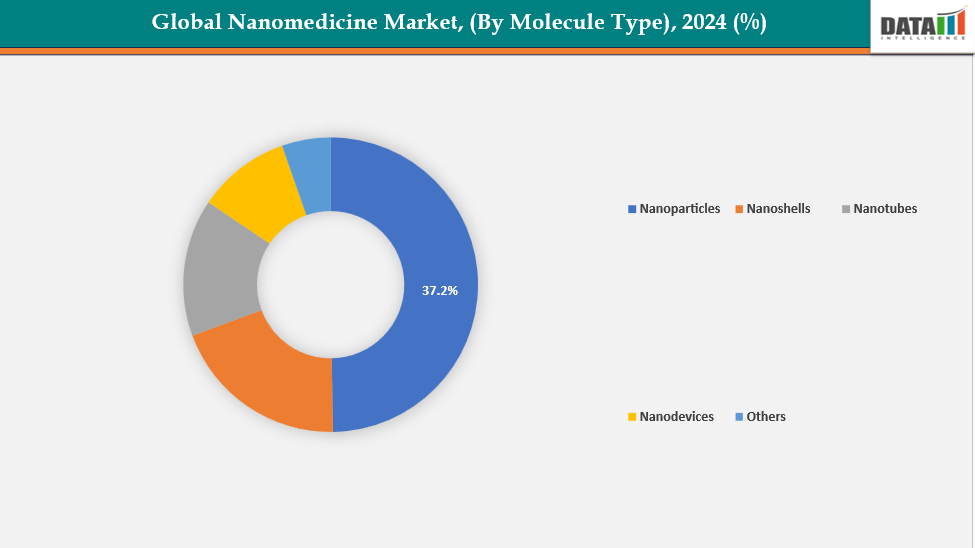

- The nanoparticles segment from molecule type is dominating the nanomedicine market with a 37.2% share in 2024.

- The oncology segment form indication is dominating the nanomedicine market with a 45.3% share in 2024

- Top companies in the nanomedicine market include Bristol-Myers Squibb, Baxter, Sigma-Tau Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Pfizer Inc., Leadiant Biosciences, Inc., Ipsen Biopharmaceuticals, Inc., Fresenius Kabi AG, Vivesto, and Gilead Sciences, Inc., among others.

Market Dynamics

Drivers: Rising prevalence of chronic diseases are accelerating the growth of the nanomedicine market

The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, diabetes, and neurological conditions is a major driver for the nanomedicine market. The effectiveness of traditional medicines is sometimes limited by issues such as non-specific targeting, systemic toxicity, and inadequate absorption. By facilitating targeted medication distribution, controlled release, and improved bioavailability, nanomedicine solves these problems and makes sure that therapeutic agents more precisely reach diseased cells while reducing unwanted effects. Furthermore, sophisticated nanocarriers can penetrate biological barriers like the blood-brain barrier, increasing the range of chronic illnesses that can be treated.

Owing to factors such as the rising prevalence of chronic diseases, for instance, according to the International Diabetes Federation in 2024, vision-related conditions included macular degeneration affecting 8 million, glaucoma 7.7 million, and diabetic retinopathy 3.9 million, while presbyopia emerged as the leading cause of near vision impairment, impacting 826 million people worldwide, and approximately 589 million adults aged 20–79 years were living with diabetes globally. Additionally, the CDC reported that in 2023, 919,032 people in the U.S. died from cardiovascular diseases.

Restraints: Technical challenges in nanomedicine development are hampering the growth of the nanomedicine market

Technical difficulties are a major factor impeding the market expansion for nanomedicine since creating medication formulations at the nanoscale is extremely complicated and necessitates exact control over a number of variables. Nanomedicines depend on homogeneous particle composition, size, shape, and surface charge to guarantee reliable drug delivery, stability, and bioavailability. Increased toxicity, erratic pharmacokinetics, or decreased therapeutic efficacy can result from variations in these variables.

Additionally, it is challenging to scale up the production of nanomedicines from the laboratory to the industrial level because it requires specialized machinery, repeatable manufacturing procedures, and stringent quality control. There are difficulties in creating, storing, and sterilizing nanoparticles.

For more details on this report, see Request for Sample

Segmentation Analysis

The global nanomedicine market is segmented based on molecule type, indication, end-user, and region

By Molecule Type: The nanoparticles segment from molecule type is dominating the nanomedicine market with a 37.2% share in 2024

The nanoparticles segment dominates the nanomedicine market due to its versatility, proven efficacy, and broad therapeutic applications. Targeted drug delivery requires precise control over size, surface charge, and functionalization, which can be achieved by engineering nanoparticles in lipid-based, polymeric, or inorganic forms. This improves treatment results by allowing medications to concentrate in sick tissues (such as tumors) and reducing systemic negative effects.

Additionally, their wide-ranging applications, including cancer therapy, infectious disease treatment, gene delivery, and diagnostic imaging, make them more dominant. For instance, in September 2025, Arbor Biotechnologies announced that the FDA had accepted the IND application for ABO-101, a lipid nanoparticle-based gene-editing therapy for primary hyperoxaluria type 1 (PH1). The redePHine Phase 1/2 study was designed to assess its safety, tolerability, pharmacokinetics, pharmacodynamics, and preliminary efficacy in adult and pediatric patients.

By Indication: The oncology segment form indication is dominating the nanomedicine market with a 45.3% share in 2024

The oncology segment dominates the nanomedicine market because cancer remains a leading cause of morbidity and mortality globally, driving demand for advanced therapeutic solutions. Chemotherapeutic drugs can accumulate preferentially in tumor tissues while reducing systemic toxicity thanks to targeted medication delivery made possible by nanomedicine. Anti-cancer medications' stability, controlled release, and bioavailability are improved by lipid nanoparticles, polymeric micelles, and liposomal formulations.

Additionally, combination medicines, imaging, and better therapy monitoring and results are all made possible by nanoparticles. The use of nanomedicine in cancer is supported by the rising incidence of solid tumors and the drawbacks of traditional chemotherapy. Thus, the majority of nanomedicine uses are in oncology, which also receives a lot of funding. and research focus.

Geographical Analysis

North America is dominating the global nanomedicine market with a 48.5% in 2024

North America dominates the global nanomedicine market due to its advanced healthcare infrastructure, strong pharmaceutical and biotechnology sectors, and well-established research capabilities. Rapid development and commercialization of nanomedicine therapies are made possible by the region's significant R&D investments, regulatory assistance, and clinical trial networks. The need for targeted, regulated, and customized treatments is fueled by the high occurrence of cancer, genetic abnormalities, and chronic diseases. For instance, according to the Cancer Progress Report 2024, an estimated 2,001,140 new cancer cases were diagnosed, and 611,720 deaths occurred due to cancer in the USA.

In the USA, the nanomedicine market is expanding due to substantial R&D investments, supportive regulatory policies, and growing adoption of targeted drug delivery systems, lipid nanoparticles, and advanced gene and cancer therapies. For instance, in June 2025, Alembic Pharmaceuticals received final US FDA approval for its ANDA of Doxorubicin Hydrochloride Liposome Injection (20 mg/10 mL and 50 mg/25 mL), deemed therapeutically equivalent to Baxter’s Doxil, enabling single-dose vial administration.

Europe is the second region after North America which is expected to dominate the global nanomedicine market with a 34.5% in 2024

Europe’s nanomedicine market is growing due to high disease awareness, robust healthcare infrastructure, and widespread access to medical facilities. Expansion is further fueled by industry collaborations, research partnerships, and joint initiatives, enhancing the development and adoption of advanced nanomedicine therapies.

Germany’s nanomedicine market is driven by advanced healthcare infrastructure, supportive regulations, and high public awareness. Widespread access through hospitals, clinics, and digital platforms, along with government initiatives and continuous research, accelerates adoption and market growth nationwide.

The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

The Asia-Pacific including Japan, China, India, and South Korea, is expanding due to rising disease awareness, urbanization, and improved healthcare access. Growth is fueled by government initiatives, public health campaigns, and advancements in nanotechnology-based diagnostics and targeted therapies, enhancing early detection and treatment adoption.

China’s nanomedicine market is rapidly growing due to advanced healthcare infrastructure, rising disease awareness, and strong regulatory support. Expedited NMPA approvals for clinical trials, strategic collaborations, and licensing agreements with global pharmaceutical companies are accelerating the development and adoption of innovative nanomedicine therapies nationwide. For instance, in June 2024, China approved CSPC Pharmaceutical Group’s mRNA-based cancer cell therapy for human clinical trials, marking a significant advancement in synthetic mRNA technology for targeted cancer treatment.

Competitive Landscape

Top companies in the nanomedicine market include Bristol-Myers Squibb, Baxter, Sigma-Tau Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., Pfizer Inc., Leadiant Biosciences, Inc., Ipsen Biopharmaceuticals, Inc., Fresenius Kabi AG, Vivesto, and Gilead Sciences, Inc., among others.

Bristol-Myers Squibb: Bristol-Myers Squibb (BMS) is a global biopharmaceutical leader advancing nanomedicine through innovative drug delivery systems. Focusing on liposomes and nanocarriers, BMS enhances targeted delivery of small molecules and genes, improving therapeutic outcomes, particularly in oncology, immunology, hematology, and fibrotic diseases.

Key Developments:

- In June 2025, Health Canada approved a clinical trial for a first-in-class nanoparticle developed by Toronto researchers, enabling a novel, less-invasive approach to detect and treat cancer, marking a significant advancement in targeted cancer therapy.

Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Molecule Type | Nanoparticles, Nanoshells, Nanotubes, Nanodevices and Others |

| By Indication | Oncology, Neurodegenerative Diseases, Cardiovascular Diseases, Immunology, Infectious Diseases and Others | |

| By End User | Hospitals, Clinics, Diagnostic Laboratories, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global nanomedicine market report delivers a detailed analysis with 62 key tables, more than 58 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical pharmaceuticals-related reports, please click here