Market Size

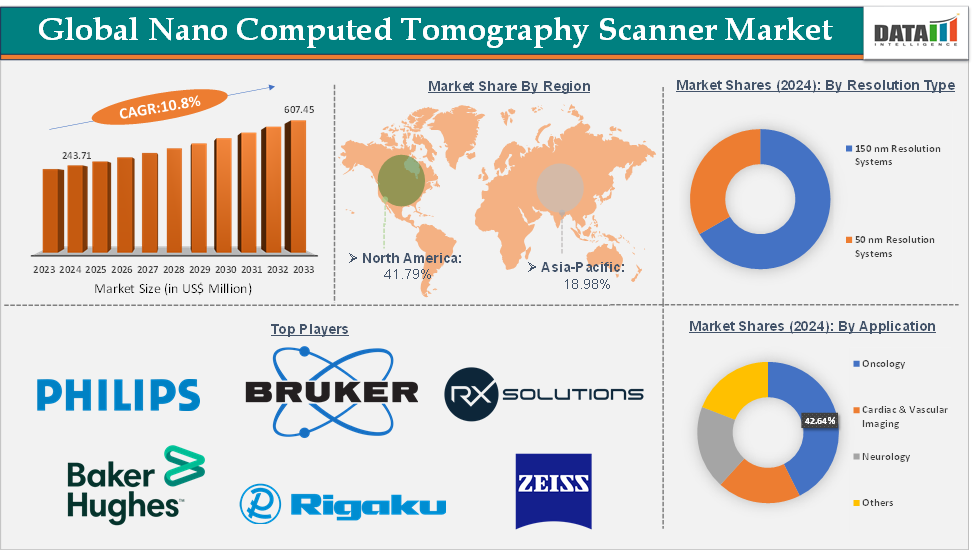

The global nano computed tomography scanner market size was valued US$ 243.71 Million in 2024 and is expected to reach US$ 607.45 Million by 2033, growing at a CAGR of 10.8% during the forecast period 2025-2033.

Market Overview

The global nano computed tomography (Nano‑CT) Scanner market is experiencing robust growth, driven by increasing demand for ultra‑high-resolution imaging in fields such as oncology, neurology, and industrial inspection. Advancements in nanotechnology, AI-enhanced imaging software, and rising healthcare research investments propel the market. 150 nm resolution systems currently dominate due to their broad applicability, but 50 nm systems are gaining traction with research institutes and niche industries seeking sub-micron precision. North America leads the market in both revenue and technology development, while the Asia-Pacific region is the fastest-growing, thanks to expanding medical infrastructure and localized manufacturing.

Executive Summary

Market Dynamics

Drivers:

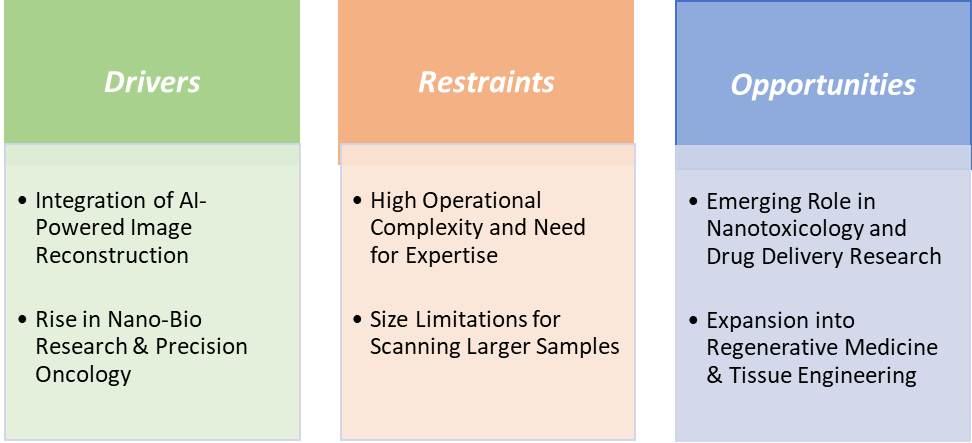

Integration of AI-powered image reconstruction is significantly driving the nano computed tomography scanner market growth

The integration of AI-powered image reconstruction is playing a pivotal role in accelerating the growth of the nano computed tomography (Nano‑CT) scanner market by addressing several critical limitations traditionally associated with high-resolution imaging. Nano‑CT generates extremely large and complex datasets due to its sub-micron resolution, often resulting in long scan times, noise-heavy outputs, and computational bottlenecks. AI-driven reconstruction algorithms such as deep learning-based denoising, super-resolution enhancement, and iterative reconstruction techniques are significantly reducing scan time and improving image clarity, even at lower radiation doses.

Companies like Philips, Zeiss and Bruker are embedding AI into their Nano‑CT platforms to automate segmentation, classify internal structures, and extract quantitative data,revolutionizing workflows in materials research, battery failure analysis, and oncology diagnostics. In industrial settings, AI-enhanced reconstruction enables real-time inspection of semiconductor components or 3D-printed microstructures, ensuring quality control without sacrificing speed.

For instance, in February 2024, Royal Philips launched the Philips CT 5300 system equipped with advanced AI capabilities designed to be used for diagnosis, interventional procedures and screening. The flexible X-ray CT system increases diagnostic confidence, streamlines workflow efficiency, and maximizes system uptime, helping to improve patient outcomes and department productivity. The new system introduces Nanopanel Precise, the industry’s first detector built from the ground up specifically for AI-based reconstruction. This brand-new detector leverages the full capabilities of Philips Precise Image reconstruction software to deliver high-quality images at much lower radiation dose.

Restraints:

Size limitations for scanning larger samples are hampering the growth of the nano-computed tomography scanner market

Size limitations for scanning larger samples represent a significant constraint on the growth of the market, as most systems are optimized for small-scale, high-resolution imaging, typically suited for samples under a few millimeters. This restricts their use in industries and applications where larger components or biological specimens need to be analyzed in full.

Even when scanning large samples is technically possible, it often requires segmenting the object, scanning in parts, and stitching the images digitally, an approach that is time-consuming, prone to errors, and computationally expensive. This hinders workflow efficiency and limits the broader industrial or clinical adoption of Nano‑CT. While some vendors are working on scalable systems or multi-scale imaging solutions, the current hardware limitations continue to restrict the market to niche applications, thereby slowing its overall commercial expansion.

For more details on this report – Request for Sample

Segment Analysis

The global nano computed tomography scanner market is segmented based on resolution type, application, end-user, and region.

The oncology segment from the application is dominating the nano computed tomography scanner market with a 42.64% share in 2024

Oncology is the dominant segment in the market, primarily due to the technology’s unmatched ability to visualize cancerous tissues and tumor microenvironments at sub-micron resolution. Unlike conventional imaging techniques, Nano‑CT allows researchers and clinicians to examine fine morphological changes, such as tumor vasculature, cell infiltration, and necrosis, with extreme precision critical for early cancer detection, drug efficacy studies, and tumor progression tracking.

Moreover, Nano‑CT’s ability to generate high-resolution 3D reconstructions of solid tumors aids in quantitative analysis of cancer tissue volumes, vascular density, and bone-tumor interactions, which is particularly useful in cancers like osteosarcoma or bone metastasis studies. Leading research institutions and pharmaceutical companies are increasingly investing in Nano‑CT systems for oncology-focused imaging pipelines, leveraging their capabilities for biomarker research and personalized medicine development. This high demand in cancer research, coupled with the rising global cancer burden, continues to make oncology the most significant segment in the market.

Geographical Analysis

North America is expected to dominate the global nano computed tomography scanner market with a 41.79% in 2024

North America is the dominant region in the market, driven by its strong foundation in advanced research infrastructure, robust healthcare systems, and early adoption of cutting-edge imaging technologies. The United States, in particular, houses a large concentration of world-class research institutions, pharmaceutical companies, and academic medical centers that actively invest in high-resolution imaging for biomedical and industrial applications. Organizations such as the National Institutes of Health (NIH) and leading universities regularly use Nano‑CT for applications in oncology research, regenerative medicine, and nanotoxicology.

Additionally, North America is home to several key Nano‑CT system manufacturers and technology innovators, including Bruker and Philips, who continue to push advancements in resolution, AI integration, and system performance. Furthermore, the presence of a skilled workforce, ongoing collaborations between academia and industry, and early regulatory support for advanced imaging technologies solidify North America’s leadership. As a result, the region consistently accounts for the largest market share globally and is expected to maintain its dominance.

Competitive Landscape

Top companies in the nano computed tomography scanner market include Koninklijke Philips N.V., Bruker, RX Solutions, Baker Hughes Company, Rigaku Holdings Corporation, ZEISS Group, Excillum, and ProCon X‑Ray GmbH, among others.

Market Scope

Metrics | Details | |

CAGR | 10.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Resolution Type | 150 nm Resolution Systems and 50 nm Resolution Systems |

Application | Oncology, Cardiac & Vascular Imaging, Neurology and Others | |

End-User | Hospitals, Diagnostic Centers, Academic & Research Institutions and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global nano computed tomography scanner market report delivers a detailed analysis with 56 key tables, more than 51 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical imaging-related reports, please click here