Epigenetics Market Size & Industry Outlook

The global market for epigenetics is experiencing significant growth due to the increasing utilization of epigenetic technologies in biopharmaceutical and biotechnology sectors. Organizations are employing epigenetics for drug discovery, personalized medicine, and the development of biomarkers, leading to a higher demand for sophisticated solutions.

Advances in next-generation sequencing (NGS), PCR-based assays, and tools for epigenetic profiling have enhanced sensitivity, throughput, and precision, allowing for more thorough analyses of DNA methylation, histone modifications, and chromatin accessibility. These developments enable researchers to investigate disease mechanisms, pinpoint therapeutic targets, and create individualized treatment options. Furthermore, the integration of automation and AI into epigenetic processes has sped up research timelines and lowered expenses.

Key Highlights

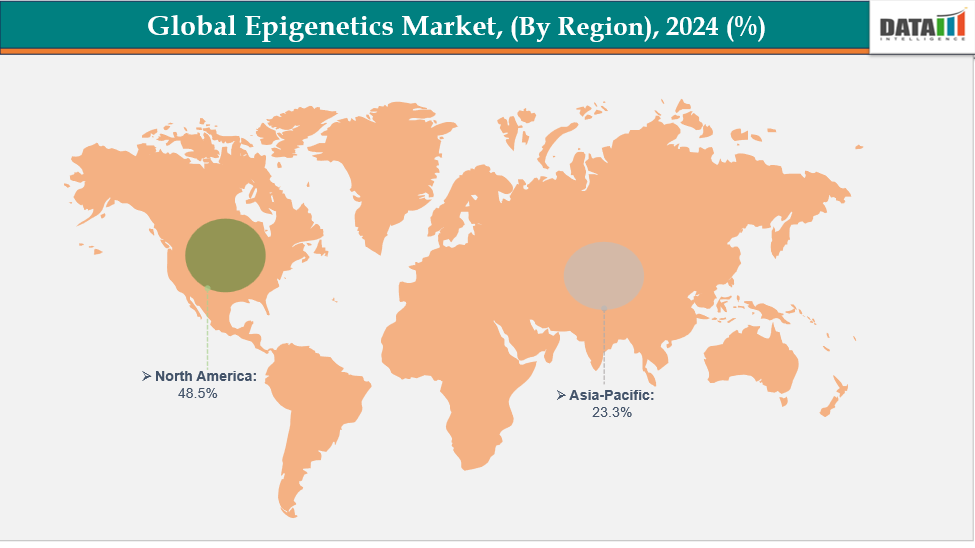

- North America is dominating the global epigenetics market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global epigenetics market, with a CAGR of 7.7% in 2024

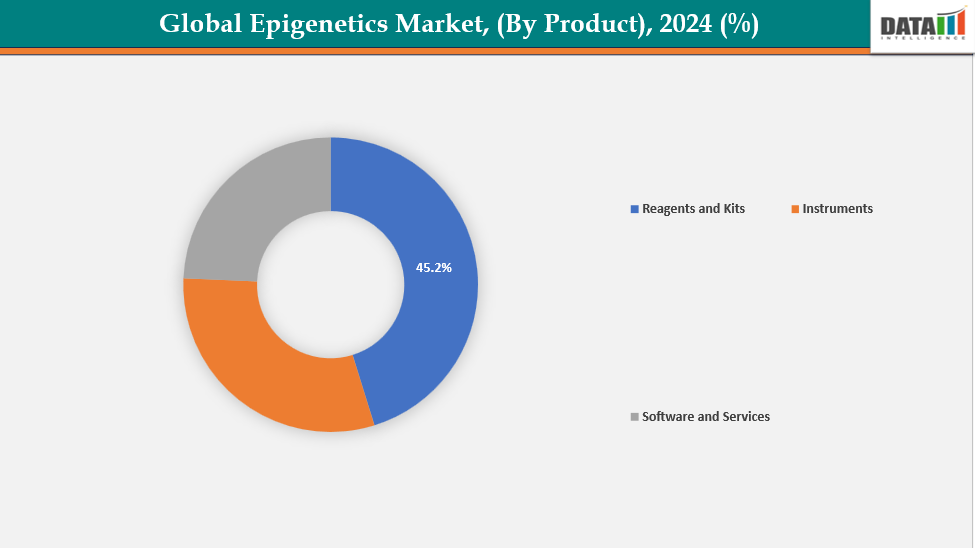

- The reagents and kits segment is dominating the epigenetics market with a 45.2% share in 2024

- The DNA methylation analysis segment is dominating the epigenetics market with a 35.3% share in 2024

- Top companies in the epigenetics market include Illumina, Inc., EpigenTek Group Inc., Sigma-Aldrich, Zymo Research Corporation, Epigenie, QIAGEN, New England Biolabs, Thermo Fisher Scientific, Inc., Abcam Limited., Bio-Rad Laboratories, Inc., among others.

Market Dynamics

Drivers: Increased research and development investments are accelerating the growth of the epigenetics market

Increased investments in research and development (R&D) are fueling the expansion of the global epigenetics sector by facilitating the identification of new biomarkers and therapeutic targets. Pharmaceutical and biotech firms are dedicating considerable resources to create epigenetic treatments for cancer, autoimmune diseases, and neurological conditions. Research institutions, both academic and clinical, are progressing in technologies like CRISPR-based epigenome editing, DNA methylation testing, and histone modification analysis. Investments in R&D foster innovation in high-throughput sequencing, bioinformatics software, and AI-assisted data analysis, enabling quicker and more precise interpretation of intricate epigenetic information.

Owing to the factors like increased research and development investments, for instance, in May 2025, longevity biotech NewLimit raised $130 million in Series B funding to advance its epigenetic reprogramming platform, aiming to extend human healthspan and accelerate the development of therapies designed to increase the number of healthy years in human life.

Moreover, in January 2025, Tune Therapeutics completed over $175 million in Series B financing, led by New Enterprise Associates, Yosemite, Regeneron Ventures, and Hevolution Foundation, to advance its pioneering epigenome editing programs and accelerate the development of innovative therapeutic solutions.

Restraints: Complexity in interpreting epigenetic modifications and multi-omics data is expected to hamper the growth of the epigenetics market

The global epigenetics market is encountering obstacles due to the difficulty in interpreting epigenetic modifications. Changes in epigenetics, which include DNA methylation, histone modifications, and the activity of non-coding RNA, are highly variable and depend on context, differing across various tissues, developmental phases, and environmental factors. Merging these modifications with multi-omics data, such as genomics, transcriptomics, and proteomics, adds additional layers of complexity.

Additionally, precise analysis necessitates sophisticated bioinformatics tools, significant computational resources, and specialized knowledge. Variations in standardization among laboratories and discrepancies in data processing techniques may result in varying outcomes.

For more details on this report, see Request for Sample

Epigenetics Market, Segment Analysis

The global epigenetics market is segmented based on product, technology, end user, and region

By Product: The reagents and kits segment is dominating the epigenetics market with a 45.2% share in 2024

The reagents and kits segment leads the global epigenetics market, driven by the growing need for dependable, standardized tools in both research and diagnostics. Kits streamline processes for analyzing DNA methylation, histone modifications, and non-coding RNAs, minimizing experimental errors. Reagents ensure uniform, high-quality results across laboratories, enhancing the reproducibility of research findings. The increasing focus on epigenetics research related to cancer, neurodegenerative diseases, and autoimmune conditions fuels the demand for these products.

Moreover, academic institutions and biopharmaceutical companies favor pre-prepared kits for research that is both cost-effective and time-efficient. For instance, in May 2025, Ellis Bio, a University of Chicago spinout, launched its first product, the SuperMethyl Fast Bisulfite Conversion Kit, at the Chicago Biomedical Consortium, aiming to advance epigenomics research by translating pioneering academic discoveries into transformative tools for researchers worldwide.

By Technology: The DNA methylation analysis segment is dominating the epigenetics market with a 35.3% share in 2024

The segment focusing on DNA methylation analysis is leading the global epigenetics market due to of its essential role in comprehending gene regulation and the mechanisms of various diseases. DNA methylation is an important epigenetic modification that affects conditions like cancer, neurological disorders, and autoimmune diseases. The growing interest in biomarkers for early disease diagnosis and the advancement of personalized medicine is fueling the need for methylation analysis. Cutting-edge technologies, including bisulfite sequencing, methylation-specific PCR, and high-throughput microarrays, offer precise, sensitive, and scalable solutions.

Moreover, the introduction of new products and innovations in DNA methylation enhance the segment's prominence. For instance, in January 2025, New England Biolabs launched EM‑seq v2, an enhanced enzyme‑based kit for sensitive detection of 5mC and 5hmC, offering a wider input range (100 pg–200 ng) and a faster, streamlined workflow, avoiding DNA damage and biases associated with traditional bisulfite sequencing.

Epigenetics Market, Geographical Analysis

North America is dominating the global epigenetics market with 48.5% in 2024

The North American region held a significant share of the global epigenetics market, driven by its advanced healthcare system, high rates of cancer and chronic illnesses, and the presence of prominent biotech and pharmaceutical firms. The region's leadership in the market was further bolstered by substantial research and development investments, supportive regulatory environments, early embrace of epigenetic technologies, and increasing awareness of personalized medicine.

In the United States, the expansion of the epigenetics market was fueled by increased investments in research and development, research grants, funding for epigenetic treatments, and a growing incidence of cancer and chronic illnesses. For instance, in March 2025, Epicrispr Biotechnologies secured $68 million in the first close of its Series B financing to support clinical development of EPI‑321, a first-in-class, disease-modifying epigenetic therapy for facioscapulohumeral muscular dystrophy (FSHD).

Europe is the second region after North America, which is expected to dominate the global epigenetics market with 34.5% in 2024

In Europe, the epigenetics industry has seen significant growth driven by the increasing incidence of cancer and chronic illnesses, substantial research funding, and a strong innovation environment. Favorable regulatory conditions, continuous advancements in biologics, and strategic partnerships between biotech and pharmaceutical firms have propelled product development, clinical advancements, and growth in the regional market.

Furthermore, the continuous support from the government for research and development initiatives is anticipated to lead to substantial growth in the worldwide epigenetics market. For instance, in February 2024, the European Commission approved the EpiCancer research project, funding €1.5 million to advance functional epigenetics and cancer diagnostics across European research institutions.

Additionally, in September 2024, the Deutsche Forschungsgemeinschaft (DFG) established the Priority Programme EPIADAPT (SPP 2502) to fund six years of research on epigenomic adaptations in developing neural chromatin.

The Asia Pacific region is the fastest-growing region in the global epigenetics market, with a CAGR of 7.7% in 2024

The Asia-Pacific epigenetics market has grown swiftly due to heightened investments in biotechnology, a rising incidence of cancer and chronic conditions, and government healthcare initiatives that are favourable. Additionally, the progress in epigenetic research, the need for targeted treatments, and strategic partnerships between major pharmaceutical and biotechnology firms in China, Japan, India, and South Korea have also fuelled this growth.

China's epigenetics market has expanded rapidly, driven by significant investments in research and development alongside the high prevalence of cardiovascular diseases. Collaborations between companies and strategic agreements have expedited innovation, clinical advancement, and the commercialization process. Owing to factors like strategic agreements, for instance, in December 2024, Epigenic Therapeutics joined Bayer Co. Lab in China through a strategic agreement, gaining access to Bayer’s global network and expertise to accelerate innovations in next‑generation epigenetic modulation therapies.

Epigenetics Market Competitive Landscape

Top companies in the epigenetics market include Illumina, Inc., EpigenTek Group Inc., Sigma-Aldrich, Zymo Research Corporation, Epigenie, QIAGEN, New England Biolabs, Thermo Fisher Scientific, Inc., Abcam Limited., Bio-Rad Laboratories, Inc., among others.

Illumina, Inc.: Illumina, Inc. is a global leader in genomics and epigenetics, providing advanced sequencing and array-based technologies for DNA methylation and chromatin analysis. The company’s epigenetic solutions support research in cancer, aging, and precision medicine, enabling biomarker discovery, diagnostics, and therapeutic development. Illumina’s continuous innovation and high-throughput platforms drive adoption in both academic and clinical epigenetics markets worldwide.

Key Developments:

- In September 2025, Epigenica AB was awarded a 5 million SEK Eurostars grant to conduct the 30‑month NUPLEX project, advancing its proprietary multiplexed epigenomic profiling technology for circulating nucleosomes and enabling AI-powered multi-cancer liquid biopsy diagnostics.

- In June 2025, Epigenica AB closed a $2.2 million (SEK 21.5 M) investment round led by Voima Ventures to accelerate growth and commercial expansion of its high-throughput epigenetic screening tools across key global markets.

Market Scope

| Metrics | Details | |

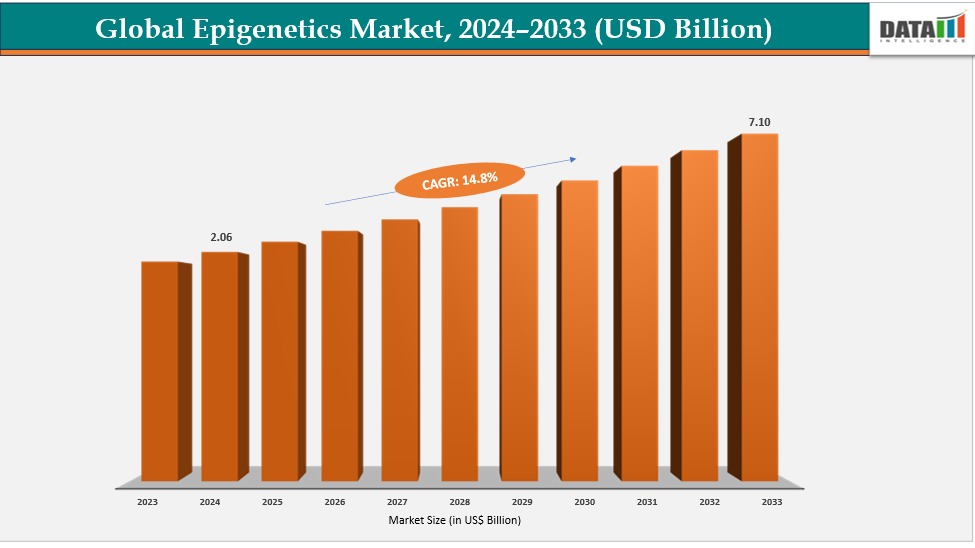

| CAGR | 14.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product | Reagents and Kits, Instruments, Software and Services |

| By Technology | DNA Methylation Analysis, Histone Modification Analysis, Non-coding RNA Analysis, Chromatin Accessibility Analysis, and Others | |

| By End User | Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospitals and Diagnostic Laboratories and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global epigenetics market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here