Immuno-Oncology Assays Market Size

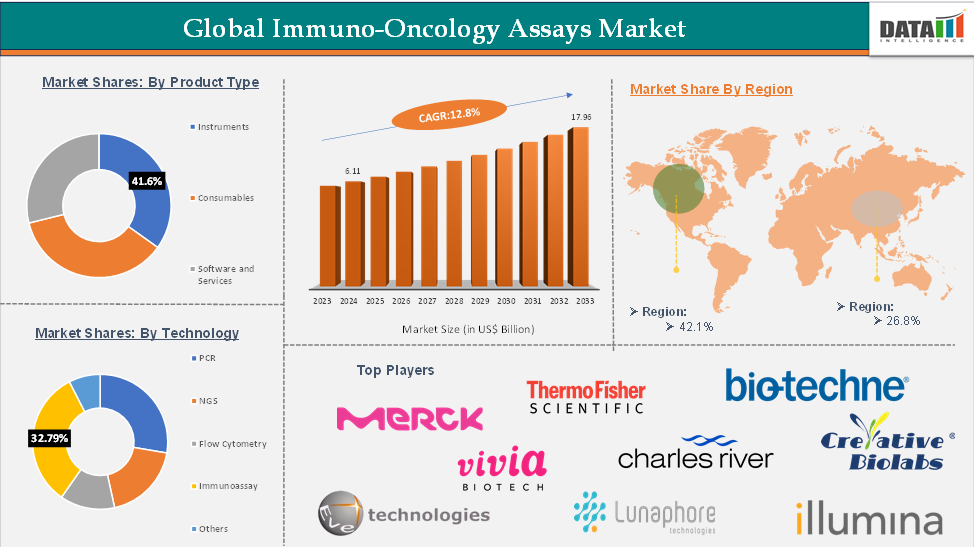

Immuno-Oncology Assays Market Size reached US$ 6.11 Billion in 2024 and is expected to reach US$ 17.96 Billion by 2033, growing at a CAGR of 12.8% during the forecast period 2025-2033.

Immuno-oncology assays are diagnostic tools that analyze immune responses and biomarkers to guide and monitor cancer immunotherapies.

The Immuno-oncology assays market is experiencing rapid growth, driven by the rising global cancer burden and increasing adoption of personalized medicine. These assays play a critical role in identifying and validating predictive biomarkers, monitoring immune responses, and guiding immunotherapy decisions.

Increasing developments in the immuno-oncology sector, advancements in technologies such as next-generation sequencing (NGS), multiplex immunohistochemistry (IHC), and spatial biology platforms, along with a surge in demand for companion diagnostics and targeted therapies, are driving the immuno-oncology market growth.

Expanding assay applications beyond common cancers like melanoma and colorectal cancer to rare and solid tumors, integration of AI for improved biomarker analysis, and growth in emerging markets where healthcare infrastructure is rapidly developing are expected to create lucrative opportunities for the market in the future.

North America is expected to remain the dominant region, supported by strong R&D activity, early regulatory approvals, and high adoption of immunotherapy. However, the Asia-Pacific region is anticipated to show the fastest growth due to increasing investments, rising cancer incidence, and growing awareness of advanced diagnostic tools. Overall, the market is poised for substantial expansion as precision oncology continues to reshape cancer care globally.

Executive Summary

For more details on this report – Request for Sample

Immuno-Oncology Assays Market Dynamics: Drivers & Restraints

Increasing Developments in the Immuno-Oncology Sector are Expected to Drive the Immuno-Oncology Assays Market

Recent developments in immuno-oncology testing are significantly enhancing the prospects for more effective cancer diagnosis and treatment. A core focus of current innovation is on cancers with high prevalence, such as melanoma and colorectal cancer. Multiple companies and research institutions are introducing advanced diagnostic tools, grants, and platforms to support and accelerate this effort.

For example, in July 2024, Oxford BioDynamics announced a keynote presentation at the 14th World Summit for Clinical Biomarkers and Companion Diagnostics, highlighting the diagnostic, predictive, and prognostic capabilities of its EpiSwitch 3D genomics platform. This technology offers promising potential as a companion diagnostic assay.

Similarly, in February 2023, Agilent Technologies announced the integration of its xCelligence RTCA HT (real-time cell analysis high-throughput) platform with the BioTek BioSpa 8 Automated Incubator, enhancing workflow automation capabilities. This new combination of technologies was developed in response to market demands and offers innovative functionality for creating label-free high-throughput potency assays in the immuno-oncology field.

Further supporting innovation, Lunaphore launched the SPYRE Immuno-Oncology Grant Program in 2023 to help laboratories integrate spatial biology technologies into their immuno-oncology research. Meanwhile, Veracyte, Inc. shared data on its Immunoscore Immune Checkpoint (IC) assay, a tool designed to identify patients with metastatic colorectal cancer (mCRC), showcasing the expanding utility of immune profiling in treatment selection.

These advancements, along with increased investment in cancer research, growing awareness of diagnostic innovations, and the introduction of novel technologies, are collectively driving growth in the immuno-oncology assays market and offering new hope for personalized cancer therapy..

High Costs of Assays are Expected to Hinder the Immuno-Oncology Assays Market

The high cost of immuno-oncology assays is a significant barrier to market growth, particularly in low- and middle-income countries and smaller healthcare facilities. These assays often rely on advanced technologies such as multiplex immunohistochemistry, flow cytometry, next-generation sequencing (NGS), and spatial transcriptomics, all of which require expensive equipment, skilled personnel, and rigorous quality control.

For instance, automation systems and high-throughput platforms used in immuno-oncology diagnostics can cost between $40,000 and $60,000, excluding the ongoing expenses for reagents, software licenses, and data analysis infrastructure.

Immuno-Oncology Assays Market Segment Analysis

The global immuno-oncology assays market is segmented based on component type, cancer type, application, end user, and region.

Technology:

The immunoassay segment is expected to hold 32.79% of the global immuno-oncology assays market

The immunoassay segment is dominating the immuno-oncology assays market due to its precise and accurate ability to detect and treat cancer, especially before metastasis occurs. Immuno-oncology assays, such as immuno-cell killing assays, cell proliferation assays, and next-generation sequencing (NGS) assays, are gaining prominence for their specificity in identifying cancer at an early stage, thereby improving treatment outcomes. These assays are crucial in the growing field of precision medicine, where targeted therapies are designed based on individual cancer profiles.

For instance, in April 2023, Agilent Technologies Inc. launched the Agilent SureSelect Cancer CGP Assay, an NGS-based assay designed to profile a wide range of tumor types, further advancing precision immuno-oncology.

Similarly, in January 2022, Oncocyte partnered with Thermo Fisher Scientific to clinically validate the Oncomine Comprehensive Assay Plus, aiming to develop the Determalo test to predict responses to immuno-oncology therapies.

These advancements reflect the increasing role of immunoassays in enhancing the specificity and accuracy of cancer detection, driving the growth and dominance of this segment in the market.

Immuno-Oncology Assays Market Geographical Analysis

North America is expected to hold 42.1% of the global immuno-oncology assays market

North America is expected to dominate the global immuno-oncology assays market, primarily due to its advanced healthcare infrastructure, high prevalence of cancer, and strong research and development ecosystem. The region continues to lead the global immuno-oncology assays market, bolstered by recent regulatory approvals and product launches that underscore the region's commitment to advancing cancer diagnostics.

For instance, in August 2024, the FDA approved the SeCore CDx HLA A Sequencing System as a companion diagnostic for afamitresgene autoleucel. This approval highlights the growing integration of companion diagnostics in immuno-oncology, ensuring that therapies are matched to patients based on specific genetic markers.

These developments reflect North America's pivotal role in the evolution of immuno-oncology diagnostics, driven by robust regulatory support, significant research investments, and a strong infrastructure for clinical implementation.

Asia-Pacific is expected to hold 26.8% of the global immuno-oncology assays market

The Asia-Pacific region is projected to be the fastest-growing market in the global immuno-oncology landscape, driven by a rising cancer burden, increased government investment, and expanding research capabilities.

With nearly 50% of global cancer cases occurring in Asia, countries like China, India, and Japan are witnessing surging demand for advanced cancer diagnostics and treatments. Government support through national cancer control programs and investment in biotech innovation is accelerating research and facilitating regulatory approvals for novel immunotherapies.

Additionally, the region’s improving healthcare infrastructure and growing participation in clinical trials are contributing to the rapid adoption of immuno-oncology assays and therapies. Together, these factors position Asia-Pacific as the fastest-growing region in the global immuno-oncology market in the coming years.

Immuno-Oncology Assays Market Top Companies

The top companies in the immuno-oncology assays market include Merck KGaA, Thermo Fisher Scientific Inc., Lunaphore Technologies SA., Eve Technologies., Vivia Biotech S.L, Illumina, Inc., Charles River Laboratories, Bio-Techne, Creative Biolabs, Miltenyi Biotec, Adipogen Life Sciences, among others.

Key Developments

- On April 16, 2025, PODO Therapeutics announced that it will present its latest research at the American Association for Cancer Research (AACR) Annual Meeting 2025, scheduled for April 25-30 in the United States. The company will feature two poster presentations showcasing its innovative platform, which utilizes cancer organoids co-cultured with immune cells to more accurately predict individual patient responses to both immunotherapies and radiation treatments.

- In September 2024, BioMed X, a renowned German biomedical research institute, announced the launch of a new research team in collaboration with Ono Pharmaceutical Co., Ltd. from Japan. This partnership, the institute’s first with Ono Pharmaceutical, aims to explore the antitumor effects of neutrophils and develop next-generation immunotherapies.

- In July 2024, Tempus AI, Inc. announced that its multimodal immune profile score (IPS) algorithmic test is now available for research use only (RUO). IPS is the first offering of a larger immunotherapy-based portfolio being developed at Tempus to bring next-generation algorithmic diagnostics to the immuno-oncology space.

Market Scope

| Metrics | Details | |

| CAGR | 12.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Instruments, Consumables, Software and Services |

| Assay Type | Cell Proliferation Assays, Cell Migration and Invasion Assays, Phagocytosis Assays, Immune Cell Killing Assays, Others | |

| Route of Administration | PCR, NGS, Immunoassay, Flow Cytometry, Others | |

| Indication | Colorectal Cancer, Breast Cancer, Lung Cancer, Melanoma, Others | |

| End User | Academic Institutes, Research Organizations, Diagnostics Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global immuno-oncology assays market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.