Methanol Market Overview

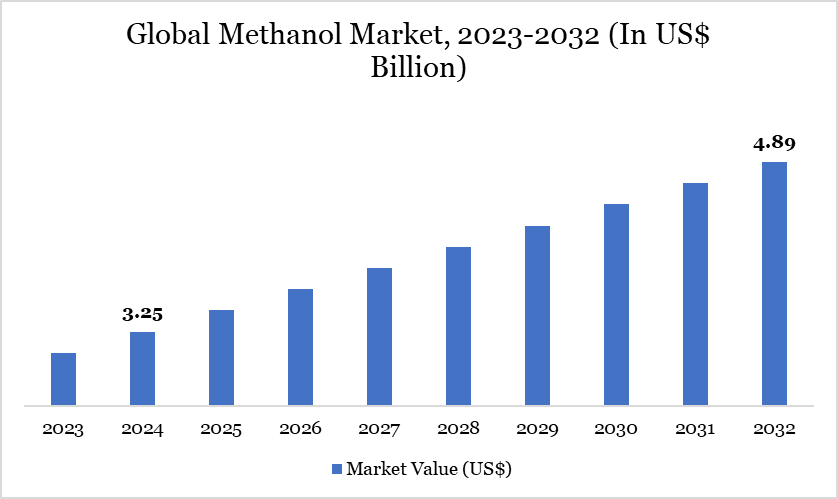

Methanol Market reached US$ 3.25 billion in 2024 and is expected to reach US$ 4.89 billion by 2032, growing with a CAGR of 5.23% during the forecast period 2025-2032.

The global methanol market is undergoing significant growth, supported by its many applications in sectors including fuel, polymers, and chemicals. Methanol, as a fundamental chemical, is predominantly synthesized fromnatural gas, providing both carbon and hydrogen for its production. The usage of methanol as a cleaner-burning fuel is rapidly increasing, particularly in the transportation and energy sectors.

Current global methanol production is roughly 98 million tons per year and is anticipated by the International Renewable Energy Agency (IRENA) to quintuple, reaching 500 million tons by 2050. This expansion signifies an increasing interest in renewable methanol and its contribution to emissions mitigation.

The Asia-Pacific region maintains market leadership, propelled by rising demand from industrial economies such as China and India. The dual benefits of economical manufacturing and clean energy potential are reinforcing methanol's role as an essential element in the global shift towards reduced-emission energy and industrial practices.

Market Trends

A significant development in the methanol industry is the increase in its utilization as a clean-burning alternative fuel. Methanol's capacity to substantially diminish environmental pollutants up to 95% decrease in CO₂ and 80% in NOx emissions-positions it as a pivotal component in the transition to sustainable energy.

Countries are progressively incorporating methanol-blended fuels in automobile applications to comply with emissions regulations. Recent evidence indicates that bio-methanol combustion eradicates SOx emissions and achieves up to 95% reduction in CO₂ emissions compared to conventional fuels. The environmental advantage is driving methanol demand, especially in the transportation sectors of Asia-Pacific and Europe.

Automotive makers are investigating methanol compatibility with traditional internal combustion engines, hence augmenting its feasibility as a transitional fuel. Furthermore, advancements in renewable methanol technology-specifically e-methanol produced from electrolysis and biogenic CO₂-exemplify the industry's proactive attitude toward sustainability. These trends underscore methanol's increasing significance in attaining global carbon neutrality objectives.

Methanol Market Scope

Metrics | Details |

By Feedstock | Coal, Natural Gas, Others |

By Derivatives | Traditional Chemical, Energy Related |

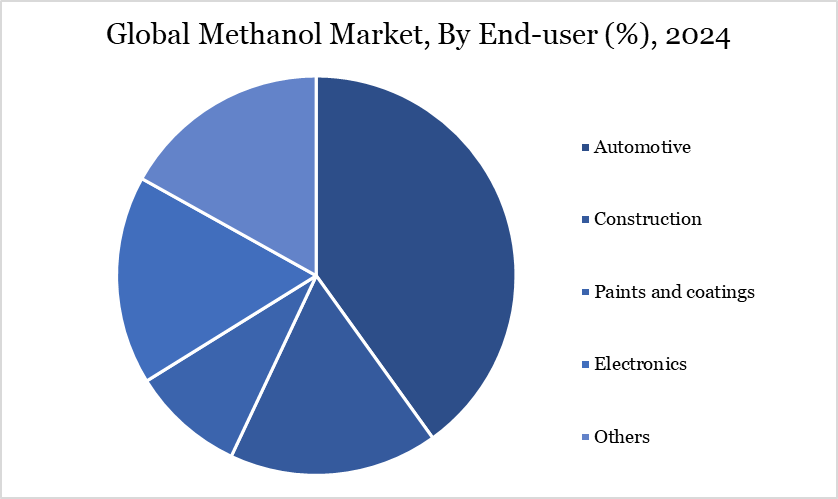

By End-user | Automotive, Construction, Paints and Coatings, Electronics, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

The Role of Methanol in Automotive Transformation

A primary driver for growth in the methanol market is its increasing utilization in the automotive sector, driven by rising demand for methanol's clean-burning characteristics and environmental benefits. Methanol-powered automobiles produce up to 20% less greenhouse gas emissions than gasoline-powered vehicles.

Renewable methanol has the potential to reduce carbon emissions by as much as 95%, contingent upon the feedstock and production methodology employed. China's dedication to methanol-powered vehicles is demonstrated by the creation of facilities with the capacity to manufacture 300,000–500,000 M100 engine units per year as of 2022.

Methanol fuel eradicates sulfur oxides and markedly diminishes particle emissions, providing a definitive means to mitigate the environmental effects of transportation. Given the global focus on decarbonizing the automotive industry, methanol offers a conveniently accessible and scalable option. Its compatibility with current fueling infrastructure and cost-effectiveness enhance its attractiveness, fostering substantial growth in both mature and developing vehicle markets.

Health Dangers Impeding Methanol's Wider Utilization

The health hazards linked to its utilization provide a significant market constraint. Acute exposure may result in significant consequences, including optic nerve injury and irreversible blindness. BMC Ophthalmology emphasizes that the use of even 4–10 mL can lead to irreversible visual impairment caused by optic atrophy.

Public Health England indicates that the fatal dose of methanol ranges from 300 to 1,000 mg/kg, with the possibility of enduring neurological sequelae. Chronic occupational exposure presents a considerable risk; symptoms encompass chronic headaches and ocular discomfort. To alleviate these risks, stringent regulatory constraints are imposed.

The UK REACH Regulations provide workplace exposure limits of 266 mg/m³ for long-term exposure and 333 mg/m³ for short-term exposure. These rigorous regulations elevate compliance expenses and restrict the application of methanol in specific industrial settings. Consequently, although its advantages in production and fuel, health and safety issues provide a significant obstacle to its unrestricted global implementation.

Segment Analysis

The global methanol market is segmented based on feedstock, derivatives, end-user and region.

Expanding Methanol for Enhanced Mobility Sustainability

The automobile industry is becoming a significant consumer of methanol, largely due to its clean combustion characteristics and escalating environmental laws aimed at vehicle emissions. Methanol is increasingly being considered as an alternative to conventional fuels in internal combustion engines and hybrid fuel systems.

In China, governmental measures and industry collaboration have expedited the introduction of methanol-fueled automobiles. Engine plants are already manufacturing up to 500,000 M100-compatible units per year (as of 2022), marking an unparalleled scale of methanol's integration into the automobile sector. This trend is reinforced by methanol's capacity to diminish particulate matter, nitrogen oxides, and entirely eradicate sulfur oxides.

The industry's transition to decarbonization corresponds with methanol's capacity to serve as a transitional fuel, facilitating sustainability objectives without requiring comprehensive electric vehicle infrastructure establishment. Moreover, methanol's compatibility with existing gasoline supply infrastructures reduces the obstacles to its adoption, rendering it an appealing short- to medium-term solution for enhanced mobility in both developed and emerging economies.

Geographical Penetration

North America’s Consistent Expansion During Energy Transition

The methanol market in North America is experiencing consistent growth, bolstered by a transforming energy landscape and infrastructure adept at supporting cleaner fuels. The region advantages from sophisticated natural gas infrastructures that enable economical methanol synthesis. In contrast to the Asia-Pacific region, North America's market is predominantly shaped by environmental legislation and sustainability objectives rather than solely by cost considerations.

The US and Canada are progressively investing in green methanol solutions and carbon-neutral technologies, demonstrating the region's enduring commitment to decarbonization. The automotive and marine sectors' quest for cleaner fuel options is also driving market growth.

In contrast to China or India, North America's import quantities are comparatively modest, rendering the region more self-sufficient. Continuous research and development investments in renewable methanol production and the use of collected CO₂ for e-methanol synthesis enhance North America's prospects of being a significant contributor to sustainable methanol advancement in the next decades.

Sustainability Analysis

The methanol market is seeing a significant shift towards sustainability, propelled by environmental restrictions and heightened scrutiny of carbon-intensive production techniques. Conventional methanol production using steam methane reforming generates 0.5–1.5 tons of CO₂ for each ton of methanol, resulting in a considerable carbon footprint.

This has resulted in the implementation of advanced technologies like as carbon capture and utilization (CCU) and electrolysis-based production. A significant milestone is the commercial-scale green methanol facility established by European Energy, which employs three 17.5 MW electrolysers to transform solar energy into hydrogen, subsequently synthesizing it with biogenic CO₂ to yield 42,000 tons of e-methanol per year.

Prominent organizations including as Maersk, LEGO, and Novo Nordisk are currently employing this sustainable fuel. These improvements signify a crucial transformation in the market, with green methanol emerging as a viable and eco-friendly option. The necessity of decarbonization will likely transform the future direction of the industry through the use of renewable methanol.

Competitive Landscape

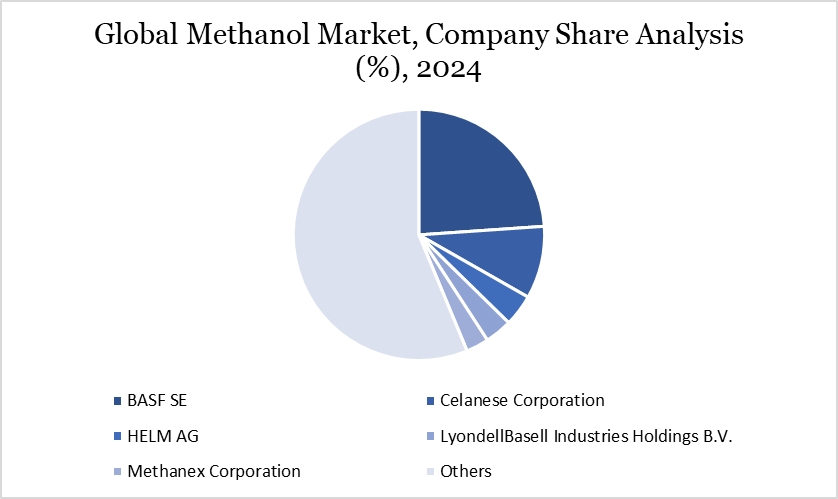

The major global players in the market include BASF SE, Celanese Corporation, HELM AG, LyondellBasell Industries Holdings B.V., Methanex Corporation, MITSUBISHI GAS CHEMICAL COMPANY, INC., MITSUI & CO., LTD., PETRONAS Chemicals Group, SABIC, Zagros Petrochemical and among others.

Methanol Market Key Developments

In September 2024, Methanex Corporation finalized an agreement to acquire OCI Global's international methanol division for US$ 2.05 billion. The purchase encompasses OCI's stake in two methanol plants located in Beaumont, Texas, one of which additionally manufactures ammonia. This will assist the corporation in sustaining its dominant position in the methanol sector.

In June 2023, HELM Proman Methanol (HPM), a preeminent provider of global methanol supply solutions and a subsidiary of the HELM group, reinitiated its international marketing efforts under the new brand, Valenz.

In March 2023, Zagros Petrochemical Company (ZPC) and Dalian Petrochemical Company entered into an agreement to establish a methanol-to-synthetic ethanol conversion facility.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies