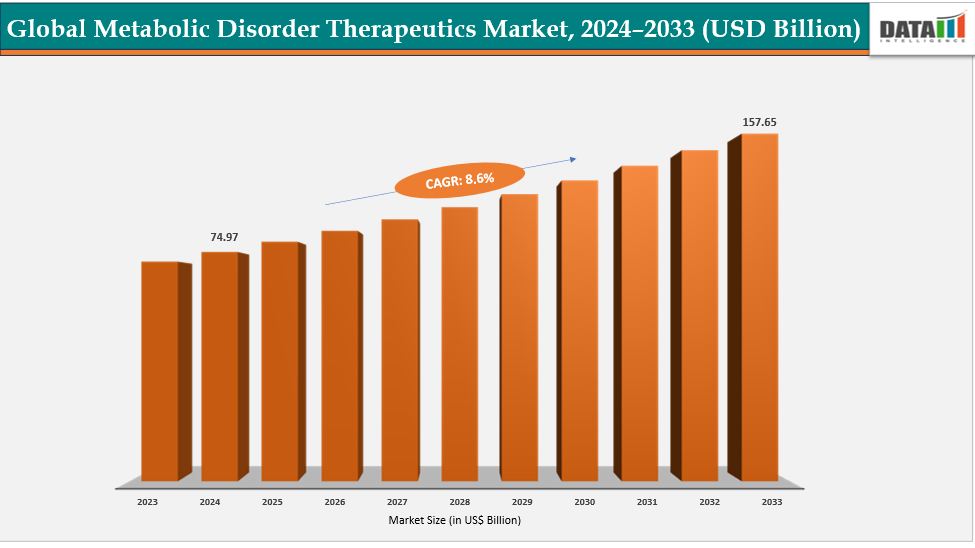

Metabolic Disorder Therapeutics Market Size & Industry Outlook

The market for treatments for metabolic disorders has grown considerably rapidly due to advancements in gene-based and biologic therapy. The development of more accurate and durable treatments for uncommon and chronic metabolic illnesses has been made possible by developments in gene-editing, RNA-based, and enzyme replacement technologies. Prominent biotech and pharmaceutical businesses have increased their R&D investments, which has hastened product approvals and expanded clinical pipelines. Orphan drug incentives and fast-track designations are two further ways that governments and regulatory agencies have encouraged innovation. The development of targeted therapies has been aided by enhanced knowledge of genetic and metabolic pathways brought about by collaborative research between academia and industry.

Key Highlights

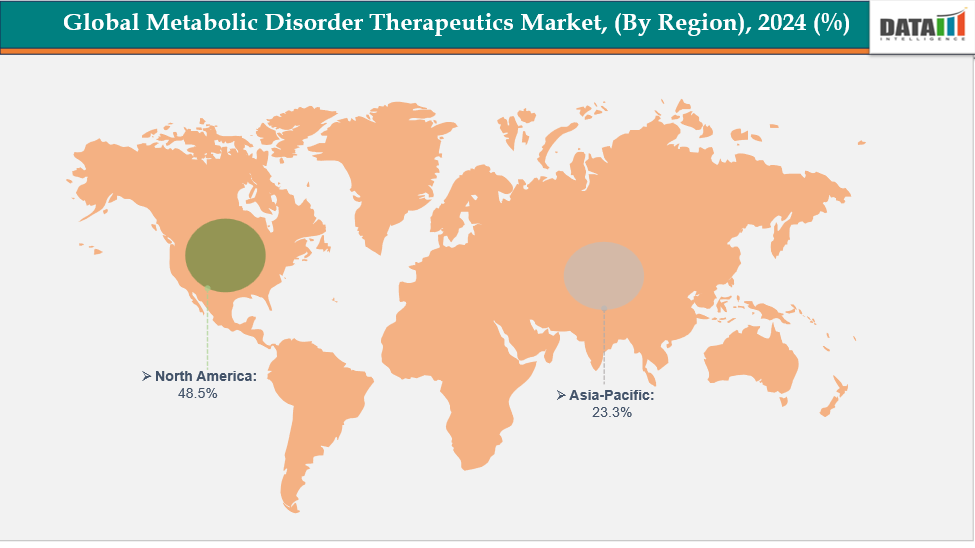

- North America is dominating the global metabolic disorder therapeutics market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global metabolic disorder therapeutics market, with a CAGR of 7.7% in 2024

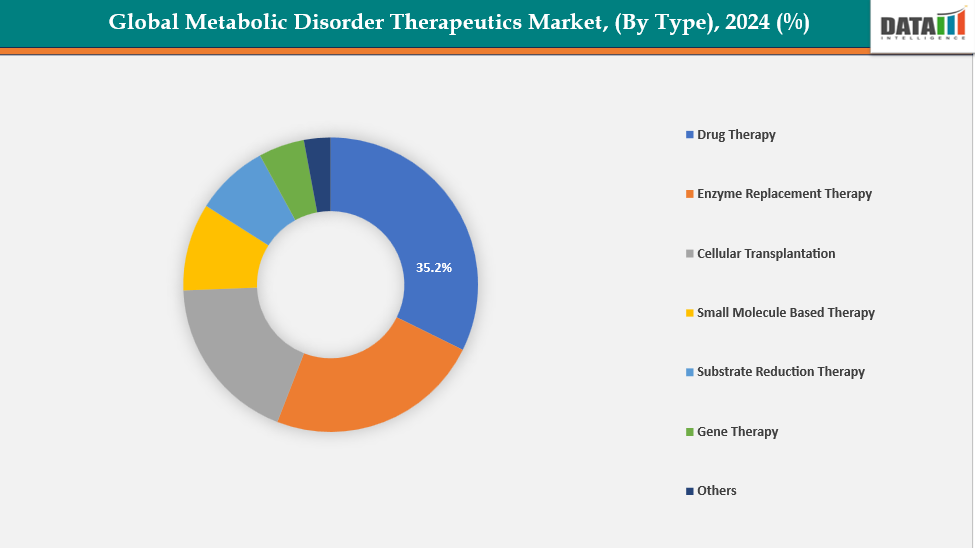

- The drug therapy segment is dominating the metabolic disorder therapeutics market with a 35.2% share in 2024

- The diabetes segment is dominating the metabolic disorder therapeutics market with a 33.3% share in 2024

- Top companies in the metabolic disorder therapeutics market include Novo Nordisk, Sanofi, Takeda Pharmaceuticals U.S.A., Inc., BioMarin Pharmaceutical Inc., Esperion Therapeutics, Inc., Pfizer Inc., Ultragenyx Pharmaceutical Inc., Chiesi USA, Inc., Eli Lilly and Company, and Johnson & Johnson, among others.

Market Dynamics

Drivers: The rising global burden of diabetes and obesity are accelerating the growth of the metabolic disorder therapeutics market

The growing prevalence of obesity and diabetes worldwide has emerged as a key driver of the market expansion for treatments for metabolic disorders. Urbanization, poor diets, and sedentary lifestyles have all contributed to the rise of metabolic syndromes and the resulting need for efficient therapies. There is an increasing demand for sophisticated treatments such GLP-1 agonists, insulin analogs, and combination therapy as type 2 diabetes and its comorbidities become more common.

Owing to the factors like worldwide prevalence, for instance, according to WHO data published in 2024, overweight and obesity were among the leading causes of disability and mortality in the European Region, affecting around 60% of adults, one-third of school-aged children, and 8% of children under five. For diabetes Globally, an estimated 537 million adults have diabetes, with a projected increase to 783 million by 2045.

Restraints: High cost of advanced biologic therapies are hampering the growth of the metabolic disorder therapeutics market

The market expansion for treatments for metabolic disorders has been severely impeded by the high expense of sophisticated biologic therapy. High production and delivery costs result from the need for intricate manufacturing procedures, specialized storage, and strict quality controls for biologic medications, such as gene, RNA, and enzyme replacement treatments.

Furthermore, many patients cannot pay these costs, especially in underdeveloped nations with weak reimbursement systems. Financial limitations frequently affect payers and healthcare providers, which limits access and delays the uptake of costly biologics.

For more details on this report, see Request for Sample

Metabolic Disorder Therapeutics Market, Segment Analysis

The global metabolic disorder therapeutics market is segmented based on type, disorder type, route of administration and region

By Therapy Type: The drug therapy segment is dominating the metabolic disorder therapeutics market with a 35.2% share in 2024

The global market for metabolic disorder treatments was dominated by the drug therapy segment due to of its broad accessibility, affordability, and demonstrated clinical effectiveness in treating major metabolic diseases like diabetes, obesity, and hypercholesterolemia. Oral and injectable medications, such as SGLT2 inhibitors, lipid-lowering medicines, and GLP-1 agonists, were widely used, which contributed to the segment's rise. The discovery of next-generation medicines, combination therapies, and ongoing R&D improvements improved patient adherence and treatment results.

Moreover, frequent regulatory approvals, and expanding patient populations in both developed and emerging markets reinforced its leadership. For instance, in July 2025, PTC Therapeutics, Inc. announced that the U.S. FDA had approved SEPHIENCE (sepiapterin) for treating children and adults with phenylketonuria (PKU), including those with hyperphenylalaninemia (HPA), marking a significant advancement in managing sepiapterin-responsive PKU across a wide age range.

By Disorder Type: The diabetes segment is dominating the metabolic disorder therapeutics market with a 33.3% share in 2024

The market for metabolic disease treatments was dominated by the diabetes segment due to of its large global patient population and rising prevalence. The increase in type 2 diabetes cases was mostly caused by sedentary lifestyles, rising obesity rates, and poor eating habits. Dominance in the market was further reinforced by robust government programs for managing diabetes, enhanced diagnostic capabilities, and more access to cutting-edge treatments.

Moreover, continuous innovation in biologics, insulin analogs, and GLP-1 receptor agonists, along with the introduction of dual and triple agonist therapies, enhanced treatment outcomes and patient compliance. For instance, in February 2025, Sanofi received FDA approval for Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to Novolog, for improving glycemic control in adults and pediatric patients with diabetes mellitus, marking a significant milestone in advancing affordable, effective insulin therapies for better blood sugar management.

Metabolic Disorders Therapeutics Market, Geographical Analysis

North America is dominating the global metabolic disorder therapeutics market with a 48.5% in 2024

North America dominated the market for metabolic problem treatments due to the region's high rates of obesity, diabetes, and inherited metabolic illnesses. Regional leadership and market expansion were greatly aided by the region's sophisticated healthcare system, robust pharmaceutical industry, advantageous reimbursement practices, and ongoing R&D investment in gene treatments and biologics.

In the USA, the expansion of metabolic disorder therapies was fueled by improvements in GLP-1 and combination medications, increased patient awareness, and rising metabolic disease prevalence. Moreover, the recent launch of new companion combination products further supported effective and personalized weight management solutions. For instance, in November 2023, the U.S. FDA granted approval to Eli Lilly’s Zepbound (tirzepatide) injection for chronic weight management in adults who are obese or overweight and have at least one weight-related condition, to be used alongside a reduced-calorie diet and increased physical activity.

Europe is the second region after North America which is expected to dominate the global metabolic disorder therapeutics market with a 34.5% in 2024

In Europe, the market for treatments for metabolic disorders expanded rapidly as a result of the increased prevalence of lipid metabolism disorders, lysosomal storage diseases, and diabetes. Product innovation, early diagnosis, and broad adoption throughout the region were further hastened by favorable regulatory policies, robust research funding, and increased access to advanced biologics, enzyme replacement, and gene therapies.

Owing to factors like new product launches, for instance, in August 2025, the European Commission granted Madrigal Pharmaceuticals conditional marketing authorization for Rezdiffra (resmetirom), making it the first approved therapy in the European Union for adults with noncirrhotic metabolic dysfunction-associated steatohepatitis (MASH) with moderate to advanced liver fibrosis.

The Asia Pacific region is the fastest-growing region in the global metabolic disorder therapeutics market, with a CAGR of 7.7% in 2024

The market for metabolic disease treatments in Asia-Pacific grew rapidly as a result of rising healthcare costs, supportive government initiatives, and the incidence of diabetes and obesity. Biotechnology developments, rising demand for gene and enzyme therapies, and strategic partnerships with South Korea, Japan, China, and India's top pharmaceutical companies all contributed to the region's expansion.

China’s metabolic disorder therapeutics market expanded rapidly, driven by rising metabolic disorder rates, higher disposable incomes, and increasing health awareness. Continuous innovation, expanding local players, and favorable NMPA approvals for advanced anti-obesity drugs supported strong market growth and accelerated adoption of effective therapeutic solutions nationwide. Owing to factors like NMPA approvals, for instance, in June 2025, Innovent Biologics, Inc. announced that China’s National Medical Products Administration (NMPA) had approved Mazdutide, the world’s first dual GCG/GLP-1 receptor agonist, for chronic weight management in adults with overweight or obesity, marking a significant milestone in next-generation metabolic and obesity treatment.

Metabolic Disorder Therapeutics Competitive Landscape

Top companies in the metabolic disorder therapeutics market include Novo Nordisk, Sanofi, Takeda Pharmaceuticals U.S.A., Inc., BioMarin Pharmaceutical Inc., Esperion Therapeutics, Inc., Pfizer Inc., Ultragenyx Pharmaceutical Inc., Chiesi USA, Inc., Eli Lilly and Company, and Johnson & Johnson, among others.

Novo Nordisk: Novo Nordisk is a global leader in metabolic disorder therapeutics, specializing in diabetes, obesity, and rare endocrine diseases. With a strong portfolio of insulin analogs, GLP-1 receptor agonists, and obesity treatments, the company focuses on advancing metabolic health through innovative biologics and RNA-based therapies, continuous R&D investment, and strategic global partnerships to enhance patient outcomes.

Key Developments:

- In September 2025, Innovent Biologics, Inc. received approval from China’s National Medical Products Administration (NMPA) for Mazdutide, the world’s first dual GCG/GLP-1 receptor agonist, for glycemic control in adults with type 2 diabetes, marking a major advancement in metabolic disease treatment.

- In March 2024, Madrigal Pharmaceuticals, Inc. received FDA accelerated approval for Rezdiffra (resmetirom), in combination with diet and exercise, for treating adults with noncirrhotic NASH and moderate to advanced liver fibrosis, marking the first approved therapy for this serious metabolic liver disease.

Market Scope

| Metrics | Details | |

| CAGR | 8.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Therapy Type | Drug Therapy, Enzyme Replacement Therapy, Cellular Transplantation, Small Molecule-Based Therapy, Substrate Reduction Therapy, Gene Therapy and Others |

| By Disorder Type | Diabetes, Obesity, Lysosomal Storage Diseases, Hypercholesterolemia and Other | |

| By Route of Administration | Oral, Injectable and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global metabolic disorder therapeutics market report delivers a detailed analysis with 62 key tables, more than 58 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here