Hypercholesterolemia Treatment Market Overview

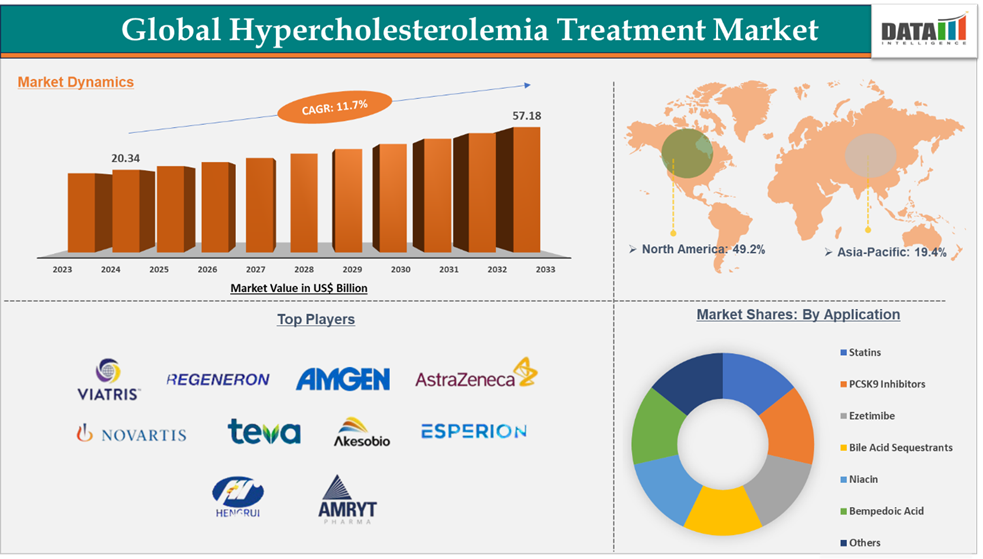

Hypercholesterolemia Treatment Market reached US$ 20.34 billion in 2024 and is expected to reach US$ 57.18 billion by 2033, growing at a CAGR of 11.7% during the forecast period 2025-2033.

Hypercholesterolemia is a condition characterized by high levels of low-density lipoprotein (LDL-C) in the blood. LDL-C is considered bad cholesterol, which increases the risk of cardiovascular disease and stroke. There are two types of hypercholesterolemia, which are notably primary (genetic), such as familial hypercholesterolemia, or secondary due to factors like poor diet, obesity, diabetes, or hypothyroidism.

Most people show no symptoms, but severe cases may present with fatty deposits on the skin or around the eyes and early cardiovascular events. Risk factors include age, family history, unhealthy lifestyle, smoking, and existing metabolic disorders. Diagnosis is done through a lipid panel that measures total cholesterol, LDL, HDL, and triglycerides.

Treatment starts with lifestyle changes, including a heart-healthy diet, regular exercise, weight management, and quitting smoking. When lifestyle changes aren’t enough, medications like statins, ezetimibe, PCSK9 inhibitors, bempedoic acid, and inclisiran are prescribed to lower cholesterol levels. In severe genetic cases, combination therapy may be required.

The hypercholesterolemia treatment market is experiencing significant growth due to rising prevalence, rising awareness and diagnosis rate, increasing novel product development activities, and subsequent market approvals, market penetration in emerging countries, etc. The development of biologic drugs is a key trend that is positively impacting the market growth.

Executive Summary

For more details on this report – Request for Sample

Hypercholesterolemia Treatment Market Dynamics: Drivers & Restraints

The rising innovative product approvals are driving the market growth

The market for hypercholesterolemia treatment is expected to be greatly driven by new product development activities and product approvals. Several products that are currently available in the market are expanding their application and thereby increasing the patient reach.

For instance, in March 2024, the U.S. Food and Drug Administration (FDA) has provided extended approval for Praluent (alirocumab) developed by Regeneron Pharmaceuticals Inc. as an adjunct to diet and other low-density lipoprotein cholesterol (LDL-C) lowering therapies to include pediatric patients aged 8 and older with heterozygous familial hypercholesterolemia (HeFH).

Moreover, in January 2025, Ultragenyx Pharmaceutical Inc. announced that the European Commission (EC) had extended the approval of Evkeeza (evinacumab) as an adjunct to diet and other lipid-lowering therapies to treat children aged 6 months and older with homozygous familial hypercholesterolemia (HoFH). The Drug has received commercialization rights in the U.S. in March 2023, which is being done by Regeneron Pharmaceuticals, Inc.

Moreover, several new products are entering the market and are expected to serve the population with high unmet needs. For instance, in September 2024, the National Medical Products Administration (NMPA) of China approved the New Drug Application (NDA) of ebronucimab, which is indicated for the treatment of primary hypercholesterolemia and mixed hyperlipidemia, and heterozygous familial hypercholesterolaemia (HeFH). Ebronucimab is a PCSK9 inhibitor developed by Akeso Biopharma Co., Ltd., which is currently being launched in China due to high demand.

In Japan, Otsuka Pharmaceutical Co., Ltd. has submitted the New Drug Application (NDA) to the Japanese Ministry of Health, Labour and Welfare for the manufacture and sale of bempedoic acid developed by Esperion Therapeutics, Inc. for the treatment of hypercholesterolemia and familial hypercholesterolemia.

Additionally, in the U.S., LIB Therapeutics Inc. has announced that the U.S. FDA has accepted for review the Biologics License Application (BLA) of Lerodalcibep, which is aimed at reducing LDL-C in patients with atherosclerotic cardiovascular disease (ASCVD), primary hyperlipidemia, including heterozygous, and those 10 years or older with homozygous familial hypercholesterolemia (HeFH / HoFH).

The side effects associated with hypercholesterolemia treatment may restrain the market growth.

Statins are the most commonly used drugs for the treatment of hypercholesterolemia and are known to have potential side effects. The common side effects can include muscle pain, weakness (myalgia), liver enzyme abnormalities, and in rare cases, severe muscle problems like rhaRegeneron Pharmaceuticals Inc. omyolysis.

According to a research study published in the Journal of Clinical Lipidology, Statin intolerance is reported in 5% to 30% of patients, which is a key contributor to the loss of patient adherence to these therapies.

These side effects may discourage some patients from taking statins or lead to treatment discontinuation. This treatment discontinuation is due to the patient’s dissatisfaction. In response to side effects, some patients and healthcare providers may explore alternative cholesterol-lowering medications or treatment strategies that have different side effect profiles.

Moreover, the PCSK9 inhibitors are gaining huge popularity in the hypercholesterolemia treatment landscape. However, these drugs are also associated with several side effects.

These drugs, sold under the popular brands PRALUENT and REPATHA, can produce serious allergic reactions in certain patients. This can significantly contribute to the loss of treatment adherence.

Hypercholesterolemia Treatment Market Segment Analysis

The global hypercholesterolemia treatment market is segmented based on disease type, treatment type, distribution channel, and region.

Statins in the treatment type segment are dominating with the highest market share of 45.6% of market share in the global hypercholesterolemia treatment market.

Statins are the most widely used drugs for hypercholesterolemia due to their proven ability to significantly lower low-density lipoprotein cholesterol (LDL-C). This class includes drugs like atorvastatin, simvastatin, and rosuvastatin, which can reduce LDL-C by 30% to 50%, depending on the dose, and have been shown to reduce the risk of heart attacks, strokes, and cardiovascular-related deaths.

Their widespread use is supported by decades of clinical trial data, which demonstrated that statins improve survival in high-risk patients. In addition to efficacy, statins are generally safe and well-tolerated, with rare serious side effects. The availability of generic versions has made statins affordable and accessible worldwide, contributing to their dominance in the hypercholesterolemia treatment market.

Moreover, international guidelines, such as those from the American College of Cardiology (ACC) and the European Society of Cardiology (ESC), recommend statins as first-line therapy for managing hypercholesterolemia. Alternative treatments like ezetimibe or PCSK9 inhibitors exist but are typically used as add-on therapies or in statin-intolerant patients due to higher costs. Altogether, this combination of efficacy, safety, cost-effectiveness, and strong clinical endorsement explains why statins hold the largest market share in cholesterol management.

Hypercholesterolemia Treatment Market Geographical Analysis

North America dominated the hypercholesterolemia treatment market with the highest share of 49.2% in 2024

The North America region is expected to hold the largest market share over the forecast period, owing to the strong presence of major players and advanced healthcare infrastructure. This strong presence of key players can actively perform in clinical trials and research activities, resulting in regulatory approvals, such as FDA approvals for novel therapeutics are seen in the region.

For instance, on April 11, 2025, the U.S. Food and Drug Administration (FDA) granted Fast Track designation for VERVE-102 for the treatment of patient groups with hyperlipidaemia and high lifetime cardiovascular risk. VERVE-102 is Verve Therapeutics' novel, in vivo, investigational base editing medicine designed to be a single-course treatment that permanently turns off the PCSK9 gene in the liver and durably reduces disease-driving LDL-C. VERVE-102 is currently being tested in the Phase 1b Heart-2 clinical trial, which is designed to evaluate the safety and tolerability of VERVE-102 administration in adult patients with heterozygous familial hypercholesterolemia (HeFH) and/or premature coronary artery disease (CAD) who require additional lowering of LDL-C.

Furthermore, North America is known for its well-established and advanced healthcare infrastructure, including hospitals, specialty clinics, research and academic institutes, and others. This advanced healthcare infrastructure is at the forefront of better treatment for hypercholesterolemia patients. This advanced healthcare infrastructure also offers favourable reimbursement policies to patients for effective treatment. The improved insurance coverage offers better treatment for many patients at affordable costs, leading to market dominance in the region.

Hypercholesterolemia Treatment Market Major Players

The major global players in the hypercholesterolemia treatment market are Viatris Inc., Amgen Inc., Amryt Pharma plc (CHIESI Farmaceutici S.p.A.), AstraZeneca Plc., Regeneron Pharmaceuticals, Inc., Novartis AG, Teva Pharmaceutical Industries Ltd., Akeso Biopharma Co., Ltd., Esperion Therapeutics, Inc., and Jiangsu Hengrui Pharmaceuticals Co., Ltd., among others.

Market Scope

Metrics | Details | |

CAGR | 11.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Disease Type | Genetic Hypercholesterolemia (Familial Hypercholesterolemia), Acquired Hypercholesterolemia |

Treatment Type | Statins, PCSK9 Inhibitors, Ezetimibe, Bile Acid Sequestrants, Niacin, Bempedoic Acid, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |