Medical Supplies and Equipments Market Overview

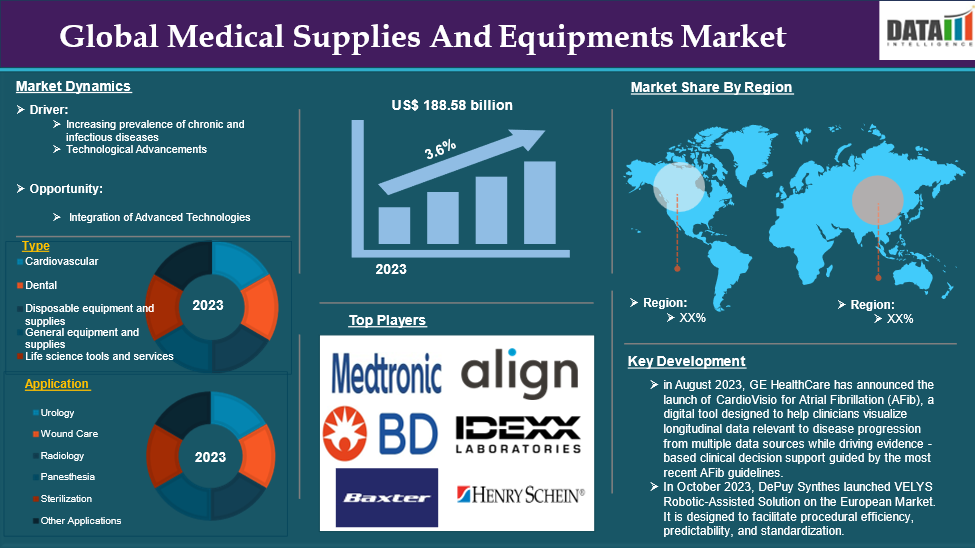

The global Medical Supplies and Equipments Market reached US$ 143.1 billion in 2023 and is expected to reach US$ 188.58 billion by 2031, growing at a CAGR of 3.6% during the forecast period 2024-2031.

Medical supplies and equipment are used in hospitals and clinics for medical purposes such as surgeries. These supplies allow health care professionals to assess a patient's medical needs. The medical supplies and equipment include storage and transport, durable medical equipment, and diagnostic and electronic medical equipment.

The Medical Supplies and Equipments Market is driven by the factors such as the increasing prevalence of chronic diseases, increasing demand for novel treatment options, increasing awareness, growing patient demand for better treatment, and advancements in treatment options. The North America region is expected to hold the largest market share owing to the strong presence of majors in the region.

Executive Summary

For more details on this report – Request for Sample

Medical Supplies and Equipments Market Dynamics: Drivers & Restraints

Increasing prevalence of chronic and infectious diseases

The increasing prevalence of chronic diseases is expected to be a significant factor in the growth of the global Medical Supplies and Equipments Market. The market is anticipated to be driven by the growing number of patients with chronic diseases like cancer, diabetes, and cardiovascular conditions. For instance, according to the Centers for Disease Control and Prevention, around 20.1 Million adults age 20 and older have coronary artery disease, about 7.2% in the United States. According to the National Center for Biotechnology Information, 2023, Osteoporosis is the most common metabolic bone disorder globally and in tropical countries. The prevalence of osteoporosis is 30 to 50% among postmenopausal women and up to 20% in men above 50 years. Furthermore, according to the World Health Organization, 2023, diseases like cancers, chronic obstructive pulmonary diseases, asthma, diabetes, and cardiovascular diseases affect people in low- and middle-income countries, where more than three-quarters of global NCD deaths (31.4 million) occur that rounds up to 80%. Approximately 17 million people die from an NCD before age 70.

As a result of increasing prevalence of chronic and infectious diseases, the major players have launched medical supplies and equipments to provide more efficient diagnosis and treatments. For instance, in August 2023, GE HealthCare has announced the launch of CardioVisio for Atrial Fibrillation (AFib), a digital tool designed to help clinicians visualize longitudinal data relevant to disease progression from multiple data sources while driving evidence-based clinical decision support guided by the most recent AFib guidelines. So, the market is driven as a result of increasing prevalence of chronic and infectious diseases and launch of products.

High costs of medical equipment

The increasing cost of medical supplies and equipment hinders the market. The cost of medical equipment goes from $2,000 to $100,000 USD. The average price of dental equipment ranges around $7,501, ophthalmology ranges around $8,012. The price also varies according to the technology used and brand value. Highend medical equipment costs where in the brand value adds up. Integration of advanced features like artificial intelligence, machine learning, robotics, etc brings up the cost to a higher level. The maintenance costs also shoot up which can be a burden for most of the buyers.

Medical Supplies and Equipments Market Segment Analysis

The global Medical Supplies and Equipments Market is segmented based on product type, technology, distribution channel and region.

Orthopedic implants and prosthetics segment is expected to dominate the global Medical Supplies and Equipments Market share

Orthopedic Implants are designed to replace a damaged bone or cartilage which mostly occurs by accidents and injuries. Most of the implants and prosthetics are used to cover up the damages caused due to burns and injuries that destroy bones and other cartilage at the target site. Ageing also causes destruction of bone density which gives rise to diseases like osteoporosis. Bone-related diseases lead to severe pain which sometimes requires replacement surgery that makes use of orthopedic implants.

Orthopedic Implants and Prosthetics is expected to hold the largest share in the segment due to the increasing product launches and advancements by key companies like Johnson & Johnson and Smith+Nephew etc. For instance, in July 2023, the Orthopaedic Implant Company (OIC) has announced the launch of its unique Threaded Metacarpal Nail System. This innovative approach to metacarpal fixation represents a huge step forward in hand fracture care, offering orthopedic surgeons a superior solution that combines efficiency, stability, and convenience of use. The OIC Threaded Metacarpal Nail System has a low insertion torque and a minimally compressive design, ensuring maximum stability for a variety of fracture patterns. The completely threaded construction and tapered head diameter enable robust fixation, allowing for early mobilization of patients. So, the increased accidents and injuries and new launches that use advanced technology make the segment the most dominating.

Medical Supplies and Equipments Market Geographical Analysis

The North America region is expected to hold the largest market share over the forecast period owing to the strong presence of major players and increasing advancements. North America, particularly the United States, has a well-developed healthcare infrastructure with advanced medical facilities, research institutions, and specialized dermatology centers. This infrastructure supports the diagnosis, treatment, facilitating the growth of the market. The availability of specialized healthcare professionals further enhances the quality of care provided to patients. The region is at the forefront of technological advancements in healthcare. North America is known for its strong emphasis on research and development, leading to the introduction of innovative treatment options and diagnostic tools for chronic diseases like cancer.

Advancements in medical devices and integration with AI and machine learning keep up the demand for medical devices in this region. For instance, in June 2023, A-dec launched the First Digitally Connected Dental Chair and Delivery System. A-dec 500 Pro and A-dec 300 Pro delivery systems available for North American markets The United States boasts advanced healthcare infrastructure, including state-of-the-art hospitals, research institutions, and medical facilities. This infrastructure facilitates the adoption of the latest technologies and advancements in medical devices.

Asia Pacific is growing at the fastest pace in the global medical supplies and equipment’s market

Asia Pacific is experiencing the fastest growth in global medical supplies and equipment’s market owing to the increasing incidence of chronic diseases and technological advancements in the region. For instance, according to the National Institute of Health, the expected number of cancer cases in India for 2022 is 14,61,427 (crude rate: 100.4 per 100,000). In India, one out of every nine people is likely to develop cancer over his or her lifetime. Males and females were most likely to develop lung and breast cancer, respectively. The growing burden of noncommunicable diseases (NCDs) has prompted healthcare systems to seek innovative approaches to care delivery, leading to increased demand for medical supplies and equipment tailored for chronic disease management

Medical Supplies and Equipments Market Major Players

The major global players in the global Medical Supplies and Equipments Market include Medtronic Inc., Becton Dickinson & Company, Baxter International Inc., Align Technology Inc., IDEXX Laboratories Inc., Henry Schein Inc., Cooper Companies Inc., Bio Rad Laboratories Inc., Hill Rom Hldg Inc., ICU Medical Inc. among others.

Key Developments

• In February 2023, CurvaFix, Inc. launched a smaller-diameter, 7.5mm CurvaFix IM Implant, designed to simplify surgery and provide strong, stable fixation in small-boned patients.

- In October 2023, DePuy Synthes launched VELYS Robotic-Assisted Solution on the European Market. It is designed to facilitate procedural efficiency, predictability, and standardization.

- In August 2023, Smith+Nephew launched the OR3O dual mobility system for hip arthroplasty in India.

Emerging Players

Genomtec, QuantiLight, and GeneSys Bio among others

Report Insights

| Metrics | Details | |

| CAGR | 3.6% | |

| Market Size Available for Years | 2022-2031 | |

| Estimation Forecast Period | 2024-2031 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | Cardiovascular, Dental, Disposable equipment and supplies, General equipment and supplies, Life science tools and services, others |

| Application | Urology, Wound Care, Radiology, Panesthesia, Sterilization, Other Applications | |

| End-User | Hospital, Clinic, Assisted Living Centers & Nursing Homes, Ambulatory Surgery Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Medical Supplies and Equipments Market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.