Global Longevity Therapeutics Market – Industry Trends & Outlook

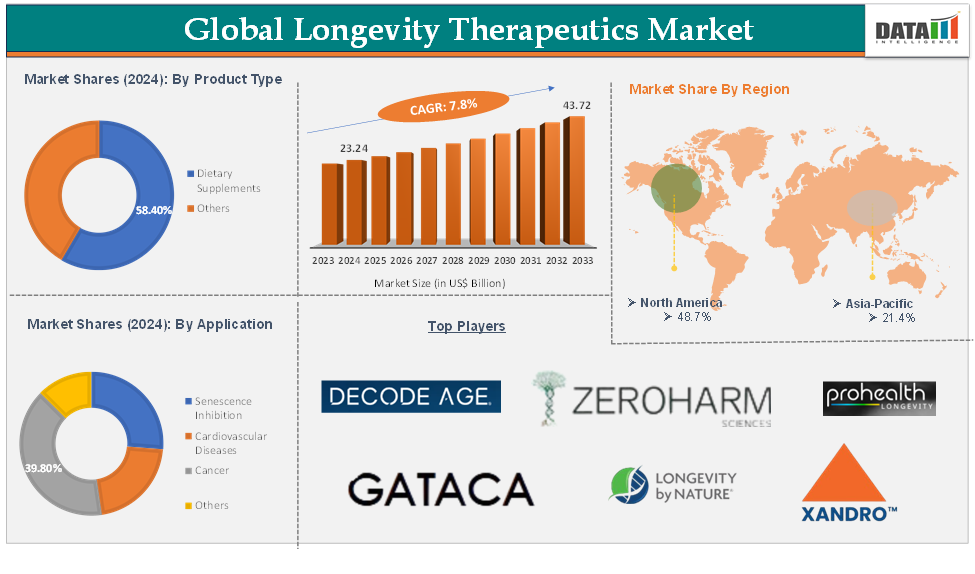

The global longevity therapeutics market was valued at US$ 21.74 Billion in 2023. The market size reached US$23.24 Billion in 2024 and is expected to reach US$43.72 Billion by 2033, growing at a CAGR of 7.8% during the forecast period 2025-2033.

The global longevity therapeutics market encompasses medical and scientific strategies, products, and interventions aimed at extending human lifespan and promoting healthy aging. Key drivers of the longevity therapeutics market include the rapidly aging global population, increasing life expectancy, and a rising prevalence of chronic diseases associated with aging. Growing awareness of preventive healthcare and wellness, breakthroughs in gene and regenerative medicine, and rising healthcare expenditures are major contributors to market growth.

Major trends shaping the market include the integration of gene editing and stem cell therapies, the expansion of wearable health technologies for personalized care, and the popularity of nutraceuticals targeting cellular health.

Significant opportunities exist in emerging markets such as Asia-Pacific, Latin America, and the Middle East, where improving healthcare infrastructure and rising disposable incomes are creating new demand for longevity therapeutics. There is also potential for growth in the development of personalized medicine, AI-driven diagnostics, and novel delivery systems for anti-aging therapies. The expanding applications of stem cell and gene therapies, combined with regulatory support for innovative treatments, present substantial commercial prospects for companies operating in this sector.

Global Longevity Therapeutics Market – Executive Summary

Global Longevity Therapeutics Market Dynamics: Drivers

Rising global aging population

The increase in life expectancy and the rapid growth of the elderly population, especially in developing regions, are key forces driving the global longevity therapeutics market. These trends create a large, expanding, and urgent need for therapies that can support healthy aging, prevent age-related diseases, and enhance the quality of life for older adults worldwide.

According to World Health Organization (WHO) data in February 2025, the number of people aged 60 and older is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030. This demographic shift is not limited to wealthy countries; it is accelerating even more rapidly in developing regions, where improvements in healthcare and living standards are driving both longer life spans and a growing elderly population.

The expansion of anti-aging formulations is fueled by the demographic shift toward an older population, which is driving both consumer demand and innovation in the market. For instance, in January 2024, Healthy Extracts Inc. launched LONGEVITY Anti-Aging, a proprietary plant-based nutraceutical formulation aimed at supporting skin vitality, arterial flexibility, and cellular and joint health. This new product is part of Healthy Extracts’ broader strategy to acquire, develop, and market science-backed, research-proven, and proprietary plant-based supplements within high-growth segments of the multibillion-dollar nutraceuticals market.

Rising prevalence of chronic diseases

The rising prevalence of chronic diseases is a major driver for the global longevity therapeutics market. According to World Health Organization (WHO) data in 2021, NCDs, including cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes, were responsible for at least 43 million deaths, accounting for 75% of all non-pandemic-related deaths globally. Strikingly, 18 million of these deaths occurred in people under age 70, with 82% of premature NCD deaths happening in low- and middle-income countries. This highlights both the scale and the inequity of the NCD burden worldwide.

Cardiovascular diseases led the toll, causing over 19 million deaths, followed by cancers (10 million), chronic respiratory diseases (4 million), and diabetes (over 2 million, including kidney disease deaths caused by diabetes). These four disease groups alone account for 80% of all premature NCD deaths, underscoring their central role in global mortality and morbidity.

Detection, screening, and treatment of NCDs, along with palliative care, are essential components of the response, but the sheer scale and complexity of these diseases demand innovative approaches. This is where the longevity therapeutics market becomes crucial: it focuses on developing advanced therapies that target the underlying biological mechanisms of aging and chronic disease progression, offering hope for prevention, delay, or reversal of these conditions.

Global Longevity Therapeutics Market Dynamics: Restraints

Stringent regulatory requirements

Stringent regulatory requirements are a significant restraint for the global longevity therapeutics market. Unlike traditional disease categories, aging itself is not yet recognized as a disease by any major healthcare regulator worldwide, which creates fundamental challenges for the approval and commercialization of longevity-focused products. As a result, companies developing anti-aging and longevity therapeutics must navigate a complex and evolving regulatory landscape, often having to demonstrate the safety and efficacy of their products through rigorous clinical trials designed for specific age-related diseases rather than for aging as a primary indication.

Global Longevity Therapeutics Market Dynamics: Opportunities

Emerging markets expansion

Expanding into emerging markets represents a major opportunity for the global longevity therapeutics market. These regions, including Asia-Pacific, Latin America, the Middle East, and Africa, are experiencing rapid improvements in healthcare infrastructure, rising disposable incomes, and a growing awareness of preventive health and wellness solutions. As populations in these areas age and the prevalence of chronic diseases increases, demand for advanced anti-aging and longevity therapies is expected to surge.

Emerging markets are particularly attractive because they combine large, underserved populations with increasing government and private investment in healthcare modernization. This creates fertile ground for companies to introduce innovative therapies such as gene and cell therapies, senolytics, and personalized medicine, which have already shown strong growth in developed markets. Additionally, the expansion of digital health technologies, telemedicine, and wearable devices in these regions enables broader access to longevity solutions and facilitates personalized care delivery.

For instance, in October 2024, Longevity Health, a clinical services company and the nation’s fastest-growing Institutional Special Needs Plan (ISNP), entered into a joint venture with the client facilities of Infinity Healthcare Consulting, a prominent multi-state consulting firm for skilled nursing facilities. This partnership enables Longevity Health to expand its services into three new states and grow its presence in an additional state, further extending its national reach.

Also, in September 2024, the Estate, a luxury hospitality concept, emerged from a collaboration between lifestyle company SBE, its visionary founder Sam Nazarian, and renowned entrepreneur Tony Robbins. This innovative venture seamlessly blends high-end accommodations with cutting-edge health and wellness services, catering to the increasing demand for longevity and disease prevention solutions.

For more details on this report, Request for Sample

Global Longevity Therapeutics Market - Segment Analysis

The global longevity therapeutics market is segmented based on product type, application, and region.

Product Type:

The dietary supplements product type segment is expected to hold 58.4% of the global longevity therapeutics market in 2024

The dietary supplements product type segment is a major and rapidly growing category within the global longevity therapeutics market. This segment includes a wide range of products such as vitamins, minerals, botanicals, amino acids, enzymes, and other bioactive compounds designed to support overall health and address specific age-related concerns like immune function, cognitive health, joint mobility, and skin vitality.

The growth of this segment is fueled by the rising global aging population, increased consumer focus on preventive health, and the prevalence of chronic diseases. As more people seek to maintain vitality and manage health proactively, dietary supplements have become popular tools for filling nutritional gaps and supporting healthy aging.

Additionally, ongoing innovation in product formulations such as supplements targeting brain health, bone strength, and beauty-from-within, along with the use of natural and organic ingredients, continues to attract health-conscious consumers. With the global dietary supplements market projected to grow significantly in the coming years, this segment remains a cornerstone of the longevity therapeutics industry, offering accessible and customizable solutions for individuals aiming to extend their health span and improve quality of life as they age.

For instance, in March 2025, AgelessRx introduced Methylene Blue capsules as part of its mission to make cognitive longevity solutions more accessible and effective. This launch marks AgelessRx's entry into the rapidly growing cognitive health market. Methylene Blue, a compound with over 150 years of therapeutic use, is gaining renewed attention for its potential to support brain health, memory, focus, and cellular energy production. These factors have solidified the segment's position in the global longevity therapeutics market.

Global Longevity Therapeutics Market – Geographical Analysis

North America is expected to hold 48.7% of the global longevity therapeutics market in 2024

The increasing rates of cardiovascular risk factors such as obesity, diabetes, sedentary lifestyles, and poor diet, combined with an aging population, are significantly boosting demand for longevity and anti-senescence therapies.

For instance, in the U.S., all four major cardiovascular risk factors are projected to rise sharply between 2025 and 2060, with diabetes expected to increase by 39.3% to affect 55 million people, alongside notable increases in dyslipidemia, hypertension, and obesity. Longevity therapies are being developed to target aging-related cellular damage and improve heart health, directly addressing this growing burden.

The number of people aged 65 and above in North America has increased significantly, leading to a higher prevalence of age-related conditions such as osteoarthritis and joint pain. This demographic shift is expanding the market for longevity and anti-aging interventions.

North America boasts advanced healthcare systems, extensive networks of hospitals, and leading research institutions. This environment supports the rapid adoption and development of longevity therapies, including gene therapy, regenerative medicine, and AI-powered diagnostics. The presence of major biotech and pharmaceutical companies further accelerates innovation and commercialization in the sector.

For instance, in February 2025, Junevity is a biotechnology startup focused on developing "Cell Reset" therapeutics, a new class of medicines designed to reverse cellular damage associated with aging and age-related diseases. The company officially launched with $10 million in seed funding and is based on research from the University of California, San Francisco, led by co-founder Dr. Janine Sengstack. Thus, the above factors are consolidating the region's position as a dominant force in the global longevity therapeutics market.

Asia Pacific is expected to hold 21.4% of the global longevity therapeutics market in 2024

The Asia-Pacific region, particularly countries like China, Japan, and India, is witnessing a significant increase in its elderly population. This demographic shift is leading to a higher prevalence of age-related diseases and a growing demand for therapies that address aging and promote healthy longevity.

There is increasing public awareness about the benefits of preventive healthcare, wellness, and anti-aging solutions. This is coupled with a strong cultural acceptance and historical use of traditional and alternative medicine, especially botanicals and natural products, which remain popular for longevity and anti-aging in the region.

The region is seeing rapid progress in gene therapy, immunotherapy, and regenerative medicine, which are creating innovative treatment options for age-related conditions. Expanding applications of stem cell therapies and the integration of nanotechnology with regenerative medicine are also driving market growth.

There is a rising consumer demand for nutraceuticals, supplements, and functional foods targeting cellular health, beauty, and vitality. The popularity of wearable health tech and personalized care solutions is also on the rise, reflecting broader trends toward proactive health management.

For instance, in April 2024, the Longevity India Initiative, spearheaded by the Indian Institute of Science (IISc), embarks on a mission to propel research on aging and promote extended healthy lifespans in India. This far-reaching endeavor tackles the complex challenges of aging through a holistic, multidisciplinary approach that seamlessly blends expertise from the realms of biology, technology, and healthcare. Thus, the above factors are consolidating the region's position as a dominant force in the global longevity therapeutics market.

Global Longevity Therapeutics Market – Competitive Landscape (Major Players)

The major global players in the longevity therapeutics market include Decode Age, Zeroharm, Gataca, Longevity by Nature, ProHealth, Inc., Xandro Lab., NanoSPACE, AgeX Therapeutics, Inc., T.A. SCIENCES, and Elysium Health, Inc., among others.

Global Longevity Therapeutics Market – Competitive Landscape (Emerging Players)

The emerging players in the longevity therapeutics market include Longeveron, and Stealth BioTherapeutics Inc., among others.

Global Longevity Therapeutics Market – Key Developments

In May 2025, Jupiter Neurosciences, Inc., a clinical-stage pharmaceutical company, commercially launched Nugevia, a new line of performance and longevity supplements. This marks a strategic expansion from their pharmaceutical roots into the consumer wellness market, with products expected to be available direct-to-consumer in the third quarter of 2025.

In April 2025, I Peace, Inc., a leader in induced pluripotent stem cell (iPSC) technology, launched personalized iPS cell production and longevity-focused rejuvenation therapies in the United States. This move brings advanced, age-reversed stem cell technology previously available only in limited settings to the broader public.

In September 2024, Longevity Biomedical, Inc., a company focused on developing new therapies and technologies to extend human healthspan and longevity, announced a business combination (a type of merger) with FutureTech II Acquisition Corp., a special purpose acquisition company (SPAC).

In August 2024, Orgenesis Inc., a global biotech company specializing in cell and gene therapies, formed a strategic partnership with Harley Street Healthcare Group (HSHG), a leading provider of personalized and preventative health services, to launch a global longevity and wellness initiative.

Global Longevity Therapeutics Market – Scope

Metrics | Details | |

CAGR | 7.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Dietary Supplements, Others |

Application | Senescence Inhibition, Cardiovascular Diseases, Cancer, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global longevity therapeutics market report delivers a detailed analysis with 60 key tables, more than 54 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.