Liquid Nitrogen Market Size

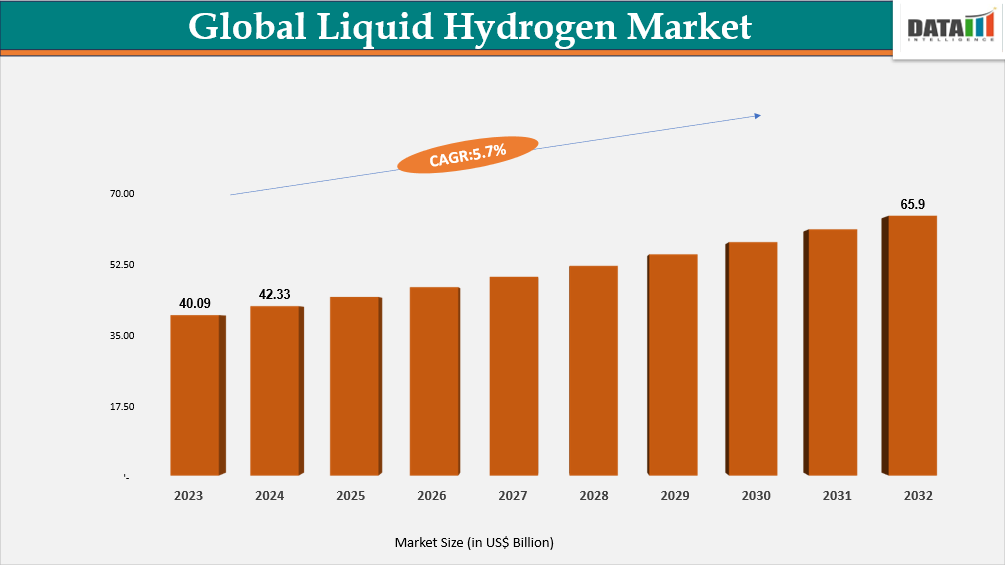

The global liquid hydrogen market was valued at US$ 42.3 billion in 2024 and is projected to reach US$ 65.9 billion by 2032, growing at a CAGR of 5.7% during the forecast period 2025–2032. This growth is driven by increasing demand from the aerospace, automotive and industrial sectors, where liquid hydrogen’s high energy density, clean-burning characteristics and efficiency offer significant advantages. Additionally, the rising adoption of hydrogen fuel cells, expansion of hydrogen production and storage infrastructure and the global push toward low-carbon and renewable energy sources are expected to further accelerate market growth.

Liquid Hydrogen Industry Trends and Strategic Insights

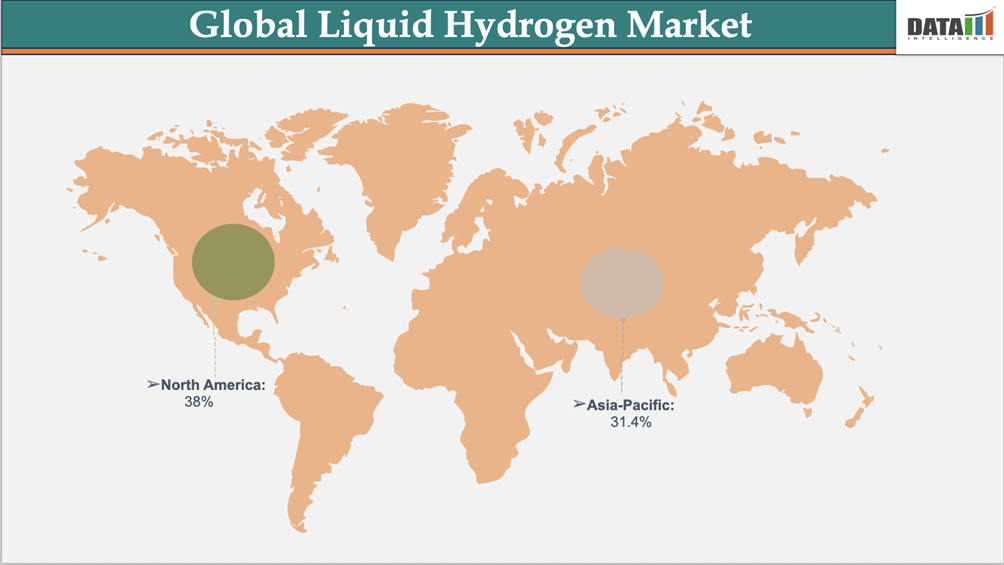

North America dominates the market, capturing the largest revenue share of 38% in 2024.

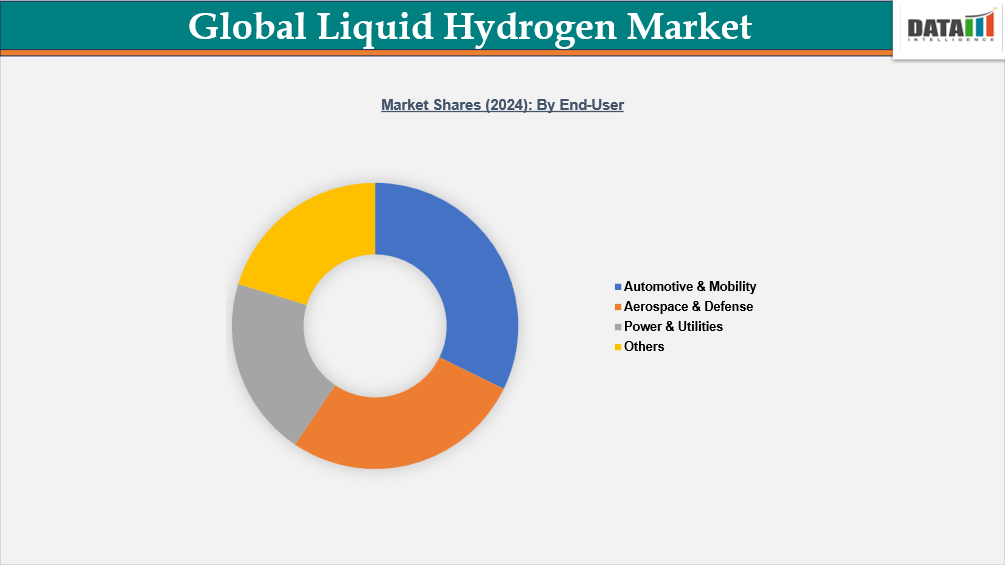

By end-user, the automotive & mobility segment is projected to experience the largest market, registering a significant 28.87% in 2024.

Global Liquid Hydrogen Market Size and Future Outlook

2024 Market Size: US$ 42.3 Billion

2032 Projected Market Size: US$ 65.9 Billion

CAGR (2025-2032): 5.7%

Largest Market: North America

Fastest Market: Asia-Pacific

Market Scope

Metrics | Details |

By Product Type | Green Liquid Hydrogen, Blue Liquid Hydrogen, Grey Liquid Hydrogen, Other |

By Grade | Industrial Grade, Aerospace Grade, Fuel Cell Grade, Others |

By Application | Fuel Cells, Rocket Fuel & Aerospace Propulsion, Energy Storage & Power Generation, Others |

By End-User | Automotive & Mobility, Aerospace & Defense, Power & Utilities & Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Automotive and Clean Energy Transition

The automotive sector is a key driver of the global liquid hydrogen market, supported by rising adoption of fuel cell vehicles and clean energy technologies. Hydrogen’s high energy density, fast refueling capability and zero carbon emissions make it a vital fuel for decarbonizing transportation and supporting aerospace and industrial energy storage. Government incentives, net-zero emission targets and investments in hydrogen-powered mobility are further accelerating demand. Companies like Air Liquide and Air Products are expanding production and storage capacities to ensure reliable supply for automotive and industrial applications, reinforcing the market’s growth trajectory.

High Costs and Infrastructure Challenges

Despite its growth potential, the liquid hydrogen market faces restraints due to high production, storage and transportation costs. Advanced liquefaction processes require significant energy input, raising operational expenses. Additionally, limited refueling infrastructure and supply chain complexities hinder widespread adoption, especially in emerging economies. Safety concerns associated with handling and storing cryogenic hydrogen further add to regulatory hurdles. These challenges slow down scalability and make it difficult for liquid hydrogen to compete with other clean energy alternatives without continued government support and technological breakthroughs.

Segmentation Analysis

The global liquid hydrogen market is segmented based on product type, grade, application, end-user and region.

Automotive Sector Leads Global Liquid Hydrogen Market Through Rising Demand for Fuel Cell Vehicles

The automotive industry is emerging as the largest end-user of liquid hydrogen, primarily fueled by the rapid adoption of fuel cell electric vehicles (FCEVs), hydrogen-powered buses and long-haul trucks. Liquid hydrogen plays a vital role in powering fuel cell stacks and ensuring efficient onboard storage, thanks to its high energy density and ability to deliver extended driving ranges compared to battery-electric alternatives. Zero-emission mobility solutions are increasingly prioritized as nations work toward decarbonization goals.

Government-backed incentives, subsidies and stricter emission regulations in key markets such as Europe, North America and Asia-Pacific further strengthen the industry’s growth. Leading automakers and energy companies are investing heavily in hydrogen refueling stations and supply chains, ensuring that FCEVs and heavy-duty transport can scale efficiently in the coming years. As a result, the automotive sector continues to spearhead demand, positioning liquid hydrogen as a cornerstone of the clean mobility revolution.

Fuel Cells, Aerospace Propulsion, Energy Storage & Other Industrial Applications Support Market Growth

Beyond the transportation sector, liquid hydrogen is gaining significant traction across diverse industries. In aerospace, it serves as a primary propellant for rocket propulsion systems, powering both satellite launches and next-generation space exploration missions. In energy, liquid hydrogen is increasingly adopted as a long-duration renewable energy storage solution, balancing intermittent solar and wind generation.

Additionally, its role as a clean feedstock in chemicals, metallurgy and semiconductor manufacturing further broadens its industrial importance. Global investments in large-scale hydrogen infrastructure, including liquefaction plants, pipelines and storage terminals, are accelerating adoption. Countries such as Japan, Germany and US are leading with national hydrogen strategies and billion-dollar funding commitments. Collectively, these advancements highlight how liquid hydrogen is evolving from a niche fuel to a mainstream energy carrier, supporting the global transition toward low-carbon and sustainable industries.

Geographical Penetration

North America Dominates Liquid Hydrogen Market Driven by Industrial and Automotive Applications

North America is at the forefront of the liquid hydrogen market, with US emerging as the dominant player in the region. Key federal initiatives, including the Hydrogen Shot program and various Department of Energy (DOE) hydrogen projects, are accelerating market development. Substantial investments in large-scale liquefaction facilities, storage infrastructure, and the deployment of fuel cell vehicles are driving robust demand. Continued technological advancements and supportive policies are expected to sustain US’s leadership position in the regional liquid hydrogen market.

US Liquid Hydrogen Market Outlook

US stands as North America’s largest liquid hydrogen market, propelled by government-backed programs and strategic investments in the hydrogen value chain. Efforts such as large-scale liquefaction plants, expanded storage solutions, and increasing fuel cell vehicle adoption are key growth drivers. With ongoing policy backing and innovation in hydrogen technologies, US market is projected to experience steady growth, reinforcing its position as a regional leader in liquid hydrogen production and consumption.

Canada Liquid Hydrogen Market Outlook

Canada’s liquid hydrogen market is growing steadily, driven by its national hydrogen strategy and investments in green hydrogen production, refueling stations and industrial applications. The country focuses on renewable-based hydrogen projects for mobility, power generation and industrial processes. Increasing collaborations between public and private sectors and government-backed incentives are accelerating adoption across key applications.

Mexico Liquid Hydrogen Market Outlook

Mexico is emerging as a developing market for liquid hydrogen, with pilot projects in industrial and transportation sectors and government initiatives promoting clean energy adoption. Investments in hydrogen infrastructure and renewable energy integration are gradually increasing, creating opportunities for growth. Mexico’s focus on sustainable industrial processes and mobility solutions positions the country as a future contributor to North America’s liquid hydrogen market.

Asia-Pacific Leads Liquid Hydrogen Market Growth Fueled by Automotive and Industrial Demand

Asia-Pacific is rapidly emerging as one of the fastest-growing markets for liquid hydrogen, propelled by rising demand across automotive, aerospace and energy storage sectors. The region benefits from strong industrial growth, extensive hydrogen infrastructure and technological advances in liquefaction, storage and fuel cell applications. Key players like Japan, South Korea, China and Australia are investing heavily across hydrogen mobility, clean energy initiatives and industrial uses, solidifying the region’s prominence in the global landscape.

Recent global developments underscore the growing momentum in the clean hydrogen sector. In 2025, over US$ 110 billion has been committed to more than 500 clean hydrogen projects worldwide, with US$ 35 billion approved in just 2024—a testament to growing confidence in hydrogen’s role in the energy transition. Notably, Air Products has achieved a milestone by supplying liquid hydrogen to "Breakthrough," the world’s first hydrogen fuel-cell superyacht. This achievement demonstrates hydrogen’s viability in advanced maritime applications

Japan Liquid Hydrogen Market Insights

Japan’s liquid hydrogen market is growing steadily, supported by robust government initiatives such as the Green Growth Strategy and the Hydrogen Roadmap. Investments in refueling stations, large-scale liquefaction facilities and fuel cell vehicles are driving strong demand. Technological advancements in storage and transportation enhance efficiency and safety, ensuring steady market growth.

China Liquid Hydrogen Industry Growth

China remains a major contributor to Asia-Pacific liquid hydrogen market, accounting for a significant share of regional production and consumption. The country is expanding hydrogen refueling stations, industrial hydrogen applications and research in fuel cell mobility. Government-led infrastructure projects and policy support are accelerating adoption, positioning China as a central player in the regional market.

Australia Liquid Hydrogen Market Trends

Australia is witnessing rising demand for liquid hydrogen in industrial, automotive and energy storage applications. Australia focuses on green hydrogen production and export potential, while South Korea invests in hydrogen-powered transportation and fuel cell technology. Combined, these countries are supporting the broader growth of the Asia-Pacific liquid hydrogen market, driven by sustainability goals and technological innovation.

Sustainability Analysis

The liquid hydrogen market is increasingly embracing sustainability due to its role in reducing carbon emissions across automotive, aerospace and energy sectors. Companies are investing in green hydrogen production using renewable energy sources such as wind and solar, which significantly lowers the carbon footprint compared to conventional hydrogen production from fossil fuels.

Sustainable infrastructure development, including low-energy liquefaction and efficient storage systems, is becoming standard practice. The adoption of liquid hydrogen in fuel cell vehicles, aerospace propulsion and energy storage contributes to decarbonization, supporting global net-zero targets. Overall, the market is shifting toward environmentally responsible growth, integrating circular economy principles and clean energy technologies.

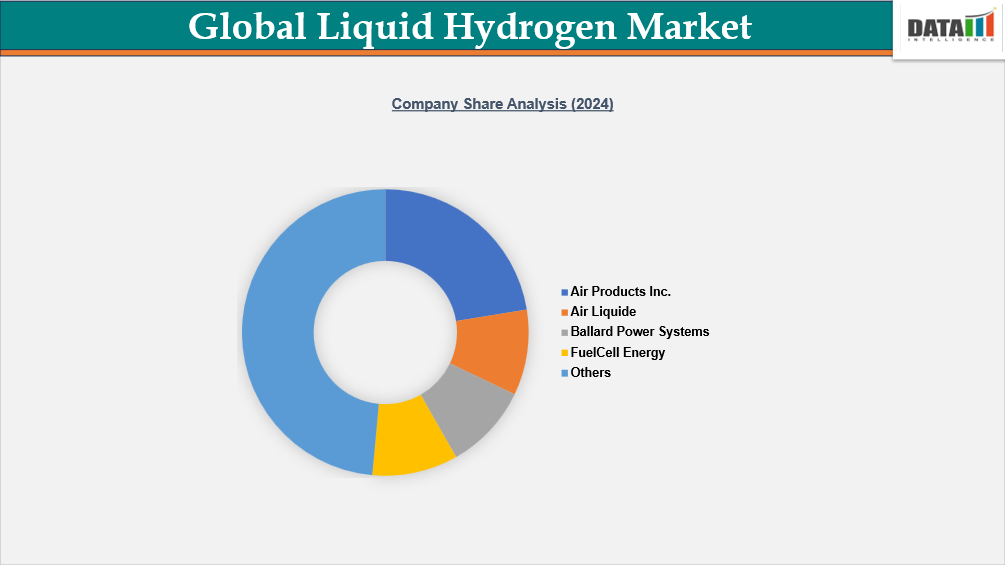

Competitive Landscape

The liquid hydrogen market is highly competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

Key players include Air Products Inc, Air Liquide, Ballard Power Systems, FuelCell Energy Inc, ELME MESSER L, FirstElement Fuel Inc, RUSAL Linde plc, Cummins Inc, PLUG POWER INC and PowerCell Sweden AB.

Companies focus on expanding production capacities, optimizing supply chains and adopting low-carbon and energy-efficient processes to gain an edge.

Key Developments

On February 18, 2025, Air Liquide announced a joint investment exceeding 1 billion with TotalEnergies to develop two large-scale, low-carbon hydrogen production plants in the Netherlands. One of these is the ELYgator project, a 200 MW electrolyzer in the Port of Rotterdam, backed by both companies, each committing approximately 600 million.

On March 10, 2025, FuelCell Energy, in collaboration with Diversified Energy and TESIAC, announced the creation of a strategic partnership to develop off-grid power solutions for data centers. This initiative targets the conversion of captured coal mine methane (CMM) and natural gas into clean, dispatchable energy via advanced fuel cell technology—producing as much as 360 MW of electricity across sites in Virginia, West Virginia and Kentucky.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies