Japan Electronics Market Size

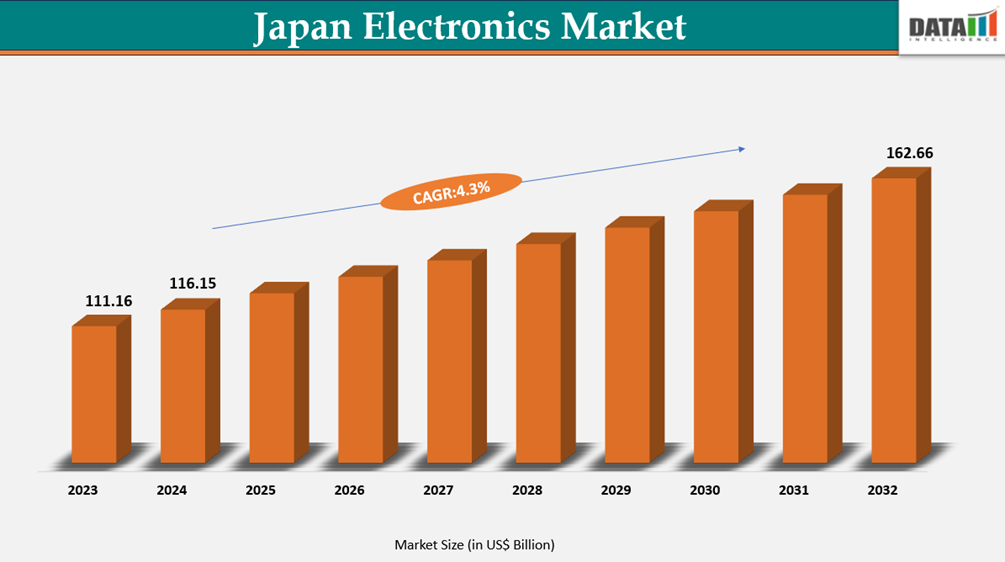

The Japan electronics market reached US$111.16 billion in 2023, with a rise to US$ 116.15 billion in 2024, and is expected to reach US$ 162.66 billion by 2032, growing at a CAGR of 4.3% during the forecast period 2025–2032.

The Japan electronics market is one of the most advanced and dynamic technology landscapes globally, renowned for its innovation, precision manufacturing, and early adoption of cutting-edge technologies. The sector encompasses a broad range of products, including consumer electronics, industrial electronics, semiconductors, electronic components, and emerging technologies such as robotics, IoT devices, and smart home systems. Japanese electronics firms have historically led global innovation, with companies like Sony, Panasonic, Toshiba, and Sharp setting benchmarks in product quality, reliability, and technological sophistication.

Consumer electronics remain a significant driver, fueled by high domestic demand for smartphones, wearables, home appliances, and audiovisual equipment. Simultaneously, the industrial electronics segment including semiconductors, sensors, and control systems supports Japan’s robust manufacturing ecosystem, powering automotive, robotics, energy, and industrial automation sectors. The market benefits from strong research and development capabilities, strategic collaborations, and government initiatives aimed at promoting next-generation technologies, such as 5G, AI, and robotics, under the Society 5.0 framework.

Electronics Industry Trends and Strategic Insights

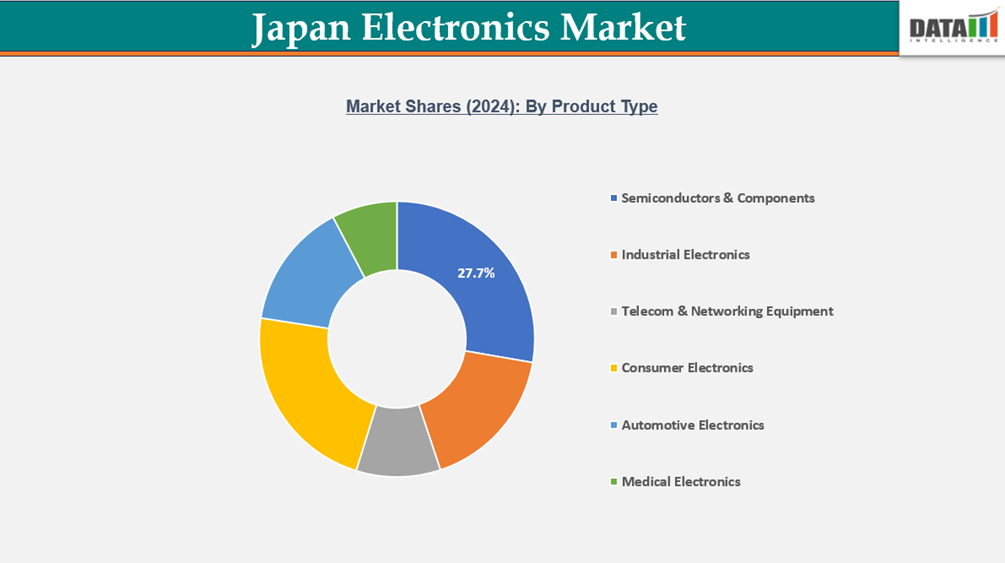

- By product type, semiconductors dominate due to global demand and advanced manufacturing. Consumer electronics grow fastest, driven by smart devices and IoT. Industrial electronics maintain steady domestic demand.

- By price range, high-end electronics lead, fueled by premium quality and features. Ultra-high-end and luxury segments expand with cutting-edge innovations and professional-grade equipment.

Japan Electronics Market Size and Future Outlook

- 2024 Market Size: US$111.16 billion

- 2032 Projected Market Size: US$162.66 billion

- CAGR (2025-2032): 14.3%

- Largest Market: Semiconductors & Components

- Fastest Market: Consumer Electronics

Market Scope

| Metrics | Details |

| By Product Type | Consumer Electronics (Audio/Video, Mobile Devices, Computing, Gaming, Home Appliances, Others), Industrial Electronics (Process Control Systems, Industrial Automation, Test & Measurement, Power Electronics Others), Telecom & Networking Equipment (Core Network Equipment, Access Equipment, Enterprise Networking), Medical Electronics (Diagnostic Imaging, Patient Monitoring, Therapeutic Devices Wearable Medical Devices), Automotive Electronics, Semiconductors & Components |

| By Price Range | Premium / High-End, Mid-Range / Value, Budget / Economy |

| By End User | Consumer (B2C), Enterprise / Corporate (B2B), Government & Public Sector, Small & Medium Businesses (SMBs) |

| By Distribution Channel | Consumer (B2C), Enterprise / Corporate (B2B), Government & Public Sector, Small & Medium Businesses (SMBs) |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed information, Request for Sample

Market Dynamics

Rising Global Demand for Semiconductors Accelerates Industrial and Consumer Electronics Adoption

The global semiconductor industry is experiencing unprecedented growth, driven by surging demand across both industrial and consumer electronics sectors. In the industrial domain, semiconductors underpin automation, smart manufacturing, and robotics. Rising adoption of Industry 4.0 technologies, including IoT-enabled machinery and AI-powered production lines, has intensified reliance on high-performance chips, catalyzing operational efficiency and predictive maintenance capabilities. These developments have propelled semiconductor consumption in sectors such as automotive, aerospace, and industrial automation, positioning semiconductors as a critical enabler of digital transformation.

Consumer electronics represent another significant growth vector, with smart devices, wearables, and connected home appliances fueling chip demand. The proliferation of 5G-enabled smartphones, tablets, and laptops has further amplified the need for advanced processors, memory, and sensors. Rising consumer expectations for enhanced performance, faster processing, and energy efficiency continue to drive innovation and adoption. Moreover, the expansion of e-commerce and digital entertainment ecosystems is accelerating production of high-tech consumer electronics, further bolstering semiconductor requirements.

Intense International Competition Pressures Prices and Reduces Profit Margins

Intense international competition exerts significant pressure on businesses operating in global markets, fundamentally affecting pricing strategies and profit margins. As firms face competitors offering similar products or services across borders, price differentiation becomes a primary tool to attract consumers. This environment often triggers price wars, where companies’ lower prices to maintain or expand market share, directly compressing profit margins. Global competitors with cost advantages—such as access to cheaper labor, raw materials, or advanced technology—can offer lower prices sustainably, forcing domestic firms to either reduce costs or accept reduced profitability.

The impact of international competition also extends to operational efficiency. Companies must invest in process optimization, automation, and supply chain enhancements to maintain cost competitiveness. At the same time, quality and innovation remain crucial differentiators; firms cannot rely solely on low pricing without risking brand dilution or consumer dissatisfaction. Exchange rate volatility further complicates pricing decisions, as fluctuations can make exports more expensive or imports cheaper, influencing both revenue and costs.

Segment Analysis

Japan electronics market is segmented based on the product type, price range, end user and distribution channel.

Electronics Tradition, Craftsmanship, and Global Prestige Drive Market Leadership

Consumer electronics remain the dominant segment in Japan’s electronics market, upheld by a legacy of precision engineering, quality mastery, and cultural reverence for craftsmanship. Rooted in decades of expertise, Japanese electronics have evolved beyond early adoption of Western technologies to establish their own global identity defined by reliability, innovation, and meticulous design. Boutique manufacturers and R&D labs are reinforcing this legacy by combining traditional engineering principles with advanced materials and localized software ecosystems, producing limited-edition models that emphasize authenticity and superior user experience.

The growing appreciation for premium and ultra-premium devices, both domestically and internationally, has positioned Japanese electronics as a luxury good and an experiential product. Exports to Europe, the U.S., and Asia-Pacific continue to rise as global connoisseurs seek unique features crafted with specialized components or rare materials. Meanwhile, domestic consumers, especially millennials, are showing renewed interest in homegrown craftsmanship through brand heritage centers and tech showcase events.

Tech Innovation and Localized Aesthetics Fuel Rapid Market Expansion

Wearable technology and smart home devices are the fastest-growing segments in Japan’s electronics market, propelled by creativity, feature diversity, and rising consumer preference for seamless, integrated living. Tech companies are leveraging Japan’s rich design heritage—minimalist aesthetics, intuitive interfaces, cultural motifs, and a focus on harmony—to craft unique, culturally-inspired products that differentiate themselves from global counterparts. This localization of design and user experience not only enhances functionality but also appeals to younger consumers seeking authenticity and innovation.

Rapid innovation in feature experimentation, limited-edition collaborations, and small-batch premium offerings are reshaping Japan’s position within the global tech renaissance. Manufacturers are integrating sustainable production methods, transparent supply chains, and aesthetic branding to attract eco-conscious and design-driven audiences. The versatility of IoT devices in creating connected ecosystems aligns with the growing smart-city culture across Japan’s urban centers, particularly in Tokyo and Osaka.

Japan Faces Intense Global Competition Impacting Prices and Profit Margins

Japan’s industries are increasingly influenced by intense international competition, pressuring prices and compressing profit margins. Global rivals offering similar high-quality products often leverage cost advantages, advanced technology, and efficient production processes, forcing Japanese firms to innovate while maintaining cost-effectiveness. Price wars have become common, compelling companies to balance competitive pricing with sustainable profitability.

Operational efficiency is critical Japanese companies invest in automation, lean manufacturing, and optimized supply chains to control costs without compromising quality. Innovation and differentiation remain key, as consumers seek unique features and advanced functionalities in products ranging from electronics to automotive components. Exchange rate fluctuations further impact export competitiveness, affecting revenues and costs.

While intense competition challenges margins, it drives Japanese companies toward higher efficiency, technological advancement, and global market adaptability, enabling them to sustain profitability and remain competitive in a rapidly evolving international landscape.

Sustainability Analysis

Sustainability has become a core strategic focus for businesses in Japan, driven by environmental regulations, consumer expectations, and global corporate responsibility trends. Companies are increasingly adopting eco-friendly practices, such as reducing carbon emissions, optimizing energy consumption, and minimizing waste across production and supply chains. Resource efficiency and circular economy principles are emphasized to ensure long-term operational viability while lowering environmental impact.

Japanese firms also integrate social sustainability by fostering safe working conditions, employee well-being, and ethical sourcing. Corporate governance mechanisms ensure accountability, transparency, and adherence to sustainability standards, which enhance brand reputation and stakeholder trust. Moreover, investors and international partners increasingly favor companies demonstrating measurable environmental, social, and governance (ESG) performance.

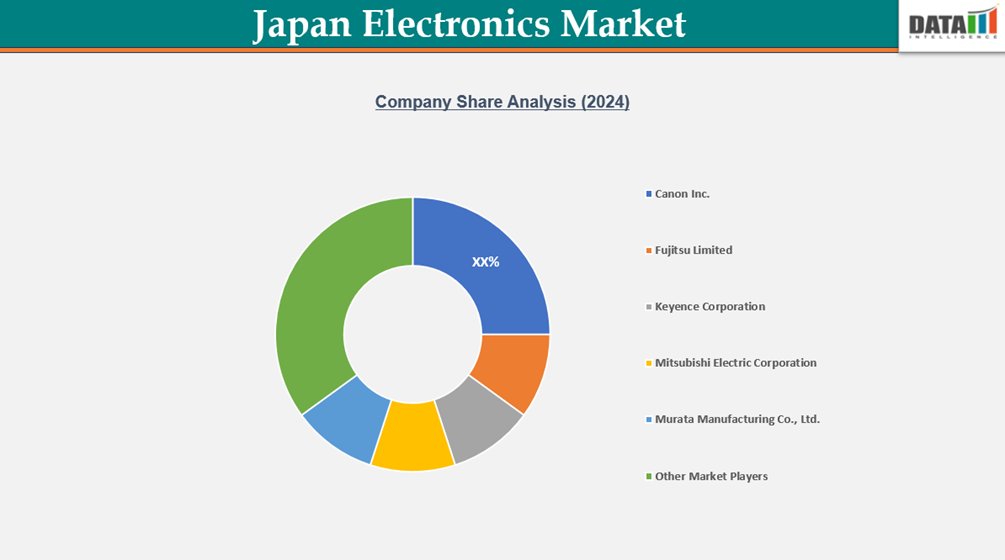

Competitive Landscape

- Japan electronics market in Japan is dominated by a mix of leading domestic producers. Canon Inc., Fujitsu Limited, Keyence Corporation, Mitsubishi Electric Corporation, Murata Manufacturing Co., Ltd., NEC Corporation, Nintendo Co., Ltd., Panasonic Holdings Corporation, Sony Group Corporation, and TDK Corporation collectively hold a significant market presence through strong brand recognition, diversified product portfolios, and strategic distribution across domestic and international markets.

- A second tier of smaller or niche electronics firms focuses on specialized offerings such as industrial automation solutions, high-precision components, and gaming peripherals. These producers leverage advanced technology, innovation, and targeted R&D to address gaps in performance, efficiency, and product customization within the market.

- The broader market remains fragmented, with emerging firms experimenting in areas like AI integration, IoT-enabled devices, renewable energy electronics, and miniaturized components. Market expansion is fueled by rising domestic and global demand for high-tech solutions, government support for technological innovation, and Japan’s reputation as a leader in electronics manufacturing and innovation.

Key Developments

- 2025 – Fujitsu Limited: Specializes in IT services, computing hardware, and AI-driven solutions, emphasizing sustainability and energy-efficient technologies.

- 2025 – Keyence Corporation: Develops industrial automation sensors and measurement devices, integrating smart technologies for optimized manufacturing processes.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies