Dialysis Equipment Market Size and Trends

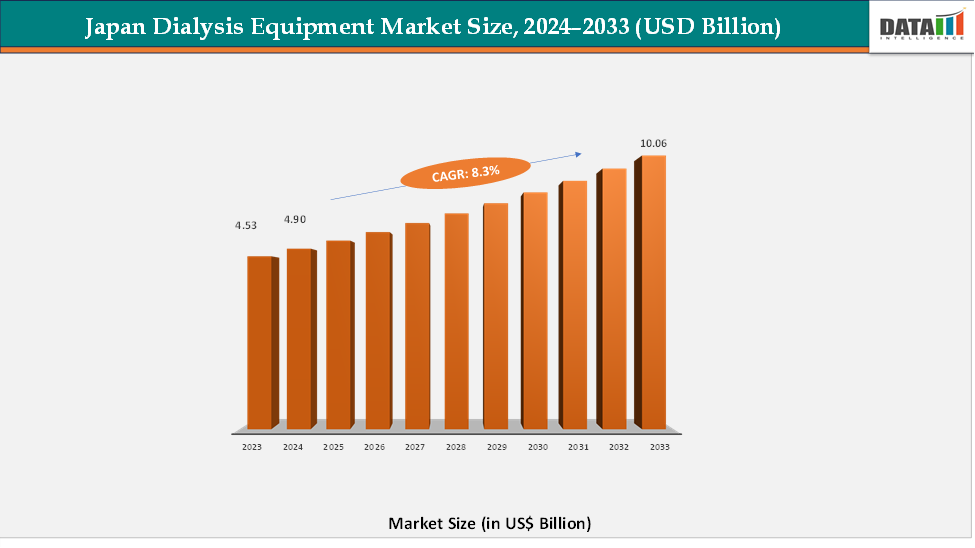

The Japan dialysis equipment market reached US$ 4.53 billion in 2023, with a rise to US$ 4.90 billion in 2024, and is expected to reach US$ 10.06 billion by 2033, growing at a CAGR of 8.3% during the forecast period 2025–2033. The Japan dialysis equipment Market is witnessing steady growth, driven by the rising prevalence of kidney-related disorders, an aging population, and continuous technological advancements in dialysis care solutions. With a high prevalence rate of 2,781 dialysis patients per million population and 39,683 new patients recorded in 2022, Japan represents one of the most mature dialysis markets globally. The growing incidence of diabetic nephropathy, chronic glomerulonephritis, and nephrosclerosis is fueling demand for both hemodialysis and peritoneal dialysis systems. Manufacturers are increasingly focusing on developing portable, automated, and patient-centric dialysis equipment to improve treatment efficiency and convenience, especially for home-based care. Furthermore, supportive government healthcare initiatives, comprehensive insurance coverage, and the expansion of specialized dialysis centers across the country are reinforcing Japan’s position as a technologically advanced and rapidly evolving market for dialysis equipment.

Market Size & Forecast

- 2024 Market Size: US$4.90 billion

- 2033 Projected Market Size: US$10.06 billion

- CAGR (2025–2033): 8.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Japan Dialysis Equipment Market: Executive Summary

Japan Dialysis Equipment Market Dynamics: Drivers & Restraints

Driver: Rise in Technological Advancements

The Japan dialysis equipment market is expected to witness significant growth, driven by continuous technological advancements that are improving the efficiency, safety, and comfort of dialysis treatments. Modern innovations, such as portable and home-use dialysis machines, automated monitoring systems, and wearable artificial kidneys, are increasing accessibility and convenience for patients requiring long-term dialysis support. These advancements not only enhance treatment precision but also reduce hospital dependency, thereby improving patient quality of life and increasing overall profitability for healthcare providers.

According to recent data, the prevalence rate of dialysis patients in Japan stands at 2,781 per million population, with a mean age of 69.87 years. Diabetic nephropathy remains the leading cause, accounting for 39.5% of cases, followed by chronic glomerulonephritis (24.0%) and nephrosclerosis (13.4%). Furthermore, in 2022, Japan recorded 39,683 new dialysis patients, indicating a sustained demand for effective and advanced dialysis solutions. The integration of cutting-edge technologies is, therefore, crucial to supporting this growing patient base while optimizing clinical outcomes and operational efficiency across dialysis centers.

Restraint: High Cost of the Equipment

The high cost of dialysis equipment remains a major challenge that could restrain market growth. Advanced dialysis machines, water treatment systems, and disposable accessories involve substantial capital investment and ongoing maintenance expenses, which can burden smaller clinics and healthcare facilities. The integration of new technologies, while improving treatment outcomes, further escalates equipment prices. Moreover, the high cost of consumables and replacement parts adds to the overall treatment expenses, indirectly affecting patients and healthcare providers alike.

For more details on this report, Request for Sample

Japan Dialysis Equipment Market Segmentation Analysis

The Japan dialysis equipment market is segmented by product type, disease condition, end user and region.

Product Type: The hemodialysis devices segment is estimated to have 45.8% of the dialysis equipment market share.

The hemodialysis devices continue to dominate owing to their widespread adoption in hospitals and dialysis centers, supported by well-established infrastructure, skilled medical staff, and reliable reimbursement frameworks. Hemodialysis remains the preferred treatment modality for most patients due to its high efficiency in removing waste products and maintaining electrolyte balance. The large number of dialysis facilities across Japan, along with the aging population and high prevalence of diabetic nephropathy, further strengthens the dominance of this segment.

The peritoneal dialysis devices segment is estimated to have 29.3% of the dialysis equipment market share.

The peritoneal dialysis devices are emerging as the fastest-growing segment, driven by the rising preference for home-based and patient-friendly dialysis options. Technological advancements such as automated peritoneal dialysis (APD) systems, compact designs, and digital monitoring tools are enabling patients to manage dialysis independently with improved convenience and flexibility. Moreover, the growing emphasis on reducing the burden on healthcare facilities and improving patient quality of life is encouraging a gradual shift toward peritoneal dialysis in Japan. This trend, combined with increasing awareness and supportive government initiatives promoting home healthcare, is expected to accelerate the adoption of peritoneal dialysis devices in the coming years.

Japan Dialysis Equipment Market – Competitive Landscape

The major players in the dialysis equipment market include Nikkiso Co., Ltd., Fresenius Medical Care Japan, SB-KAWASUMI LABORATORIES, INC., Asahi Kasei Medical Co., Ltd., Toray Medical Co., Ltd., Terumo Corporation, NIPRO, JMS Co., Ltd, and Baxter.

Key Developments:

- In February 2025, JMS Co., Ltd. launched its latest innovation, the Multifunctional Dialysis Machine “SD-X01”, also known as the JMS Single Patient Dialysis Machine. The newly introduced SD-X01 is designed to enhance treatment efficiency, patient safety, and operational convenience, reflecting JMS’s continued commitment to advancing dialysis technology and improving the quality of renal care

Market Scope

| Metrics | Details | |

| CAGR | 8.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Hemodialysis Devices, Peritoneal Dialysis Devices, Others |

| Disease Condition | Chronic, Acute | |

| End User | Hospitals, Clinics, Dialysis Centers, Ambulatory Surgical Centers, Homecare Settings | |

The Japan dialysis equipment market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here