Japan Cell Therapy Market: Industry Outlook

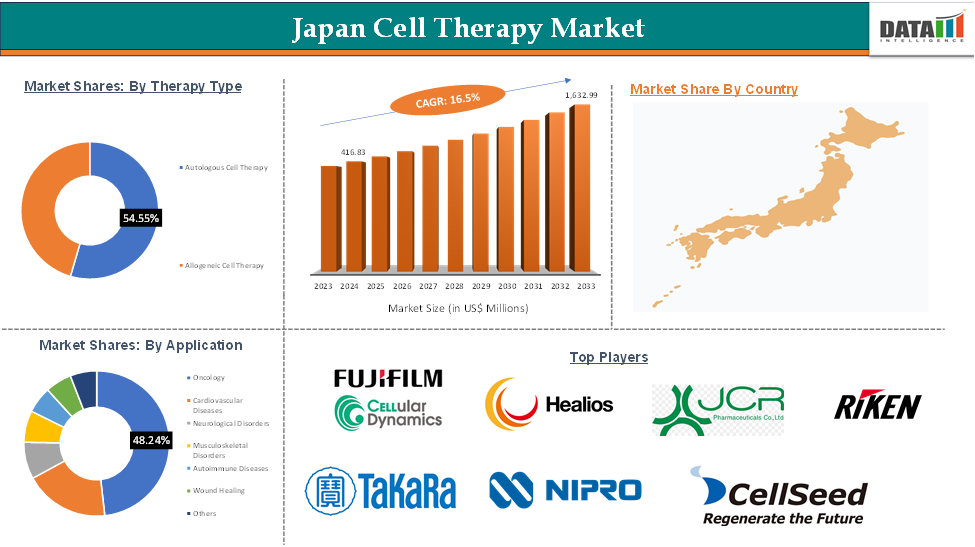

Japan Cell Therapy Market reached US$ 416.83 Million in 2024 and is expected to reach US$ 1,632.99 Million by 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033.

The Japan cell therapy market stands out as a hub of innovation, supported by proactive government policies, streamlined regulatory pathways, and a robust academic research environment. Japan’s global leadership in induced pluripotent stem cell (iPSC) research—spearheaded by institutions like Kyoto University’s CiRA and RIKEN—continues to accelerate advancements in regenerative medicine. In 2025, the market growth is being fueled by the country’s rapidly aging population and rising burden of chronic and degenerative diseases such as Parkinson’s, heart failure, and certain cancers. Additionally, there’s increasing demand for personalized, cell-based therapies targeting oncology, neurology, and rare genetic disorders. Favorable regulatory initiatives like the Sakigake fast-track system are also enabling quicker approval and commercialization of novel therapies.

Executive Summary

For more details on this report, Request for Sample

Japan Cell Therapy Market: Market Dynamics: Drivers & Restraints

Driver: Rise in the Prevalence of Cancers in Japan

The increasing cancer prevalence in Japan is driving the growth of the country's cell therapy market. Conventional treatments like chemotherapy and radiation have limitations, leading to a demand for personalized, targeted approaches. Cell therapies, particularly CAR-T and T-cell-based immunotherapies, harness the body's immune system to combat cancer. This has accelerated research, clinical trials, and regulatory support, making oncology a central focus for innovation and investment in Japan's cell therapy landscape.

For instance, Japan's cancer prevalence is projected to rise by 13.1% by 2050, primarily due to a 13.6% increase in female survivors. From 2040 onwards, females will overtake males in prevalence counts. The most prevalent cancer sites in 2050 are colorectal, female breast, prostate, lung, and stomach cancers, accounting for 66.4% of survivors. Males are expected to experience the highest absolute increases in prostate, lung, and malignant lymphoma cancers, while females are expected to experience the highest absolute increases in breast, colorectal, and corpus uteri cancers.

Hence, the rising cancer prevalence in Japan, particularly among females, will drive demand for innovative treatments like cell therapy. The dominance of breast, colorectal, and prostate cancers aligns with current targets of cell-based immunotherapies. From 2040, gender-focused cell therapy development is possible, and high survivor rates indicate a growing market for long-term, less invasive treatments.

Restraint: Dearth of Skilled Professionals

The cell therapy market in Japan faces a significant challenge due to a lack of skilled professionals. Despite Japan's strong academic infrastructure, there is a shortage of trained personnel capable of handling complex cell culture techniques, Good Manufacturing Practice compliance, and large-scale manufacturing processes. This talent gap hinders product development, delays clinical trial execution, and limits therapy scalability, affecting the market's ability to meet growing domestic and global demand.

Japan Cell Therapy Market: Segment Analysis

The Japan cell therapy market is segmented based on therapy type, cell type, source, application, and end user.

Therapy Type:

The autologous cell therapy from therapy type segment is expected to dominate the Japan cell therapy market with the market share of 54.55%

Autologous cell therapy is a treatment method where a patient's own cells are collected, modified, or expanded, and reintroduced into their body to treat diseases. This method reduces immune rejection risk and is widely used in Japan for regenerative medicine, oncology, and orthopedics, enhancing patient outcomes.

Japan's increasing demand for personalized, minimally invasive treatments is driving the growth of autologous cell therapy. The country's regulatory framework supports accelerated approval pathways for regenerative therapies, favoring autologous approaches due to lower immunogenic risk and ethical acceptability. The aging population and rising degenerative diseases like osteoarthritis and cardiovascular disorders make autologous therapies promising. The integration of advanced cell-processing technologies and hospital-based programs further enhances accessibility and growth.

For instance, in September 2024, Biostar Stem Cell Research Institute's affiliate hospital, Shinjuku Clinic, has been approved for Japanese post-production of a regenerative medical technology to treat Alzheimer's. The technology involves administering autologous fat-derived stem cells cultured with patented technology into the spinal cavity and intravenously.

Japan Cell Therapy Market: Competitive Landscape

The Japan cell therapy market features a strong mix of established pharmaceutical firms, innovative biotech startups, and renowned research institutions. Key players include Fujifilm Cellular Dynamics, Healios K.K., JCR Pharmaceuticals, RIKEN, Takara Bio, Nipro Corporation, Medinet Ltd., and CellSeed Inc. These companies are actively advancing regenerative medicine through iPSC-based research, immuno-cell therapies, and cell processing technologies.

Backed by Japan’s supportive regulatory environment and substantial R&D investment, these firms are driving commercialization of cutting-edge cell therapies across oncology, neurology, and rare disease areas, helping position Japan as a global leader in cell-based innovation.

Scope

| Metrics | Details | |

| CAGR | 16.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Therapy Type | Autologous Cell Therapy, Allogeneic Cell Therapy |

| Cell Type | Stem Cells, Non-stem Cells | |

| Source | Bone Marrow, Umbilical Cord Blood, Adipose Tissue Peripheral Blood, Others | |

| Application | Oncology, Cardiovascular Diseases, Neurological Disorders Musculoskeletal Disorders, Autoimmune Diseases, Wound Healing, Others | |

| End User | Hospitals & Clinics, Academic & Research Institutes, Biopharmaceutical and Biotechnology Companies | |