Global IT Asset Management Software Market: Industry Outlook

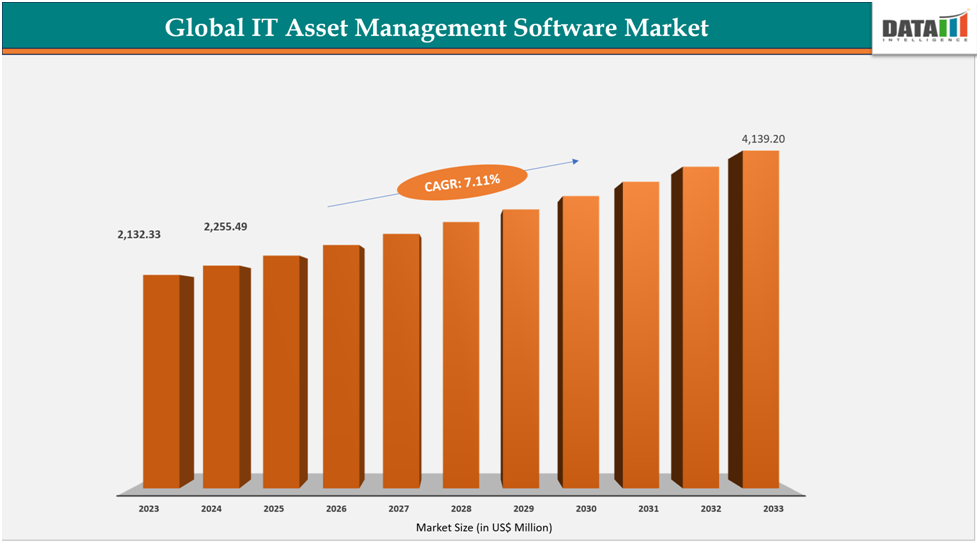

The global IT asset management software market reached US$ 2,132.33 million in 2023, with a rise to US$ 2,255.49 million in 2024, and is expected to reach US$ 4,139.20 million by 2033, growing at a CAGR of 7.11% during the forecast period 2025–2033.

The Global IT Asset Management (ITAM) Software Market is expanding rapidly as organizations worldwide prioritize compliance, cybersecurity, and cost optimization across hybrid infrastructures. In the U.S., federal agencies spend nearly US$ 100 billion annually on IT, with the Office of Management and Budget requiring all agencies to maintain comprehensive IT asset inventories under the Federal Information Technology Acquisition Reform Act (FITARA). In Asia, India’s Ministry of Electronics and Information Technology reported that the country’s IT and business services sector reached US$ 14.05 billion in 2022, reflecting increased enterprise demand for asset tracking and lifecycle management.

Europe is also actively reshaping its IT asset oversight, with the European Commission’s Cybersecurity Act mandating tighter controls on software and hardware inventories across critical sectors. Meanwhile, in Japan, the Ministry of Internal Affairs and Communications noted that over 70% of large enterprises adopted multi-cloud strategies in 2023, which adds complexity and strengthens the case for ITAM platforms. This confluence of compliance frameworks, cyber risks, and digital transformation initiatives underlines the global momentum for ITAM software adoption.

Key Market Trends & Insights

The U.S. Office of Management and Budget oversees nearly US$ 100 billion in federal IT spending annually, and under FITARA, agencies are required to maintain IT asset inventories, making North America the largest market for ITAM adoption.

India’s Ministry of Electronics and Information Technology recorded US$ 14.05 billion in IT and business services revenue in 2022, while Japan’s Ministry of Internal Affairs and Communications noted 70% of large firms used multi-cloud setups in 2023, fueling rapid ITAM demand in APAC.

The U.S. Federal Trade Commission reported over US$ 10 billion in cybercrime losses in 2023, highlighting the risks of unmanaged IT assets and driving global enterprises to accelerate ITAM software adoption.

Market Size & Forecast

2024 Market Size: US$ 2,255.49 million

2033 Projected Market Size: US$ 4,139.20 million

CAGR (2025–2033): 7.11%

Asia Pacific: Fastest growing market in 2024

North America: Largest market

Drivers & Restraints

Driver: Rising Complexity of Hybrid IT Infrastructures

The rising complexity of hybrid IT infrastructures is a key driver for the Global IT Asset Management Software Market, as organizations balance on-premises systems with cloud platforms. According to the U.S. Government Accountability Office, about 80% of federal IT spending in 2023 was still dedicated to operating and maintaining legacy systems, even as agencies migrate to cloud environments. This dual reliance creates asset visibility and compliance challenges that can only be addressed through advanced ITAM tools capable of tracking software licenses, hardware lifecycles, and cloud subscriptions simultaneously.

Enterprises across regions are experiencing similar pressures, with government frameworks accelerating digital adoption. Japan’s Ministry of Internal Affairs and Communications reported that over 70% of large enterprises used multiple cloud service providers in 2023, highlighting the prevalence of hybrid and multi-cloud strategies. In Canada, the 2023 Digital Operations Strategic Plan emphasized integrating cloud and on-premises assets to strengthen cybersecurity and efficiency in government operations. These developments underscore the need for ITAM platforms that can centralize asset management across increasingly fragmented infrastructures, driving robust market demand.

Restraint: High Implementation and Integration Costs

High implementation and integration costs remain a major restraint in the Global IT Asset Management Software Market, particularly for small and mid-sized enterprises. In the US, the Small Business Administration reported that firms with fewer than 500 employees spend on average 7% of their annual revenue on technology upgrades, leaving limited budgets for enterprise-grade ITAM deployments. Similarly, a survey by the UK Government’s Department for Digital, Culture, Media and Sport found that over 40% of medium businesses struggled to allocate sufficient funds for IT security and compliance software, underscoring how upfront investment and integration complexity limit adoption despite recognized benefits.

For more details on this report, - Request for Sample

Segmentation Analysis

The global IT asset management software market is segmented based on component, deployment mode, organization size, application, and region.

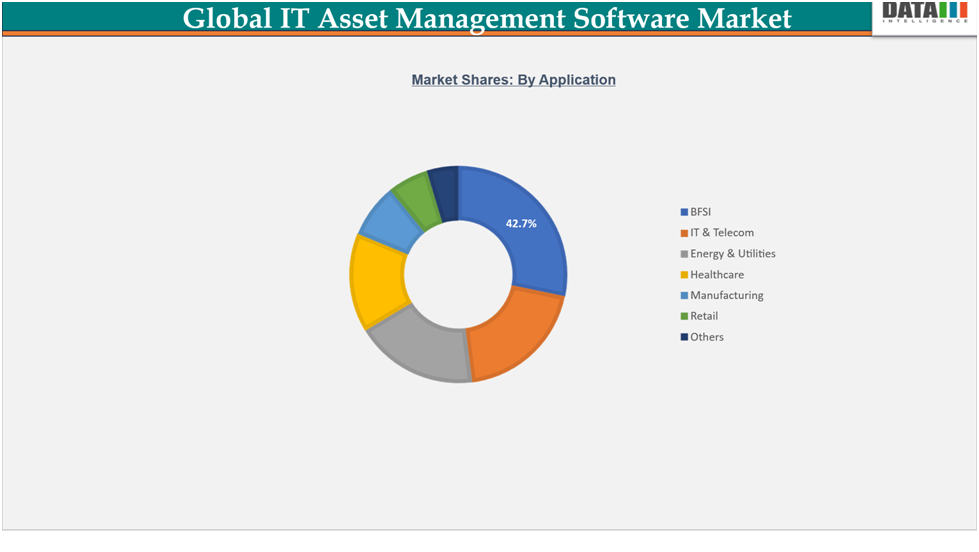

Application: BFSI segment is estimated to have 42.7% of the IT asset management software market share.

The Banking, Financial Services, and Insurance (BFSI) sector is a dominant force in IT Asset Management (ITAM) software adoption, accounting for around 42.7% of the global market share. Financial institutions operate some of the most complex IT infrastructures, requiring robust lifecycle management of hardware, software, and cloud assets. In the United States, the Federal Financial Institutions Examination Council (FFIEC) mandates strict IT asset inventory and risk management protocols to ensure data security and regulatory compliance. Similarly, the Reserve Bank of India has issued guidelines for IT governance and risk management, requiring banks to maintain comprehensive IT inventories and enhance system audits. These compliance frameworks are directly fueling the adoption of ITAM solutions across the BFSI sector.

At the company level, leading banks are already heavily invested in ITAM platforms to improve visibility and control over their IT estates. JPMorgan Chase reported technology expenses exceeding US$ 17.8 billion in 2023, with significant allocations toward IT modernization and asset tracking initiatives. In Japan, major insurers such as Nippon Life and Dai-ichi Life have accelerated digital transformation projects, leveraging cloud infrastructure and requiring detailed software asset management to support compliance under the country’s Act on the Protection of Personal Information (APPI). These examples highlight how regulatory pressure, combined with rising cybersecurity threats and digitalization initiatives, is consolidating BFSI as the single largest driver of ITAM software demand globally.

Geographical Analysis

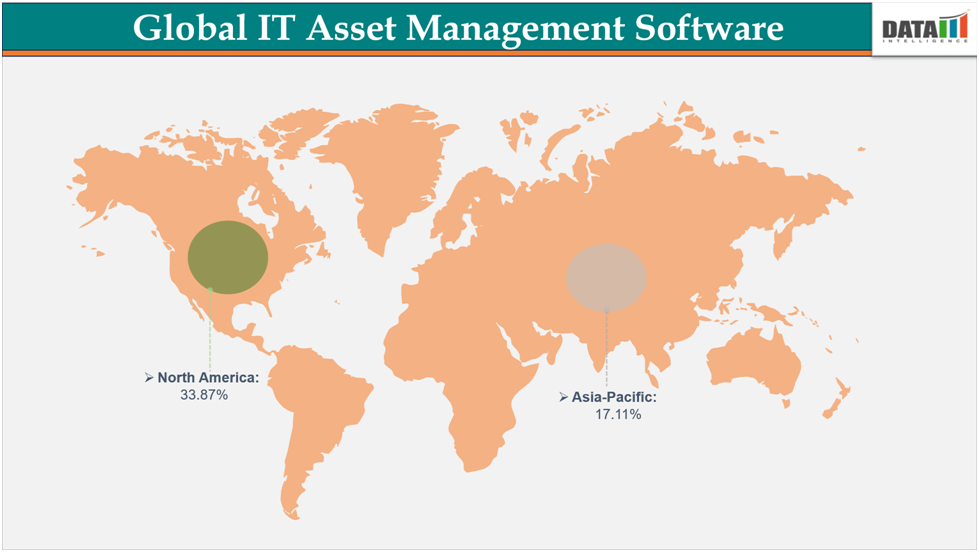

The Asia-Pacific IT asset management software market was valued at 17.11% market share in 2024

Asia-Pacific is emerging as the fastest growing region for IT Asset Management (ITAM) software, supported by strong digital adoption across enterprises. In India, the Ministry of Electronics and Information Technology reported that the country’s IT and business services market reached US$ 14.05 billion in 2022, with managed services, including ITAM solutions, contributing US$ 7.34 billion. Large-scale national initiatives such as Digital India and Smart City Mission are pushing organizations to adopt asset management platforms to ensure compliance and cost efficiency in IT infrastructure.

In China, the Ministry of Industry and Information Technology noted that cloud computing services revenue rose by over 40% year-on-year in 2022, highlighting the rapid shift toward cloud-based IT asset tracking and lifecycle management. This environment, along with expanding 5G connectivity, creates fertile ground for ITAM software demand across the region.

Meanwhile, the Japanese government has introduced a Digital Marketplace for IT procurement starting in fiscal year 2024 to enable government organizations to procure software solutions more efficiently and give local software firms better access; this move is expected to increase demand for software asset management and related ITAM tools in the public sector.

Japan has also prioritized digital transformation via its newly established Digital Agency (since 2021), which coordinates procurement reforms and standardization of IT systems across government and local administrations. Additionally, Japan’s cloud computing market has demonstrated strong growth: public cloud revenue has been increasing, with large enterprises accounting for about 63% of cloud revenue share in 2024. These Japan-specific developments reinforce Asia-Pacific’s overall fastest-growing position for IT Asset Management software, as cloud migration requires tracking, optimizing, and securing IT assets across hybrid environments.

The North America IT Asset Management Software market was valued at 33.87% market share in 2024

In the United States, federal mandates like the Federal Information Technology Acquisition Reform Act (FITARA) require agencies to maintain comprehensive inventories of hardware and software assets, pushing up investments in ITAM tools and platforms. Company spending data from US enterprises indicate rising budgets for cybersecurity, compliance, and audit readiness components of asset management, reflected in an estimated US$ 10+ billion annual loss from cybercrime in 2023, highlighting the cost of poor asset visibility. (This drives demand to prevent losses.)

The US information sector’s economic output was over US$ 2.1 trillion in 2022, demonstrating large base spending power and infrastructure over which ITAM systems can be deployed. In Canada, the 2023 Digital Operations Strategic Plan has emphasized lifecycle management of government IT assets as a critical leverage area for cost savings, security, and sustainability, resulting in procurement reforms and greater adoption of centralized IT asset tracking systems. Together, regulatory pressure, high cloud adoption, and large-scale organizational infrastructures mean that North America remains the largest absolute market for ITAM software.

Competitive Landscape

The global IT asset management software market features several prominent players, including IBM Corporation, Microsoft Corporation, BMC Software, Inc., Hewlett Packard Enterprise Development LP, Oracle Corporation, ServiceNow, Inc., Ivanti, Inc., Snow Software AB, Flexera Software LLC, and Freshworks Inc. among others.

ServiceNow, Inc.: ServiceNow, Inc. is witnessing particularly strong demand. Its cloud-based IT Asset Management (ITAM) platform is widely adopted by enterprises undergoing digital transformation and hybrid IT infrastructure expansion. Governments and large corporations are increasingly focusing on cost optimization, software license compliance, and sustainability goals such as reducing e-waste. ServiceNow’s ITAM solutions help organizations track hardware, software, and cloud assets across distributed environments, which is becoming critical as global IT spending continues to rise, surpassing US$ 5 trillion in 2024 according to industry estimates. This trend positions ServiceNow as a key beneficiary of the growing demand for centralized, automated, and compliance-driven IT asset management solutions.

Market Scope

Metrics | Details | |

|---|---|---|

CAGR | 7.11% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Deployment Mode | On-Premises, Cloud-Based |

Organization Size | Small and Medium Enterprises (SMEs), Large Enterprises | |

Component | Software, Services | |

| End-User | BFSI, IT & Telecom, Energy & Utilities, Healthcare, Manufacturing, Retail and Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global IT asset management software market report delivers a detailed analysis with 70 key tables, more than 63 visually impactful figures, and 230 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here