Overview

The global insect pest control market reached US$18.1billion in 2023, rising to US$19.4billion in 2024 and is expected to reach US$32.1billion by 2032, growing at a CAGR of 6.5% from 2025 to 2032.

The global insect pest control market is growing steadily, driven by the increasing focus on sustainable farming and the urgent need to safeguard crops from pest-related damage. Rising food security concerns, higher productivity requirements, and the growing incidence of pest infestations are key factors supporting market expansion. A wide range of solutions, such as chemical insecticides, biological agents, and integrated pest management (IPM) practices, are being increasingly adopted to enhance crop protection and boost yields.

Innovations in pest detection technologies and the rising popularity of eco-friendly, bio-based pest control products are further transforming the industry landscape. Moreover, supportive government policies encouraging sustainable agriculture and reduced chemical dependency are promoting market growth. As awareness of environmental preservation and pest resistance increases, the global insect pest control market is expected to maintain a strong growth trajectory in the years ahead.

Insect Pest Control Market Industry Trends and Strategic Insights

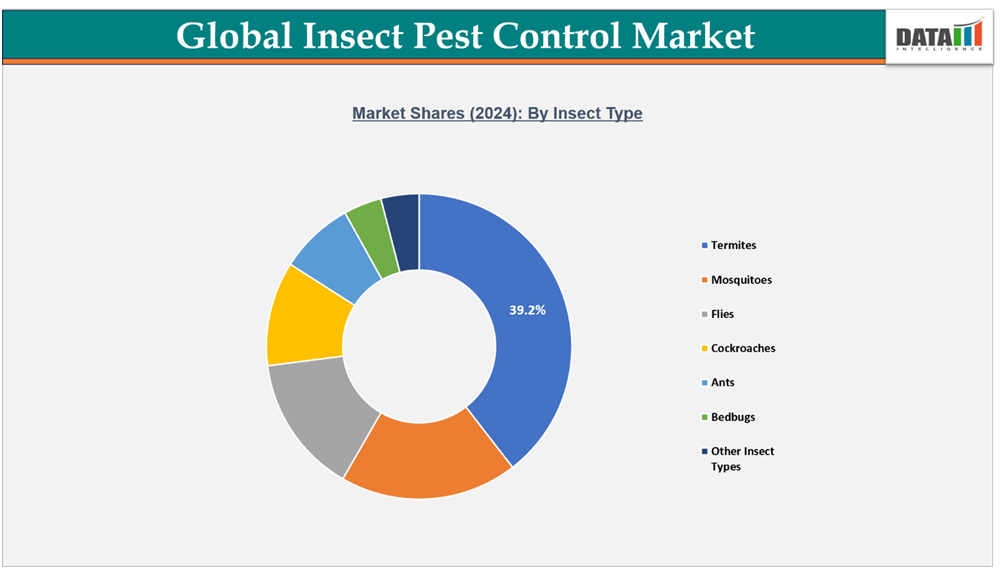

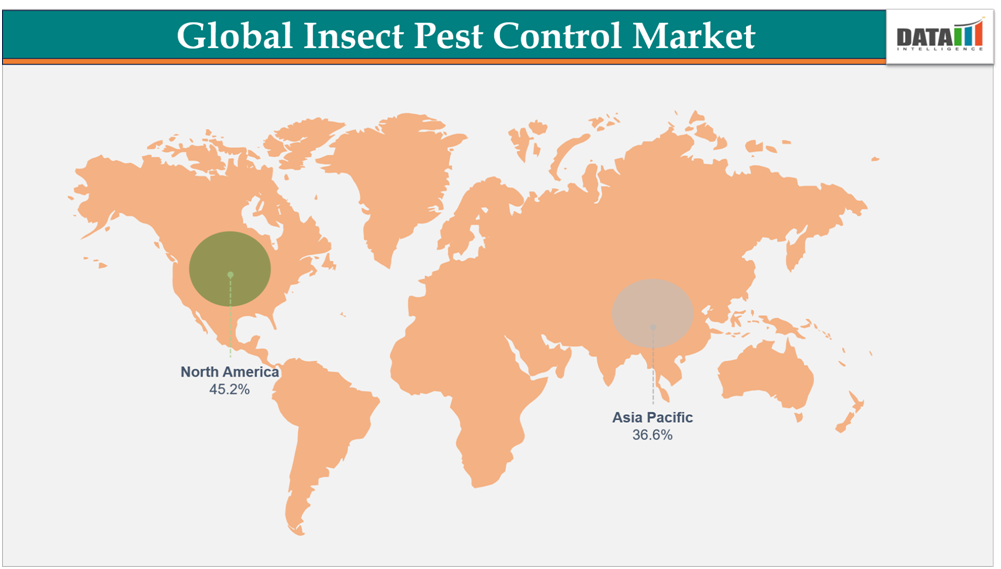

- North America leads the global insect pest control market, capturing the largest revenue share of 45.2% in 2024.

- By insect type segment, termites lead the global insect pest control market, capturing the largest revenue share of 39.2% in 2024.

Global Insect Pest Control Market Size and Future Outlook

- 2024 Market Size:US$19.4billion

- 2032 Projected Market Size:US$32.1billion

- CAGR (2025–2032):6.5%

- Dominating Market: North America

Fastest Growing Market: Asia-Pacific

source: Datam intelligence email : [email protected]

Market Scope

| Metrics | Details |

| By Insect Type | Termites, Mosquitoes, Flies, Cockroaches, Ants, Bedbugs, Other Insect Types |

| By Control Method | Chemical Control, Biological Control, Mechanical & Physical Control, Other control methods |

| By Application | Residential, Commercial, Agricultural, Industrial |

| By Form | Dry, Liquid |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising incidence of vector-borne diseases

The increasing spread of vector-borne diseases such as malaria, dengue, Zika virus, and chikungunya continues to be a major catalyst for the growth of the global insect pest control market. Factors like climate change, rapid urbanization, poor waste management, and rising global temperatures have expanded the habitats of disease-carrying insects, leading to more frequent outbreaks worldwide. As a result, both public and private sectors are investing heavily in advanced pest control methods to protect human health and limit economic losses caused by these diseases.

In December 2024, Unitaid and the University of Notre Dame announced a significant breakthrough in malaria prevention with the introduction of a spatial repellent called Mosquito Shield™. The product, when used alongside insecticide-treated nets, reduced first-time and overall malaria infections by 33%, according to a study published in The Lancet. This marks an important milestone toward a World Health Organization (WHO) recommendation for a completely new class of vector control tools, signaling a shift toward innovative, science-driven pest management strategies.

Such advancements underscore the urgent global demand for integrated pest management (IPM) approaches that combine biological, chemical, and environmental control measures. Governments and health organizations are increasingly promoting sustainable, targeted, and data-driven pest control systems to reduce reliance on conventional insecticides and combat the resurgence of vector-borne diseases more effectively. The trend is expected to further boost market growth, particularly in high-risk regions across Asia-Pacific, Latin America, and Sub-Saharan Africa.

Segmentation Analysis

The global insect pest control market is segmented based on insect type, control method, application, form and region.

Termite Control Segment Leads the Market with Focus on Preventive and Sustainable Solutions

The termite control segment holds a dominant share of the global insect pest control market, driven by the severe structural damage termites cause and the rising need for preventive treatment. Growing adoption of chemical barriers, baiting systems, and integrated pest management (IPM) is strengthening market demand.

In 2025, PHOENIX AXN Growth Partners, parent company of ACTION Termite and Pest Control, partnered with Patriot Pest & Termite Control in Arizona, its eighth regional alliance, highlighting industry consolidation and the push for localized, advanced solutions. North America leads the segment due to stringent infrastructure standards, while Asia-Pacific is rapidly growing with expanding construction activity and awareness of termite risks.

Mosquito Control Segment Grows Rapidly Amid Rising Disease Outbreaks and Urbanization

The mosquito control segment is expanding steadily, fueled by the surge in vector-borne diseases such as dengue, malaria, and the Zika virus. Urbanization, climate change, and poor waste management continue to intensify mosquito breeding, driving public health and residential demand.

Governments across North America and the Asia-Pacific are implementing integrated vector management (IVM) programs that combine biological, environmental, and chemical controls. Innovations such as drone-based spraying, AI surveillance, and biocontrol agents like Wolbachia are boosting sustainable control methods. North America dominates the market, followed by Asia-Pacific, supported by seasonal outbreaks and strong public health initiatives.

Geographical Penetration

DOMINATING MARKET:

North America Dominates the Global Insect Pest Control Market with Growing Focus on Innovation and Sustainability

The North American insect pest control market is set for consistent growth through 2024, supported by rapid urbanization, increasing awareness of vector-borne diseases, and expanding demand for pest management across residential, commercial, and industrial sectors. The region’s mature pest control ecosystem, stringent hygiene regulations, and strong emphasis on safety standards continue to drive adoption of both traditional and eco-friendly pest management solutions.

US Insect Pest Control Market Overview

The US remains the leading market in North America, driven by rising demand for pest control services in households, offices, and commercial establishments. Increasing concerns over health hazards linked to pests such as mosquitoes, termites, and rodents are accelerating market expansion. Adoption of digital pest monitoring systems, sensor-based traps, and data-driven management tools is also growing, helping service providers deliver more efficient and predictive pest management. The trend toward sustainable practices is strengthening, with greater use of integrated pest management (IPM) techniques and bio-based formulations.

Canada Insect Pest Control Market Outlook

Canada’s pest control industry is expanding steadily, particularly in residential, hospitality, and food service sectors, where hygiene compliance is a top priority. In 2025, Senske Family of Companies (SFC), a prominent lawn and pest control provider, acquired Huron Pest Control in Ontario. Following the acquisition, operations continued under Mosquito Buzz, Senske’s Canadian brand specializing in mosquito and tick management. This strategic move reflects the growing consolidation trend among service providers to broaden regional presence and deliver customized pest solutions.

Overall, North America is expected to maintain its leadership in the global insect pest control market, driven by technology adoption, service integration, and the ongoing shift toward sustainable, environmentally conscious pest control practices.

FASTEST GROWING MARKET:

Asia-Pacific Becomes the Fastest-Growing Region Driven by Urban Expansion, Climate Adaptation, and Rising Pest Management Demand

The global insect pest control market is expanding rapidly, with Asia-Pacific emerging as the fastest-growing region in 2025. Growth is fueled by increasing urbanization, climate-driven pest challenges, and growing awareness of health and hygiene. Governments and private companies are investing in large-scale pest management programs, integrating smart monitoring technologies, and adopting eco-friendly control solutions to enhance public health and agricultural productivity across the region.

India Insect Pest Control Market Outlook

India is witnessing robust growth in insect pest control services, driven by rising pest-borne disease cases and government initiatives promoting sanitation and hygiene. The expanding urban population, along with rapid growth in the food service and hospitality sectors, is creating strong demand for professional pest control solutions. Increasing adoption of biological control agents, herbal repellents, and digital monitoring tools reflects the country’s shift toward sustainable pest management. Strategic partnerships between domestic and global players are also improving accessibility and innovation in the market.

China Insect Pest Control Market Trends

China continues to play a pivotal role in regional market growth, supported by large-scale infrastructure development and proactive government efforts to control mosquito- and fly-borne diseases. The adoption of drone-assisted spraying, automated monitoring systems, and eco-friendly insecticides is rising rapidly. Additionally, China’s agricultural sector is increasingly focusing on integrated pest management (IPM) to protect crops while minimizing chemical use. Collaboration between leading pest control firms and technology providers is further enhancing operational efficiency and innovation in the country.

Overall, Asia-Pacific is set to remain the fastest-expanding region in the global insect pest control market, driven by sustainability goals, rapid urban growth, and continuous advancements in pest management technologies and infrastructure.

Sustainability and ESG Analysis

Sustainability is emerging as a core priority in the global insect pest control industry, guiding innovation, regulatory compliance, and corporate responsibility. Companies are increasingly adopting eco-friendly pest management methods, biodegradable formulations, and integrated pest management (IPM) systems to minimize environmental impact.

In July 2025, Businesses Uniting to Guarantee Sustainability (BUGS) launched the second edition of the Pest Management Industry Sustainability Guidelines at the FAOPMA conference in Penang, Malaysia, reinforcing industry-wide commitment to responsible practices.

Manufacturers are investing in green technologies, bio-based products, and energy-efficient operations to meet global ESG standards. This shift toward sustainability is strengthening environmental accountability, enhancing brand credibility, and shaping the future of the pest control market worldwide.

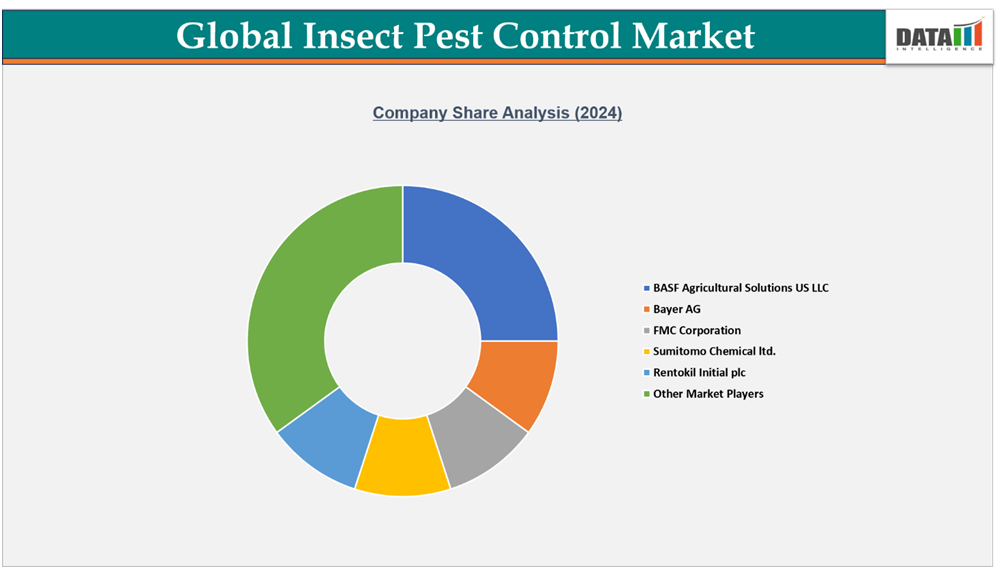

Competitive Landscape

- The global insect pest control market remains highly competitive, with a blend of prominent international corporations and strong regional players. Key companies such as Bayer AG, BASF, FMC Corporation, Sumitomo Chemical Ltd., Rentokil Initial plc, and Rollins Inc. maintain a strong presence through extensive product portfolios, advanced pest management technologies, and consistent investments in innovation and R&D.

- Many industry participants are expanding into emerging markets through mergers, acquisitions, and strategic alliances. Collaborations with digital monitoring and smart pest management solution providers are enabling firms to enhance efficiency, scalability, and service reach across diverse agricultural and commercial sectors.

- The competitive environment is shaped by growing demand for sustainable pest control practices, innovation in bio-based formulations, and advancements in smart detection systems. Compliance with evolving regulations, product innovation, and technology integration continue to be key differentiators driving long-term success in the global insect pest control market.

Key Developments

- In November 2025, globally, thousands of insect species pose a serious threat to crop yields by feeding on plants, transmitting diseases, and damaging plant tissues. This results in substantial agricultural losses estimated at 20% to 40% of global crop production, including key staples like wheat, corn, and rice, amounting to nearly $70 billion annually.

Investment & Funding Landscape

The global insect pest control market is attracting significant investor interest, with funding increasingly directed toward technology-enabled and sustainable pest management solutions. In September 2025, PATS raised €2.7 million (approx. US$3.1 million) in seed funding to advance its AI-based pest management systems. The round, backed by Division Q, Percival Participations, Delft Enterprises, and other tech and horticulture investors, will help the company expand internationally, enhance its product range, and scale production from its Delft headquarters. PATS specializes in automated pest control toolsincluding detection systems, predictive algorithms, and dronesthat enable real-time monitoring and targeted pest intervention while minimizing insecticide use.

Also in September 2025, Pest Share, a digital platform offering on-demand pest control services for the residential rental market, secured US$28 million in Series A funding. The capital will fuel its national growth and further integrate pest control into property management operations.

These investments underscore the industry’s growing shift toward AI-driven, sustainable, and precision-based pest control solutions, reflecting a global commitment to innovation, efficiency, and environmental responsibility.

What Sets This Global Insect Pest Control Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect insect pest control commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.