Injection In-Mold Labels Market Size

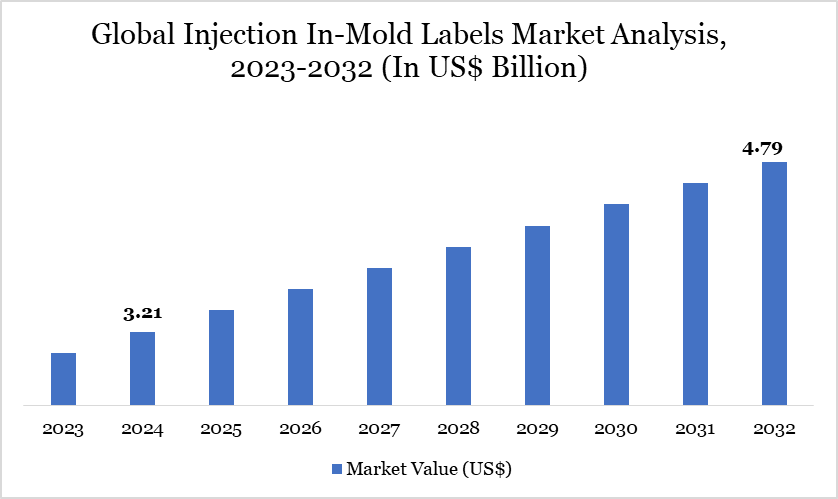

Injection In-Mold Labels Market reached US$ 3.21 billion in 2024 and is expected to reach US$ 4.79 billion by 2032, growing with a CAGR of 5.13% during the forecast period 2025-2032.

With the growing focus on sustainability and environmental responsibility, there is a greater need for eco-friendly packaging solutions such as injection-in-mold labels. IMLs produced from recyclable materials with eco-friendly printing options promote sustainability and attract environmentally concerned consumers and businesses. Injection-in-mold labels can integrate tamper-evident features like seals, perforations, or holographic elements, assuring consumers of product integrity and safety.

In 2025, North America is expected to be the second-dominant region with about 25% of the global injection-in-mold labels market. North American consumers exhibit a preference for premium-quality products with attractive packaging. Injection-in-mold labels offer superior printing quality, vibrant graphics, and customization options, making them ideal choices for brands seeking to differentiate their products and create a strong visual impact on store shelves.

Injection In-Mold Labels Market Trend

The global injection-mold labels (IML) market is witnessing significant growth, driven by increasing demand for sustainable and visually appealing packaging solutions. Governments worldwide are implementing regulations to reduce plastic waste, encouraging the adoption of eco-friendly packaging methods like IML. For instance, the European Union's Single-Use Plastics Directive aims to minimize the environmental impact of certain plastic products, promoting the use of recyclable and durable labeling options.

Additionally, the US Environmental Protection Agency (EPA) supports sustainable materials management, further bolstering the shift towards IML technologies. These regulatory frameworks are propelling manufacturers to invest in IML, which offers enhanced design flexibility, durability, and recyclability, aligning with global sustainability goals.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

By Material | Polypropylene, Polyethylene, Polyvinyl Chloride (PVC), ABS Resins, Others |

By Printing Technology | Flexographic Printing, Offset Printing, Others |

By Application | Food and Beverages, Chemicals, Home & Personal Care, Consumer Goods, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Injection In-Mold Labels Market Dynamics

Growing Advancements in Technology

Continuous improvements in printing technology, materials science and production methods improve the quality, efficiency and versatility of injection-molded labels. Manufacturers may now generate IMLs with higher print quality, more customization possibilities and shorter turnaround times because to innovations like digital printing, graphics and automation.

Advancements in technology are significantly propelling the global injection in-mold labels (IML) market. The integration of artificial intelligence and robotics in injection molding processes has led to increased efficiency and precision. For instance, modern injection molding machines equipped with AI algorithms have achieved up to a 30% reduction in energy consumption and a 25% decrease in defect rates, enhancing overall production quality and sustainability.

Additionally, the adoption of Industry 4.0 technologies, such as real-time data analytics and automated quality control systems, has streamlined operations and reduced cycle times by 10% to 30%. These technological advancements, supported by governmental initiatives promoting smart manufacturing, are driving the growth and adoption of IML solutions globally.

High Investments and Complexity

Adopting IML technology necessitates a considerable initial investment in specialized equipment, molds and infrastructure. For small and medium-sized organizations (SMEs) or businesses with low financial resources, the initial investment cost acts as a barrier to entering the injection in-mold labels market. Designing and preparing artwork for injection-mold labels can be difficult and time-consuming.

Achieving ideal registration, color consistency and graphics alignment necessitates specialized knowledge and skill, which presents a problem for brand owners and packaging designers. Injection in-mold labeling could not be appropriate for all container types, geometries or materials. Certain packaging styles or designs may provide hurdles for injection in-mold labels application, restricting the market's applicability and potential growth in specific industries or product categories.

Injection In-Mold Labels Market Segment Analysis

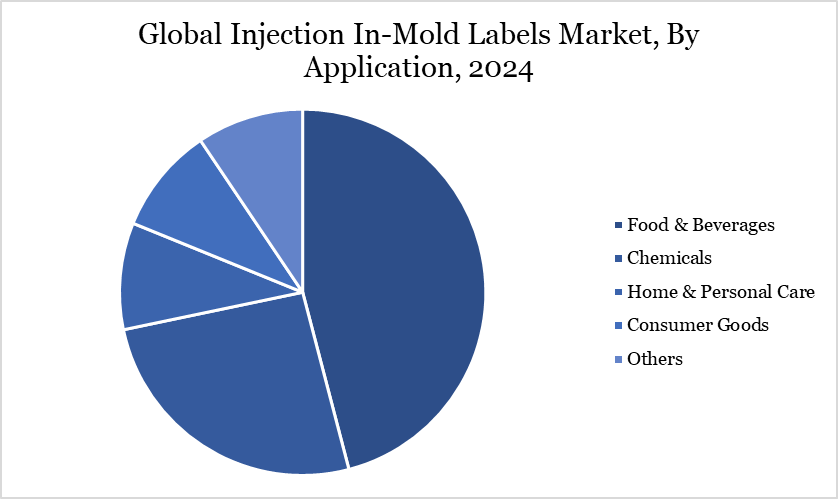

The global injection in-mold labels market is segmented based on material, printing technology, application and region.

Rising Aesthetic Value of Packaging in the Food & Beverage Sector

Food & beverages are expected to be the dominant segment with over 1/4th of the market during the forecast period 2025-2032. Owing to the importance of packaging aesthetics in the food & beverage industry, in-mold labeling is expected to be widely adopted. Packaging prolongs the shelf life of products and attracts potential purchasers. The increased barrier makes in-mold labeling advantageous for the food and beverage industries, improving the shelf life of packaged commodities.

Muller Printing Technology, a manufacturer of molds and automation solutions for thin wall packaging, stated in September 2022 that its in-mold labelling automation technology would be used in sustainable injection molding packaging. The technology is introduced to produce a 100% monomaterial container composed of totally recyclable polypropylene, together with a wrap-around and bottom polypropylene-based label.

Injection In-Mold Labels Market Geographical Share

Growing Technology Advancements in Asia-Pacific

Asia-Pacific is expected to be the dominant region in the global injection in-mold labels market covering about 25% of the market. Advances in printing technology, materials science and manufacturing methods improve the efficiency, quality and versatility of injection-mold labels in Asia-Pacific. Digital printing, high-definition graphics and automation all contribute to market growth by allowing for greater customization, cost-effectiveness and shorter production cycles.

In March 2024, Mold-Tek Packaging Limited, a major player in the Indian packaging sector, has invested in a Durst RSCi 510mm press with priming and varnishing stations to revolutionize digital printing for in-mold labels. According to Durst, Mold-Tek, established in 1986, has grown to dominate with around 25 percent market share, over 2000 employees, 10 production plants and a fleet of over 150 injection machines. Recognizing the need for digital printing for high-quality in-mold Labels, Mold-Tek partnered with Durst Group and Newgen Printronics - official partner for Durst Group in India - with specific objectives.

Sustainability Analysis

The global injection in-mold labels (IML) market is advancing sustainability through innovations that align with governmental environmental objectives. IML technology integrates labels directly into packaging during manufacturing, eliminating the need for adhesives and facilitating seamless recycling processes. The Association of Plastic Recyclers (APR) recognizes IML as a preferred method for enhancing recyclability, as the labels and containers are composed of compatible materials, streamlining the recycling stream.

Injection In-Mold Labels Market Major Players

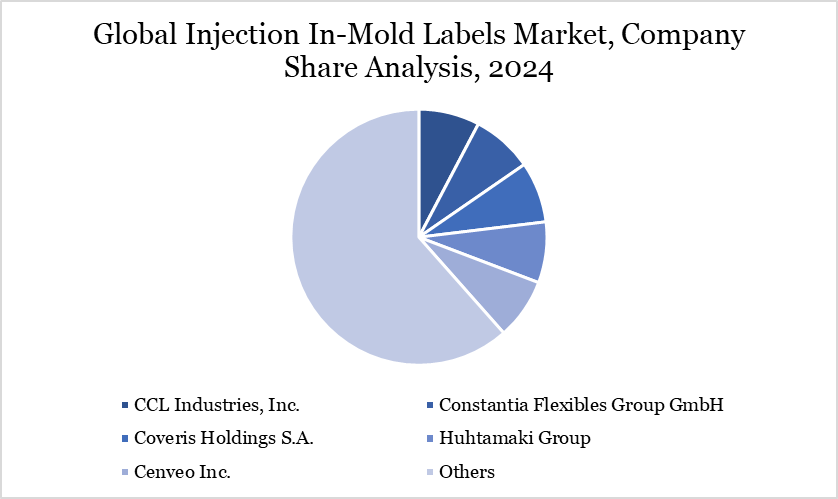

The major global players in the market include CCL Industries, Inc., Constantia Flexibles Group GmbH, Coveris Holdings S.A., Huhtamaki Group, Cenveo Inc., Hammer Packaging, Fuji Seal International Inc., Avery Dennison Corporation, Innovia Films Ltd. and Inland.

Key Developments

In 2024, Mold-Tek Packaging Limited invested in a Durst RSCi 510mm press with priming and varnishing stations to transform digital printing for in-mold labels.

In 2023, SABIC teamed up with three in-mold labeling experts to show the use of certified sustainable polypropylene resins in mono-PP thin-wall container packaging without sacrificing quality, processability, safety or convenience. The single-step IML method decorates the part inside the injection mold, making the label an integrated part of the packaging.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies