Infusion Systems Market Size & Industry Outlook

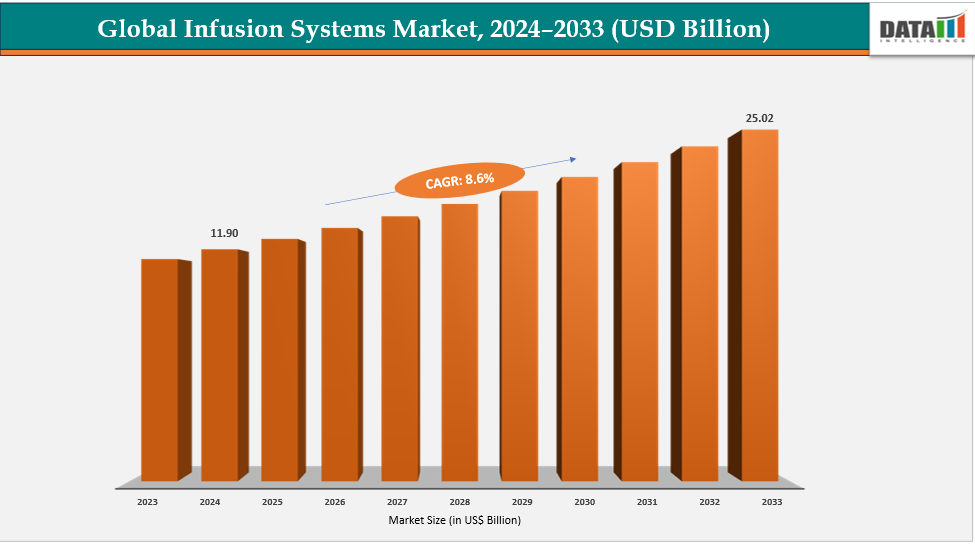

The global infusion systems market size was US$ 11.90 Billion in 2024 and is expected to reach US$ 25.02 Billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025-2033.

Technological innovations are speeding up the expansion of the infusion systems market. Intelligent infusion pumps enhance the accuracy of dosing. Interconnected devices facilitate monitoring in real-time. IoT-integrated systems provide remote oversight. Automated notifications minimize medication errors. Sophisticated safety software guarantees patient safety. Wireless connectivity boosts workflow productivity. Portable infusion pumps cater to home healthcare needs. Devices compatible with MRI broaden clinical uses.

Disposable infusion systems streamline processes. AI-driven insights enhance treatment optimization. Closed-loop systems increase dosing precision. Intuitive user interfaces promote system adoption. Energy-efficient designs improve portability. Multi-drug delivery systems optimize time efficiency. Data recording aids in meeting regulatory standards. Advanced sensing technology helps prevent blockages. Adaptive flow management ensures reliable delivery. Integration with electronic health records enhances documentation practices.

Key Highlights

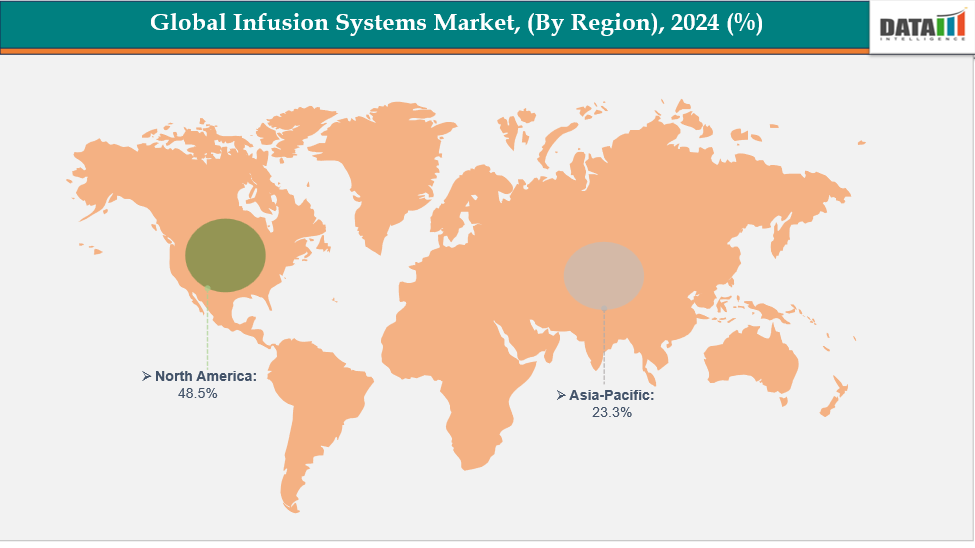

- North America is dominating the global infusion systems market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global infusion systems market, with a CAGR of 7.7% in 2024.

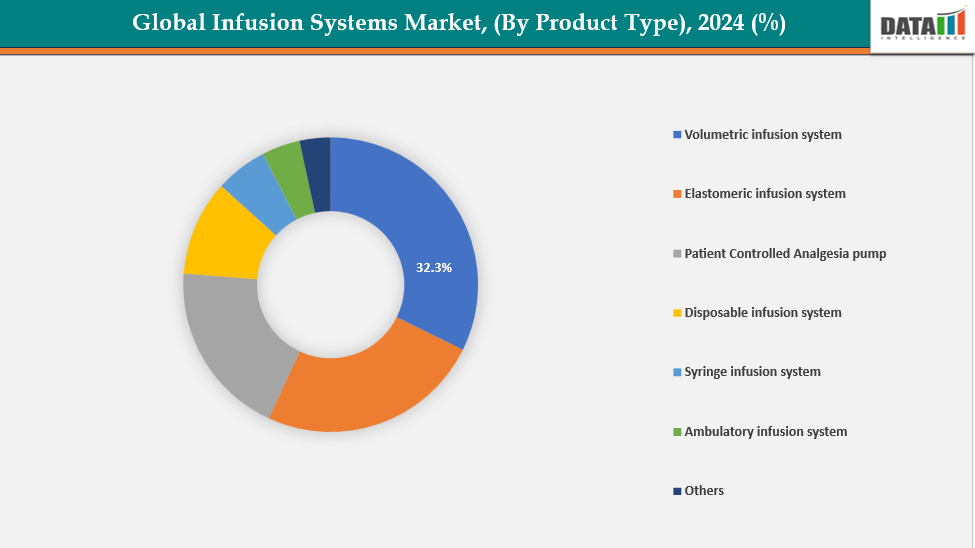

- The volumetric infusion system segment is dominating the infusion systems market with a 32.3% share in 2024

- The chemotherapy segment is dominating the infusion systems market with a 35.3% share in 2024

- Top companies in the infusion systems market include B. Braun Medical Inc., AKAS Infusions, CONTEC MEDICAL SYSTEMS CO., LTD, Devay, Infusyn Therapeutics, Baxter, Eitan Medical, ICU Medical, Inc., Moog, Inc., and Fresenius Kabi India Pvt., among others.

Market Dynamics

Drivers: Growing home healthcare is accelerating the growth of the infusion systems market

The expansion of home healthcare is fueling the infusion systems market. Many patients opt for home treatment. Hospitals are decreasing the length of inpatient stays. Infusion at home enhances convenience and improves quality of life. Patients with chronic illnesses require consistent therapy. Treatments for conditions like cancer, diabetes, and pain management are increasingly moving to home environments. Portable pumps and elastomeric devices aid in maintaining mobility. Smart, connected devices facilitate remote monitoring. Caregivers can safely oversee dosing. Fewer hospital visits result in lower costs.

In addition, the introduction of new devices and the regular approvals from regulators are contributing to the dominance of this segment. For instance, in May 2024, Moog Inc. received FDA 510(k) clearance for the CURLIN 8000 Ambulatory Infusion System, a premium infusion platform specifically developed to support safe and efficient home-based infusion therapy for patients.

Patient safety concerns and improper infusion are expected to hamper growth of the infusion systems market

Concerns regarding patient safety and inadequate infusion practices present major issues in the infusion systems market. Mistakes in medication administration can happen because of incorrect pump programming. Infections related to catheters may develop from improper usage. Inaccuracies in infusion rates can result in either underdosing or overdosing. The complexity of device operation raises the potential for human error.

In addition, devices that are not functioning properly or lack proper maintenance can jeopardize patient health. Excessive alerts from smart pumps can lead to alarm fatigue, diminishing the response to notifications. For instance, in July 2023, Baxter Healthcare Corporation recalled SIGMA Spectrum and Spectrum IQ infusion systems due to repeated upstream occlusion false alarms. The FDA classified it as a Class I recall, as device use could have caused serious injuries or death.

For more details on this report, see Request for Sample

Infusion Systems Market, Segment Analysis

The global infusion systems market is segmented based on product, application, end user, and region

By Product: The volumetric infusion system segment is dominating the infusion systems market with a 32.3% share in 2024

The segment of volumetric infusion systems leads the global market for infusion devices. These pumps provide accurate and controlled delivery of fluid volumes. They are commonly utilized in hospitals, intensive care units, and specialized wards. Their precision minimizes medication errors. They facilitate high-risk treatments such as chemotherapy and urgent care. Advanced features offer alarms and real-time monitoring capabilities. Their integration with hospital information technology systems enhances workflow efficiency. They are more effective in managing large-volume infusions compared to syringes or elastomeric pumps.

Moreover, ongoing improvements in infusion pumps and their approvals contribute to its dominance. For instance, in April 2024, Baxter International received U.S. FDA 510(k) clearance for its Novum IQ large-volume infusion pump, a volumetric infusion system integrated with Dose IQ Safety Software, enabling clinicians to deliver precise, connected, and intelligent infusion therapy across diverse patient care settings.

By Application: The chemotherapy segment is dominating the infusion systems market with a 35.3% share in 2024

The chemotherapy sector leads the global infusion systems market. The incidence of cancer is rising across the globe. Chemotherapy necessitates the accurate delivery of medications. Infusion systems provide precise dosing and scheduling. Volumetric and syringe pumps are commonly utilized. Medical facilities and specialized oncology units depend on these systems. Ambulatory pumps for chemotherapy are also employed in home-care environments. Sophisticated smart pumps minimize medication mistakes.

Furthermore, the ongoing advancements in technology along with their regulatory endorsements facilitate secure application. For instance, in May 2025, Iradimed Corporation received FDA 510(k) clearance for its next-generation MRidium 3870 IV Infusion Pump System. The MRI-compatible device enabled precise fluid and medication delivery for patients undergoing MRI scans, reinforcing Iradimed’s position as the sole supplier of non-magnetic MRI infusion pumps.

Infusion Systems Market, Geographical Analysis

North America is dominating the global infusion systems market with 48.5% in 2024

North America leads the global infusion systems market owing to its advanced healthcare infrastructure, widespread adoption of smart infusion technologies, and the existence of major medical device manufacturers. The region's market dominance is fueled by significant investment in R&D, supportive reimbursement policies, an increasing trend toward home healthcare, and a rising need for accurate drug delivery.

In the United States, the market for infusion systems expanded owing to a rise in FDA approvals, expedited review processes, and advancements in technology like smart pumps and connected devices, which improve treatment accuracy and patient comfort. For instance, in April 2025, ICU Medical Inc. received FDA 510(k) clearance for the Plum Solo and updated Plum Duo precision IV pumps, along with LifeShield infusion safety software, marking the launch of its ICU Medical IV Performance Platform and a new category of precision infusion devices.

Europe is the second region after North America, which is expected to dominate the global infusion systems market with 34.5% in 2024

In Europe, the market for infusion systems has grown due to the increasing prevalence of diseases, better access to advanced treatments, and the implementation of early screening initiatives. The swift uptake of smart infusion devices, along with regulatory approvals, significant investments in research and development, and a growing reliance on these devices for improved treatment effectiveness and wider patient access throughout the region has further contributed to this expansion.

Additionally, the approvals for Quality Management Systems (QMS) under the European Medical Device Regulation (MDR) greatly enhanced market growth and access to treatments throughout Europe. For instance, in January 2025, Innovative Health Sciences (IHS) passed the final stage of the European MDR Quality Management System audit for the Insignis Infusion System, enabling global distribution of its portable, affordable syringe device for safe and accurate intravenous and subcutaneous medication delivery.

The Asia-Pacific region is the fastest-growing region in the global infusion systems market, with a CAGR of 7.7% in 2024

The Asia-Pacific market for infusion systems, particularly in major nations such as China, Japan, South Korea, and India, has seen significant growth driven by heightened awareness of diseases, better access to healthcare, increasing need for accurate drug administration, the integration of cutting-edge infusion technologies, and robust government efforts advocating for early diagnosis and effective patient management.

Japan's infusion systems market experienced consistent growth, fueled by an increase in chronic disease cases, the approval of advanced infusion devices by the PMDA, the integration of smart technologies, robust domestic manufacturing, and partnerships with international medical device firms. This growth can be attributed to factors such as the approvals granted by the PMDA. For instance, in July 2024, KORU Medical Systems received regulatory clearance in Japan for its FreedomEdge System, allowing safe and precise delivery of multiple drugs, including Hizentra, Cuvitru, and Aspaveli. This approval marked a significant advancement in large-volume subcutaneous infusion therapy, expanding patient access and supporting innovative, patient-centric treatment options.

Infusion Systems Market Competitive Landscape

Top companies in the infusion systems market include B. Braun Medical Inc., AKAS Infusions, CONTEC MEDICAL SYSTEMS CO., LTD, Devay, Infusyn Therapeutics, Baxter, Eitan Medical, ICU Medical, Inc., Moog, Inc., and Fresenius Kabi India Pvt., among others.

B. Braun Medical Inc.: B. Braun Medical Inc. is a global leader in infusion therapy, offering a comprehensive portfolio of infusion systems, including volumetric pumps, syringe pumps, elastomeric devices, and accessories. The company focuses on patient safety, precision drug delivery, and innovative technologies. Strong R&D, global presence, and collaborations with healthcare providers position B. Braun as a key player in the infusion systems market.

Key Developments:

- In November 2024, Boston Scientific Corporation entered into a definitive agreement to acquire Intera Oncology Inc., gaining the FDA-approved Intera 3000 Hepatic Artery Infusion Pump and floxuridine, expanding its portfolio for hepatic artery infusion therapy to treat liver tumors from metastatic colorectal cancer.

- In August 2024, Innovative Health Sciences (IHS) expanded its commercialization team to market the Insignis Syringe Infusion System, which had received FDA clearance in March 2024. The system offered accurate, affordable intravenous and subcutaneous infusion across hospital, clinic, ambulatory, and home-care settings.

Market Scope

| Metrics | Details | |

| CAGR | 8.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product | Volumetric infusion system, Elastomeric infusion system, Patient Controlled Analgesia pump, Disposable infusion system, Syringe infusion system, Ambulatory infusion system, Others |

| By Application | Chemotherapy, Diabetes, Pain Management, Gastrointestinal Disorders, Others | |

| By End User | Hospitals, Diagnostic Centers, Homecare, Specialty Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global infusion systems market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here