Wearable Injectors Market Size - Industry Trends & Outlook

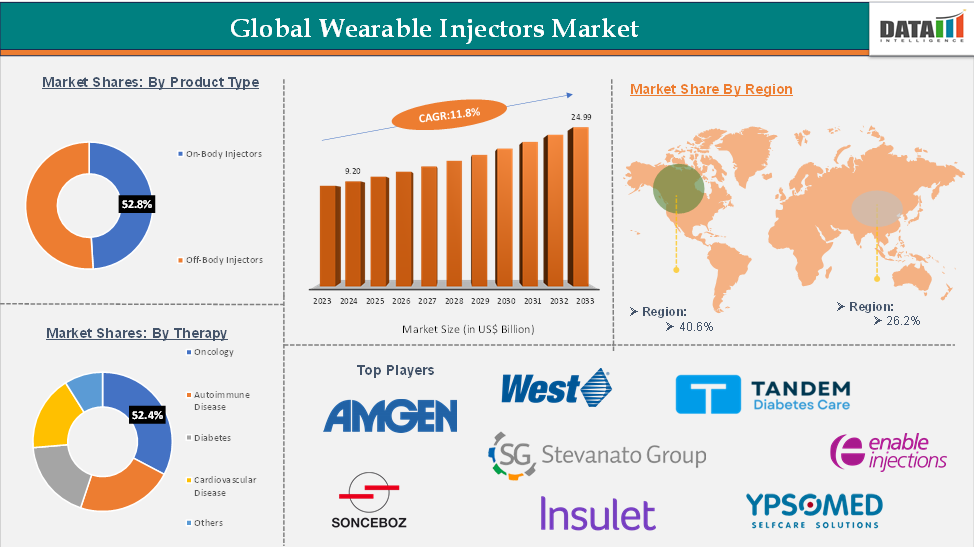

Wearable Injectors Market size reached US$ 9.20 Billion in 2024 and is expected to reach US$ 24.99 Billion by 2033, growing at a CAGR of 11.8% during the forecast period 2025-2033.

The wearable injectors market refers to the segment of medical devices designed to deliver large-volume medications subcutaneously over extended periods, allowing patients to self-administer treatments with minimal clinical supervision.

The market is experiencing robust growth, driven by the rising prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders that require regular and precise drug delivery. Technological advancements, including the development of user-friendly, adhesive-based injectors and the growing shift toward biologics and home-based healthcare, are further accelerating adoption.

Despite the challenges, the market presents significant opportunities, especially with the increasing demand for personalized medicine, the expansion of remote patient monitoring, and emerging markets showing rising healthcare investment and chronic disease burdens.

Executive Summary

For more details on this report – Request for Sample

Wearable Injectors Market Dynamics: Drivers & Restraints

Rise in technological advancements is expected to drive the wearable injectors market

Technological advancements are significantly propelling the growth of the wearable injectors market by enhancing device functionality, patient comfort, and integration with digital health ecosystems. Innovations such as improved needle-free delivery mechanisms, longer battery life, and real-time connectivity are making these devices more user-friendly and efficient.

These advanced devices are gaining approvals from the regulatory bodies and are making them available across various regions. For instance, in March 2025, Enable Injections received CE mark approval for its enFuse syringe transfer system, a wearable drug delivery device. The enFuse on-body delivery system is designed to administer a subcutaneous abdominal bolus of drugs or biologic products in alignment with specific drug product requirements, offering a convenient and efficient solution for patients requiring large-volume injections.

Similarly, Eli Lilly’s wearable insulin delivery system utilizes artificial intelligence to adjust insulin doses based on continuous glucose monitoring data, aiming to improve glycemic control for diabetes patients. These technologies will not only improve the efficacy of treatments but also align with the growing trend towards personalized and remote healthcare, thereby driving the adoption of wearable injectors in the global market.

High costs of wearable injectors are expected to hinder the wearable injectors market

The high cost of wearable injectors is expected to be a major factor hindering the growth of the wearable injector market. These devices often incorporate advanced technologies, such as precise drug delivery mechanisms, connectivity features, and compatibility with biologics, which significantly increase manufacturing and development costs.

As a result, the end price for consumers and healthcare systems can be prohibitively high, particularly in low- and middle-income countries. The financial burden may discourage both patients and healthcare providers from adopting these devices, especially when lower-cost alternatives like traditional injections or infusion systems are available. This cost barrier can slow market penetration and restrict the widespread adoption of wearable injectors, despite their clinical benefits.

Wearable Injectors Market Segment Analysis

The global wearable injectors market is segmented based on type, therapy, end user, and region.

Type:

The on-body injectors segment is expected to hold 52.8% of the global wearable injectors market

On-body injectors (OBIs), also known as on-body delivery systems (OBDS), are advanced drug delivery devices designed to automatically administer a pre-measured dose of medication, typically through a needle, ensuring precise and timely treatment without requiring patient intervention. These systems enhance treatment adherence by minimizing the risk of missed doses or incorrect administration, offering a stable and consistent platform for recovery without the need for clinical visits.

OBIs are particularly effective for delivering larger volumes of biologic drugs, which are increasingly preferred by pharmaceutical companies for treating chronic and complex conditions. These devices allow patients to receive the correct dose at the optimal site, improving therapeutic outcomes. With optional connectivity features, OBIs are also playing a crucial role in bridging gaps in healthcare infrastructure by integrating with connected health services for real-time monitoring and data sharing.

This segment is currently dominating the wearable injectors market, driven by growing demand for patient-centric, home-based care solutions and recent product launches. For instance, in December 2023, Coherus BioSciences received FDA approval for UDENYCA ONBODY, an on-body injector presentation of its pegfilgrastim biosimilar used to reduce infection risk in chemotherapy patients. Such innovations reflect the segment’s growing importance in oncology and chronic disease treatment, reinforcing its leadership in the global wearable injector space.

Wearable Injectors Market Geographical Analysis

North America is expected to hold 40.6% of the global wearable injectors market

North America is poised to maintain its leadership in the global wearable injectors market, driven by a combination of high disease prevalence, advanced healthcare infrastructure, and regulatory support.

The rising prevalence of chronic conditions such as diabetes and cancer significantly contributes to the demand for wearable injectors. For instance, according to the International Agency for Research on Cancer, it is stated that in 2022, 2.6 million cancer cases were reported. This number is expected to reach 3.8 million by 2045. These conditions often require frequent medication administration, making wearable injectors an attractive solution for patients and healthcare providers seeking efficient and convenient drug delivery methods.

Recent product launches and approvals further underscore North America's pivotal role in the wearable injectors market. Companies are introducing more appealing solutions to gain traction from individuals. BD's Libertas wearable injector, designed for subcutaneous delivery of biologic therapies, exemplifies the region's commitment to innovation in drug delivery systems. Such advancements not only enhance patient adherence to treatment regimens but also align with the growing preference for home-based care and self-administration, reducing the burden on healthcare facilities.

North America's combination of high disease prevalence, advanced healthcare infrastructure, and regulatory support positions it as a dominant force in the global wearable injectors market. The region's continued focus on innovation and patient-centric solutions is expected to drive sustained growth and adoption of wearable injectors in the coming years.

Wearable Injectors Market Top Companies

The top companies in the wearable injectors market include BD, Ypsomed AG, Amgen, Inc., Insulet Corporation, ENABLE INJECTIONS, West Pharmaceutical Services, Inc., CeQur Corporation, Sonceboz, Tandem Diabetes Care, Inc., Stevanato Group, among others.

Market Scope

Metrics | Details | |

CAGR | 11.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | On-Body Injectors, Off-Body Injectors |

Therapy | Oncology, Autoimmune Disease, Diabetes, Cardiovascular Disease, Others | |

End User | Hospitals and Clinics, Home Care, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global wearable injectors market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.