Inflammatory Diseases Biologics Market Size & Industry Outlook

The market for inflammatory illness biologics is expanding as a impact of the growing demand for anti-inflammatory biologics, which are more effective than traditional treatments and have more specific mechanisms of action. Biologics have become more popular as autoimmune diseases including Crohn's disease, psoriasis, and rheumatoid arthritis have become more prevalent. Reduced relapse rates and patient preference for cutting-edge, long-acting treatments further increase their allure. Biopharmaceutical advancements and ongoing research and development expenditures have produced new biologics and biosimilars with enhanced safety profiles.

Key Highlights

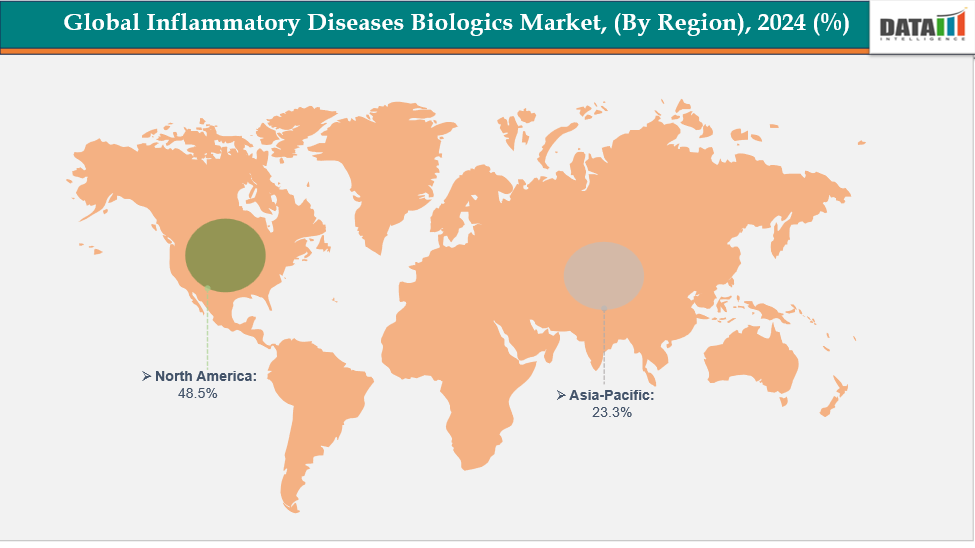

- North America is dominating the global inflammatory diseases biologics market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global inflammatory disease biologics market, with a CAGR of 7.7% in 2024.

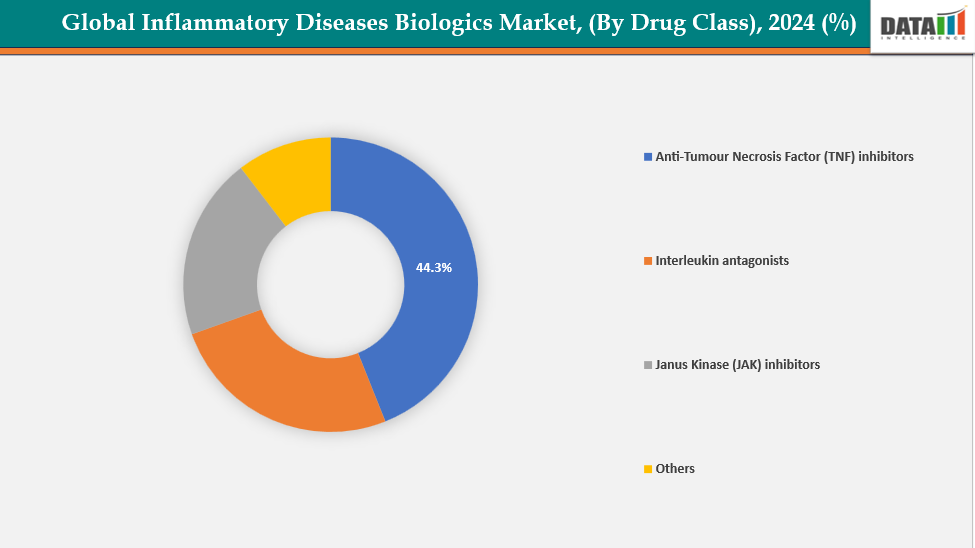

- Anti-tumor necrosis factor (TNF) inhibitors are dominating the inflammatory disease biologics market with a 44.3% share in 2024

- The rheumatoid arthritis segment is dominating the inflammatory diseases biologics market with a 40.3% share in 2024

- Top companies in the inflammatory disease biologics market include Amgen Inc., Novartis Pharmaceuticals Corporation, Johnson & Johnson, Pfizer Inc., F. Hoffmann-La Roche Ltd, GSK, AbbVie, Sanofi, Eli Lilly and Company, and Takeda Pharmaceuticals U.S.A., Inc., among others.

Market Dynamics

Drivers: Expanding indications for inflammatory diseases is accelerating the growth of the inflammatory disease biologics market

Expanding indications for inflammatory diseases are accelerating the growth of the biologics market as many existing biologics are being approved for multiple autoimmune and inflammatory conditions. This broadens the eligible patient population and drives higher treatment adoption across different disease areas. As biologics continue to demonstrate safety and efficacy across diverse inflammatory pathways, their use is expanding into new therapeutic segments.

Furthermore, continuous research and development for new targets and indications and its clinical success are boosting the market growth. For instance, in September 2025, the U.S. FDA approved TREMFYA (guselkumab) for children aged six years and older with moderate to severe plaque psoriasis or active psoriatic arthritis, making it the first and only IL-23 inhibitor approved for these pediatric inflammatory disease indications.

Restraints: Side effects of anti-inflammatory biologics are hampering the growth of the inflammatory disease biologics market

Anti-inflammatory biologic side effects are impeding market expansion by causing patients and healthcare professionals to worry about their safety. These medications weaken the immune system, raising the risk of cancer, TB, and severe infections. Treatment termination is frequently the result of adverse events include liver damage, hypersensitivity, and irritation of the injection site.

For instance, IL-17 inhibitors pose a serious disease burden for those who take them because they are linked to an increased incidence of cutaneous, esophageal, and oropharyngeal candidiasis.

For more details on this report, see Request for Sample

Inflammatory Diseases Biologics Market, Segment Analysis

The global inflammatory diseases biologics market is segmented based on drug class, disease indication, distribution channel, and region

By Drug Class: Anti-tumor necrosis factor (TNF) inhibitors are dominating the inflammatory disease biologics market with a 44.3% share in 2024

The market for biologics for inflammatory diseases is dominated by anti-tumor necrosis factor (TNF) inhibitors due to their extensive indication coverage and established clinical efficacy. They have a strong market legacy and well-known brand because they were the first biologics to be licensed for major autoimmune disorders such psoriasis, inflammatory bowel disease, and rheumatoid arthritis. Numerous real-world studies have demonstrated the long-term safety and efficacy of TNF inhibitors such Humira, Enbrel, and Remicade.

Moreover, clinical trials and continuous innovation for anti–tumor necrosis factor (TNF) inhibitors further strengthen their market position. For instance, in December 2024, TNF Pharmaceuticals, Inc. announced positive topline results from its Phase 2a trial of MYMD-1 (isomyosamine), the first oral TNF-α inhibitor. The study demonstrated statistically significant efficacy in treating sarcopenia and frailty, marking a major advancement in oral anti-inflammatory therapy development.

By Disease Indication: The rheumatoid arthritis segment is dominating the inflammatory diseases biologics market with a 40.3% share in 2024

The market for biologics for inflammatory illnesses is dominated by the rheumatoid arthritis (RA) sector due to its high prevalence worldwide and robust clinical biologics acceptance. One of the most researched autoimmune diseases is RA, which has led to the early regulatory approval of important biologics including Actemra, Enbrel, and Humira. Due to their shown effectiveness in minimizing joint deterioration and enhancing quality of life, these treatments are consistently preferred by doctors.

Moreover, biosimilar and new product introductions to the market expanded patient access, increasing overall treatment volumes. For instance, in October 2025, Celltrion, Inc. announced the U.S. launch of AVTOZMA (tocilizumab-anoh) intravenous formulation. The biosimilar became available for patients with the same approved indications as the reference product Actemra, including rheumatoid arthritis, giant cell arteritis, juvenile idiopathic arthritis, COVID-19, and cytokine release syndrome, expanding biologic treatment access.

Inflammatory Diseases Biologics Market, Geographical Analysis

North America is dominating the global inflammatory diseases biologics market with 48.5% in 2024

North America dominated the market for biologics for inflammatory illnesses due to the region's high autoimmune disease prevalence, developed healthcare system, and presence of top biologic manufacturers. Strong R&D spending, advantageous reimbursement policies, and early uptake of cutting-edge biologic and biosimilar treatments all contributed to the region's dominant position in the market.

In the U.S., the market for inflammatory diseases biologics grew as a result of new FDA approvals, creative product introductions, and long-acting formulations that improved patient accessibility, treatment efficacy, and convenience for autoimmune disorders. For instance, in March 2024, Fresenius Kabi announced that the U.S. FDA had approved Tyenne (tocilizumab-aazg), the first tocilizumab biosimilar referencing Actemra, with both intravenous and subcutaneous formulations, marking a significant milestone in expanding biologic treatment options.

Europe is the second region after North America, which is expected to dominate the global inflammatory disease biologics market with 34.5% in 2024

In Europe, the market for inflammatory diseases biologics expanded as a outcome of early diagnosis programs, widespread access to cutting-edge biologic treatments, and an increase in the prevalence of autoimmune illnesses. Rapid acceptance of cutting-edge biologics and biosimilars, significant R&D investment, and European Commission approvals further enhanced regional market expansion and treatment accessibility.

Owing to factors like new product launches and European Commission approvals. For instance, in February 2025, Biocon Biologics Ltd. announced that the European Commission had granted marketing authorization for YESINTEK, its ustekinumab biosimilar, approved for treating plaque psoriasis, psoriatic arthritis, and Crohn’s disease, marking a key milestone in expanding biologic access across Europe.

The Asia Pacific region is the fastest-growing region in the global inflammatory disease biologics market, with a CAGR of 7.7% in 2024

The Asia-Pacific inflammatory diseases biologics market grew rapidly due to a rising prevalence of autoimmune disorders, increasing healthcare investments, and government initiatives promoting early diagnosis and treatment access. The region's market expansion was further reinforced by strategic alliances, biotech innovation, and growing biologics production in China, Japan, South Korea, and India.

Japan’s inflammatory disease biologics market grew steadily, driven by rising autoimmune disease prevalence, new product launches, and PMDA approvals of advanced biologics and biosimilars. Strong R&D investment, strategic collaborations with global biopharma companies, and rapid adoption of next-generation inhibitors further supported market expansion. Owing to factors like PMDA approvals. For instance, in January 2025, Biocon Biologics announced that Japan’s PMDA had approved Ustekinumab BS [YD], a biosimilar to Stelara, developed by Biocon and commercialized by Yoshindo Inc., for treating psoriasis vulgaris and psoriatic arthritis, marking a key milestone in Japan’s biosimilar market.

Competitive Landscape

Top companies in the inflammatory disease biologics market include Amgen Inc., Novartis Pharmaceuticals Corporation, Johnson & Johnson, Pfizer Inc., F. Hoffmann-La Roche Ltd, GSK, AbbVie, Sanofi, Eli Lilly and Company, and Takeda Pharmaceuticals U.S.A., Inc., among others.

Amgen Inc.:Amgen Inc. is a leading biotechnology company with a strong presence in the inflammatory disease biologics market. The company’s key products, including Enbrel (etanercept) and AMJEVITA (adalimumab-atto), target autoimmune conditions like rheumatoid arthritis and psoriasis. Amgen focuses on biosimilar development, innovative biologics, and global partnerships, strengthening its position in advancing immunology therapies and expanding patient access worldwide.

Key Developments:

- In August 2025, Accord BioPharma, Inc. announced the commercial launch of IMULDOSA (ustekinumab-srlf), a biosimilar to STELARA, for chronic, immune-mediated inflammatory conditions, such as plaque psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis, offering prefilled syringes, marking a major milestone in affordable biologic access for inflammatory disease patients.

- In March 2025, Celltrion announced that the U.S. FDA had approved OMLYCLO (omalizumab-igec) as the first and only interchangeable biosimilar to XOLAIR (omalizumab), indicated for asthma, chronic rhinosinusitis with nasal polyps, IgE-mediated food allergy, and chronic spontaneous urticaria (CSU), expanding biologic treatment options for allergic and inflammatory diseases.

- In June 2025, the U.S. FDA approved Sanofi’s Dupixent (dupilumab) as the first and only targeted biologic therapy for adult patients with bullous pemphigoid (BP), marking a significant advancement in treating this rare and chronic autoimmune blistering skin disease.

- In May 2025, Biocon Biologics announced that the UK’s MHRA had granted marketing authorization for YESINTEK, its ustekinumab biosimilar, approved for treating moderate to severe plaque psoriasis in adults and children (6+ years), as well as psoriatic arthritis and Crohn’s disease, expanding biologic access in the UK.

Market Scope

| Metrics | Details | |

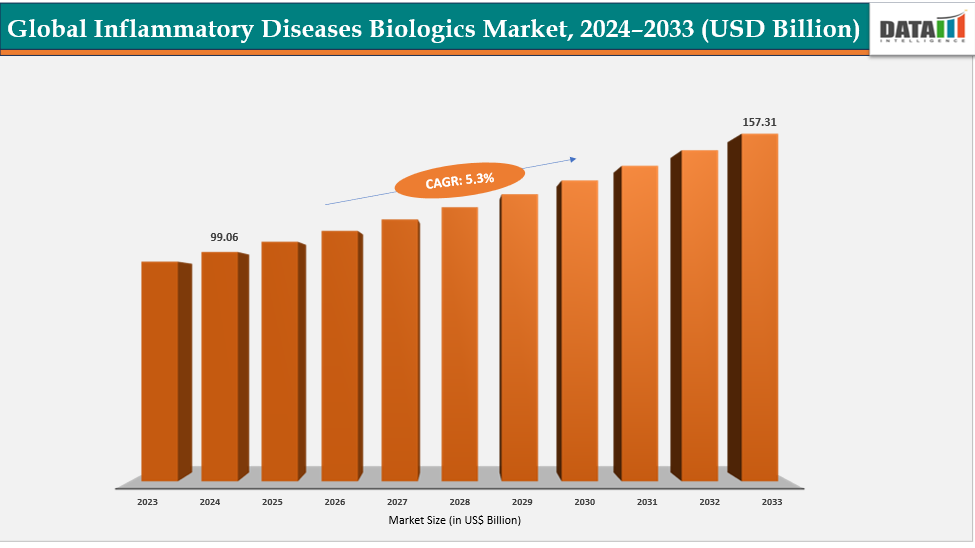

| CAGR | 5.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Anti-Tumor Necrosis Factor (TNF) inhibitors, Interleukin antagonists, Janus Kinase (JAK) inhibitors, Others |

| By Disease Indication | Rheumatoid Arthritis, Psoriasis, Inflammatory Bowel Disease, Ankylosing Spondylitis, Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global inflammatory diseases biologics market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here