Infectious Diseases Treatment Market Size & Industry Outlook

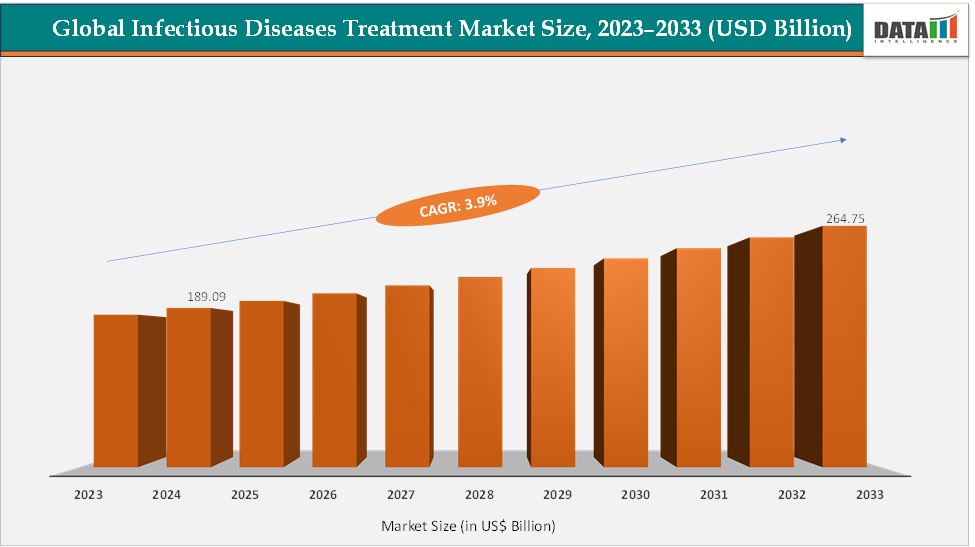

The global infectious diseases treatment market size reached US$ 189.09 Billion in 2024 from US$ 182.65 Billion in 2023 and is expected to reach US$ 264.75 Billion by 2033, growing at a CAGR of 3.9% during the forecast period 2025-2033. The market is witnessing strong growth driven by the rising global burden of antimicrobial resistance (AMR), which is predicted to cause 1.91 million annual deaths will be caused by 2050, and is pushing governments and pharma companies to invest in novel antibiotics and stewardship programs.

At the same time, the pandemic accelerated innovation in antivirals and vaccines, with products like Pfizer’s Paxlovid gaining FDA approval for high-risk COVID-19 patients and demonstrating the commercial viability of rapid-response therapies. Preventive biologics are also reshaping the landscape, for instance, AstraZeneca and Sanofi’s Beyfortus (nirsevimab) for RSV protection in infants opened a new monoclonal prophylaxis market. Together, these dynamics, such as AMR-driven demand, breakthrough antivirals, novel monoclonals, and platform-based vaccine expansion, are fueling sustained R&D pipelines, regulatory support, and procurement programs that underpin market growth.

Key Market Highlights

- North America dominates the infectious diseases treatment market with the largest revenue share of 43.17% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.2% over the forecast period.

- Based on infection type, the viral infections segment led the market with the largest revenue share of 44.71% in 2024.

- The major market players in the infectious disease treatment market are Pfizer Inc., AbbVie, Gilead Sciences, Inc., Merck & Co., Inc., Sandoz Group AG, B. Braun SE, Bayer AG, AstraZeneca, and Novartis AG, among others.

Market Dynamics

Drivers: The escalating antimicrobial resistance (AMR) crisis is significantly driving the infectious diseases treatment market growth

The escalating antimicrobial resistance (AMR) crisis is one of the most powerful growth drivers of the infectious disease treatment market, as resistance to existing therapies is rendering many standard antibiotics ineffective and creating urgent demand for new options. The World Health Organization (WHO) lists antimicrobial resistance as one of the top global public health and development threats. It is estimated that AMR was directly responsible for 1.2 million deaths worldwide in 2019 and that is likely to rise to 1.9 million annual deaths by 2050. Review on Antimicrobial Resistance, commissioned by the UK Government and Wellcome Trust and published in 2016, estimated that without intervention, the number of deaths associated with AMR globally will rise to 10 million by 2050 surpassing cancer as a leading cause of mortality.

Pharma companies are responding with novel antibiotic combinations and next-line therapies such as Pfizer’s Zavicefta (ceftazidime–avibactam) and Merck’s Zerbaxa (ceftolozane–tazobactam) have been approved for multidrug-resistant Gram-negative infections, offering new hope where older drugs fail. Similarly, Shionogi’s Fetroja (cefiderocol), approved for carbapenem-resistant infections, represents a breakthrough iron-chelating mechanism to overcome resistance. As a result, AMR has transformed from a clinical challenge into a commercial driver, stimulating continuous investment, regulatory acceleration, and product innovation that are significantly expanding the infectious disease treatment market.

Restraints: Rapid mutation and resistance of pathogens are hampering the growth of the market

Rapid mutation and resistance of pathogens act as a major restraint on the infectious disease treatment market by undermining the long-term effectiveness and commercial lifecycle of drugs and vaccines. Bacteria, viruses, and fungi evolve quickly, rendering therapies obsolete within a few years of launch and discouraging sustained investment. In viral diseases, constant mutations of influenza strains reduce the effectiveness of seasonal vaccines, requiring annual reformulation and limiting durable protection. A more recent instance is SARS-CoV-2, where rapid variant emergence reduced the efficacy of both monoclonal antibody treatments like Regeneron’s REGEN-COV and some first-generation vaccines, leading to product withdrawals and declining revenues.

Similarly, antifungal agents face rising resistance in Candida auris, a pathogen now classified as a serious global health threat by the CDC. These frequent resistance patterns increase costs, shorten product lifecycles, and force companies to invest continuously in pipeline updates without guaranteed returns. For healthcare systems, this creates procurement challenges, as drugs once considered gold standards quickly lose clinical utility. Consequently, the unpredictability of pathogen evolution hampers market stability, restricts long-term profitability, and makes infectious disease therapeutics less attractive compared to chronic disease segments with more predictable treatment outcomes.

For more details on this report – Request for Sample

Infectious Diseases Treatment Market, Segment Analysis

The global infectious diseases treatment market is segmented based on infection type, drug class, distribution channel, and region.

Infection Type: The viral infections segment is dominating the infectious diseases treatment market with a 44.71% share in 2024

The viral infections segment dominates the infectious disease treatment market primarily due to the high prevalence, chronic nature, and significant economic burden of viral diseases globally. Chronic viral infections such as HIV, hepatitis B and C, and seasonal infections like influenza contribute to sustained demand for long-term therapies, while the COVID-19 pandemic further accelerated market expansion through emergency antiviral and vaccine development. High-cost therapeutics and vaccines have amplified revenue potential, with products like Gilead’s Biktarvy and Truvada for HIV, ViiV Healthcare’s Juluca, and Merck’s Keytruda-adjacent antivirals addressing chronic viral infections, generating high annual sales.

The rapid development and commercial success of mRNA vaccines, such as Moderna’s mRNA-1273 and Pfizer-BioNTech’s BNT162b2 for COVID-19, showcased the potential of platform-based viral therapeutics, opening avenues for influenza, RSV, and other viral vaccines. Additionally, antiviral drugs like Pfizer’s Paxlovid and Merck’s Lagevrio (molnupiravir) provided effective outpatient treatment for high-risk COVID-19 patients, driving emergency procurement and high uptake in multiple regions. High investments in next-generation antiviral platforms, coupled with the need for rapid response to emerging viral outbreaks, maintain viral infections as the highest contributor in the market.

The bacterial infections segment is the fastest-growing in the infectious disease treatment market, with a 31.79% share in 2024

The bacterial infections segment is the fastest-growing in the infectious disease treatment market due to the urgent global threat of antimicrobial resistance (AMR), which has rendered many existing antibiotics ineffective and created high demand for novel therapies. Multidrug-resistant (MDR) Gram-negative and Gram-positive infections, including hospital-acquired infections like carbapenem-resistant Enterobacteriaceae (CRE), have accelerated the need for advanced antibacterial agents.

Approved products driving growth include Pfizer’s Zavicefta (ceftazidime–avibactam) and Merck’s Zerbaxa (ceftolozane–tazobactam), which treat complicated urinary tract and intra-abdominal infections caused by MDR bacteria. Additionally, Shionogi’s Fetroja (cefiderocol), a siderophore cephalosporin, addresses carbapenem-resistant infections, demonstrating innovative mechanisms to overcome resistance. The rising incidence of resistant bacterial infections globally, combined with higher treatment costs for advanced antibiotics, has accelerated revenue growth. Furthermore, emerging therapies such as bacteriophage-based treatments and adjunctive antimicrobial peptides are expanding the pipeline, positioning bacterial infections as the fastest-growing segment despite historical challenges in commercializing antibiotics.

Geographical Analysis

North America is expected to dominate the global infectious diseases treatment market with a 43.17% in 2024

North America dominates the global infectious disease treatment market due to a combination of strong regulatory infrastructure, advanced R&D capabilities, and a high prevalence of both chronic and acute infectious diseases. The region’s dominance is largely driven by the United States. The combination of high per capita healthcare spending, strong regulatory support, rapid adoption of innovative therapies, and ongoing AMR-driven demand ensures North America retains a dominant position in the global infectious disease treatment market. This dominance is expected to continue, underpinned by continued innovation, government incentives, and strong infrastructure for both acute and chronic infectious disease management.

US Infectious Diseases Treatment Market Trends

High prevalence of chronic viral infections, such as HIV and hepatitis C, fuels sustained demand for antiviral therapies, with FDA-approved products like Gilead’s Biktarvy, ViiV Healthcare’s Juluca, and Merck’s Keytruda-adjacent antivirals generating billions in annual revenue. The COVID-19 pandemic further reinforced North America’s leadership, with rapid regulatory approvals and mass vaccination campaigns for mRNA vaccines, including Pfizer-BioNTech’s BNT162b2 and Moderna’s mRNA-1273, alongside emergency-use antivirals such as Pfizer’s Paxlovid and Merck’s Lagevrio (molnupiravir).

In bacterial infections, the US benefits from both a high incidence of hospital-acquired multidrug-resistant infections and accelerated access to novel antibiotics, exemplified by FDA-approved therapies like Pfizer’s Zavicefta (ceftazidime-avibactam) and Merck’s Zerbaxa (ceftolozane-tazobactam) targeting multidrug-resistant Gram-negative pathogens. The US also leads in funding and adoption of advanced biologics, monoclonal antibodies, and next-generation vaccines, including prophylactic RSV monoclonals like Sanofi/AstraZeneca’s Beyfortus (nirsevimab).

The Asia Pacific region is the fastest-growing region in the global infectious diseases treatment market, with a CAGR of 5.2% in 2024

The Asia-Pacific region is the fastest-growing market for infectious disease treatments, driven by a combination of high disease burden, rising government investment, and increasing access to innovative therapies. The region bears a significant share of global infectious diseases, including tuberculosis, malaria, HIV, and multidrug-resistant bacterial infections, creating strong demand for both therapeutics and vaccines. Rapid economic growth in countries like China, India, and Southeast Asian nations has improved healthcare access and affordability, while rising awareness and government-led immunization programs are accelerating vaccine adoption.

The prevalence of multidrug-resistant infections has also stimulated demand for advanced antibiotics such as Shionogi’s Fetroja (cefiderocol) and hospital-targeted therapies in urban centers. Public-private partnerships and global initiatives, including WHO and Gavi-supported vaccination programs, are further expanding reach in both urban and rural populations. Collectively, the Asia-Pacific is fueled by growing disease prevalence, increasing awareness, and rapid adoption of new treatment platforms. These factors position the region as the fastest-growing hub for infectious disease treatments, particularly in vaccines, antivirals, and novel antibiotics addressing resistant pathogens.

Europe Infectious Diseases Treatment Market Trends

The infectious disease treatment market in Europe is experiencing steady growth, driven by rising antimicrobial resistance (AMR) and robust adoption of innovative therapeutics and vaccines. AMR is a significant concern, with the European Centre for Disease Prevention and Control (ECDC) reporting approximately 35,000 deaths annually due to resistant infections, prompting increased investment in novel antibiotics and stewardship programs. European regulators, particularly the European Medicines Agency (EMA), have accelerated approvals for high-value therapies, such as Pfizer’s Zavicefta (ceftazidime-avibactam) and Shionogi’s Fetroja (cefiderocol) for multidrug-resistant Gram-negative infections, and Gilead’s Biktarvy for HIV management.

Vaccine uptake has surged with EMA-approved products like Pfizer-BioNTech’s BNT162b2, Moderna’s mRNA-1273, and Sanofi Pasteur’s Vaxigrip Tetra influenza vaccine, supported by EU immunization programs and COVID-19 response campaigns. The region also emphasizes preventive biologics, exemplified by Beyfortus (nirsevimab) for RSV prophylaxis in infants, expanding the market for long-acting monoclonals. Europe’s aging population, rising chronic viral infections, and increasing prevalence of hospital-acquired resistant infections create sustained demand for high-cost, advanced therapies are driving consistent market growth, with Europe holding a significant share in both antibacterial and antiviral segments, while positioning itself as a hub for next-generation vaccines and biologics.

Competitive Landscape

Top companies in the infectious diseases treatment market include Pfizer Inc., AbbVie, Gilead Sciences, Inc., Merck & Co., Inc., Sandoz Group AG, B. Braun SE, Bayer AG, AstraZeneca, and Novartis AG, among others.

Market Scope

| Metrics | Details | |

| CAGR | 3.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Infection Type | Viral Infections, Bacterial Infections, Fungal Infections, and Parasitic Infections |

| Drug Class | Antibacterials, Antivirals, Antifungals, Antiparasitic Drugs, and Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global infectious diseases treatment market report delivers a detailed analysis with 59 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

- Bacterial Infectious Diseases Therapeutics Market

- Infectious Disease Testing Products Market

- Respiratory Infectious Disease Diagnostics Market

For more pharmaceuticals-related reports, please click here