Global Inductive Charging Market: Industry Outlook

The global inductive charging market reached US$7.16billion in 2023, with a rise to US$ 8.60 billion in 2024, and is expected to reach US$49.62billion by 2033, growing at a CAGR of 21.5% during the forecast period 2025–2033.

The global inductive charging market is growing steadily, fueled by the rising adoption of electric vehicles (EVs), consumer electronics, and industrial automation. The demand is supported by the push for convenience, reduced dependence on wired charging, and the global transition toward clean mobility. Technological advancements such as resonant inductive coupling, dynamic wireless charging for EVs, and integration with smart infrastructure are reshaping the industry. Strategic initiatives, government support, and collaborations between automakers and charging technology providers are accelerating market expansion.

The US leads the inductive charging market with strong policy support and rapid EV adoption. In 2023, Representative Haley Stevens of Michigan introduced the Wireless Electric Vehicle Charging Grant Program Act, aimed at establishing a US Department of Transportation (DOT) grant initiative to support dynamic wireless EV charging. Inspired by a pilot project in Michigan, this legislation seeks to position the US at the forefront of wireless charging innovation. Supported by federal initiatives, advanced R&D capabilities, and partnerships between technology providers and automakers, the US remains a pioneer in scaling inductive charging infrastructure.

Japan is also emerging as a key player, showcasing cutting-edge wireless EV charging technology. WiTricity, a global leader in wireless charging solutions, demonstrated its EV wireless charging technology across a variety of vehicles, highlighting the ease of charging by simply parking and charging. Such demonstrations underscore Japan’s commitment to technological innovation and consumer convenience. With strong government backing, automotive partnerships, and the presence of leading technology firms, Japan is expected to accelerate the adoption of inductive charging across both passenger vehicles and public infrastructure.

Key Market Trends & Insights

Asia-Pacific held the largest share of the global inductive charging market in 2024 and is expected to maintain its leadership throughout the forecast period. Growth in the region is supported by rapid EV adoption, favorable government policies promoting clean transportation, and large-scale investments in smart city and infrastructure projects. Countries such as China, Japan, and South Korea are at the forefront of integrating wireless charging into both mobility and consumer electronics. Japan, in particular, has showcased WiTricity’s wireless EV charging technology, reinforcing its commitment to advancing convenient and user-friendly charging solutions.

North America is anticipated to record the fastest growth rate, driven by strong policy initiatives, a surge in EV penetration, and innovative pilot programs in wireless charging. The introduction of the Wireless Electric Vehicle Charging Grant Program Act of 2023 by Representative Haley Stevens highlights the region’s proactive stance in building dynamic wireless charging infrastructure. With robust R&D capabilities, collaboration between automakers and technology providers, and increasing government support, North America is poised to accelerate its presence in the global market.

The inductive technology segment continues to dominate the market, owing to its extensive use across electric vehicles, consumer electronics, and industrial equipment. Its advantages such as safety, convenience, and the ability to charge without physical connectors make it the preferred choice for next-generation wireless power solutions. Expanding adoption across automotive, mobile devices, and healthcare applications ensures its central role in driving the future of wireless charging.

Market Size & Forecast

2024 Market Size: US$8.60Billion

2033 Projected Market Size: US$49.62Billion

CAGR (2025–2033): 21.5%

Asia-Pacific: Largest market in 2024

North America: Fastest-growing market

Drivers & Restraints

Driver: Rising EV Adoption and Government Incentives

The global inductive charging market is expanding rapidly, driven by the accelerating adoption of electric vehicles (EVs) and strong government support worldwide. Inductive charging offers a convenient, cable-free solution that enhances the user experience and supports large-scale EV penetration. Governments are introducing dedicated programs, subsidies, and infrastructure investments to build a robust wireless charging ecosystem, encouraging collaboration between automakers and technology providers.

For instance, in 2024, India launched the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE), a flagship EV incentive program running from October 2024 to March 2026 with a US$123.48million outlay. The scheme aims to accelerate EV adoption through buyer subsidies and build critical EV charging infrastructure, which is expected to open opportunities for inductive charging deployment in the country. Alongside Japan’s demonstration of WiTricity’s wireless charging technology, these initiatives underscore how rising EV adoption, backed by strong government incentives, is a key driver for the inductive charging market.

Restraint: High Installation Costs and Lower Efficiency

Despite its growing adoption, the inductive charging market faces constraints related to cost and efficiency. The infrastructure required for wireless EV charging—such as embedded road systems, specialized pads, and compatible vehicle receivers—entails high upfront investment, which slows widespread deployment. In addition, inductive systems often experience energy transfer losses, making them less efficient compared to conventional wired charging methods. These issues create concerns for both consumers and large-scale infrastructure planners.

For instance, several municipal projects evaluating dynamic wireless charging have noted significantly higher per-mile installation costs compared to traditional charging stations. Furthermore, efficiency drops during misalignment between the vehicle and the charging pad reduce charging reliability. Unless costs decline and efficiency improves through technological advancements, these factors will continue to act as barriers to mass-scale adoption of inductive charging.

For more details on this report : Request for Sample

Segmentation Analysis

The global inductive charging market is segmented based on technology, transmission range, component, application and region.

Technology: The Inductive segment accounts for an estimated 32.4% of the global inductive charging market.

Inductive charging represents the foundation of the wireless charging ecosystem, providing a seamless, contactless method to power electric vehicles, consumer electronics, and industrial devices. Companies in this segment are focused on improving coil design, alignment accuracy, and energy transfer efficiency to ensure safe, reliable, and scalable solutions. The technology is increasingly viewed as essential for enabling the next generation of mobility and smart infrastructure.

Market growth is being propelled by rapid EV adoption, increasing demand for cable-free charging in smartphones and wearables, and integration into automated and autonomous mobility systems. Leading providers such as WiTricity, Plugless Power, Momentum Dynamics, Qualcomm Halo, and InductEV dominate the space with advanced inductive platforms. For instance, InductEV, a global leader in high-power wireless charging for commercial EVs, recognized Tesla’s decision to implement low-power inductive wireless charging in its Robotaxi fleet, underscoring the industry’s growing acceptance of wireless charging as a critical enabler of future electric mobility across all vehicle types.

Looking forward, the inductive technology segment is expected to maintain its dominant role in the wireless charging market, supported by widespread adoption in the automotive sector, ongoing use in consumer electronics, and expanding applications in healthcare and industrial automation. Although challenges such as high infrastructure costs, lower efficiency compared to wired charging, and standardization barriers remain, advances in resonant coupling, modular charging designs, and system interoperability are anticipated to sustain strong growth and reinforce the segment’s leadership in the global market.

Geographical Analysis

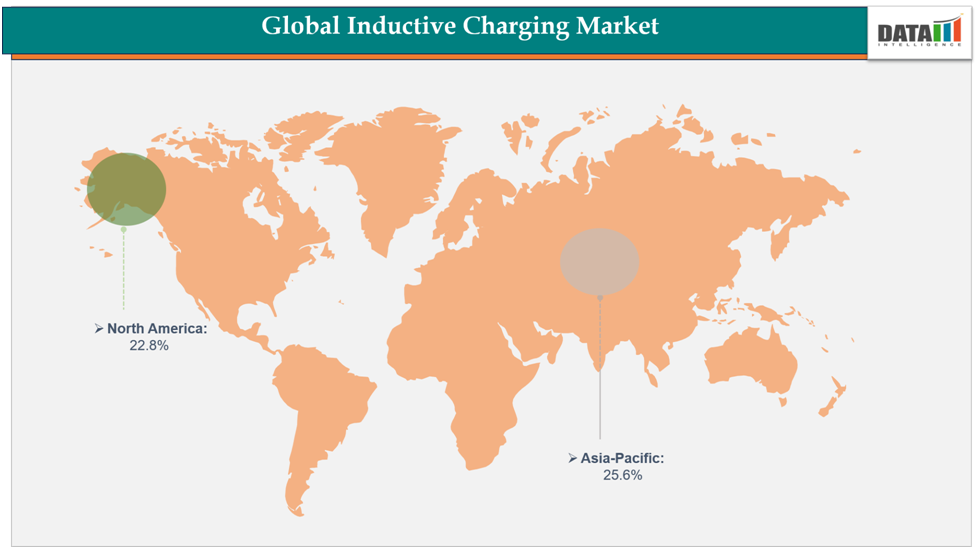

The Asia-Pacific inductive charging market was valued at 25.6% of the global market share in 2024

Asia-Pacific accounted for the largest share of the global inductive charging market in 2024 and is expected to retain its dominance throughout the forecast period. The region’s growth is primarily driven by rising EV adoption, supportive government policies, and large-scale investments in smart charging infrastructure. Countries such as China, Japan, and South Korea are leading this expansion through extensive collaborations between automakers, energy providers, and technology companies.

For example, Mitsubishi Motors Corporation (MMC), MC Retail Energy Co., Ltd., Kaluza Japan, and Mitsubishi Corporation officially launched an EV smart-charging service in 2024, leveraging connected technologies. Verified through a proof of concept (PoC) initiated in February 2024, the project enhanced both app functionality and service quality, highlighting Asia-Pacific’s leadership in advancing inductive and smart-charging ecosystems. Continued investments in infrastructure, strategic partnerships, and government-backed programs are expected to sustain the region’s dominant position in the global inductive charging market.

The North America inductive charging market was valued at 22.8% of the global market share in 2024

North America is projected to be the fastest-growing regional market, driven by advanced R&D, strong private-sector investments, and federal initiatives aimed at developing dynamic wireless charging infrastructure. Rising EV penetration and government-backed clean mobility programs are further fueling demand across the US and Canada.

For instance, Siemens invested US$25 million to acquire a minority stake in WiTricity, a US-based wireless charging technology leader. This collaboration aims to accelerate innovation in wireless EV charging, with the market in North America and Europe projected to reach US$ 2 billion by 2028. Federal funding programs, private investments, and strategic partnerships are expected to reinforce North America’s rapid growth trajectory, making it the fastest-growing region in the global inductive charging market.

Competitive Landscape

The major players in the inductive charging market include WiTricity Corporation, Volkswagen, Wifekin - PULS GmbH, InductEV, Inc., Qualcomm Incorporate, STMicroelectronics, Power mat, Electron, HEVO inc, Plugless Power Inc

WiTricity Corporation: WiTricity Corporation is a pioneering leader in the global inductive charging market, specializing in wireless power transfer technologies that enable seamless and efficient charging for electric vehicles (EVs). The company’s proprietary magnetic resonance technology delivers high-performance, standardized solutions that support passenger cars, commercial fleets, and future autonomous mobility ecosystems. Its flagship wireless charging platforms are designed to ensure fast, safe, and convenient energy transfer without physical connectors, advancing the transition toward next-generation electric mobility. With strong intellectual property, strategic collaborations with leading automakers, and investment partnerships with companies like Siemens, WiTricity continues to drive innovation in wireless charging infrastructure. By enabling broad adoption across EV segments, the company reinforces its role as a key enabler of the global smart mobility and electrification ecosystem.

Market Scope

Metrics | Details | |

CAGR | 21.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Technology | Inductive, Magnetic resonant, Radio frequency (RF) |

| Transmission Range | Low Power (Below 15W), Medium Power (15W to 50W), High Power (Above 50W) |

| Component | Transmitters, Receivers |

| Application | Automotive, Consumer Electronics, Industrial, Healthcare, Aerospace & Defense, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global inductive charging market report delivers a detailed analysis with 70 key tables, more than 64visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.