India Generators Market is segmented By Type (Diesel Generators, Diesel/Gas Hybrid Generator), By Power Rating (Less than 3 kVA, 3-5 kVA, 6-10 kVA, 11-25 kVA, 26-75 kVA, 76-100 kVA, 101-375 kVA, 376-750 kVA, Above 750 kVA), By End User (Residential, Commercial, Industrial, Others), and By Country (India, North India, North Central Zone, Central Zone, East Zone) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

India Generic Drugs Market Size

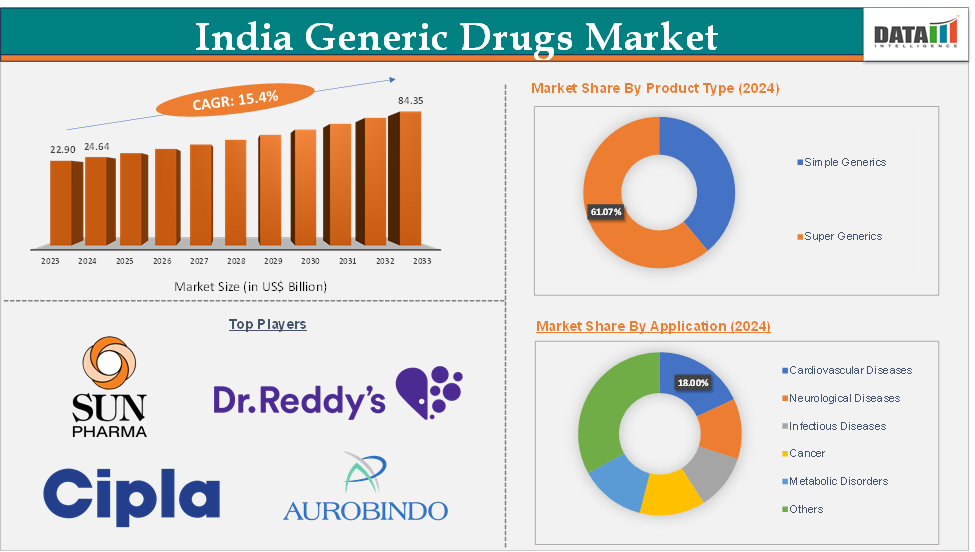

The India generic drugs market size reached US$ 24.64 Billion in 2024 from US$ 22.90 Billion in 2023 and is expected to reach US$ 84.35 Billion by 2033, growing at a CAGR of 15.4% during the forecast period 2025-2033.

India Generic Drugs Market Overview

India is the largest supplier of generic medicines, holding a 20% share in the global supply by manufacturing 60,000 different generic brands across 60 therapeutic categories. As of 2023, generic drugs constitute approximately 70% of the total pharmaceutical market in India. This rising demand for generic drugs in India is accelerating the market growth.

The Pharmaceutical and Medical Device Bureau of India plans to expand these generic drug stores to 25,000 by 2026. Thus, the expanding generic drug stores boost the sales of the various generic drugs, which is driving the market.

The India generic drugs market stands as a cornerstone of the country’s pharmaceutical industry, offering immense growth potential fueled by demographic trends, favorable government policies, and India’s manufacturing expertise. Addressing quality perception challenges, improving regulatory harmonization, and leveraging technological innovations will be critical for sustaining long-term growth and global leadership in generics.

India Generic Drugs Market Executive Summary

India Generic Drugs Market Dynamics

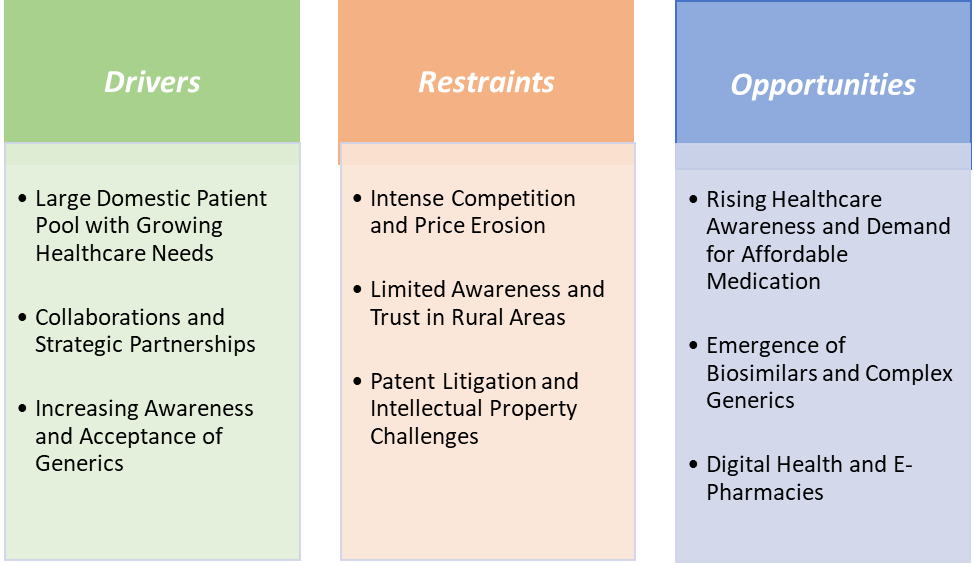

Drivers:

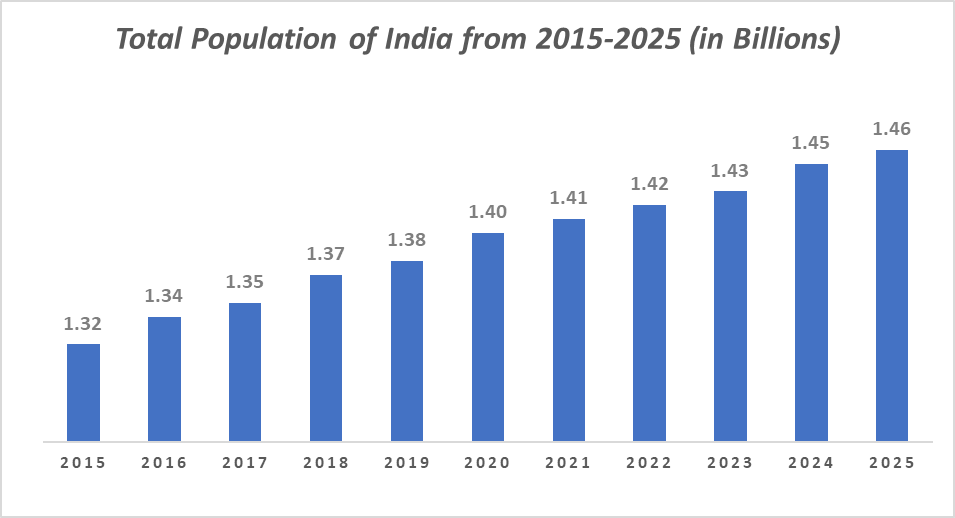

India’s vast and growing population of over 1.46 billion people creates a massive domestic demand for affordable healthcare solutions, especially generic medicines. The country faces a high burden of chronic and infectious diseases, including diabetes, cardiovascular diseases, respiratory illnesses, and tuberculosis, which require long-term, consistent medication.

According to the Indian Council of Medical Research (ICMR), more than 77 million people in India have diabetes, and cardiovascular diseases account for over 28% of total deaths in the country. These chronic conditions necessitate continuous, cost-effective medication, largely provided by generics. Additionally, India reports high incidences of infectious diseases such as tuberculosis (about 2.7 million cases annually, the highest globally) and HIV, which require affordable drug regimens, while generics serve as the backbone for treatment affordability and accessibility.

With around 70% of healthcare expenses being out-of-pocket for patients, generics offer an economical alternative to branded drugs, helping reduce the financial burden on families. For instance, generic antiretroviral drugs for HIV treatment cost up to 90% less than branded equivalents, facilitating wider access.

According to the National Institute of Health, India records over 1.3 million new cancer cases annually, with projections indicating a rise to nearly 1.7 million by 2035. Indian companies’ ability to manufacture affordable, quality generic oncology drugs and biosimilars is expanding treatment access and fueling market growth.

Recent data from the Longitudinal Ageing Survey in India (LASI) indicates that 21% of the elderly population in India suffers from at least one chronic condition, with urban areas showing a higher prevalence (29%) compared to rural areas (17%). Hypertension and diabetes are the most prevalent, together accounting for about 68% of all chronic diseases among the elderly. Cardiovascular diseases affect 37% of individuals above 75 years, while bone or joint diseases and chronic lung diseases are also significant concerns. These rising chronic diseases among the elderly population are accelerating the growth of the generic drugs, which offer affordable healthcare.

Restraints:

Intense competition and price erosion are hampering the growth of the India generic drugs market

Numerous players often compete on price rather than innovation or differentiation, forcing companies to reduce prices aggressively to maintain or grow market share. This continual price undercutting compresses profit margins.

The National Pharmaceutical Pricing Authority (NPPA) regularly sets price ceilings on essential medicines, further restricting the ability of companies to maintain healthy margins amid competition. Lower profitability discourages pharmaceutical companies from investing heavily in research, development, and advanced manufacturing technologies needed for complex generics or biosimilars.

Smaller or less efficient firms often struggle to survive, leading to market consolidation but also reducing competition in the long term. While intense competition ensures affordable drugs for consumers, the resulting price erosion limits profitability for generic drug makers, curtailing their capacity to invest in innovation and expand. This dynamic poses a key restraint to sustainable growth in India’s generic drugs market.

Opportunities:

Digital health and E-pharmacies create a market opportunity for the India generic drugs market

India has over 900 million internet users and a rapidly growing base of smartphone users, fueling access to digital health platforms and online pharmacies. This digital reach makes healthcare and medicines, especially affordable generics, more accessible to urban and rural populations alike. Digital platforms provide clear pricing and often offer discounts or subscription-based models for generic drugs, making them highly attractive to price-sensitive Indian consumers. This encourages higher adoption of generics over branded drugs.

According to the National Institute of Health, at present, India has about 50+ E-pharmacy spaces providing quality and affordable medicines to about 5,000,000 patients per month across the country. E-pharmacies like PharmEasy, 1mg, Netmeds, and Medlife offer doorstep delivery of medicines, including generic drugs, reducing the need to visit physical pharmacies. This convenience is especially beneficial for chronic disease patients who require regular medication refills.

India Generic Drugs Market Trends

For more details on this report – Request for Sample

India Generic Drugs Market, Segment Analysis

The India generic drugs market is segmented based on product type, route of administration, application, and distribution channel.

The cardiovascular diseases segment from the application reached US$ 4.44 Billion in 2024 in the India generic drugs market

Cardiovascular diseases are the leading cause of mortality in India, accounting for over 28% of all deaths according to the World Health Organization (WHO). According to the study conducted by the National Institute of Health, the prevalence of CVD among adults aged 60 years and above in India was 33.6%. Similarly, the growing incidence of hypertension, coronary artery disease, and stroke due to urbanization, sedentary lifestyles, and dietary changes drives massive demand for cardiovascular generic medications.

According to the Indian Heart Association, 50% of all heart attacks in Indian men occur under 50 years of age, and 25% of all heart attacks in Indian men occur under 40 years of age. This creates a huge and steady market for affordable treatment options, which is driving the demand for generic drugs.

As the CVD cases are rising in India, major and emerging market players are focusing on cardiovascular generic medications. For instance, in March 2025, Alkem Laboratories launched generic empagliflozin and its combinations in India under the brand name “Empanorm.” The company has priced the product approximately 80 per cent lower than the innovator products. Empagliflozin is a Sodium-Glucose Co-Transporter-2 (SGLT-2) inhibitor used in the treatment of chronic heart failure (HF).

Similarly, in May 2025, Medkart introduced a game-changing innovation, India's first room-temperature stable generic Nicorandil tablets, making heart medication more accessible, affordable, and logistically convenient.

India Generic Drugs Market Competitive Landscape

Top companies in the India generic drugs market include Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Cipla, Lupin, Aurobindo Pharma Limited., Biocon Limited, Alkem, Zydus Pharmaceuticals, Inc., GLENMARK PHARMACEUTICALS LTD., and NATCO Pharma Limited, among others.

India Generic Drugs Market, Key Developments

In April 2025, Camber launched 13 new generic products in the first quarter of 2025. With strong momentum, Camber is on track to introduce more than 60 new medications this year, strengthening their mission to improve access and affordability across the healthcare landscape.

In March 2025, Mankind Pharma launched the generic version as well as its fixed dose combination (FDCs) of diabetes drug empagliflozin in India, at a 90% discount to the originator, Boehringer Ingelheim’s drug, Jardiance.

India Generic Drugs Market Scope

Metrics | Details | |

CAGR | 15.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Simple Generics and Super Generics |

Route of Administration | Oral, Topical, Injectable, Inhalers, and Others | |

Application | Cardiovascular Diseases, Neurological Diseases, Infectious Diseases, Cancer, Metabolic Disorders, Gastrointestinal Diseases, Respiratory Diseases, Musculoskeletal Disorders, Dermatological Conditions, and Others | |

Distribution Channel | Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies | |

DMI Insights on the India Generic Drugs Market

According to the DMI analysis, the India generic drugs market size reached US$ 24.64 Billion in 2024 and is expected to reach US$ 84.35 Billion by 2033, growing at a CAGR of 15.4% during the forecast period 2025-2033.

The Indian generic drugs market stands as one of the fastest-growing segments within the pharmaceutical industry, driven by the country’s strong manufacturing base, cost competitiveness, and expanding domestic healthcare needs. With India’s large population and rising prevalence of chronic diseases such as cardiovascular conditions, diabetes, and cancer, there is a sustained and growing demand for affordable generic medicines.

The government’s proactive policies and initiatives, including the Jan Aushadhi scheme and Ayushman Bharat, further support generic drug adoption by improving access to affordable medicines for lower-income groups and rural populations. Additionally, the rapid digital transformation and growth of e-pharmacies have significantly expanded the reach of generic drugs, particularly in semi-urban and rural areas.

India’s pharmaceutical industry benefits from a deep-rooted expertise in generic drug manufacturing, bolstered by skilled labor, low production costs, and robust export capabilities. The country is a major supplier of generics worldwide, especially to regulated markets such as the US and Europe, where demand for off-patent drugs continues to grow.

Despite its strengths, the market faces challenges that may temper growth. Intense competition among numerous players results in aggressive price erosion, squeezing margins, and profitability. Quality perception issues and regulatory hurdles, both domestically and for exports, require continuous investment in compliance and manufacturing standards.

The India generic drugs market report delivers a detailed analysis with 42 key tables, more than 39 visually impactful figures, and 125 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here