Global in-Silico Clinical Trials Market Size & Industry Outlook

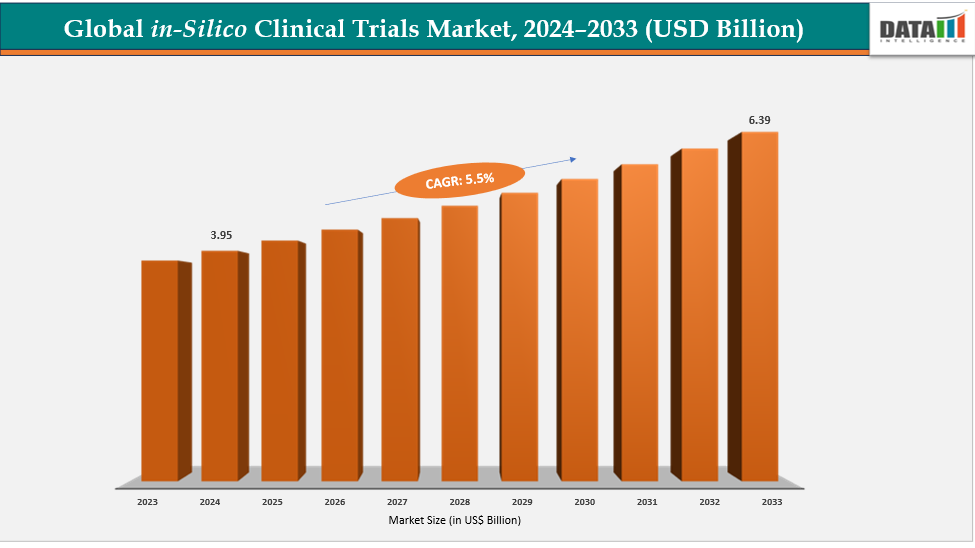

The global in-Silico clinical trials market size reached US$ 3.76 Billion in 2023 with a rise of US$ 3.95 Billion in 2024 and is expected to reach US$ 6.39 Billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The ability to rapidly replicate intricate biological and chemical processes is made possible by advances in computing power. To forecast the safety and effectiveness of drugs, AI algorithms examine vast datasets. Model accuracy is increased by expanding access to clinical and real-world data. Due to these variables, medication development is more rapid and less costly. Virtual trials help pharmaceutical companies cut expenses and time to market. It is advantageous for medtech companies to simulate device performance prior to human testing. Utilizing in-silico tools, contract research organizations (CROs) provide cutting-edge services. Investments in software and platforms are driven by strong commercial interest. Model-informed evidence is slowly being acknowledged by regulatory bodies.

Key Highlights

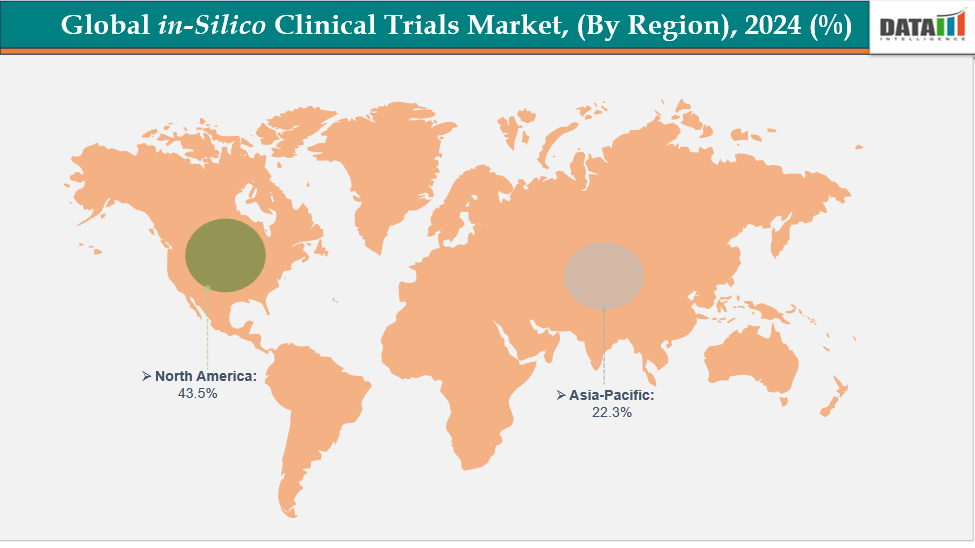

- North America dominates the in-silico clinical trials market with the largest revenue share of 43.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.4% over the forecast period.

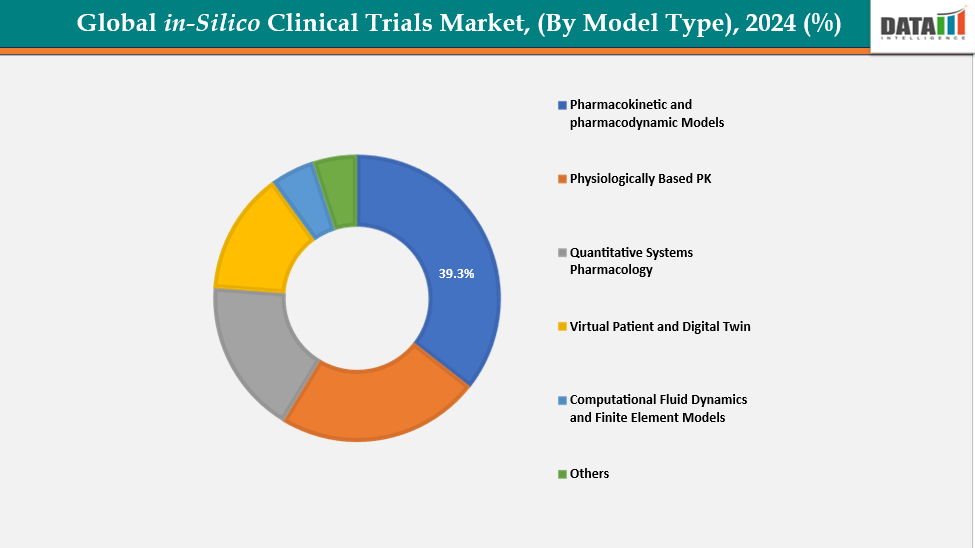

- The pharmacokinetic and pharmacodynamic models from model type is dominating the in-Silico clinical trials market with a 39.3% share in 2024

- The drug development segment from application is dominating the in-Silico clinical trials market with a 41.3% share in 2024

- Top companies in the in-Silico clinical trials market include Certara, Dassault Systèmes, InSilicoTrials Technologies, Nova, Insilico Medicine, The AnyLogic Company, Simulations Plus, VeriSIM Life, Physiomics Plc, and ANSYS, Inc., among others.

Market Dynamics

Drivers: Increased research and development spending in pharma and biotech is significantly driving the in-Silico clinical trials market growth

The in-silico clinical trials market is driven by increased research and development (R&D) expenditures in biotechnology and pharmaceutical businesses. Companies are pushed to look for quicker and more affordable solutions by growing R&D budgets. Large-scale physical experiments are not always necessary thanks to in-silico trials. They reduce the risk to patients and save time and money. To forecast results and optimize drug candidates sooner, biotech companies are employing computer modeling. Investment in cutting-edge AI platforms and simulation tools is made possible by increased spending.

Owing to factors like increased research and development spending in pharmaceutical and biotechnology companies in in-silico clinical trials. For instance, in June 2024, Veritas In-Silico Inc. achieved a key milestone in its collaborative research with Takeda Pharmaceutical Company. Using its proprietary ibVIS platform, the partnership advances small-molecule drugs targeting mRNA for multiple disease-related genes, strengthening innovation in in-silico drug discovery.

Restraints: Model credibility and validation requirements are hampering the growth of the in-Silico clinical trials market

The market expansion for in-silico clinical trials is being impeded by model believability and validation requirements. Before approving simulation-based results, regulatory bodies expect clear, dependable, and reproducible models. This necessitates thorough validation to guarantee that virtual models correctly forecast real-world events. This procedure is expensive, time-consuming, and technically challenging.

Furthermore, businesses face uncertainty due to the absence of globally recognized frameworks and disparate assessment standards among regulatory agencies. Additionally, many firms lack the know-how to carry out validation in accordance with stringent requirements.

For more details on this report, see Request for Sample

In-Silico Clinical Trials Market, Segment Analysis

The global in-Silico clinical trials market is segmented based on model type, application, clinical phase, end user and region

By Model Type: The pharmacokinetic and pharmacodynamic models from model type is dominating the in-Silico clinical trials market with a 39.3% share in 2024

The market for in-silico clinical trials is dominated by the pharmacokinetic (PK) and pharmacodynamic (PD) models. They are extensively employed in medication development. The movement of medicines through the body is studied by PK models. PD models examine the physiological effects of medicines. When combined, they aid in the prediction of dose-response relationships. PK/PD data is accepted by regulators for use in making decisions. They lessen the necessity of lengthy human testing. These models are established and thoroughly tested.

Moreover, new software and product launches in pharmacokinetic (PK) and pharmacodynamic (PD) models for in-Silico trials make it dominant. For instance, in June 2025, Certara, Inc. launched Phoenix version 8.6, the industry-leading PK/PD and toxicokinetic modeling software. Widely used by over 75 of the top 100 pharmaceutical companies, Phoenix supported evaluations by 11 regulatory agencies, including the FDA, PMDA, and NMPA. The update emphasized enhanced efficiency and computational power.

By Type: The drug development segment from application is dominating the in-Silico clinical trials market with a 41.3% share in 2024

The market for in-silico clinical trials is dominated by the drug development sector. In both the preclinical and clinical stages, it is extensively utilized. It is used by businesses for exposure-response prediction and dose selection. Large patient cohorts are not as necessary with virtual models. Timeliness and development expenditures are reduced as a result. Model-informed approaches to drug development are becoming more and more accepted by regulators. In drug research and development, PK/PD and PBPK models are frequently used. They aid in safety and efficacy prediction. Accuracy is increased by AI and mechanistic modeling. Early decision-making and risk assessment are discussed in the section.

Moreover, agreement, partnership, and collaboration between pharma companies and in-Silico software companies fuel the market. For instance, in March 2023, Premier Research and InSilicoTrials signed an agreement to collaborate on drug development, leveraging in-silico modeling and simulation to optimize regulatory pathways for rare disease therapies, enabling faster, safer, and more efficient development of new treatments.

In-Silico Clinical Trials Market, Geographical Analysis

North America is expected to dominate the global in-silico clinical trials market with a 43.5% in 2024

The market for in-silico clinical trials is dominated by North America because of its sophisticated pharmaceutical infrastructure, robust R&D capabilities, and early embrace of computer modeling and artificial intelligence. The region's market is expanding due to high investment in drug research, regulatory support for model-informed approaches, and the need for quicker, more affordable clinical trials.

The U.S. is leading the in-silico clinical trials market with strong regulatory support, advanced computational infrastructure, rapid AI adoption, and efficient and innovative drug development approaches. Moreover, FDA-hosted workshops for in-Silico trials make it a market dominance.

For instance, in August 2024, the FDA and the Clinical Trial Transformation Initiative (CTTI) hosted a workshop on Artificial Intelligence in Drug & Biological Product Development, focusing on innovations and best practices in clinical trials, reviewing over 300 AI-inclusive submissions, and advancing AI regulatory science through Model Informed Drug Development.

Europe is the second region after North America which is expected to dominate the global in-Silico clinical trials market with a 34.5% in 2024

The in-silico clinical trials market in Europe is expanding rapidly, led by Germany, the UK, and France, supported by advanced computational infrastructure and high AI adoption. Moreover, strong EMA and EU regulatory support and growing company collaborations and agreements promote efficient, innovative, and cost-effective drug development. For instance, in September 2024, the In-Silico World project, a four-year European Commission-funded collaboration, concluded with its final meeting, highlighting key resources and strategies developed to reduce barriers and accelerate the adoption of computer modeling and simulation in derisking new medical products.

Germany’s leadership in the in-silico clinical trials market is driven by strong regulatory frameworks, advanced computational research, and government-backed initiatives. The BVL supports AI-driven modeling, simulation, and model-informed drug development, promoting efficient, ethical, and innovative drug evaluation and approval processes.

The Asia Pacific region is the fastest-growing region in the global in-silico clinical trials market, with a CAGR of 7.4% in 2024.

The in-silico clinical trials market in the Asia-Pacific region, including China, India, Japan, and South Korea, is expanding rapidly. Growth is driven by rising AI adoption, government-backed digital health initiatives, improved research infrastructure, and increasing awareness of simulation-based drug development to enhance clinical efficiency, reduce costs, and accelerate innovation.

India’s in-silico clinical trials market is expanding rapidly, driven by strong government initiatives promoting AI and digital health, increasing pharma R&D investment, and collaborations enhancing computational modeling for faster, cost-effective, and data-driven drug development and regulatory innovation. Owing to factors like government initiatives. For instance, in May 2023, InSilicoTrials and InSilicoMinds (Ikiminds Pvt. Ltd.) met with the Deputy Drugs Controller of India to discuss advancements in artificial intelligence, modeling, and simulation, exploring their potential to enhance the pharmaceutical, life sciences, and medical device industries.

In-Silico Clinical Trials Market Competitive Landscape

Top companies in the in-Silico clinical trials market include Certara, Dassault Systèmes, InSilicoTrials Technologies, Nova, Insilico Medicine, The AnyLogic Company, Simulations Plus, VeriSIM Life, Physiomics Plc, and ANSYS, Inc., among others.

Certara: Certara is a global leader in biosimulation and AI-driven drug development, offering advanced modeling and simulation solutions to enhance clinical trial efficiency. Their platforms, such as Simcyp and Phoenix, enable virtual clinical trials, optimizing dosing, safety, and efficacy assessments. Trusted by over 2,600 companies worldwide, Certara's expertise accelerates regulatory submissions and supports informed decision-making across all stages of drug development

Key Developments:

- In May 2025, the FDA announced a strategic shift away from animal testing, noting that over 90% of drugs successful in animals failed human approval. The new roadmap emphasized new approach methodologies, including in vitro human-based systems, in-Silico modeling, and innovative platforms for assessing immunogenicity, toxicity, and pharmacodynamics.

- In November 2023, InSilicoTrials was awarded the prestigious 2023 Innovation Radar Prize by the European Commission in the AI and Smart Devices category, recognizing its pioneering use of in-silico technology to revolutionize drug and medical device development.

- In September 2023, Nova announced the successful prospective prediction of AstraZeneca’s Phase III FLAURA2 trial using its AI-driven jinkō platform, marking a first-of-its-kind achievement in in-silico clinical trial simulation to optimize next-generation trial design.

- In May 2023, InSilicoTrials and IBSA Group partnered to advance clinical trials using in-silico medicine, combining AI and simulation tools with IBSA’s expertise in reproductive medicine and hyaluronic acid-based products to revolutionize drug and medical device development processes.

Market Scope

| Metrics | Details | |

| CAGR | 5.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Model Type | Pharmacokinetic and pharmacodynamic Models, Physiologically Based PK, Quantitative Systems Pharmacology, Virtual Patient and Digital Twin, Computational Fluid Dynamics and Finite Element Models and Others |

| By Application | Drug Development, Medical Device Evaluation, Regulatory Submissions, Post-Market Surveillance and Others | |

| By End User | Pharmaceutical and Biotech Companies, Medical Device Manufacturers, Academic and Research Institutes, contract research organizations, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global in-Silico clinical trials market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here