In-Mold Labels Market Size

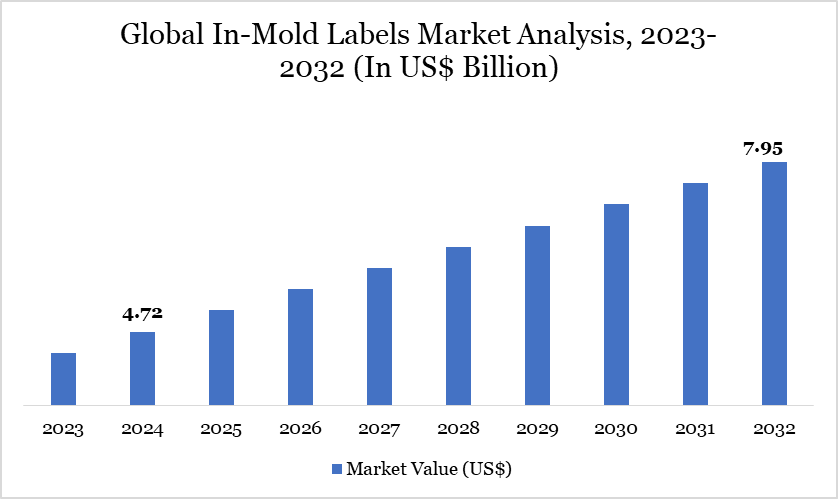

In-Mold Labels Market Size reached US$ 4.72 billion in 2023 and is expected to reach US$ 7.95 billion by 2031, growing with a CAGR of 6.73% during the forecast period 2025-2032.

As in-mold labels are permanent package components, they appear seamless. Owing to their increased durability, the labels can be used in a variety of adverse environments, including low temperatures and liquid exposure. It also helps to maintain crucial descriptions like usage instructions, key ingredients and other product characteristics intact.

The restrictive regulatory environment for product labeling, safety requirements and traceability demands pushes global usage of in-mold labels. In-mold labels help brand owners meet regulatory standards by integrating essential product information, regulatory symbols and tamper-evident elements into packaging containers.

In 2024, North America was the second-dominant region with about 25% of the global in-mold labels market. North America has a robust consumer packaged goods (CPG) market, which includes food & beverages, personal care products, pharmaceuticals, and household items. The increasing consumption of these items supports the demand for in-mold labels, which provide greater shelf appeal, branding prospects, and product differentiation.

In-Mold Labels Market Trend

The global in-mold labels (IML) market is experiencing significant growth, driven by government regulations and initiatives promoting sustainable and compliant packaging solutions. In the US, the Food and Drug Administration (FDA) enforces stringent labeling requirements to ensure consumer safety, leading to increased adoption of durable and integrated labeling methods like IML.

The European Union's Packaging and Packaging Waste Directive mandates that all packaging be recyclable or reusable by 2030, encouraging the use of eco-friendly labeling solutions such as IML. In the Asia-Pacific region, countries like Japan and South Korea have implemented policies to reduce packaging waste, further propelling the demand for sustainable labeling technologies. These regulatory frameworks are collectively fostering the expansion of the IML market by emphasizing environmental responsibility and product safety.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

By Material | Polypropylene, Polyethylene, Polyvinyl Chloride (PVC), ABS Resins, Others |

By Technology | Extrusion Blow Molding, Injection Molding, Thermoforming, Others |

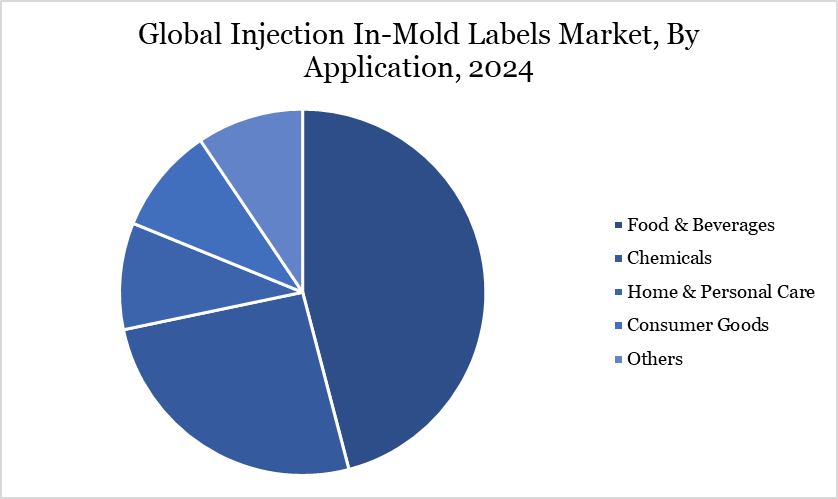

By Application | Food and Beverages, Chemicals, Home & Personal Care, Consumer Goods, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

In-Mold Labels Market Dynamics

Increased Decorating Options

In-mold labeling gives the user with more decorative options than other methods. The labels are strong and resilient, able to endure severe handling and shipment-induced scuffing, give maximum print quality, offer a wide range of appearance and feel options and allow for quick design changes. Manufacturers are increasingly relying on in-mold labeling technologies to improve brand awareness, product differentiation and customer engagement.

In August 2024, nnovia Films, a major producer of BOPP films, has launched RayoForm ELR70, a new film for large-format in-mold labeling containers. This five-layer semi-cavitated film, with one side matt and one side gloss, offers a reduction in density versus standard white films. The two-side treatment allows for the control of anti-static levels for the high-speed sheet feeding and molding process, giving optimal print and molding performance.

High Investments and Complexity

Implementing in-mold labeling frequently necessitates a considerable initial investment in specialized equipment, molds and technology. It can function as a barrier for smaller businesses or those with restricted funds, limiting their ability to enter or expand in the market. In-mold labeling is not generally applicable to all packaging materials or manufacturing methods.

Certain materials, like glass or metal, may not be appropriate for in-mold labeling, limiting their use in a variety of sectors and products. In-mold labeling necessitates perfect coordination among label design, mold manufacture and injection molding operations. Ensuring accurate alignment, adhesion and quality control throughout the manufacturing process can be difficult and may need specialised skills.

In-Mold Labels Market Segment Analysis

The global in-mold labels market is segmented based on material, technology, application and region.

Rising Aesthetic Value of Packaging in the Food & Beverage Sector

The food & beverages segment is expected to be the dominant segment with over 1/4th of the market during the forecast period 2025-2032. With regard to the importance of packaging aesthetics in the food & beverage industry, in-mold labeling is expected to be widely used. Packaging increases the shelf life of items and attracts potential buyers. The improved barrier makes in-mold labeling useful for the food and beverage industries by extending the shelf life of packaged foods.

Muller Technology, a manufacturer of molds and automation solutions for thin wall packaging, stated in September 2022 that its in-mold labelling automation technology would be used in sustainable injection molding packaging. The technology is introduced to produce a 100% monomaterial container composed of totally recyclable polypropylene, together with a wrap-around and bottom polypropylene-based label.

In-Mold Labels Market Geographical Share

Growing Demand for Customized Labels in Asia-Pacific

Asia-Pacific is the dominant region in the global in-mold labels market covering over 30% of the market. In-mold labels are extremely customisable, which is expected to increase demand for innovative, personalized and premium labels in the region. Companies in the region foresee an increase in demand for in-mold labels, prompting them to enter the market or expand their manufacturing capacity.

In India, the packaging industry is growing at over 18% annually, driven by demand for premium consumer goods, according to the Indian Institute of Packaging (IIP). China’s Ministry of Ecology and Environment has introduced new rules requiring 30% of plastic packaging to be recyclable by 2025. Japan’s Circular Economy policy encourages the use of sustainable packaging materials to reduce landfill waste by 25% by 2030. ASEAN nations are promoting smart labeling under regional trade agreements to improve product traceability and labeling compliance.

Sustainability Analysis

The global in-mold labels (IML) market is increasingly aligning with sustainability goals, driven by government regulations and initiatives promoting eco-friendly packaging solutions. For instance, the European Union's Packaging and Packaging Waste Directive mandates that all packaging be recyclable or reusable by 2030, encouraging the adoption of sustainable labeling practices like IML. In the US, the US Plastics Pact aims to ensure that all plastic packaging is reusable, recyclable, or compostable by 2025, further supporting the shift towards sustainable labeling solutions.

Additionally, the Asia-Pacific region is witnessing increased governmental activities toward a more sustainable economy, with initiatives like ANZPAC promoting a circular economy where packaging waste is minimized. These regulatory frameworks are propelling the demand for in-mold labels, which offer recyclability and reduced material usage, contributing to global sustainability efforts.

In-Mold Labels Market Major Players

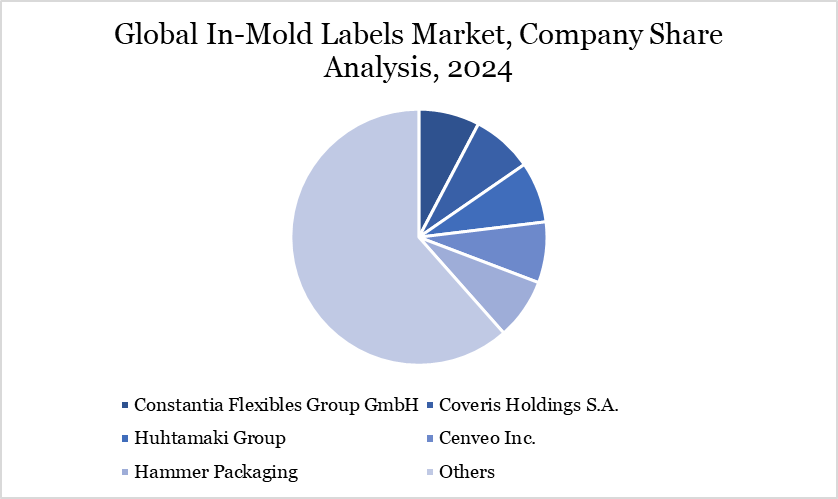

The major global players in the market include CCL Industries, Inc., Constantia Flexibles Group GmbH, Coveris Holdings S.A., Huhtamaki Group, Cenveo Inc., Hammer Packaging, Fuji Seal International Inc., Avery Dennison Corporation, Innovia Films Ltd. and Inland.

Key Developments

In 2024, Mold-Tek Packaging Limited invested in a Durst RSCi 510mm press with priming and varnishing stations to transform digital printing for in-mold labels.

In 2023, SABIC teamed up with three in-mold labeling experts to show the use of certified sustainable polypropylene resins in mono-PP thin-wall container packaging without sacrificing quality, processability, safety or convenience. The single-step IML method decorates the part inside the injection mold, making the label an integrated part of the packaging.

In 2023, Multi-Color Corporation, one of the world's major label producers, is happy to announce the acquisition of Korsini, a leading in-mold label solutions provider based in Turkey.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies