Antifibrinolytic Drugs Market Size & Industry Outlook

Increasing surgical procedures and an aging demographic are greatly boosting the market for antifibrinolytic medications. With an increasing number of individuals receiving orthopedic, cardiovascular, and trauma-related surgeries, the need for efficient bleeding-control agents like tranexamic acid has risen. Elderly individuals are more vulnerable to ailments necessitating surgery and face a greater likelihood of significant blood loss, increasing the dependence on antifibrinolytics in clinical settings. Global healthcare systems are implementing standardized blood-management protocols, in which antifibrinolytic medications are crucial for decreasing transfusion requirements and enhancing patient safety.

Key Highlights

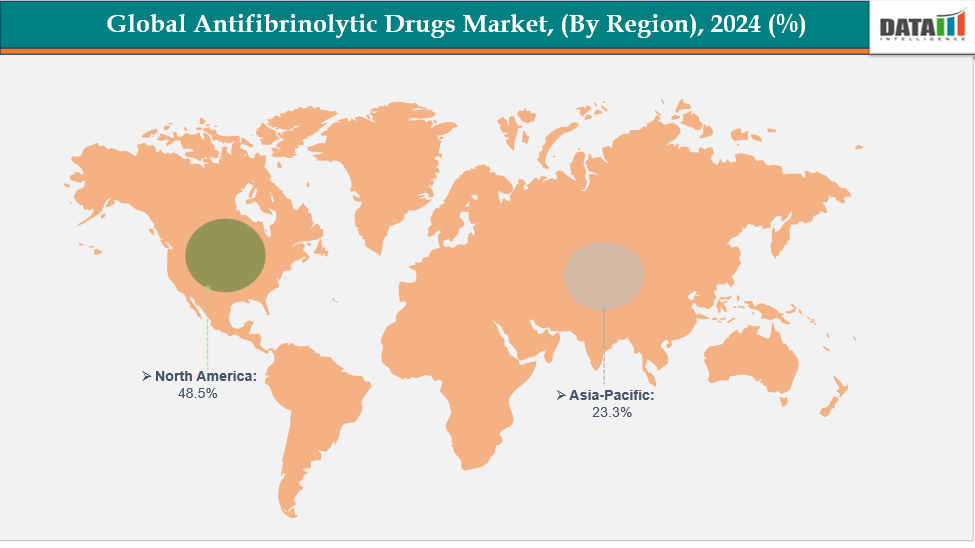

- North America is dominating the global antifibrinolytic drugs market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the Global Antifibrinolytic Drugs Market, with a CAGR of 7.7% in 2024.

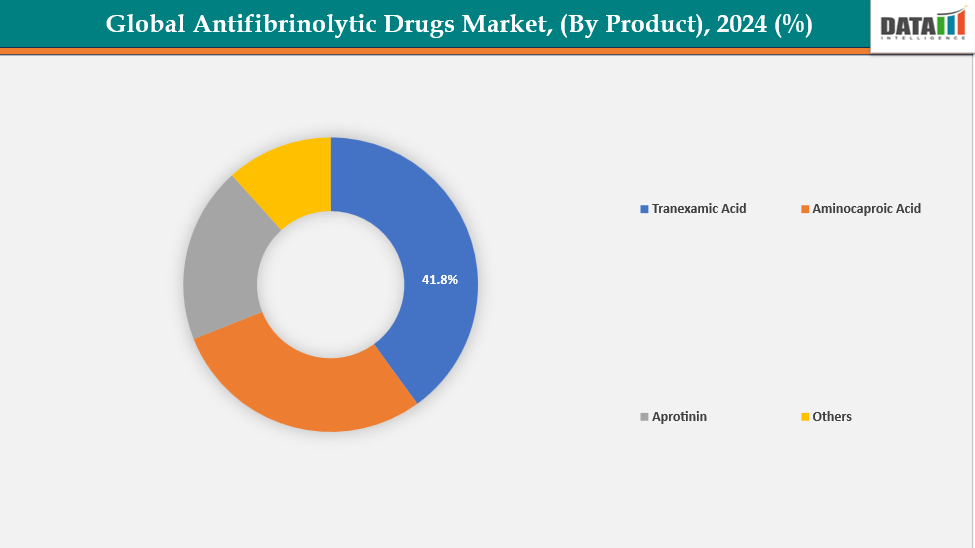

- The tranexamic acid segment is dominating the antifibrinolytic drugs market with a 41.8% share in 2024

- The gynecology segment is dominating the antifibrinolytic drugs market with a 40.2% share in 2024

- Top companies in the antifibrinolytic drugs market include Pfizer Inc., Ferring Pharmaceuticals Inc., XANODYNE PHARMACEUTICALS, INC., Bayer Pharmaceuticals Corporation, and Baxter, among others.

Market Dynamics

Drivers: Rising generic drug formulations are accelerating the growth of the antifibrinolytic drug market

The increasing accessibility of generic antifibrinolytic medications, particularly tranexamic acid, is driving market expansion by enhancing affordability and broadening availability in hospitals, surgical facilities, and emergency care environments. Generic competition reduces treatment expenses, facilitating broader utilization in low- and middle-income areas where price sensitivity is significant. Enhanced output from various manufacturers bolsters supply reliability and aids national procurement initiatives, especially in trauma and obstetric healthcare.

Moreover, the presence of oral, IV, and topical generic formulations also allows clinicians to choose cost-effective options tailored to different indications, boosting overall utilization. For instance, in June 2024, Avenacy announced the U.S. launch of its FDA-approved Tranexamic Acid Injection, USP, a therapeutic generic to Cyklokapron. The product was introduced for short-term use in hemophilia patients to prevent or reduce bleeding and minimize replacement therapy during and after tooth extraction.

Limited innovation in new molecules is hampering the growth of the antifibrinolytic drugs market

Restricted innovation in novel antifibrinolytic compounds is hindering market expansion since the sector is still largely controlled by older, established generics like tranexamic acid. In the absence of a substantial pipeline of innovative agents that provide better effectiveness or enhanced safety, firms have no means to distinguish their products or justify higher prices. This results in fierce price rivalry, decreasing profit margins, and a strong reliance on commodity-style purchasing.

Furthermore, the lack of innovation limits growth into new treatment areas, since the majority of clinical studies prioritize refining current formulations over uncovering groundbreaking mechanisms.

For more details on this report, see Request for Sample

Antifibrinolytic Drugs Market, Segment Analysis

The global antifibrinolytic drugs market is segmented based on molecule type, indication, route of administration, distribution channel, and region

By Molecule Type: The tranexamic acid segment is dominating the antifibrinolytic drugs market with a 41.8% share in 2024

The tranexamic acid (TXA) category leads the antifibrinolytic drugs market, as it is the most commonly used, economical, and clinically proven option for various bleeding conditions. Compelling data from extensive studies in trauma, postpartum bleeding, and surgical procedures has led to the widespread incorporation of TXA in worldwide guidelines, enhancing its use in hospitals and emergency care. In comparison to traditional agents such as aprotinin, TXA presents a safer profile, reduced regulatory limitations, and simpler storage and management.

Moreover, its presence in several affordable generic forms (IV, oral, and topical) enhances adoption in both advanced and developing markets. For instance, in April 2024, Nexus Pharmaceuticals received FDA approval for its Tranexamic Acid in 0.7% Sodium Chloride Injection, expanding its generic injectable portfolio. The intravenous antifibrinolytic was approved for short-term use in hemophilia patients to support blood clot stability after procedures.

By Indication: The gynecology segment is dominating the antifibrinolytic drugs market with a 40.2% share in 2024

The antifibrinolytic drugs market is mainly led by the gynecology sector due to the significant worldwide incidence of postpartum hemorrhage (PPH) and heavy menstrual bleeding (HMB), both of which depend considerably on tranexamic acid as a primary treatment choice. Key evidence backing TXA use in PPH, coupled with WHO guideline suggestions, has hastened its implementation in hospitals and maternity facilities. Growing surgical activities in gynecology, including hysterectomy, cesarean sections, and minimally invasive surgeries, amplify the need for management of perioperative bleeding.

In addition, the widespread availability of oral and injectable TXA, low cost, and strong safety profile make it preferable in both developed and emerging markets. For instance, in April 2024, Maxwellia expanded menstrual health access by announcing Evana 500 mg tranexamic acid tablets and Ultravana 250 mg naproxen tablets. Both products were set to become available over the counter, enabling women to manage heavy and painful periods without a prescription.

Antifibrinolytic Drugs Market, Geographical Analysis

North America is dominating the global antifibrinolytic drugs market with 48.5% in 2024

The global antifibrinolytic drugs market was led by North America due to elevated surgical volumes, robust trauma and obstetric care systems, and the prevalent utilization of tranexamic acid. Robust healthcare systems, swift implementation of guideline-based treatments, and the existence of leading pharmaceutical companies have bolstered the region’s leading market status.

In the United States, the market for antifibrinolytic drugs grew due to recent FDA approvals, more frequent use of tranexamic acid in surgical and trauma settings, and a rise in the application of evidence-based protocols for managing bleeding

Europe is the second region after North America, which is expected to dominate the global antifibrinolytic drugs market with 34.5% in 2024

The European market for antifibrinolytic drugs grew due to recent approvals from the EMA, the introduction of new TXA formulations, and ongoing clinical research. Collaborative efforts within the industry, advancements in manufacturing technology, and a robust healthcare framework improved treatment availability, expanded therapeutic alternatives, and sped up the uptake of modern antifibrinolytic therapies throughout the region

Moreover, exclusive licensing and supply agreements expanded distribution, strengthened supply chains, and improved regional access to antifibrinolytic drugs. For instance, in February 2025, Hyloris Pharmaceuticals signed an exclusive license and distribution agreement with Colonis Pharma for XTRAZA, its proprietary tranexamic acid oral rinse. The partnership expanded UK access to a targeted antifibrinolytic option for anticoagulated patients undergoing dental procedures with bleeding risks.

The Asia-Pacific region is the fastest-growing region in the global antifibrinolytic drugs market, with a CAGR of 7.7% in 2024

The market for antifibrinolytic drugs in the Asia-Pacific region is rapidly growing due to increasing surgical procedures, a rise in trauma and postpartum bleeding incidents, and improved healthcare infrastructure. Heightened awareness of evidence-based approaches to bleeding management and the wider accessibility of tranexamic acid in China, Japan, South Korea, and India further propel regional market expansion

In India, the antifibrinolytic drug market is growing due to rising surgical procedures, increasing trauma cases, wider adoption of tranexamic acid in hospitals, and improved healthcare access supported by government initiatives and expanding domestic pharmaceutical manufacturing. For instance, in November 2025, Rafa Laboratories secured a landmark BARDA contract worth up to $186 million to advance a novel intramuscular tranexamic acid formulation. The initiative supported development of a life-saving, prehospital treatment option aimed at improving rapid intervention for uncontrolled bleeding.

Antifibrinolytic Drugs Market Competitive Landscape

Top companies in the antifibrinolytic drugs market include Pfizer Inc., Ferring Pharmaceuticals Inc., XANODYNE PHARMACEUTICALS, INC., Bayer Pharmaceuticals Corporation, and Baxter, among others.

Pfizer Inc: Pfizer Inc. plays a significant role in the antifibrinolytic drugs market through its long-standing product Cyklokapron (tranexamic acid), widely used to control bleeding in surgical, trauma, and medical settings. Leveraging its global distribution network, strong manufacturing capabilities, and continuous investment in hospital-based therapeutics, Pfizer supports broad access to antifibrinolytic treatments and contributes to market stability with high-quality, reliable formulations.

Key Developments:

- In August 2025, Hyloris Pharmaceuticals signed an exclusive license and supply agreement with Huons Co., Ltd. for XTRAZA, granting Huons rights to commercialize the product in South Korea. Under the deal, Hyloris agreed to exclusively supply XTRAZA, strengthening its global expansion strategy.

- In May 2025, Hyloris Pharmaceuticals entered an exclusive licensing agreement with AFT Pharmaceuticals for its tranexamic acid oral rinse, XTRAZA. The deal granted AFT commercialization rights across Canada, Australia, New Zealand, Singapore, and Hong Kong, expanding XTRAZA’s global reach and strengthening Hyloris’ international partnership network.

Antifibrinolytic Drugs Market Scope

| Metrics | Details | |

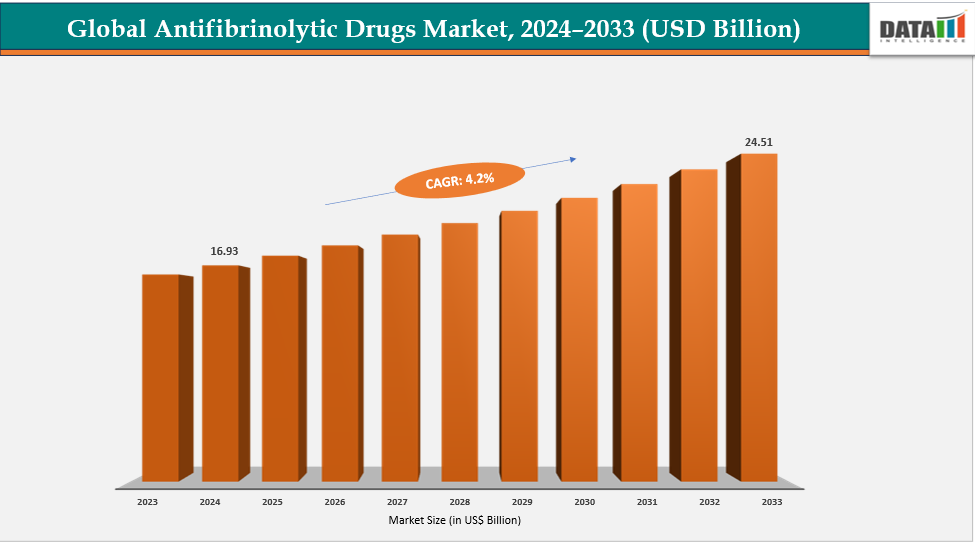

| CAGR | 4.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Molecule Type | Tranexamic Acid, Aminocaproic Acid, Aprotinin, Others |

| By Indication | Gynecology, Hereditary Angioedema, Gastrointestinal, Bleeding, Hemorrhage, Surgeries, Others | |

| By Route of Administration | Oral, Injectable | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global antifibrinolytic drugs market report delivers a detailed analysis with 73 key tables, more than 68 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here