Hemoconcentrators Market Size & Industry Outlook

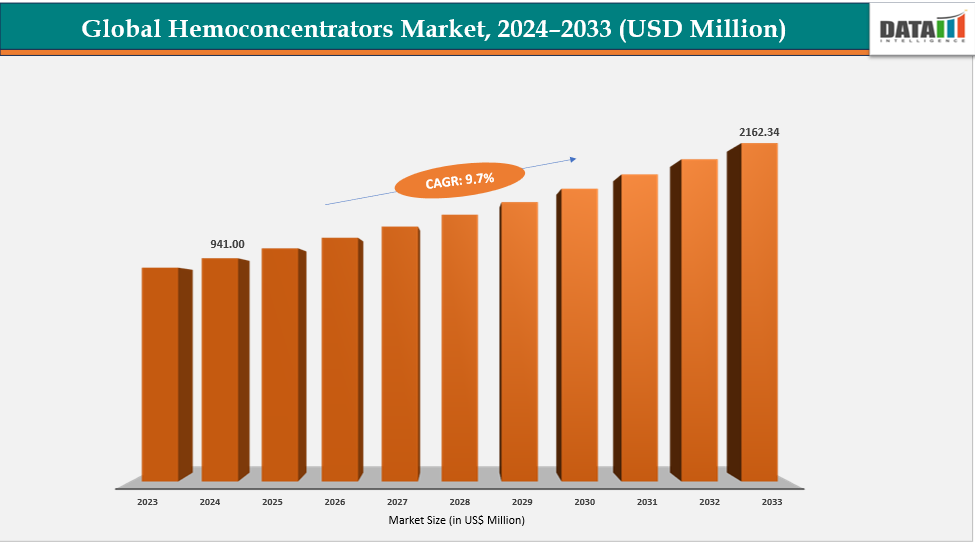

The global hemoconcentrators market size reached US$ 863.30 Million in 2023 with a rise of US$ 941.00 Million in 2024 and is expected to reach US$ 2,162.34 Million by 2033, growing at a CAGR of 9.7% during the forecast period 2025-2033.

The market for hemoconcentrators is being driven by an increase in the prevalence of kidney and cardiovascular diseases. Worldwide, the number of cardiovascular procedures is rising. Cardiopulmonary bypass operations are frequently necessary for patients. During surgery, hemoconcentrators aid in controlling blood volume and preserving the appropriate hematocrit. Additionally on the rise are kidney illnesses, particularly chronic kidney disease. Dialysis uses hemoconcentrators to effectively remove extra fluid. The need for these devices rises as the number of patients increases. Hospitals aim to increase patient safety and surgical results. The demand for blood transfusions is decreased by hemoconcentrators. This promotes a quicker recovery and reduces problems.

Key Highlights

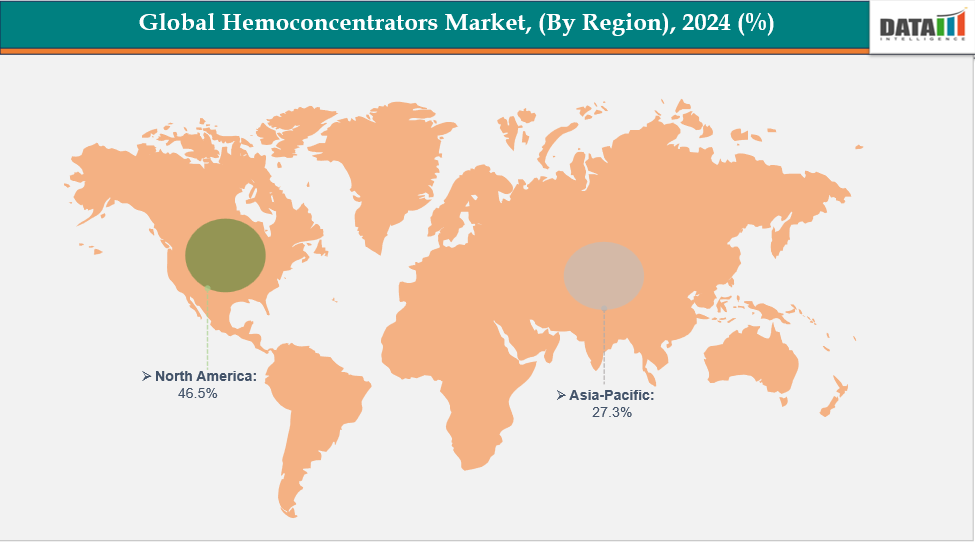

- North America is dominating the Global Hemoconcentrators Market with the largest revenue share of a 46.5% in 2024

- The Asia Pacific region is the fastest-growing region in the Global Hemoconcentrators Market, with a CAGR of 7.8% in 2024

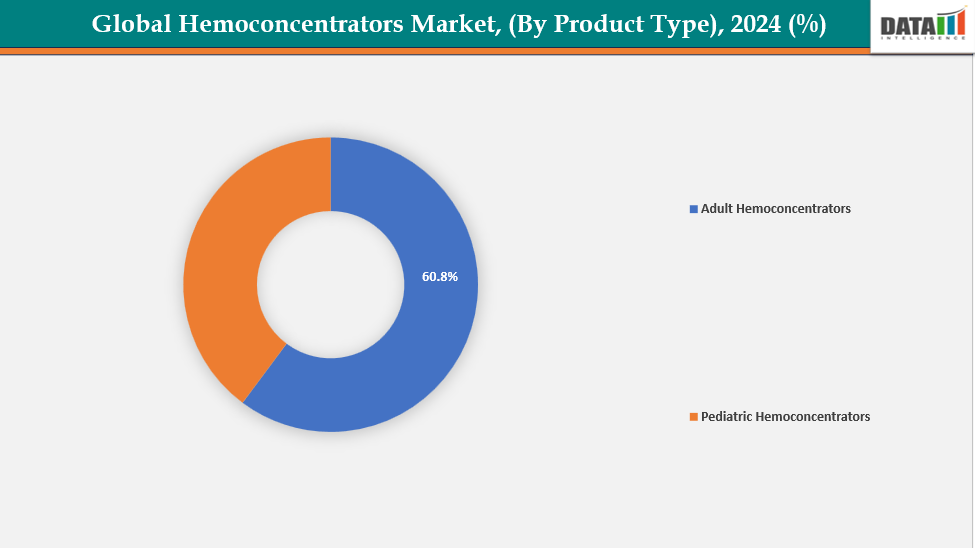

- The adult hemoconcentrators from product type is dominating the hemoconcentrators market with a 60.8% share in 2024

- The cardiovascular diseases segment form indication is dominating the hemoconcentrators market with a 42.3% share in 2024

- Top companies in the hemoconcentrators market include Minntech Corp, Terumo Cardiovascular Systems Corporation, MAQUET Cardiopulmonary AG, LivaNova, Inc., Medica SPA, Medtronic, NIPRO, Haemonetics Corporation, Medivators Inc., and Weigao Medical International Co., Ltd., among others.

Market Dynamics

Drivers: Technological advancements are accelerating the growth of the hemoconcentrators market

The market for hemoconcentrators is expanding due to technological advances. The efficiency of filtration is increased by new membrane materials. In operating rooms, designs that are small and lightweight improve usability. Ultrafiltration can be controlled in real time thanks to sensors and monitoring systems. Human error during procedures is decreased by automation. Modern designs reduce hemolysis and blood injury. Models tailored to adults and children meet a range of patient demands. Workflow is enhanced through integration with cardiopulmonary bypass systems. Regulatory clearances are supported by improved safety features.

Owing to factors like technological advancements, in August 2025, MEDICA USA Inc. received FDA 510(k) clearance for the Purema H Hemoconcentrator – Pediatric model. The device featured a high-permeability hemodialysis system with a 0.5 m² surface area, 500 mL/min blood flow, and 67 mL priming volume.

Restraints: High initial costs of treatment restrict adoption and slow growth of the hemoconcentrators market

The market adoption of hemoconcentrators is limited by their high starting costs. Modern gadgets are costly to produce. Clinics and hospitals must make large capital investments. They are difficult for smaller medical facilities to afford. Procurement in emerging markets is restricted by high costs. Upgrades to newer technologies are delayed due to cost concerns. Budgets for procurement give priority to necessary equipment above specialized gadgets.

Additionally, access is restricted for patients in low-income areas. The market's growth is slowed by these financial obstacles. In developed areas, adoption rates continue to be higher. Although there are advantages to technology, cost is still a major barrier.

For more details on this report, see Request for Sample

Hemoconcentrators Market, Segment Analysis

The global hemoconcentrators market is segmented based on product type, indication, end user and region

By Product Type: The adult hemoconcentrators from product type is dominating the hemoconcentrators market with a 60.8% share in 2024

The Enzyme Replacement Therapy (ERT) industry dominates the market for treating mucopolysaccharidosis (MPS). ERTs like laronidase, idursulfase, galsulfase, and vestronidase alfa are frequently approved for a range of MPS types. The systemic symptoms of the disease are effectively managed by these medications. They have a proven safety record and efficacy. ERTs are considered the gold standard of treatment for people with non-neuronopathic MPS.

Moreover, new product launches and product approvals make this segment dominant. For instance, in February 2024, Medica S.p.A., through its subsidiary Tecnoideal America, received FDA 510(k) authorization to distribute its hemoconcentrators in the U.S. These devices were designed for adult patients to remove excess blood fluids and restore physiological conditions during or after cardiopulmonary bypass surgery.

By Indication: The cardiovascular diseases segment from indication is dominating the hemoconcentrators market with a 42.3% share in 2024

The cardiovascular diseases segment is dominating the hemoconcentrators market due to the high prevalence of heart-related conditions globally. Hemoconcentrators are crucial for precise fluid control during cardiopulmonary bypass treatments during heart surgery. The majority of users are adult patients having heart surgery, such as valve replacement, cardiopulmonary bypass, and coronary artery bypass. For instance, in January 2024, Tecnoideal America received FDA 510(k) clearance for the Purema H Hemoconcentrator (EtO Sterilized). The device, a high-permeability hemodialysis system, was designed for adult patients to remove excess fluid and maintain proper hematocrit during cardiopulmonary bypass.

Additionally, by assisting in the maintenance of appropriate protein and hematocrit levels, hemoconcentrators enhance patient outcomes and lower problems. The use of adult hemoconcentrators in cardiovascular procedures is further supported by technological improvements such as their high blood flow capacity and greater surface areas.

Geographical Analysis

North America is dominating the global hemoconcentrators market with a 46.5% in 2024

North America dominates the worldwide hemoconcentrators market because of its sophisticated healthcare system, high rates of cardiovascular procedures, substantial R&D expenditures, and presence of top medical device manufacturers. Regular regulatory approvals promote premarket notice and acceptance while fostering steady market expansion. For instance, in April 2025, Sorin Group Italia S.R.L. received FDA 510(k) clearance for the DHF 0.2, DHF 0.6, and SH 14 Hemoconcentrators, advanced high-permeability hemodialysis systems for adult patients.

Europe is the second region after North America which is expected to dominate the global hemoconcentrators market with a 37.5% in 2024

Europe's market for hemoconcentrators is being driven by its sophisticated healthcare system, rising cardiovascular procedure awareness, and robust research partnerships. Market expansion is being accelerated by technological developments, strategic alliances, and new EU regulatory approvals that are expanding access to cutting-edge equipment.

Germany’s hemoconcentrators market is driven by advanced healthcare infrastructure, strong cardiopulmonary surgery expertise, and rising awareness of blood management. Supportive government policies, active clinical trials, and collaborations with medical device companies further boost innovation, adoption, and market growth.

The Asia Pacific region is the fastest-growing region in the global hemoconcentrators market, with a CAGR of 7.8% in 2024

The market for hemoconcentrators in Asia-Pacific, which includes China, India, Japan, and South Korea, is expanding quickly as a result of better surgical facilities, growing healthcare costs, and growing awareness of blood control during cardiac procedures. Government programs, partnerships in clinical research, and developments in disposable and reusable hemoconcentrator technology all contribute to the market's expansion.

India’s hemoconcentrator market is growing rapidly, driven by rising cardiac procedures, supportive government policies, and increasing awareness, with strong collaborations between medical device manufacturers and hospitals enhancing adoption, innovation, and patient access. For instance, in September 2025, Max Healthcare partnered with Medtronic to inaugurate the state-of-the-art Max-Medtronic Skill Lab at Max Super Specialty Hospital, Saket, New Delhi. The advanced facility was established to enhance training in minimally invasive surgical techniques, reflecting both organizations’ commitment to clinical excellence, innovation, and continuous medical education.

Competitive Landscape

Top companies in the hemoconcentrators market include Minntech Corp, Terumo Cardiovascular Systems Corporation, MAQUET Cardiopulmonary AG, LivaNova, Inc., Medica SPA, Medtronic, NIPRO, Haemonetics Corporation, Medivators Inc., and Weigao Medical International Co., Ltd., among others.

Minntech Corp.: Minntech Corporation, a subsidiary of Cantel Medical, is a leading manufacturer of medical devices specializing in blood purification and fluid management technologies. In the hemoconcentrators market, Minntech offers advanced systems designed for cardiopulmonary bypass and dialysis applications, focusing on efficiency, safety, and biocompatibility. The company’s innovations support improved patient outcomes and global adoption in surgical and critical care settings.

Key Developments:

- In January 2025, Haemonetics completed the sale of its whole blood assets to GVS, S.p.A. GVS acquired Haemonetics’ portfolio of proprietary blood collection, processing, and filtration solutions, along with manufacturing facilities in Covina, California, and Tijuana, Mexico, including related equipment and assets, marking a strategic expansion in healthcare filtration.

Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | By Product Type | Adult Hemoconcentrators, Pediatric Hemoconcentrators |

| By Indication | Cardiovascular Diseases, Renal Diseases and Others | |

| By End User | Hospitals, Ambulatory Surgical Centers and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global hemoconcentrators market report delivers a detailed analysis with 47 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

By Product Type (Adult Hemoconcentrators, Pediatric Hemoconcentrators), By Indication (Cardiovascular Diseases, Renal Diseases and Others), By End User (Hospitals, Ambulatory Surgical Centers and Others)

Suggestions for Related Report

For more medical device-related reports, please click here