Health and Wellness Market Size

The global health and wellness market size reached US$ 7.09 Trillion in 2024 from US$ 6.57 Trillion in 2023 and is expected to reach US$ 14.92 Trillion by 2033, growing at a CAGR of 8.7% during the forecast period 2025-2033.

Health and Wellness Market Market Overview

The health and wellness market are increasingly shaped by consumer demand across diverse product types, with personal care and anti-aging leading innovations through clean beauty, dermatology solutions, and natural haircare mirroring a shift toward conscious self-care. Nutrition and food products remain a cornerstone, but consumer preferences are rapidly evolving toward functional foods, plant-based diets, and supplements tailored for immunity and performance, a trend amplified by lifestyle diseases and fitness awareness. In fitness and body wellness, digital fitness platforms, wearables, and meditation apps are expanding, driven by hybrid lifestyles and rising interest in holistic well-being.

Preventive and personalized health is gaining traction through diagnostic devices, telemedicine, and at-home monitoring, underscoring the move from treatment to prevention. The mental wellness segment is now central, with therapy apps, stress-relief products, and sleep technologies addressing post-pandemic mental health challenges. Together, these dynamics show a market moving from siloed products to interconnected ecosystems, where personalization, digital integration, and consumer trust will decide leadership.

Health and Wellness Market Summary

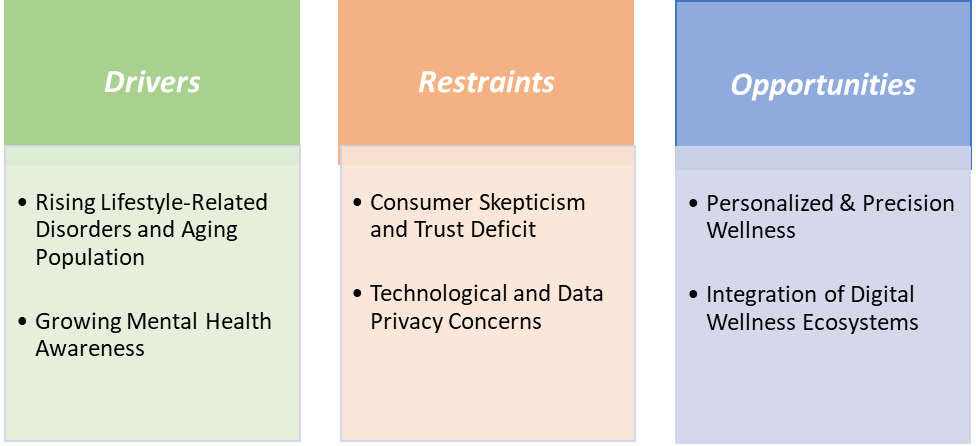

Health and Wellness Market Dynamics:

Drivers:

Rising lifestyle-related disorders and an aging population are significantly driving the health and wellness market growth

The health & wellness industry is being fundamentally reshaped by two interlinked forces such as the widespread rise of lifestyle-related disorders like obesity, diabetes, and cardiovascular conditions, and the accelerating shift in global demographics toward an aging population. As chronic conditions become more prevalent, consumers are increasingly seeking proactive, preventative solutions ranging from functional foods and supplements to diagnostics and fitness tracking to manage health before illness strikes.

According to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. At this time, the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion in 2030. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). This aging population is fueling demand for "silver economy" services, everything from elder-focused fitness tech to smart home monitoring and active-lifestyle retreats.

Consumers are embracing wearable devices and telemedicine as daily tools to support long-term wellness, making health tracking a routine habit. The "longevity trend" is transforming beauty and nutrition, with rising interest in cellular-repair supplements and NAD+ formulations aimed at aging better. At the same time, wellness services tailored to seniors like home care, mobility aids, and specialized retreats are growing in high-demand regions, propelled by innovation in assistive tech and "active aging" lifestyles.

Restraints:

Consumer skepticism and trust deficit are hampering the growth of the health and wellness market

Consumer skepticism and trust deficit are becoming critical barriers to the growth of the health and wellness market, as many consumers increasingly question the authenticity, safety, and effectiveness of products and services. The industry has been plagued by exaggerated claims ranging from “miracle” anti-aging creams to unregulated supplements, which often fail to deliver measurable results, leaving users disillusioned. The rise of misinformation on social media has worsened this, with influencers promoting unverified diets, detox teas, or quick-fix remedies that undermine scientific credibility.

Costly purchases that fail to deliver results deepen frustration, as seen with Gen Z buyers who spend heavily on collagen and wellness products but report low satisfaction and frequent suspicion of counterfeits. Additionally, concerns about data privacy in telemedicine and fitness apps make users hesitant to fully embrace digital health. Collectively, this erosion of trust slows market adoption, forces companies to spend more on transparency and validation, and creates hesitation among consumers who might otherwise engage with preventive and holistic wellness solutions.

For more details on this report – Request for Sample

Health and Wellness Market Segmentation Analysis

The global health and wellness market is segmented based on product type, gender, end-user, and region.

The nutrition and food products segment from the application is dominating the health and wellness market with a 33.62% share in 2024

The nutrition & food products segment has emerged as the powerhouse of the health & wellness industry, driven by consumers’ growing demand for functional, nutrient-enriched, and performance-enhancing food options. Functional beverages, fortified with probiotics, adaptogens, vitamins, and other bioactives, are now mainstream, fueling a surge in category growth.

On the innovation front, major and emerging market players are actively launching fortified, functional snacks, supplements, and micronutrient products. These developments reflect a broader industry trend toward personalized and preventive nutrition. For instance, in August 2025, Regenesome Inc. announced the development of the SAISEI Regenesome Supplement, a next-generation functional food designed for anti-aging and wellness.

Similarly, in July 2025, Herbalife Ltd., a premier health and wellness company, community and platform, launched MultiBurn, a next-generation multi-action dietary supplement designed with clinically studied botanical extracts to support key areas of metabolic health. Formulated by Herbalife’s global team of scientists and nutrition experts, MultiBurn is gluten-free, suitable for vegans and made without synthetic colors or dyes, reflecting the company’s commitment to clean-label, user-friendly wellness solutions.

Health and Wellness Market Geographical Share

North America is expected to dominate the global health and wellness market with a 44.39% in 2024

North America holds a commanding position in the global health and wellness landscape, buoyed by deep consumer health consciousness, robust spending capacity, and advanced infrastructure. A strong preventive healthcare mindset encourages widespread adoption of organic foods, dietary supplements, fitness programs, and telehealth services. This dominance is further reinforced by North America's leading position, supported by higher disposable incomes and established wellness ecosystems.

The US drives most of this activity, with an exceptionally large wellness industry footprint compared to Canada. Recent product innovations reflect the region’s leadership, for instance, US-based Whoop launched the advanced Whoop 5.0 and MG wearables featuring FDA-cleared ECG and blood pressure insights, highlighting North America’s edge in tech-enabled wellness.

Additionally, in June 2025, Sage Healthspan, a California-based digital health company, announced its precision health app, available for free on Apple’s App Store. Designed to address notable shortcomings in modern healthcare delivery, Sage introduces a privacy-first, on-device artificial intelligence (AI) platform aimed at helping users interpret their blood work, monitor health trends, and optimize wellness without sacrificing data security.

Health and Wellness Market Key players:

Top companies in the health and wellness market include Abbott, Bayer AG, Johnson & Johnson, Medtronic, Koninklijke Philips N.V., Haleon Group, Nestlé Health Science, Procter & Gamble, L'Oréal Paris and Danone, among others.

Health and Wellness Market Scope

Metrics | Details | |

CAGR | 8.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Trillion) | |

Segments Covered | Product Type | Personal Care, Beauty & Anti-Aging Products, Nutrition and Food Products, Fitness & Body Wellness Products, Preventive & Personalized Health Products, Mental Wellness Products, and Others |

Gender | Female and Male | |

End-User | Hospitals, Diagnostic Centers, Specialty Clinics, Homecare Settings and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global health and wellness market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here