Health & Wellness Food Market Size

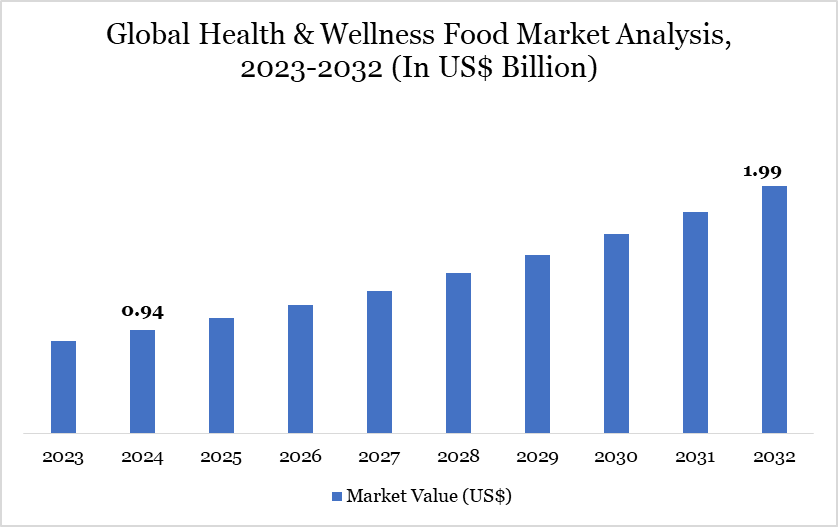

Health & Wellness Food Market size reached US$ 0.94 billion in 2024 and is expected to reach US$ 1.99 billion by 2032, growing with a CAGR of 9.81% during the forecast period 2025-2032.

The worldwide health and wellness food market is undergoing significant expansion due to changing consumer habits, an aging demographic, and increasing health apprehensions. The growing recognition of nutrition's significance in preventing lifestyle-related disorders such as obesity and diabetes is driving a transition towards health-oriented dietary practices.

Consumers are choosing clean-label products featuring transparent, uncomplicated ingredients and functional foods enhanced with vitamins, minerals, and probiotics. The increase in disposable incomes, particularly in emerging nations, facilitates enhanced investment in luxury wellness products. The plant-based food sector is increasingly recognized as a nutritional and sustainable substitute for animal products.

Advancements in food technology and delivery, particularly through online grocery platforms, are enhancing product accessibility. Companies like as Danone, Nestlé, and Mondelez are augmenting health-focused portfolios to meet this demand. The industry is poised for continuous expansion, bolstered by robust consumer interest in personal wellness, nutrition-centric innovations, and favorable regulatory environments.

Health & Wellness Food Market Trend

Multiple dynamic trends are influencing the health and wellness food market in 2024 and subsequent years. Consumers are progressively pursuing functional meals that provide certain health advantages, including immune enhancement, weight control, and digestive wellness. The clean-label movement is gaining traction, with 71% of US consumers prepared to pay a premium for products containing identifiable, natural components.

Simultaneously, there is an increasing desire for plant-based foods that are abundant in fiber, antioxidants, and protein, indicating a wider transition towards sustainability and preventative health. Personalized nutrition, driven by wearable technologies and artificial intelligence, is also gaining traction.

Approximately 20–30% of consumers in the US, United Kingdom, and China currently pursue personalized wellness solutions informed by biometric data. Currently, the inclination towards clinically validated products is surpassing the previous emphasis on "natural," especially in the realms of supplements and over-the-counter items. These tendencies signify a maturation of the market, wherein scientifically validated efficacy and customisation are essential, alongside transparency and environmental awareness.

To Know More Insights - Download Sample

Market Scope

| Metrics | Details | |

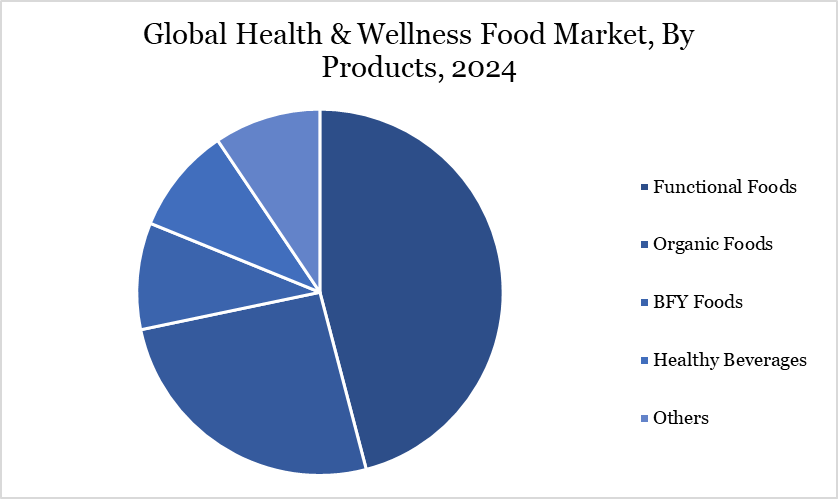

| By Product | Functional Foods, Organic Foods, BFY Foods, Healthy Beverages, Others | |

| By Distribution Channel | Supermarket & Hypermarket, Convenience Stores, Specialty Stores, Online Retailers, Others | |

| By Ingredients | Probiotics, Proteins & Amino Acids, Vitamins & Minerals, Omega-3 Fatty Acids, Dietary Fibers, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Health & Wellness Food Market Dynamics

Increasing Consumer Emphasis on Clean Labels and Natural Ingredients

Increasing consumer awareness regarding the health implications of food components is substantially enhancing the demand for clean-label and natural foods. Consumers increasingly favor items devoid of artificial colors, preservatives, and GMOs, with a heightened focus on organic and less processed alternatives.

Regulatory agencies like the FDA are intensifying labeling mandates, thereby compelling corporations to adopt more transparent methods. This has resulted in reformulations and the introduction of new products that prioritize simplicity and authenticity. In 2024, Danone broadened its “One Planet. One Health” initiative, emphasizing organic dairy and plant-based clean-label alternatives.

Likewise, Simply Good Foods announced a 12% rise in sales in 2024, attributed to its emphasis on low-sugar, clean-label products under the Atkins and Quest brands. In 2025, Mondelez, via its SnackFutures hub, launched clean-label, plant-based snacks. The rise of health-conscious lifestyles is transforming product development techniques and fostering sustainable market growth through the emphasis on natural components.

Elevated Prices and Consumer Knowledge Deficiencies Suppress Development

Premium pricing, influenced by high-quality ingredients and specific manufacturing methods, frequently renders these products unattainable for price-sensitive consumers. This notion constrains adoption, especially in emerging areas or among middle- to low-income demographics.

A continual deficiency in consumer education obstructs educated purchasing choices. A significant number of customers possess an inadequate comprehension of the nutritional benefits or effectiveness of health-enhancing foods and may be deceived by vague marketing assertions. This not only suppresses demand but also cultivates distrust.

The difficulty is exacerbated in the functional food sector, where the intricacy of components and health assertions necessitates transparent, reliable communication. Addressing these knowledge and affordability disparities is crucial for inclusive market growth. Organizations that provide cost-effective, distinctly labeled, and well conveyed products will be optimally positioned to surmount these challenges and expand their market share.

Health & Wellness Food Market Segment Analysis

The global health & wellness food market is segmented based on products, distribution channel, ingredients and region.

Nutrient-Dense Functional Foods are Gaining Global Traction

The functional food sector in the health and wellness food market is experiencing substantial expansion, mostly due to heightened health consciousness and evolving consumer lifestyles. These products are enriched with advantageous elements, including amino acids, vitamins, minerals, proteins, fatty acids, and prebiotics, providing health benefits that surpass fundamental nutrition.

Consumers are progressively favoring functional meals to tackle particular health challenges, such as weight management, diabetes, cardiovascular conditions, and overall wellness. The increasing inclination towards nutrient-dense, portable snacks is driving demand, especially among busy people in search of handy and beneficial alternatives.

The increasing impact of healthcare experts, such as physicians and nutritionists, in advocating for functional diets has augmented demand for these goods. Furthermore, corporations are enhancing their digital presence and broadening online retail networks to accommodate the changing needs of health-conscious consumers. Emerging trends, including the popularity of probiotics, prebiotics, and hemp-infused products, persist in influencing and driving growth.

Health & Wellness Food Market Geographical Share

North Americas’ Robust Consumer Demand and Regulatory Endorsement Propel Market Expansion

North America is a prominent location in the health and wellness food market, propelled by elevated consumer awareness and a strong regulatory framework. Increasing health concerns, especially related to obesity and diabetes, have prompted substantial dietary changes. Consumers are emphasizing foods that facilitate weight management and enhance overall wellness, leading to an increased demand for functional and plant-based products.

In the US, clean-label trends are notably robust, with 71% of customers expressing a willingness to pay a premium for items containing natural, plainly identifiable ingredients. Regulatory agencies such as the FDA are intensifying this trend through more stringent labeling laws, thereby enhancing transparency.

Technological innovations facilitate market expansion; wearable health gadgets and mobile applications offer personalized health insights, motivating customers to embrace customized dietary practices. Furthermore, prominent companies such as Danone and Mondelez are diligently investing in the region by broadening their product offerings and enhancing their online presence. These aspects collectively establish North America as a mature and innovation-oriented market.

Sustainability Analysis

Sustainability is becoming a fundamental aspect of the health and wellness food sector, as customers increasingly link personal well-being to environmental responsibility. The increase in plant-based diets is mostly driven by their perceived reduced environmental impact relative to animal-based options. Companies are adapting by incorporating sustainable practices into product development and procurement.

Nestlé's 2024 development of its Garden Gourmet portfolio exemplifies a combined commitment to health and sustainability, providing nutrient-dense, plant-based products with diminished ecological effect. Furthermore, clean-label formulas that exclude synthetic ingredients benefit both environmental and human health. The digital transformation in food retail, encompassing e-commerce and data-driven customisation, also reduces waste by enhancing supply chain efficiency.

As sustainability emerges as a purchase factor, firms that exhibit environmental responsibility via packaging, ingredient sourcing, and emissions reduction are likely to enhance consumer trust and foster long-term loyalty. Integrating health advantages with environmental awareness will be a strategic necessity in the forthcoming years.

Health & Wellness Food Market Major Players

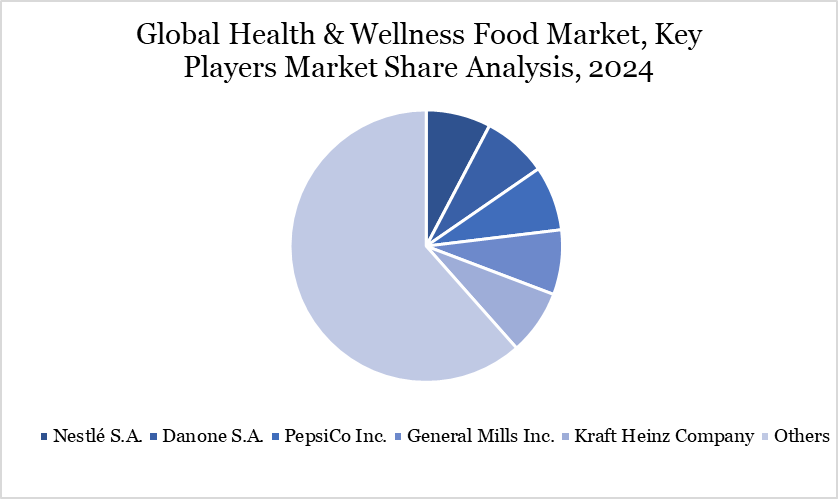

The major global players in the market include Nestlé S.A., Danone S.A., PepsiCo Inc., General Mills Inc., Kraft Heinz Company, Mondelez International Inc., GlaxoSmithKline PLC, Abbott Laboratories, Herbalife Nutrition Ltd., Archer Daniels Midland Company and others.

Key Developments

- In February 2024, Danone, a leading player in the market, announced the launch of a new line of plant-based products under its Silk brand. These new offerings include plant-based milk alternatives and yogurt, aiming to cater to the growing demand for vegan and dairy-free options

- In July 2025, Nestle and Starbucks entered into a strategic partnership to develop and market ready-to-drink coffee and tea products under the Starbucks brand. This collaboration signifies a significant move to expand their offerings in the market, leveraging Starbucks' brand recognition and Nestle’s manufacturing expertise

- In October 2024, PepsiCo completed the acquisition of Bare Foods, a leading producer of fruit and veggie chips, for approximately USD200 million. This acquisition strengthens PepsiCo's position in the market by adding a portfolio of better-for-you snack options to its offerings

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies