Market Overview

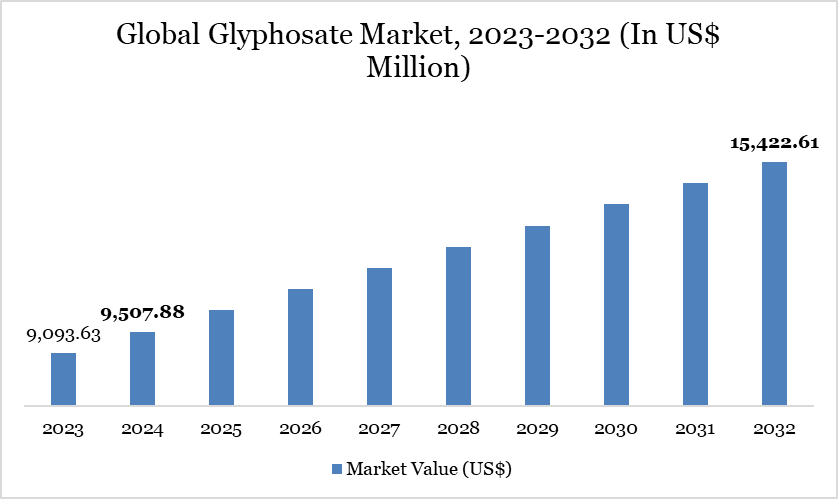

Global Glyphosate Market reached US$9,507.88 million in 2024 and is expected to reach US$15,422.61 million by 2032, growing with a CAGR of 6.23% during the forecast period 2025-2032.

The global glyphosate market has witnessed robust growth over the past decade, driven largely by the widespread adoption of herbicide-tolerant genetically modified (GM) crops and the increasing need for efficient weed control across major agricultural economies. For instance, the global area of genetically modified (GM) crop cultivation reached 20.63 million hectares in 2023, which is 118 times larger than the 1.7 million hectares in 1996.

GM soybeans accounted for 72.4% of the global soybean cropland, covering an area of 10.09 million hectares. Asia-Pacific is also emerging as a major consumer, with countries like India experiencing rising glyphosate demand due to the growth of commercial farming and government support for improved crop productivity. For instance, Indian firms like UPL Ltd. and Rallis India are expanding their herbicide offerings, including glyphosate, to meet rising rural demand during peak planting seasons..

Glyphosate Market Trend

The global glyphosate market is experiencing several notable trends that are reshaping its landscape. One of the most significant is the rising shift toward bio-based and integrated weed management solutions, as regulatory bodies and consumers push for more sustainable alternatives. While glyphosate remains dominant, growing health and environmental concerns have encouraged agrochemical companies to invest in combination products that blend glyphosate with other active ingredients to reduce resistance and environmental impact.

Another trend is the increasing weed resistance to glyphosate, especially in high-usage regions like the U.S. Midwest and parts of South America, which is prompting farmers to diversify their herbicide portfolios and adopt rotational herbicide strategies. These trends reflect a market at a crossroads—balancing high global demand with increasing pressure for safety, sustainability, and innovation.

Market Scope

Metrics | Details |

By Crop Type | Genetically Modified (GM) Crops, Conventional Crops |

By Formulation | Liquid, Dry (Powder/Granules) |

By Mode of Action | Systemic Herbicide, Non-Systemic Herbicide |

By Application | Agricultural, Non-Agricultural |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Genetically Modified (GM) Crops

The expansion of genetically modified (GM) crops, particularly those engineered to be glyphosate-tolerant, has been one of the most significant drivers of glyphosate market growth globally. These GM crops—such as Roundup Ready soybeans, corn, cotton, and canola—are specifically designed to survive glyphosate applications, allowing farmers to apply the herbicide broadly across fields without harming the main crop. Countries like the United States, Brazil, Argentina, and Canada have adopted GM crops on a large scale, leading to exponential increases in glyphosate consumption.

For instance, in 2024, 28 countries cultivated a record 209.8 million hectares of GM crops, a 1.9% increase from the previous year. Soybean, maize, and cotton are the most widely planted GM crops. This growing footprint of GM crops, combined with expanding acreage and favorable policies in emerging economies, continues to propel the global demand for glyphosate, making it a core component of modern agricultural practices.

Stringent Regulatory Restrictions and Bans

Stringent regulatory restrictions and outright bans on glyphosate use in several countries are significantly restraining the growth of the global glyphosate market. Concerns over glyphosate’s potential link to cancer—particularly non-Hodgkin’s lymphoma—and its long-term environmental impact have led regulatory agencies and courts to impose tighter controls.

For instance, the European Union has been debating the phase-out of glyphosate, with countries like Germany announcing plans to ban its use in agriculture by 2024. Similarly, France has restricted glyphosate usage in non-agricultural areas, while Thailand and Vietnam have moved to ban its import and use entirely. In the United States, ongoing litigation involving thousands of lawsuits against Bayer (formerly Monsanto) has further damaged the reputation and market confidence in glyphosate-based products.

Segment Analysis

The global glyphosate market is segmented based on crop type, formulation, mode of action, application and region.

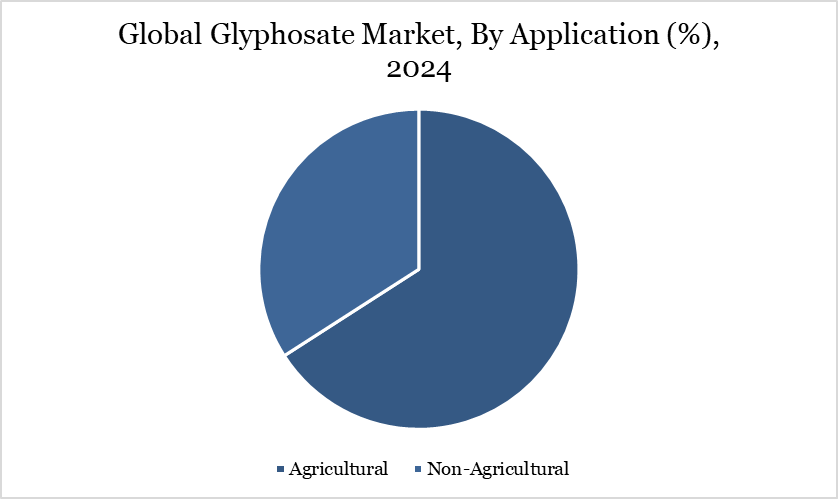

Rising Glyphosate Demand in Agricultural Segment

The agricultural segment is the primary driver of the global glyphosate market, accounting for the majority of its consumption due to the compound’s widespread use in crop cultivation for weed control. Farmers rely heavily on glyphosate to manage both pre- and post-emergent weeds across a wide variety of crops, including soybeans, corn, cotton, canola, and wheat, especially in countries practicing large-scale commercial farming.

For instance, in Brazil and Argentina, glyphosate is extensively used in soybean and maize farming, with over 90% of crops genetically engineered to tolerate glyphosate, allowing broad application without damaging the main crop. In the United States, glyphosate remains essential in conservation tillage systems, where farmers avoid plowing to preserve soil health and instead use herbicides to eliminate weeds. As global food demand grows and arable land remains limited, the agricultural sector’s dependency on glyphosate for improving farm productivity continues to fuel its market growth.

Geographical Penetration

Glyphosate Demand in North America Driven by GM Crops and Advanced Farming

North America is a dominant force in the global glyphosate market, driven by extensive cultivation of genetically modified (GM) crops and advanced farming practices. The United States, in particular, is one of the largest consumers of glyphosate due to the widespread use of glyphosate-resistant crops such as corn, soybean, and cotton. Over 90% of soybean and cotton acreage in the U.S. is planted with GM varieties that tolerate glyphosate, enabling large-scale application for effective weed control.

The region also practices conservation tillage and no-till farming, where glyphosate is essential for clearing fields without disturbing the soil, improving both environmental sustainability and crop yields. In Canada, glyphosate is widely used in wheat, canola, and barley production, especially during pre-harvest to dry down crops uniformly. Additionally, the well-established agrochemical supply chain, high adoption of precision agriculture, and strong presence of companies like Bayer (formerly Monsanto), Corteva Agriscience, and Nutrien further reinforce North America’s position as a growth engine for the glyphosate market.

Sustainability Analysis

Glyphosate enables conservation tillage and no-till farming, which preserve soil structure, reduce greenhouse gas emissions, and lower fuel consumption. In countries like the U.S. and Canada, this has contributed to more sustainable land use and improved soil health over time. Glyphosate reduces the need for multiple herbicide applications and manual labor, thus lowering water usage and operational costs.

Its broad-spectrum efficacy also reduces reliance on other, potentially more harmful chemical alternatives. By controlling weeds effectively, glyphosate allows farmers to increase productivity on the same land area, helping prevent deforestation and habitat destruction for agricultural expansion.

Competitive Landscape

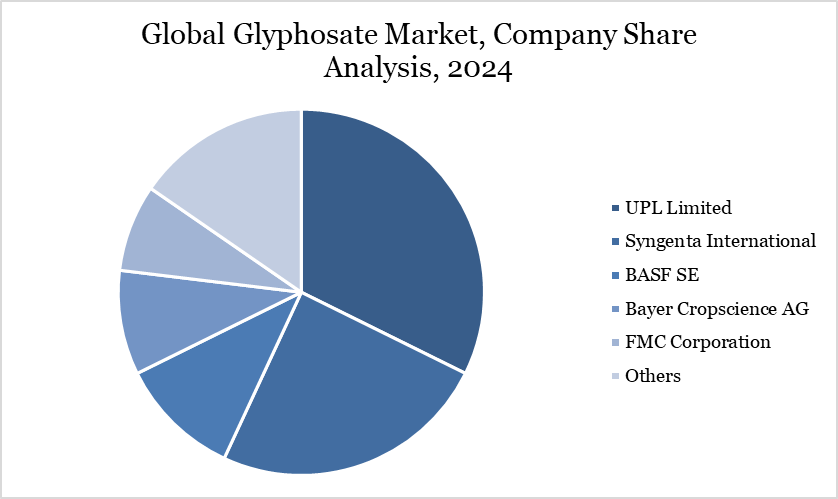

The major global players in the market include UPL Limited, Syngenta International, BASF SE, Bayer Cropscience AG, FMC Corporation, Nufarm Limited, Dow AgroSciences, Rainbow Agro, Rallis India Limited, GREENWELL BIOTECH and among others.

Key developments

In 2023, Ancient Organics Bioscience has launched PaleoPower, a microbial solution that organically breaks down glyphosate in soil. In trials, it reduced glyphosate levels by over 80% in 90 days and over 90% in 180 days, offering a natural method to remediate glyphosate contamination.

In 2023, Waters Corporation has introduced Glyphosate-V, the world's first lateral flow strip test for fully quantitative detection of glyphosate in grains and water. This innovative product enables fast, accurate, and on-site testing of one of the most widely used pesticides globally.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies