Germany Patient-Centered Medical Home Market is segmented By Product Type, By Delivery Model, By Application, By Patient Type, By End User – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Market Overview

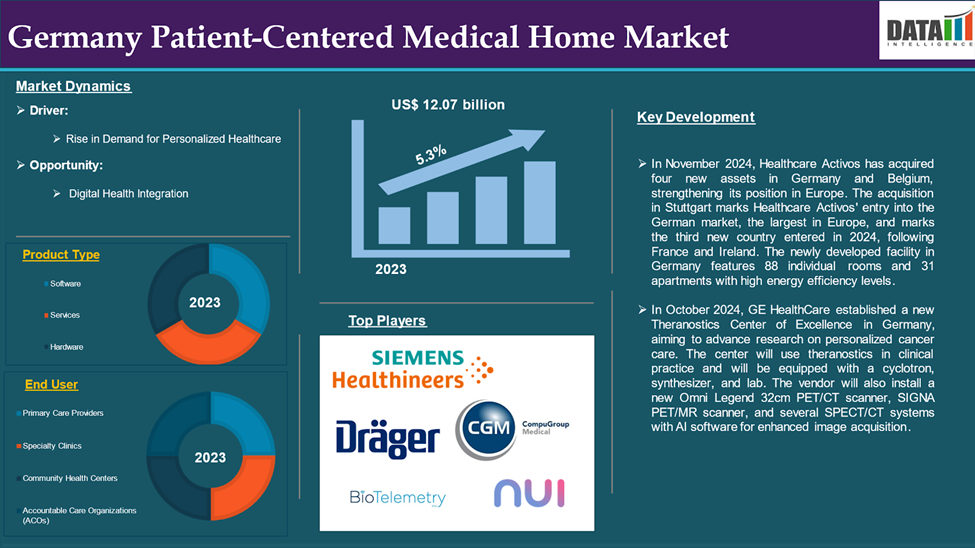

The Germany Patient-Centered Medical Home Market reached US$ 12.07 billion in 2023 and is expected to reach US$ 18.31 billion by 2031, growing at a CAGR of 5.3% during the forecast period 2024-2031.

The patient-centered medical home actually represents a model of care that places patients in center stage concerning care delivery. PCMHs help build better care relationships between patients and their clinical care teams. The research on PCMH reveals the high quality in patient experience and increase in staff well-being, along with cost reduction of used health services. In other words, recognized practices have pledged to continual quality improvement and patient-centered care.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rise in Demand for Personalized Healthcare

The soaring demand for personalized healthcare has been a key driving force in the Germany Patient-Centered Medical Home (PCMH) program market. As healthcare becomes more patient-centric, individuals are increasingly seeking care for specific needs, preferences, and conditions. PCMH is aligned with the comprehensive coordinated care that this model offers. Such relationships with primary care providers have been shown to improve quality and satisfaction.

Moreover, with the growing elderly population in Germany coupled with increasing incidences of chronicity, PCMH is expected to fetch improved management of these conditions and fewer hospital readmissions and emergency visits associated with this patient-centered approach. This relation is developing as an emerging approach toward improving healthcare outcomes and minimizing long-term health spending.

Huge Investments

One of the major impediments to the purchasing power of PCs by patients in Germany is the very high upfront costs. Setting up PCMH models necessitates procedure, hardware and technology investment in training of health care professionals for seamless care coordination among the health care sectors. Installation of electronic health records (EHR) systems and continuous training of staff would also need to be considered aside from changing models of care delivery. This high upfront cost can be a major hurdle for many health care organizations, especially smaller or independent practices.

In addition, in many cases, the reimbursement under the models for PCMH services in Germany does not cover the complete transformation cost, which makes it even less justifiable for many providers to adopt this very comprehensive care model. Hence, such financial bottlenecks slow down the dissemination of PCMH in this country.

Market Segment Analysis

The Germany patient-centered medical home market is segmented based on product type, delivery model application, patient type and end user.

Product Type:

Software segment is expected to dominate the patient-centered medical home market share

The software segment holds a major portion of the patient-centered medical home market share and is expected to continue to hold a significant portion of the patient-centered medical home market share during the forecast period.

Seamless coordination and management of patient care through software solutions are critical for the Germany Patient Centered Medical Home (PCMH) market. EHR use, practice management software, and patient communications tools are at the forefront of successful application. Those solutions allow healthcare providers to build comprehensive patient profiles, track ongoing care and outcome results, and ensure timely intervening. It makes communication flow possible among these different people-involved healthcare professionals to avoid the duplication of tests and treatments.

Moreover, Germany has a complex and decentralized health care system, so software solutions can quickly improve data exchange and integration among Primary Care Providers, Specialists, and Hospitals. Improving efficiency, reducing errors, and producing better patient outcomes are all reasons why software solutions serve as critical enablers of effective PCMH implementation.

For instance, in March 2023, WELL Health Technologies Corp. has made a strategic investment in doctorly GmbH, a medical practice management software provider based in Germany. The investment is part of a syndicate of investors including renowned venture capital firms such as Horizons Ventures, The Delta Force AG, Speedinvest, UNIQA Ventures, Calm Storm, and Seedcamp. WELL Ventures is part of a group of investors focused on empowering healthcare providers and patients globally.

Community Health Centers segment is the fastest-growing segment in the patient-centered medical home market share

The community health centers segment is the fastest-growing segment in the patient-centered medical home market share and is expected to hold the market share over the forecast period.

Community Health Centers (CHCs) serve as comprehensive care access points for underserved populations in the Germany Patient-Centered Medical Home (PCMH) market. They will be beneficial for the establishment and implementation of the PCMH model in rural or economically depressed areas that have a number of barriers to accessing high-quality intensive primary care.

The focus of CHCs in Germany is to provide continuous coordinated care through a team-based approach at the picture center for PCMH development. This includes a wider variety of services-from preventive care, and chronic disease management, to mental health and health education: together all the services would be received in a patient-tailored package.

Through care integration, bridging patients with specialists and other care providers comes up with a much stronger continuity of care. In a country like Germany that wants to achieve access to healthcare improvement and outcomes for all citizens, the role of Community Health Centers is thus fundamental to its essential patient-centered high-quality care.

Market Competitive Landscape

The major Germany players in the patient-centered medical home market include Siemens Healthineers, CompuGroup Medical SE & Co. KGaA, Drägerwerk AG & Co. KGaA, BioTelemetry Germany GmbH, InterSystems GmbH, Nui Care GmbH, AlongHealth, Intu Diagnostics, Infinitycare Companion, Mycolever GmbH and among others.

Emerging Players

The emerging players in the patient-centered medical home market include CareFirst, AmeriHealth, Aetna Better Health and among others.

| Metrics | Details | |

| CAGR | 5.3% | |

| Market Size Available for Years | 2022-2031 | |

| Estimation Forecast Period | 2024-2031 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Software, Services, Hardware |

| Delivery Model | On-Premise, Cloud-Based | |

| Application | Chronic Disease Management, Preventive Care, Acute Care, Behavioral Health | |

| Patient Type | Pediatric, Geriatric, Adult | |

| End User | Hospitals and Clinics, Home Healthcare, Ambulatory Surgical Centers, Others | |

Key Developments

- In November 2024, Healthcare Activos has acquired four new assets in Germany and Belgium, strengthening its position in Europe. The acquisition in Stuttgart marks Healthcare Activos' entry into the German market, the largest in Europe, and marks the third new country entered in 2024, following France and Ireland. The newly developed facility in Germany features 88 individual rooms and 31 apartments with high energy efficiency levels.

- In October 2024, GE HealthCare established a new Theranostics Center of Excellence in Germany, aiming to advance research on personalized cancer care. The center will use theranostics in clinical practice and will be equipped with a cyclotron, synthesizer, and lab. The vendor will also install a new Omni Legend 32cm PET/CT scanner, SIGNA PET/MR scanner, and several SPECT/CT systems with AI software for enhanced image acquisition.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Germany patient-centered medical home market report would provide approximately 70 tables, 65 figures, and 184 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.