German Automotive Testing Inspection Certification Market Size

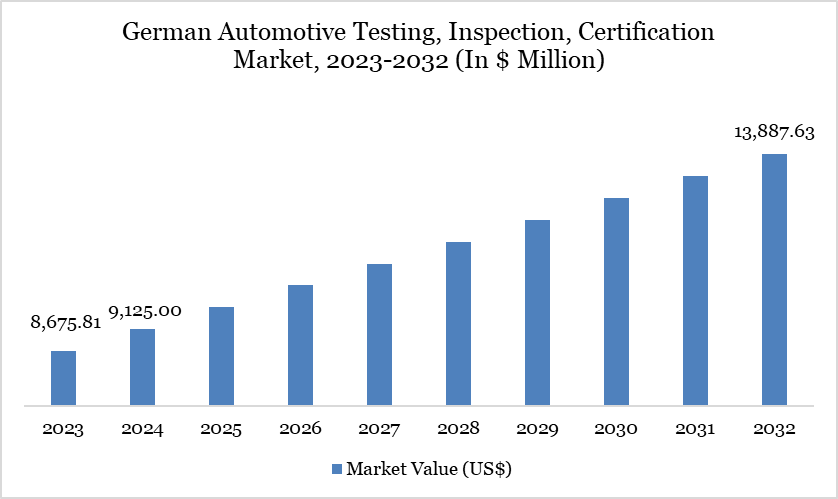

The German automotive testing, inspection and certification market reached US$ 9,125.00 million in 2024 and is expected to reach US$ 13,887.63 million by 2032, growing at a CAGR of 5.39% during the forecast period 2025-2032.

Germany’s automotive Testing, Inspection, and Certification (TIC) market is closely tied to its position as Europe’s largest vehicle manufacturing hub, producing over 4.1 million passenger cars in 2023, which represented more than 26% of total EU production. This high production volume, coupled with stringent EU and German regulatory frameworks, continues to generate strong demand for TIC services to ensure compliance with safety, emissions, and quality standards. The country is also the largest exporter of vehicles within the EU, shipping over 2.6 million passenger cars worldwide in 2023, reinforcing the importance of internationally recognized certification processes to meet diverse market entry requirements.

Additionally, Germany is strengthening its role in sustainability-driven TIC services. The Federal Motor Transport Authority (KBA) reported that in 2023, EV and plug-in hybrid registrations accounted for over 31% of all new passenger car registrations, requiring specialized testing for battery safety, electromagnetic compatibility, and charging infrastructure compliance. This rapid transformation of the automotive landscape ensures that TIC services in Germany are evolving beyond conventional safety inspections toward advanced certification for next-generation mobility.

Automotive Testing, Inspection and Certification Market Trend

A defining trend in the German TIC landscape is the rapid integration of services tailored for electric and autonomous mobility. In 2023, Germany had over 113,000 publicly accessible charging points, including more than 20,000 fast chargers, ranking it first in Europe in EV infrastructure. This growth directly boosts demand for certification of charging equipment, interoperability testing, and cybersecurity compliance of EV systems.

At the same time, the push toward autonomous vehicle development is reshaping testing requirements.

Germany became the first country in the world to pass legislation in 2021 allowing Level 4 autonomous vehicles on public roads, and the Federal Ministry for Digital and Transport has since funded over 80 pilot projects for automated and connected driving. These initiatives are driving demand for highly specialized TIC services that ensure safety, data protection, and real-time vehicle-to-infrastructure communication reliability, positioning Germany as a global frontrunner in advanced automotive certification.

Market Scope

Metrics | Details |

By Automotive Component/Type | Crash Testing, Engine & Gear Testing, Electrical Systems & Components Testing, Chassis & Suspension Testing, Emission Testing, Others |

By Vehicle Type | Passenger Vehicles, Commercial Vehicles |

By Sourcing Type | In-House, Outsourced |

By Service | Testing, Inspection, Certification |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Integration of Cybersecurity Compliance in Automotive Testing Protocols

Germany’s automotive testing, inspection, and certification (TIC) market is increasingly propelled by the urgent demand for cybersecurity compliance. Since July 2024, EU Regulation UN R155 has made cybersecurity and a Cybersecurity Management System (CSMS) mandatory for all new vehicle type approvals, compelling automakers to undergo rigorous TIC processes to demonstrate compliance across the vehicle lifecycle, from development to decommissioning. TÜV NORD, as a designated technical service provider, plays a critical role in auditing and certifying these systems under both UN R155 and ISO/SAE 21434 frameworks, positioning cybersecurity as a core revenue driver.

Moreover, the German Association of the Automotive Industry (VDA) has reinforced this trend by issuing a position paper urging legal clarity for cybersecurity testing, particularly to protect ethical hackers and testing professionals from prosecution under the country’s "Hacker Paragraph." TÜV SÜD emphasizes the EU’s Mandatory Digital Shield requirement, which mandates robust cybersecurity protection for all new vehicles starting mid-2024, highlighting the need for dedicated testing protocols for encryption, cryptographic systems, and attack-vector resilience. Together, these regulatory forces are driving a steep increase in cybersecurity-centric TIC services, elevating their role from a niche compliance check to a critical, high-growth market segment

Shortage of Skilled Workforce for Advanced Testing and Certification in Germany

Germany faces a significant skilled labor gap in its automotive testing, inspection, and certification sector, with nearly 10,300 positions remaining unfilled between July 2023 and June 2024, highlighting persistent staffing challenges even amid economic turbulence. Moreover, roughly 30% of companies in the automotive industry report staffing difficulties, reflecting widespread recruitment challenges across roles critical to testing, validation, and compliance processes. This scarcity hinders capacity expansion and delays technology-driven testing deployments, ultimately restraining the market's growth and its ability to support innovation and regulatory compliance.

Segmentation Analysis

The German automotive testing, inspection and certification market is segmented by service, automotive component/type, vehicle type, sourcing type.

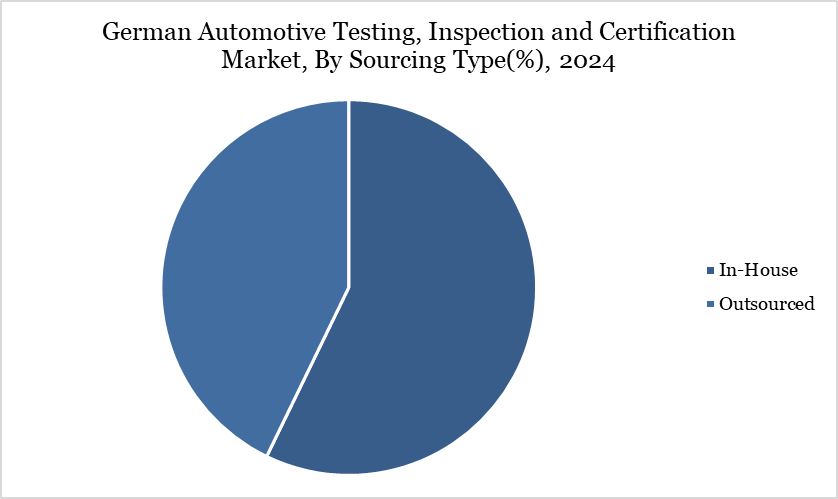

In-House Segment Holds a Significant Share

Germany’s Testing, Inspection, and Certification (TIC) market features a prominent in-house segment, which commanded approximately over 54% of total market share in 2024, underscoring manufacturers’ preference for retaining control over quality assurance processes. This dominance stems from Germany’s regulatory environment, where stringent safety and technical standards compel OEMs to develop internal testing capabilities to ensure compliance efficiently.

The in-house approach benefits automakers by enabling rapid troubleshooting, tighter confidentiality safeguards, and seamless integration with R&D and manufacturing workflows. This is particularly vital in the automotive sector, where emerging technologies, such as EV powertrains and advanced driver-assistance systems, necessitate customized, high-frequency validation that external providers may not match.

At the same time, the outsourced TIC segment is gaining traction, projected to grow robustly between 2024 and 2029. This shift reflects increasing complexity in vehicle technologies, such as connectivity and software-driven systems, and the corresponding need for specialized testing expertise. OEMs and suppliers are gradually supplementing internal testing with third-party services to access advanced methods, reduce upfront investment in lab infrastructure, and keep pace with rapidly evolving compliance demands.

Sustainability Analysis

Germany's automotive TIC market increasingly aligns with the nation’s wider sustainability transition, particularly amid efforts to decarbonize the transport sector. In 2023, the transport sector still emitted approximately 146 million tonnes of CO₂-equivalents, exceeding the legally permitted quota by about 13 million tonnes, highlighting persistent regulatory pressure and the need for robust testing regimes to validate low-emission mobility solutions.

In parallel, Germany celebrated a 3.4% reduction in total greenhouse gas emissions in 2024, reaching 649 million tonnes, driven primarily by expanded renewable energy usage (54% of electricity), though transport and buildings sectors achieved only modest cuts of 1.4% and 2.3%, respectively. Against this backdrop, TIC providers are increasingly tasked with validation of alternative powertrains and eco-efficient technologies, particularly ensuring compliance of electric and hydrogen systems under real-world type-approval testing frameworks. Moreover, the growing prevalence of electric vehicles, EV registrations surged by 35% in the first half of 2025 to 248,726 units, accounting for nearly 18% of new car registrations, further expands demand for rigorous performance, safety, and recycling-oriented testing to align with both EU and German climate neutrality targets.

Competitive Landscape

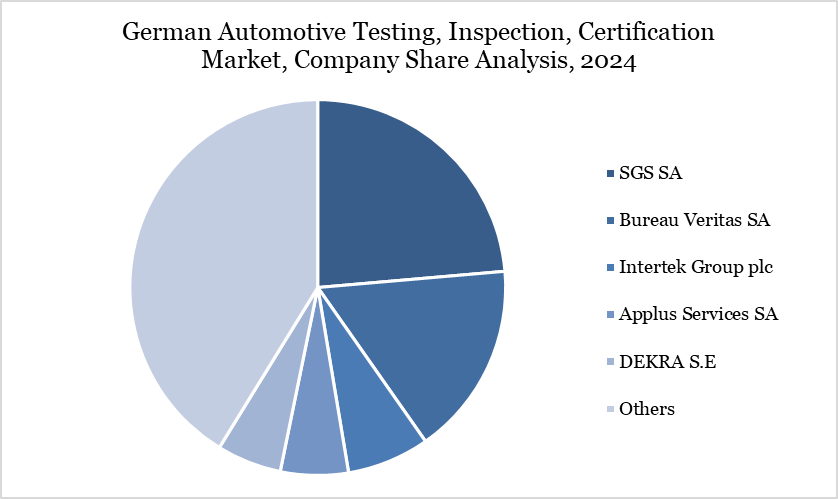

The major players in the market include SGS SA, Bureau Veritas SA, Intertek Group plc, Applus Services SA, UL Solutions Inc., Element Materials Technology Group Ltd., DNV AS, Eurofins Scientific SE, DEKRA SE, and Horiba Europe GmbH.

Key Developments

In May 2024, DEKRA inaugurated a Wi-Fi Alliance Authorized Test Laboratory (ATL) in Stuttgart, Germany, marking the first such facility in this key automotive hub. The lab enables authorized Wi-Fi CERTIFIED testing to ensure product quality, security, interoperability, and compliance with industry standards. Strategically located near major automakers and suppliers, it strengthens support for Germany’s automotive ecosystem. With this addition, DEKRA now operates four Wi-Fi Alliance authorized labs worldwide, alongside those in Spain, China, and Taiwan.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies