Food Grade Citral Market Size

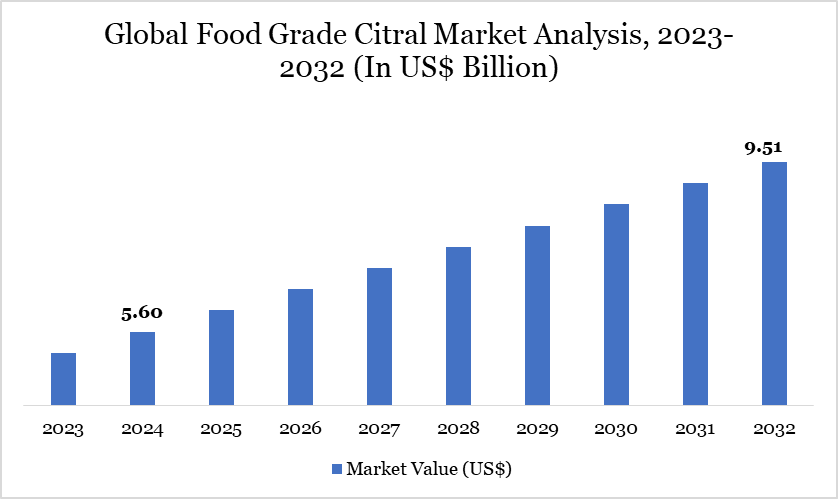

Food Grade Citral Market size reached US$ 5.60 billion in 2024 and is expected to reach US$ 9.51 billion by 2032, growing with a CAGR of 6.85% during the forecast period 2025-2032.

The food grade citral market is expanding steadily due to rising demand for natural flavoring agents in beverages, confectionery, and bakery products. Citral, primarily derived from lemongrass and citrus oils, is recognized by the US FDA as a GRAS (Generally Recognized as Safe) substance, supporting its widespread food use.

Asia-Pacific leads global production due to its agricultural advantages and large-scale operations, with China producing over 12,000 tonnes as of recent data. Companies like BASF and Wanhua Chemical are investing in high-capacity citral plants to meet growing demand and improve production efficiency.

Food Grade Citral Market Trend

A notable trend is the industry's pivot toward sustainable, large-scale citral manufacturing aligned with environmental standards. BASF’s Zhanjiang plant investment aims to enhance green citral production, contributing to its global carbon neutrality targets. Wanhua Chemical launched a 48,000-ton/year citral facility, marking it the world's largest, signaling a scale-focused, eco-efficient shift. These advancements reflect an industry-wide move toward responsible sourcing, scalability, and cleaner production systems.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Nature | Natural, Synthetic |

| By Form | Liquid, Powder |

| By Application | Flavoring Agent, Fragrance, Preservatives, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Food Grade Citral Market Dynamics

Focus on Sustainable Sourcing of Natural Ingredients

As consumers increasingly prioritize sustainability in their purchasing decisions, food manufacturers are turning to sustainably sourced natural ingredients like citral. This trend directly supports the growth of the food grade citral market. The emphasis on reducing the environmental impact of food production is encouraging the use of naturally derived citral from renewable sources like lemongrass or citrus. This push for eco-friendly practices is driving demand in the food grade citral market.

Certifications related to sustainable sourcing and organic production are becoming more influential in the market. Manufacturers using sustainably sourced citral in their products can appeal to environmentally conscious consumers, boosting the food grade citral market. Many companies in the food and beverage industry are adopting sustainability goals, including sourcing natural ingredients like citral from suppliers with responsible farming and production practices. This corporate shift helps drive the food grade citral market.

For instance, on August 30, 2024, Wanhua Chemical announced the launch of its 48,000-ton-per-year citral production facility, making it the world's largest single-unit citral production plant. This development sets a new standard for fostering stable, healthy and sustainable growth in the global aroma industry. Often referred to as the "crown jewel" of fine chemicals, citral is known for its complex production process and rigorous technical requirements.

Environmental Impact of Large-Scale Farming

Large-scale farming of plants like lemongrass or citrus, which are sources of citral, can lead to overexploitation of land and water resources. This environmental strain limits the sustainable production of food grade citral, restraining its market growth. Expanding farming operations to meet the rising demand for natural ingredients can contribute to deforestation and the destruction of ecosystems. This negative environmental impact can slow the adoption of food grade citral, particularly among environmentally conscious consumers and companies, impacting the market.

Intensive farming practices often degrade soil quality, reducing agricultural productivity over time. The unsustainable extraction of natural resources for citral production may hinder long-term availability, restraining the food grade citral market. Large-scale farming contributes to greenhouse gas emissions through deforestation, chemical use and energy consumption. As environmental concerns grow, the negative perception of the ecological footprint associated with large-scale citral farming may limit the market's expansion.

Food Grade Citral Market Segment Analysis

The global food grade citral market is segmented based on nature, form, application and region.

Natural Segment Driving Food Grade Citral Market

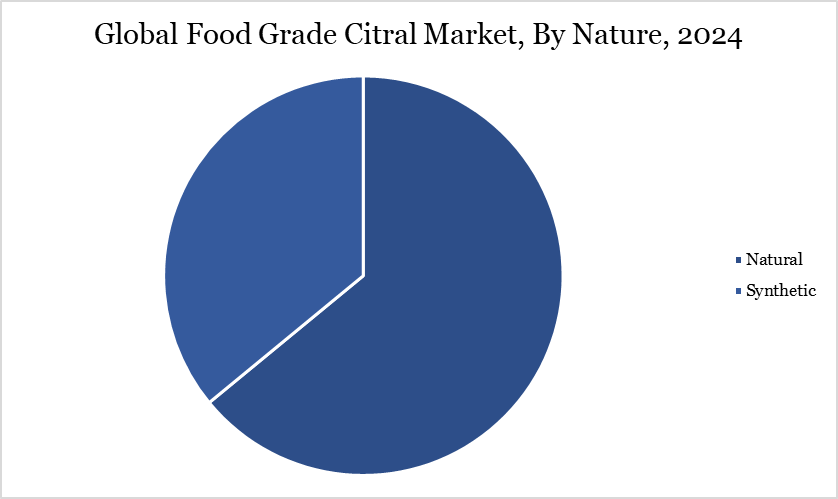

The natural segment is a key driver in the food grade citral market, propelled by escalating consumer demand for clean-label and plant-based ingredients. Natural citral, primarily extracted from lemongrass and citrus peels, aligns with the global shift towards sustainable and transparent food production.

The natural citral segment currently holds the largest share in the global food grade citral market, as manufacturers reformulate products to meet consumer preferences for natural additives. This trend is further supported by regulatory bodies like the US Food and Drug Administration (FDA), which recognizes citral as a Generally Recognized as Safe (GRAS) substance, facilitating its adoption in food applications.

Additionally, advancements in extraction technologies have improved the efficiency and sustainability of natural citral production, reducing environmental impact and production costs. These factors collectively underscore the pivotal role of the natural segment in driving the growth and sustainability of the food grade citral market.

Food Grade Citral Market Geographical Share

Demand for Food Grade Citral in Asia-Pacific

The demand for food grade citral in the Asia-Pacific region is experiencing significant growth, driven by the region's abundant natural resources and expanding food and beverage industry. China's citral production, for instance, was over 12,000 tonnes in 2017, with projections estimating an increase to over 17,600 tonnes by 2022, reflecting a 7% annual growth rate. This surge is attributed to the rapid development of industries such as pharmaceuticals, food, and health care products, which provide a broad market space for citral products.

Additionally, the region's favorable climates support the cultivation of citral-rich plants like lemongrass and citrus, further bolstering production capabilities. The increasing consumer preference for natural and clean-label products in Asia-Pacific is fueling the adoption of food grade citral in various food applications, including beverages, confectionery, and sauces.

Countries in the region are also adopting sustainable agricultural practices, enhancing the production of natural citral while aligning with global sustainability standards. This focus on eco-friendly production methods is driving market growth in Asia-Pacific, positioning the region as a leader in the global food grade citral market.

Sustainability Analysis

The sustainability profile of the food grade citral market is increasingly shaped by regulatory pressure and industry commitments to green chemistry and natural sourcing. According to the US Environmental Protection Agency (EPA) Safer Chemical Ingredients List, citral is classified as a green fragrance ingredient due to its low toxicity and biodegradability, promoting its use in food and beverage applications under safer chemical standards.

Additionally, Merck KGaA has highlighted in its environmental disclosures that it sources key aroma compounds, including citral, from certified renewable raw materials, aligning with its goal of achieving climate neutrality by 2040. These efforts reflect how leading companies and government guidelines are actively encouraging sustainable manufacturing and sourcing of citral in the food sector, supporting cleaner supply chains and lower environmental footprints.

Food Grade Citral Market Major Players

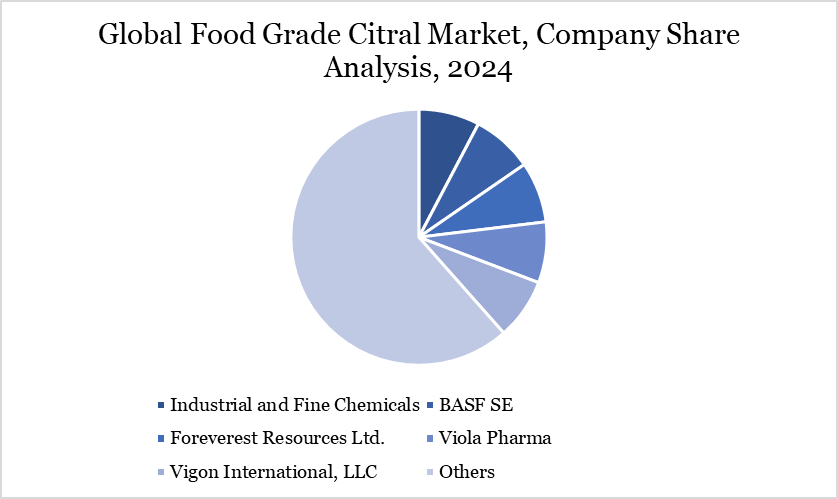

The major global players in the market include BASF SE, Foreverest Resources Ltd., Viola Pharma, Vigon International LLC, KAZIMA, Kelvin Natural Mint Ltd., Kanha Nature Oils, Merck KGaA, and Aurochemicals.

Key Developments

- On August 30, 2024, Wanhua Chemical announced the launch of its 48,000-ton-per-year citral production facility, making it the world's largest single-unit citral production plant. This achievement highlights a major advancement in Wanhua Chemical's independent research and development efforts. Often referred to as the "crown jewel" of fine chemicals, citral is known for its complex production process and rigorous technical requirements.

- On March 7, 2023, BASF announced an investment in a new citral plant at its Verbund site in Zhanjiang, China, alongside the development of menthol and linalool downstream plants at its Ludwigshafen, Germany, Verbund site. These facilities are anticipated to begin operations in 2026. This strategic investment is fueled by rising global flavor and fragrance market demand, reflecting BASF’s strong commitment to sustainability and transformation within the industry.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies