Food Contract Manufacturing & Services Market Size

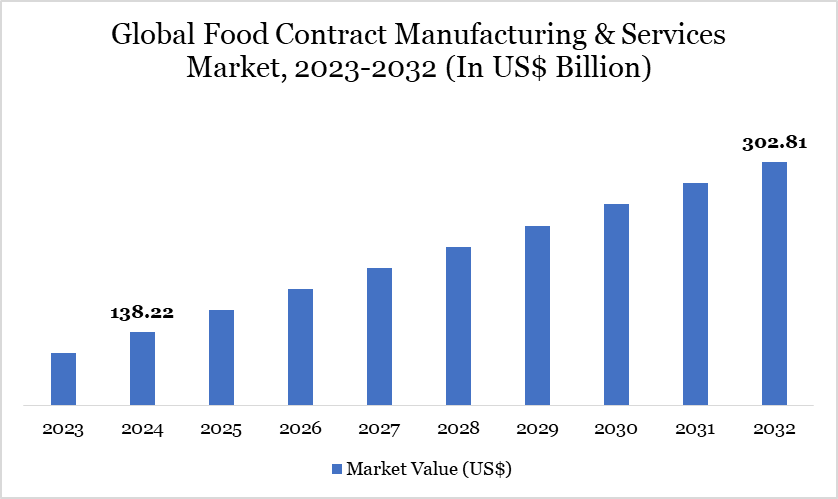

Food Contract Manufacturing & Services Market reached US$ 138.22 billion in 2024 and is expected to reach US$ 302.81 billion by 2032, growing with a CAGR of 10.3% during the forecast period 2025-2032.

The global food contract manufacturing & services market has witnessed significant growth in recent years, driven by increasing demand for outsourced food production to enhance operational efficiency, reduce costs, and allow companies to focus on core competencies such as branding and distribution. This market encompasses a range of services, including formulation, ingredient sourcing, processing, packaging, and even regulatory compliance support.

The growing complexity of food regulations, the rising demand for customized health and wellness products, and the need for rapid product innovation have compelled major food brands to rely on contract manufacturers and service providers. In particular, small- and medium-sized enterprises (SMEs) in the food and beverage sector increasingly depend on contract manufacturing to scale their production without heavy capital investments.

Food Contract Manufacturing & Services Market Trend

The global food contract manufacturing market is growing due to increasing consumer demand for customized, protein-enriched, and health-conscious products. For instance, in March 2025, Arla Foods Ingredients signed a contract with Valley Queen, a South Dakota-based dairy processor, to produce its Nutrilac ProteinBoost whey protein concentrate. This partnership aims to meet the rising demand for protein-enriched dairy while maintaining product quality and taste.

The collaboration will enhance Arla Foods’ production capacity, with production expected to begin in winter 2025/2026 after the installation of specialized equipment at Valley Queen’s Milbank plant. This allows Arla to scale efficiently and meet US market demands for innovative, protein-rich dairy ingredients.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Product Type | Bakery and Confectionery Products, Beverages, Dairy Products, Snacks and Ready-to-Eat (RTE) Foods, Meat, Poultry, and Seafood Products, Sauces, Dressings, and Condiments, Infant Food, Specialty and Functional Foods, Others | |

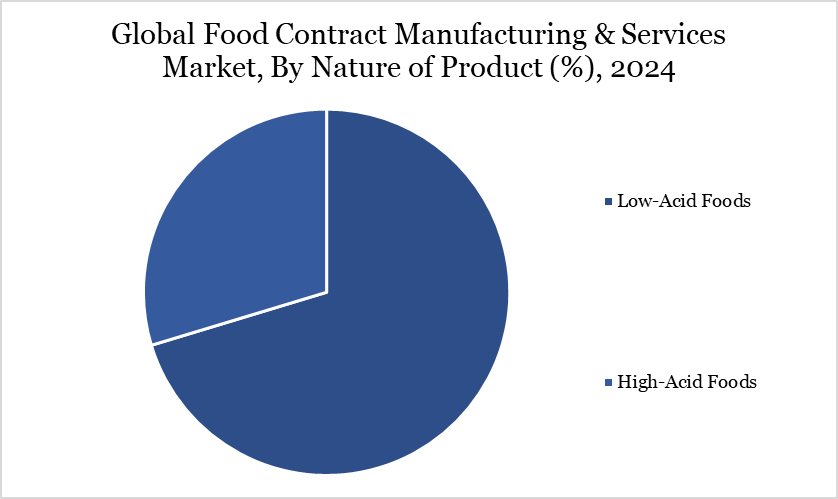

| By Nature of Product | Low-Acid Foods, High-Acid Foods | |

| By Service Type | Manufacturing Services, Product Development and Formulation, Labeling and Branding Support, Supply Chain and Logistics Support, Quality Testing and Regulatory Compliance Support | |

| By Packaging | Bottles, Cans, Pouches, Jars, Cartons | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Food Contract Manufacturing & Services Market Dynamics

Growing Demand for Customized and Specialized Products

The growing demand for customized and specialized products is a primary driver of the US food contract manufacturing market. As consumer preferences shift towards personalized, health-conscious, and innovative foods, brands are increasingly focused on offering unique products that cater to specific tastes and dietary needs. This trend has led to a surge in demand for specialized formulations, including plant-based, organic, gluten-free, high-protein, and functional foods.

To meet these needs efficiently, many companies turn to contract manufacturers who offer the necessary expertise and capabilities without the overhead costs of in-house production. In the US, the clean-label trend has seen significant growth. Consumers are demanding foods and beverages free from artificial additives, preservatives, and GMOs. Companies like Beyond Meat and Impossible Foods have partnered with specialized contract manufacturers to create innovative plant-based products.

Manufacturers such as LiDestri Food and Drink and Berner Food & Beverage are capitalizing on this trend by offering tailored formulation, processing, and packaging solutions that allow brands to scale production quickly while focusing on marketing and distribution.

Loss of Control Over Production

When companies outsource their production to third-party manufacturers, they lose direct oversight of the production process, which can lead to variations in product quality, formulation errors, or deviations from established standards. For food brands, this loss of control can result in inconsistent product batches, which might affect customer satisfaction and brand reputation.

Furthermore, the inability to monitor the entire production chain leaves companies vulnerable to potential issues with food safety and regulatory compliance. If a contract manufacturer fails to adhere to strict safety standards or does not implement proper traceability systems, the brand could face legal liabilities or damage to consumer trust.

Food Contract Manufacturing & Services Market Segment Analysis

The global food contract manufacturing & services market is segmented based on product type, nature of product, service type, packaging and region.

Expanding High-Acid Food Contract Manufacturing Market Driven by Consumer Demand for Shelf-Stable, Clean-Label Products

The high-acid food contract manufacturing market is expanding due to increased consumer demand for convenient, shelf-stable products and the preference for clean-label, health-conscious options. High-acid foods, such as sauces, salsas, and fruit juices, naturally preserve themselves due to their low pH, making them ideal for consumers seeking longer shelf life without artificial preservatives. This trend is supported by advances in food processing technologies like hot-fill and aseptic processing, ensuring product safety and quality.

For instance, in June 2024, Lassonde Industries Inc. acquired Summer Garden Food Manufacturing for US$235 million. Summer Garden, based in Boardman, Ohio, produces premium sauces and condiments under well-known brands such as Gia Russa, Little Italy in the Bronx, and G Hughes. This acquisition aligns with Lassonde’s strategy to diversify its product portfolio and strengthen its presence in the high-acid food market, tapping into the growing consumer demand for premium, shelf-stable foods.

Food Contract Manufacturing & Services Market Geographical Share

North America's Dominance in the Food Contract Manufacturing & Services Market: Driven by Innovation, Consumer Demand, and Strategic Investments

North America dominates the Food Contract Manufacturing & Services market due to a combination of advanced technological infrastructure, a robust food industry, and strong consumer demand for diverse food products. The region benefits from a well-established network of food manufacturers, suppliers, and service providers, making it a global leader in outsourcing food production.

For instance, North America's dominance is the presence of major food brands like Nestlé USA, Coca-Cola, and PepsiCo, which rely heavily on contract manufacturing for the large-scale production of their beverages and snacks. These companies partner with contract manufacturers to optimize production efficiency, reduce costs, and accelerate time-to-market for new products. Moreover, the region’s regulatory environment, which sets strict food safety and quality standards, ensures that manufacturers in North America are equipped to meet both domestic and international demands. Thus, the above factors help to boost the region's growth.

Sustainability Analysis

Sustainability has become a critical factor in the food contract manufacturing & services market, as both consumers and companies increasingly prioritize eco-friendly practices and responsible sourcing. The growing awareness of environmental issues, such as climate change, plastic pollution, and food waste, has led to a surge in demand for sustainable food production processes. Companies are adopting more sustainable manufacturing practices, including the use of renewable energy, minimizing waste through circular production models, and utilizing eco-friendly packaging materials to reduce their environmental footprint.

For example, contract manufacturers are investing in technologies to optimize water and energy usage, reducing carbon emissions in their operations. Additionally, the move toward clean-label products has prompted a shift to sourcing ingredients more sustainably. Contract manufacturers are increasingly working with suppliers who provide organic, non-GMO, and locally sourced ingredients, aligning with consumer preferences for transparency and ethical sourcing.

Food Contract Manufacturing & Services Market Major Players

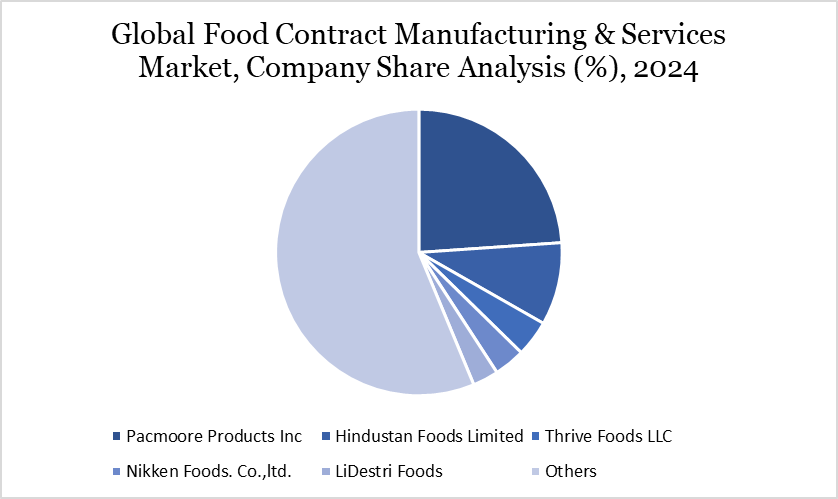

The major global players in the market include Pacmoore Products Inc, Hindustan Foods Limited, Thrive Foods LLC, Nikken Foods. Co.,ltd., LiDestri Foods, Protenergy, Berner Food & Beverage, LLC, SK Food Group, HACO AG, Christy Quality Foods and among others.

Key Developments

- In 2025, Arla Foods Ingredients signed a contract manufacturing agreement with Valley Queen, strengthening its ability to meet the growing demand for protein-enriched dairy in the US. Production of Nutrilac ProteinBoost is expected to begin at Valley Queen’s plant in Milbank, South Dakota, in winter 2025/2026, after new specialty equipment has been installed.

- In 2024, Lassonde Industries Inc, acquired Summer Garden Food Manufacturing for US$235 million. Summer Garden, based in Boardman, Ohio, produces premium sauces and condiments under well-known brands such as Gia Russa, Little Italy in the Bronx, and G Hughes. This acquisition aligns with Lassonde’s strategy to diversify its product portfolio and strengthen its presence in the high-acid food market, tapping into the growing consumer demand for premium, shelf-stable foods.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies