AI in Food Contract Manufacturing Market Size

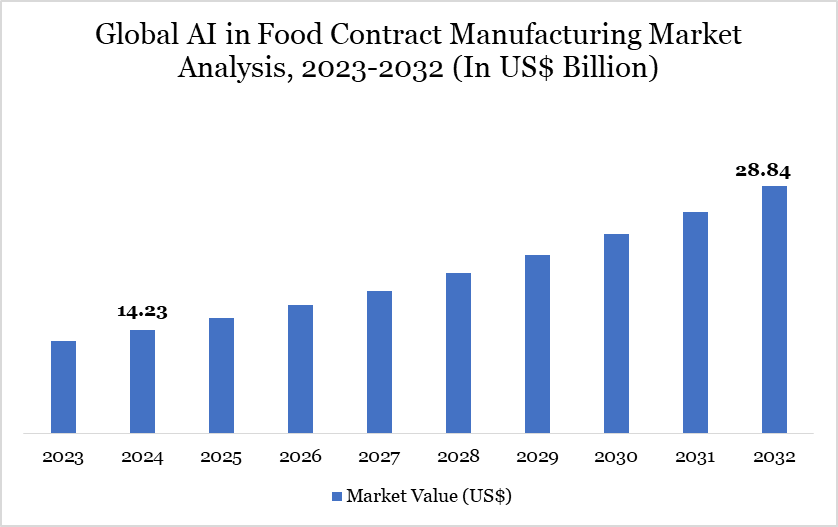

AI in food contract manufacturing market size reached US$ 14.23 billion in 2024 and is expected to reach US$ 28.84 billion by 2032, growing with a CAGR of 9.23% during the forecast period 2025-2032.

Artificial Intelligence (AI) is transforming the food contract manufacturing industry by enhancing processing, packaging, sorting, and shipping to satisfy rising global food demands. AI technologies are optimizing repetitive activities, minimizing human error, and facilitating real-time quality control and safety compliance essential elements in light of increasing regulatory oversight and customer demands.

The integration of IoT, robotics, and big data has expanded AI's function beyond mere automation to strategic business transformation. Predictive analytics effectively forecast demand, so reducing overproduction and waste, especially of perishable goods. The capacity of AI to evaluate extensive datasets facilitates swift new product creation and personalized food solutions aligned with consumer dietary habits. The AI-driven food contract manufacturing sector is experiencing a substantial transformation due to innovations like Rockwell Automation’s 42EA RightSight S18 sensors and SORTEX A GlowVision for PET sorting.

AI in Food Contract Manufacturing Market Trend

Artificial intelligence is propelling various nascent developments in food contract production. Personalization is crucial, as AI facilitates the development of customized food products that correspond to dietary requirements and lifestyle choices. The demand for quick, economical, and accessible food has prompted the implementation of AI in predictive demand forecasting, tailored marketing, and automated retail experiences, including smart shelves and checkout systems.

AI improves traceability and transparency via blockchain, fostering consumer trust. In August 2022, Rockwell Automation introduced small sensors designed for packaging and handling, exemplifying the trend towards downsized, efficient technology in the food and beverage sector. A notable development is the use of chatbots such as Niki.ai and Jio Haptik’s solution with Zoop for IRCTC train meal delivery, underscoring the transition towards intelligent customer care. Over 50% of consumers are inclined to pay a premium for enhanced service (American Express), making AI's contribution to improving brand-consumer connection essential in the competitive food industry.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Deployment Mode | On-Premise, Cloud-Based | |

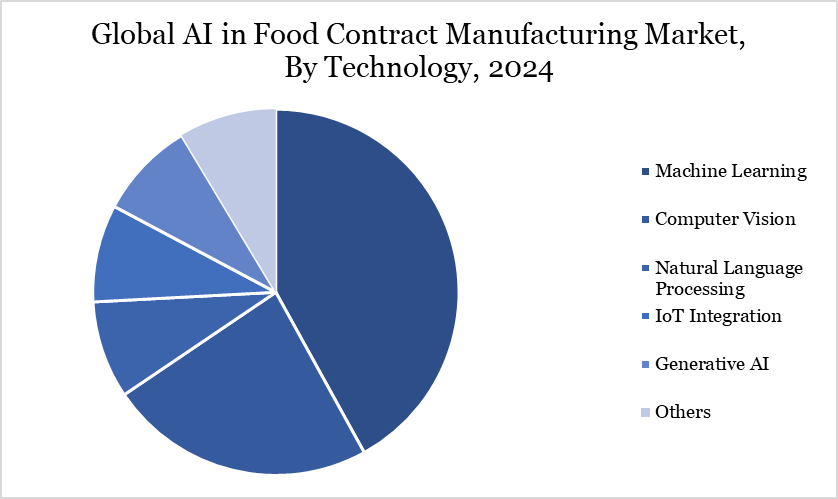

| By Technology | Machine Learning, Computer Vision, Natural Language Processing, IoT Integration, Generative AI, Others | |

| By Application | Quality Control & Inspection, Supply Chain Optimization, Inventory Management, Packaging & Sorting Automation, Food Safety & Compliance, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

AI in Food Contract Manufacturing Market Dynamics

Revolutionizing Food Contract Manufacturing Through AI-Driven Operational Intelligence

Operational efficiency is the principal driving factor for growth in AI-driven food contract manufacturing. Automation mitigates labor shortages and escalating operational expenses by reducing manual involvement in sorting, packing, and processing. Robotics and AI algorithms enhance efficiency, productivity, and accuracy in food processing, minimizing waste. Computer vision and facial/object identification improve food safety compliance by enabling real-time hygiene monitoring.

Predictive maintenance with IoT devices reduces downtime, while AI-driven data accelerates product development cycles and guarantees market-aligned innovation. Strategic investments, exemplified by the Tata Sons Chairman's endorsement of Niki.ai, indicate an increasing faith in AI as a revolutionary entity. The implementation of technology such as SORTEX A GlowVision (introduced in July 2023) enhances material inspection for food safety and diminishes contamination. Moreover, the digitization of supply chains is producing substantial data volumes, which AI analyzes to facilitate flexible, responsive, and sustainable operations, emphasizing its significance as an essential business tool in contemporary food manufacturing.

Scalability and Infrastructure Gaps Hindering AI Integration in Food Manufacturing

Numerous small and medium-sized manufacturers lack the necessary technological infrastructure and financial resources for AI implementation, encompassing data analytics platforms, sensors, machine learning models, and qualified workers. Inconsistent feedstock in food processing challenges AI training and deployment, particularly for activities necessitating regularity, such as sorting and grading. While automation can diminish reliance on labor, the initial capital investment is frequently excessive.

Only firms with strong data ecosystems can effectively utilize AI for predictive modeling and product development, while others must depend on third-party providers with established skills and pricing. The intricacy of merging AI with legacy systems and adhering to rigorous food safety rules adds further limitations. Scalability presents a significant challenge, obstructing comprehensive sector transformation despite the demonstrated long-term advantages of AI.

AI in Food Contract Manufacturing Market Segment Analysis

The global AI in food contract manufacturing market is segmented based on deployment mode, technology, application and region.

AI and Machine Learning Transformations in Food Contract Manufacturing

Machine learning (ML) technologies are transforming AI applications in food contract production, enhancing efficiency and sustainability. Machine learning algorithms, such as regression models and neural networks, examine extensive datasets by integrating past sales data, market trends, and external factors like weather and vacations. This enables enterprises to make data-informed decisions, revealing significant insights into customer demand trends. Predictive analytics instruments, like autoregressive integrated moving average (ARIMA) and long short-term memory (LSTM) models, permit real-time production modifications to address demand variations.

Moreover, sophisticated optimization methods, such as genetic algorithms and gradient descent, enhance inventory management and reduce waste, hence maximizing resource allocation and profitability. AI-driven precision farming systems in crop management utilize soil sensors, drones, and meteorological data to deliver actionable information regarding soil health and pest control. AI systems, combined with IoT sensors and RFID tags, oversee post-harvest management by monitoring storage and processing conditions. They employ deep learning models to anticipate failures and avert rotting, so ensuring high-quality food production with low loss.

AI in Food Contract Manufacturing Market Geographical Share

Technological Prowess and Compliance Shape AI Growth in North America's Food Sector

North America dominates the global AI in food contract manufacturing market, propelled by early technology adoption, substantial R&D expenditure, and a significant customer base with changing food preferences. The US market is undergoing swift expansion owing to technological preeminence and significant investments in AI research and infrastructure.

US-based enterprises and startups are leading in the development of solutions that enhance food quality, guarantee compliance, and elevate customer experiences. Artificial intelligence enables the automation of compliance reporting, real-time quality assessments, and tailored consumer engagements. In August 2022, Rockwell Automation introduced tiny, economical sensors that exemplify the trend towards scalable, AI-integrated systems.

Artificial intelligence is frequently employed in US retail settings to enhance inventory management, streamline checkout procedures, and provide personalized product suggestions. The interplay between stringent regulatory norms and technological innovation positions North America as a pivotal region for the advancement and implementation of AI in the food and beverage manufacturing industry.

Sustainability Analysis

Artificial intelligence is crucial in promoting sustainability within food contract production. AI use data-driven forecasting to mitigate food overproduction and spoilage, particularly of perishable goods, therefore substantially decreasing waste. AI improves resource efficiency by optimizing energy and water consumption throughout processing and packaging phases. Robotics and intelligent sensors facilitate precise operations that minimize raw material wastage, while real-time monitoring systems avert equipment malfunctions that may result in waste.

The combination of blockchain and AI guarantees complete traceability, hence augmenting transparency and mitigating recall risks. AI-driven compliance technologies anticipate and address food safety concerns before their escalation, hence fostering safer and more sustainable practices. Furthermore, AI enhances supply chain agility, minimizing carbon footprints through the optimization of transportation and storage.

AI in Food Contract Manufacturing Market Major Players

The major global players in the market include ABB, Honeywell International Inc., IBM Corporation, Key Technology, NVIDIA Corporation, Rockwell Automation, Sesotec GmbH, Sight Machine, Siemens, TOMRA Systems ASA.

Key Developments

- In July 2024, Chef Robotics, Inc. launched an AI-driven robot aimed at improving industrial food production and addressing labor shortages. The robot, powered by ChefOS software, aims to boost efficiency and reduce waste in large-scale food manufacturing. It may partially automate processes in a confined location, necessitating minimum resources, and enables humans to collaborate with it, hence diminishing the requirement for production area staff.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies