Flexible OLED Market Size

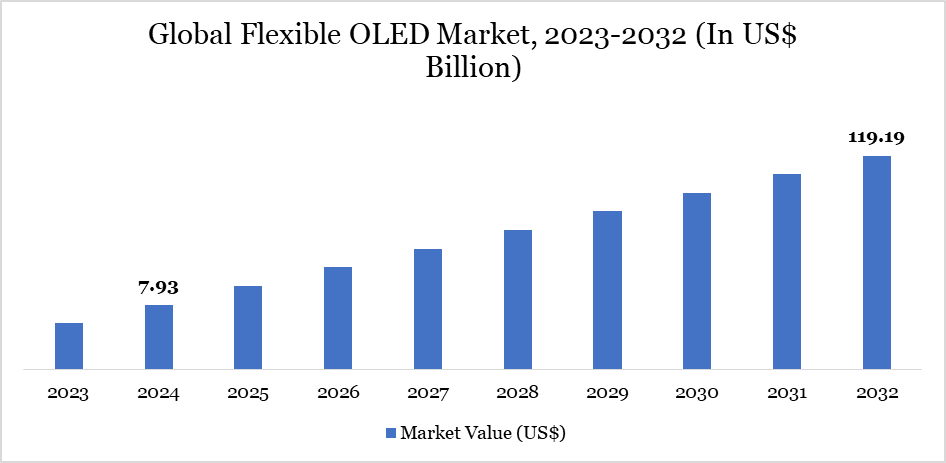

Flexible OLED Market Size reached US$7.93 billion in 2024 and is expected to reach US$119.19 billion by 2032, growing with a CAGR of 40.32% during the forecast period 2025-2032, according to DataM Intelligence report.

OLED is a cutting-edge display substrate that makes it possible to create attractive and energy-conserving displays and light panels. OLEDs are now used in a variety of mobile devices and TVs, and the next generation of such panels will be flexible and malleable. OLEDs are the latest technology innovation in the display market with improved performance and better optical features compared to conventional LED and LCDs.

Flexible OLED Market Trend

One of the most significant trends in the flexible OLED industry across the globe is the use of flexible display substrates in smartphones and tablets. The tech breakthroughs are anticipated to lead to the availability of highly flexible OLED panels, which can smoothly be integrated into flat or curved surfaces. Exhibitions by leading display and lighting companies demonstrate the revolutionary potential of the Substrate, leading to huge investment and accelerating its journey to broader acceptance.

Samsung Display plans to set up a new sixth-generation flexible OLED production line. The new line will replace the current LCD line used for TV manufacturing at SDC's Asan plant. The new fabrication plant will cost approximately US$2.7 billion and have an average monthly production of 30,000 substrates. This would bring Samsung Display's AMOLED manufacturing capacity to 195,000 substrates per month.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

By Technology | AMOLED, PMOLED |

By Substrate | Plastic, Metal Foils, Glass, Others |

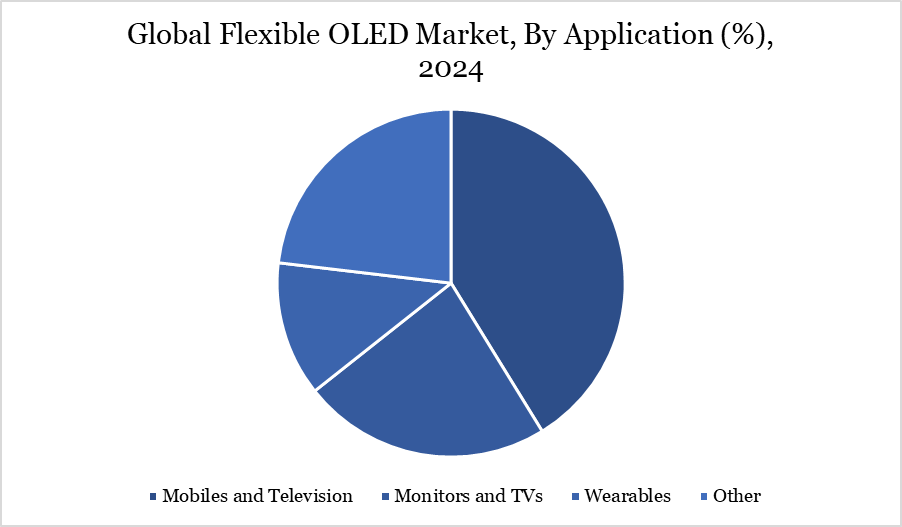

By Application | Mobiles and Television, Monitors and TVs, Wearables, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Flexible OLED Market Dynamics

Rising Demand in Electronics

As the usage of smartphones around the globe has been growing, there has been a tremendous rise in demand for ultra-high display with high-definition. Since Apple and Samsung have already implemented AMOLED display in their flagship models, other companies too are adopting the trend. Flexible OLEDs are being driven by their growing popularity, ongoing research and expanding usage in consumer electronics.

For instance, in January 2025, experts from Korea's SNU, KAIST, and KIMM announced a new lift-off method for flexible OLED displays that focused on graphene features. The GLLO or Graphene Laser Lift Off approach involves putting a single-layer CVD graphene film across a glass substrate and a polyimide sheet. This study holds enormous possibilities in the field of stretchy electronics and wearable technology.

Degradation Challenges

One of the key limitations in the flexible OLED market is the challenges associated with the solvent used in the semiconductor, insulating, and conductive layer deposition process. The use of solvents in the all-solution processable method of fabricating flexible color-tunable electroluminescent devices can lead to unwanted interactions with the underlying layers. The solvent binding to these layers can cause them to expand. The growth negatively impacts the integrity of the multilayer structures and subsequently reduces the performance of the device as a whole.

The risk of layer degradation is particularly cause for concern with flexible OLED technologies, where the integrity of precise, high-fidelity multilayer structures must be maintained for maximum performance. The spread of foundation layers can result in reduced efficiency, stability, and longevity of the device. The interest of the industry in scalable, high-performance flexible OLED systems is severely hindered by a major challenge of managing solvent interactions and structural integrity, preventing widespread acceptance of these technologies.

Flexible OLED Market Segment Analysis

The global flexible OLED market is segmented based on technology, substrate, application and region.

Technological Advancements Driving Mobiles and Television Segment Growth

The worldwide spread of smartphones is quickly driving the demand for ultra-high definition screens. Many companies, such as Apple and Samsung, are using AMOLED screens in their top-of-the-line models and other companies are following suit. However, a flexible OLED has many benefits, especially in mobile phones, such as lighter, thinner and more durable displays than glass-based ones.

There was a great benefit for mobile phone manufacturers since they provided better performance, toughness and lightweight. In May 2022, LG Display Co. Ltd made an announcement for the launch of its future-generation OLED solutions at the 2022 Society for Information Display (SID) in San Jose, California. The products included OLED.EX along with foldable and flexible OLED panels. This is expected to solidify the company's position in the OLED market studied.

Flexible OLED Market Geographical Share

Growth in Disposable Incomes in Asia-Pacific

Asia-Pacific was leading the market, the economies of major countries like India and China are growing, leading to an increase in consumers' disposable incomes. Therefore, moving towards adopting high-end electronic devices like curved televisions and high-end cellphones. As a result, driving the flexible OLED market in the region.

Samsung has announced the development of a flexible OLED screen that may become crucial for upcoming wearable electronics that stick to the skin and fit its curves. Samsung created separate OLED pixels that are ridged and placed on a flexible elastomer substrate to create a flexible screen. A flexible material is used to create connections between the OLEDs as well as between the display and the driver system.

In addition, Chinese companies are quickly setting up large-scale production sites for the production of OLEDs. BOE is setting up a factory for small OLEDs in China's southwestern city of Chongqing. The production line of OLEDs is the largest in one factory in China, producing 115 million panels per year.

Sustainability Analysis

The flexible OLED industry is moving towards greener and more energy-efficient technologies, spurred by increasing demands for stretchable OLEDs (is-OLEDs) and soft electronics. OLEDs have high energy efficiency and rich color representation and as such, they play a crucial role in contemporary display technology. Development from hard to flexible displays has resulted in the advancement of materials, including nanocomposites and intrinsically stretchable polymers, which retain flexibility and enhance device performance.

While great strides have been made in increasing the luminance and stretchability of is-OLEDs, refinement of manufacturing processes and increasing device resolution are challenges that remain. Sustainability in the is-OLED industry also depends on the materials employed in stretching cathode production, such as silver nanowires (AgNWs), graphene and PEDOT: PSS. The materials are flexible but are associated with trade-offs, such as reduced conductivity than in traditional metals and the necessity for complicated, manual lamination processes.

Flexible OLED Market Major Players

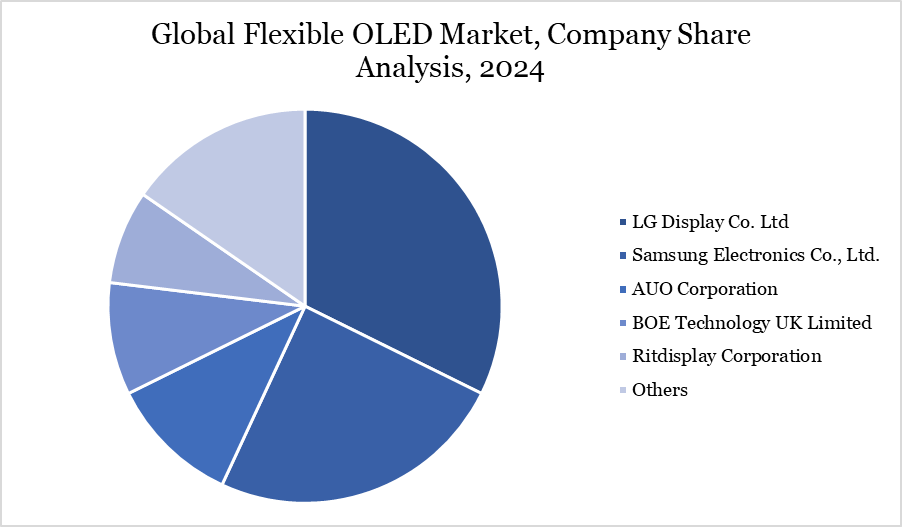

The major global players in the market include LG Display Co. Ltd, Samsung Electronics Co., Ltd., AUO Corporation, BOE Technology UK Limited, Ritdisplay Corporation, Universal Display Corporation, Visionox Company, WiseChip Semiconductor Inc., Royole Corporation and Sony Group Corporation.

Key Developments

In January 2025, Samsung Display unveiled a range of exciting OLED technologies at CES 2025. Highlights were a foldable version, a rollable one, auto screens and next-gen QD-OLED panels. Featured in the lineup was Samsung announcing to flaunt the world's largest foldable OLED: an 18.1-inch panel. For use in IT devices, the groundbreaking display aimed to bring together the functionalities of tablets, laptops and screens.

In August 2024, Samsung Electronics launched a range of Neo QLED, Micro LED, OLED and Lifestyle display collections. The new Lifestyle range display features AI-powered functionalities secured by Samsung Knox.

In January 2024, Sharp NEC has launched a next-gen MultiSync ME Series monitor that has a high haze panel and native USB-C connectivity.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies