Firming Agents Market Size

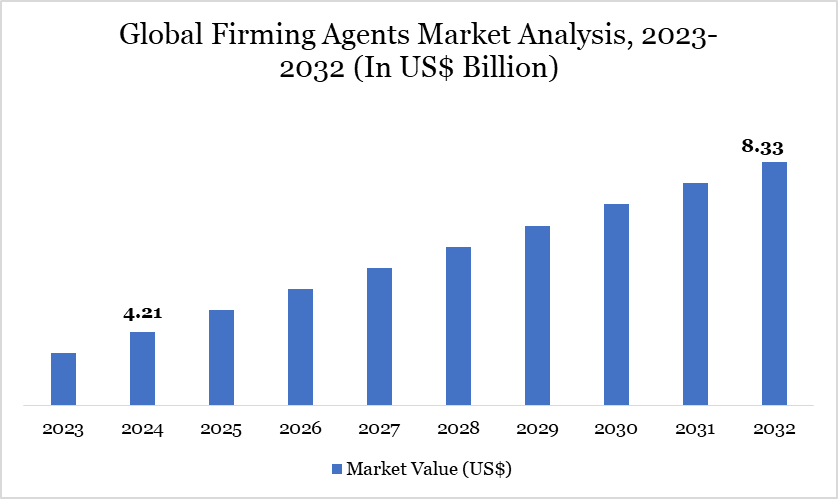

Firming Agents Market Size reached US$ 4.21 billion in 2024 and is expected to reach US$ 8.33 billion by 2032, growing with a CAGR of 8.91% during the forecast period 2025-2032.

The global firming agents market is expanding, driven by increasing demand across sectors like food & beverage, cosmetics, and pharmaceuticals. Firming agents are crucial additives that enhance texture, stability, and shelf life in food products and provide firmness in cosmetic and pharmaceutical formulations.

The adoption of firming agents is further influenced by regulatory frameworks that ensure food and product safety. Agencies such as US Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have set standards to regulate firming agents in food and other products, thereby establishing quality and safety benchmarks. The move towards sustainable and clean-label components is transforming the market, prompting manufacturers to create innovative natural firming agents sourced from plants and minerals.

Asia-Pacific is becoming one of the fastest-growing markets for home healthcare due to the increasing elderly population, adoption of technology and government efforts to decrease hospital congestion. Countries such as Japan, China and India are witnessing a surge in demand for home healthcare services, supported by government policies promoting elderly care at home. Japan, with one of the world's most rapidly aging populations, has seen significant investment in home healthcare technologies.

Firming Agents Market Trend

A notable trend in the firming agents market is the increasing regulatory emphasis on ensuring the safety and quality of these additives in processed fruits and vegetables. In the US, the Food and Drug Administration (FDA) classifies firming agents like calcium chloride and calcium lactate as substances that maintain crispness and firmness in processed produce. These agents are regulated under Title 21 of the Code of Federal Regulations (CFR), which specifies their approved uses and maximum allowable concentrations in food products.

Similarly, in the European Union, the European Food Safety Authority (EFSA) provides scientific advice to support the authorization process of food additives, including firming agents. EFSA's assessments ensure that these substances meet stringent safety standards before being approved for use in the EU market. This regulatory focus underscores the importance of firming agents in maintaining the quality and safety of processed fruits and vegetables, aligning with consumer expectations for high-quality, safe food products.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

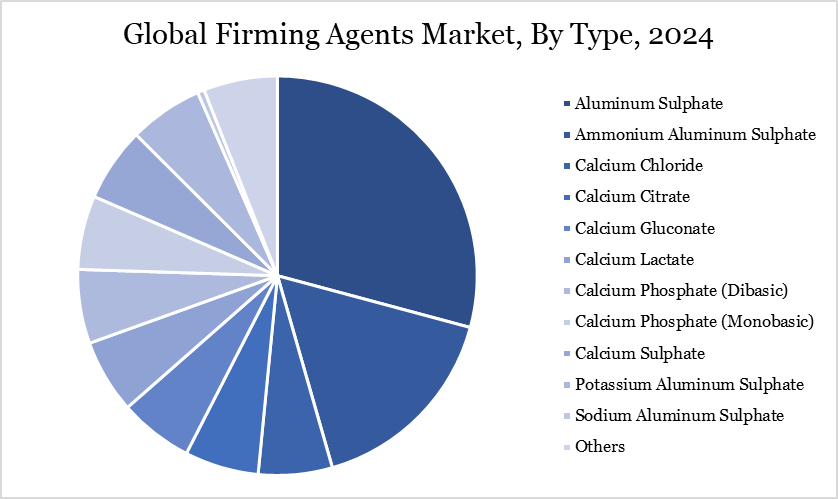

| By Type | Aluminum Sulphate, Ammonium Aluminum Sulphate, Calcium Chloride, Calcium Citrate, Calcium Gluconate, Calcium Lactate, Calcium Phosphate (Dibasic), Calcium Phosphate (Monobasic), Calcium Sulphate, Potassium Aluminum Sulphate, Sodium Aluminum Sulphate, Others |

| By Application | Fruits and Vegetables, Meat and Fish Products, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Firming Agents Market Dynamics

Technological Advancements and Clean-Label Trends

Innovations in firming agents are key growth drivers, particularly with the shift toward clean-label products. Innovative technologies are facilitating the creation of plant-derived and natural firming agents that are equally effective as their synthetic counterparts. The demand for clean-label and sustainable products has prompted manufacturers to focus on plant-derived agents like agar-agar and pectin.

Furthermore, clean label has increased by 25% year-over-year with meat substitutes, baking ingredients and flavoring, dry food and dairy as the leading categories driving the conversation, largely due to consumer preference for transparency in food labeling. Similarly, the World Bank estimates that by 2030, urban populations will make up nearly 60% of the global demographic, amplifying the need for ready-to-consume and preserved foods.

Regulatory Challenges and Costs Fluctuation

Stringent regulations governing food additives, particularly in regions like North America and Europe, present a barrier to market growth. Compliance with food safety standards from agencies like the European Food Safety Authority (EFSA) and the US Food and Drug Administration (FDA) imposes high costs on manufacturers. Additionally, ongoing regulatory updates necessitate frequent adaptations in production processes, driving up operational costs and impacting market expansion.

Furthermore, Fluctuations in the prices of agricultural goods, influenced by climatic conditions and geopolitical tensions, impact the demand and affordability of firming agents used in preserving produce. With rising costs of fruits, vegetables and other perishables, food producers are increasingly cost-sensitive, which can limit the adoption of firming agents and hinder market growth in cost-competitive regions.

Firming Agents Market Segment Analysis

The global firming agents market is segmented based on type, application and region.

Calcium Chloride Segment Driving Firming Agents Market

In 2024, firming agents like calcium chloride continue to be essential in the fruits and vegetables segment, preserving texture, appearance, and shelf life, especially in canned and packaged products. The European Union's agri-food imports reached a record US$ 193.47 billion, with significant contributions from processed fruits and nuts, underscoring the growing demand for long-lasting food products. This surge is particularly notable in regions prioritizing food security and supply chain stability.

In the US, the Food and Drug Administration (FDA) enforces the Produce Safety Rule under the Food Safety Modernization Act (FSMA), establishing science-based standards for the safe growing, harvesting, packing, and holding of fruits and vegetables. Meanwhile, the European Food Safety Authority (EFSA) continues to regulate food improvement agents, ensuring that firming agents used in produce meet stringent safety and quality standards across the European Union. These regulatory frameworks are crucial in maintaining the quality of processed produce, aligning with consumer preferences for ready-to-eat and durable food options.

Firming Agents Market Geographical Share

Demand for Firming Agents in North America

North America leads the firming agent market, largely due to its established food processing industry and stringent food safety regulations. US Food and Drug Administration (FDA) strictly oversees the utilization of firming agents in food items, maintaining elevated levels of safety and quality. This regulatory supervision lays a solid groundwork for market expansion, as it encourages consumer trust and upholds uniformity among processed food products. Additionally, the presence of large food brands in North America creates a sustained market demand.

In Canada, the Canadian Food Inspection Agency (CFIA) oversees firming agents’ use in food manufacturing, setting rigorous safety standards that bolster market expansion. The regulation assists in guaranteeing that firming agents are utilized properly to maintain food texture, aiding in market expansion in both retail and industrial sectors. Together, the FDA and CFIA's comprehensive regulatory frameworks reinforce the quality of processed foods in North America, strengthening the firming agents’ market across the region.

Sustainability Analysis

Sustainability is increasingly becoming a focal point in the firming agent market as companies seek to adopt eco-friendly alternatives that meet environmental standards. The global movement towards reducing carbon emissions has catalyzed a shift towards plant-based and biodegradable firming agents, which are seen as viable solutions to mitigate the environmental impact of food processing.

According to the United Nations, transitioning to natural firming agents could significantly lower greenhouse gas emissions within this sector. In response to rising consumer demand for sustainable practices, firms are also investing in recyclable packaging and implementing green manufacturing processes that aim to reduce their overall ecological footprint. In addition to product innovation, companies are facing heightened scrutiny regarding their sustainability claims, prompting the need for transparency and accountability.

New regulations are being introduced globally to combat greenwashing and ensure that companies substantiate their environmental claims with credible evidence. Such regulations not only promote responsible marketing practices but also encourage firms to enhance their operational efficiencies through sustainable practices. The commitment to sustainability is expected to drive innovation and foster a competitive edge in a market increasingly influenced by environmentally conscious consumers.

Firming Agents Market Major Players

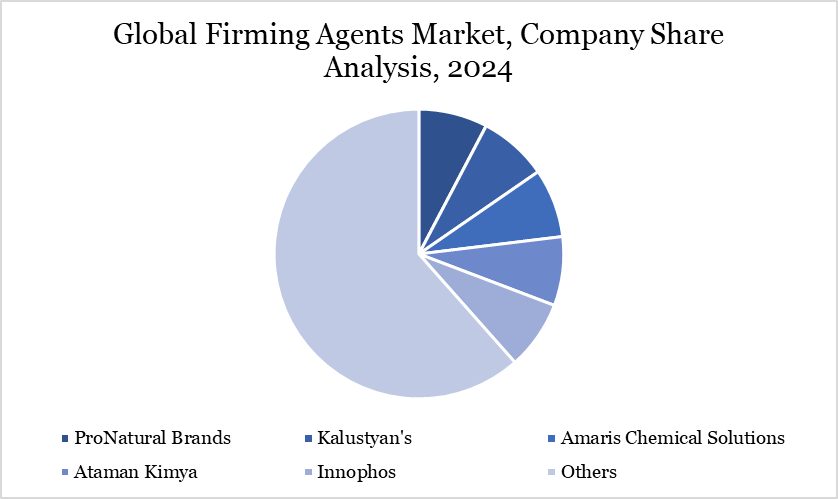

The major global players in the market include ProNatural Brands, Kalustyan's, Amaris Chemical Solutions, Ataman Kimya and Innophos, Food Ingredient Technology Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Liaoyang Fuqiang Food Chemical Co., Ltd., Ronas Chemicals Ind.Co.,Ltd. and Zhejiang Wecan Biotechnology Co., Ltd.

Key Developments

In 2024, ICL produced FruitMag, a novel natural post-harvest citrus firming solution that replaces pesticides. It is an environmentally friendly, natural and healthy firming agent. The bulk of today's citrus fruits are treated with chemical fungicides, which increase shelf life by leaving residues in the fruit. The innovative product produced by ICL paves the way for a better future.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies