Fertility Supplements Market Size & Industry Outlook

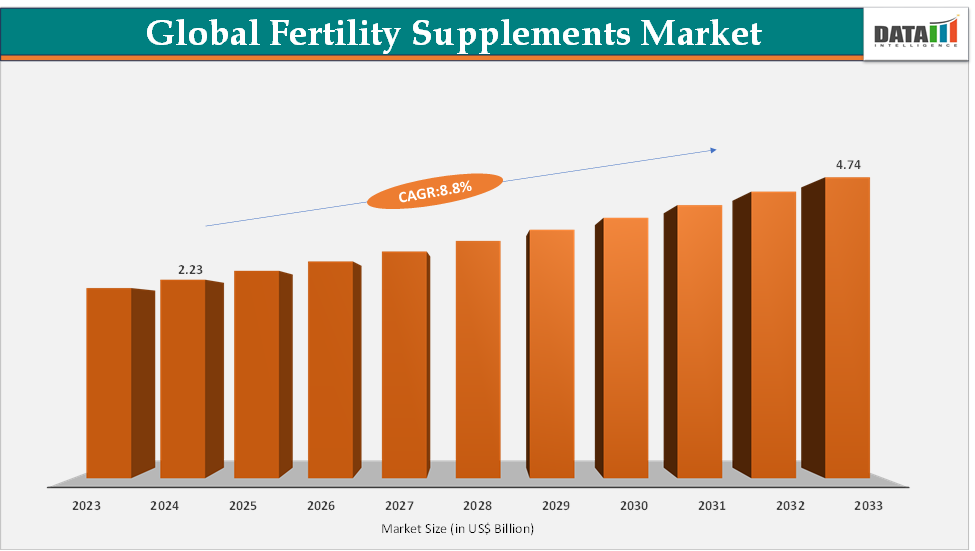

The global fertility supplements market size reached US$ 2.23 Billion in 2024 from US$ 2.06 Billion in 2023 and is expected to reach US$ 4.74 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

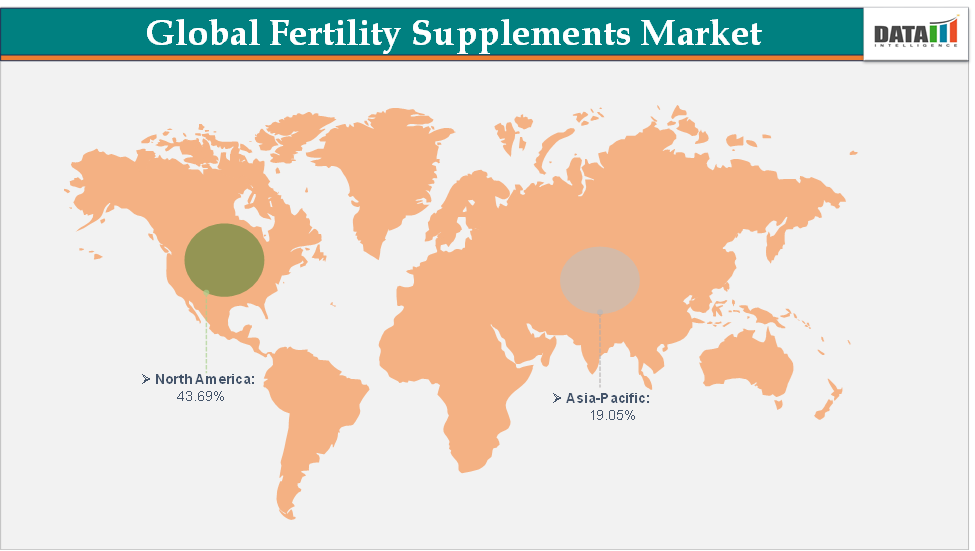

The fertility supplements market is experiencing steady growth, driven by rising infertility rates, lifestyle-related reproductive health challenges, and increasing awareness about preconception care. Demand is driven by both men and women seeking natural and convenient ways to support their reproductive health, with a strong interest in vitamins, minerals, herbal extracts, and probiotics. The growing consumer preference for natural and plant-based products, combined with the influence of e-commerce and direct-to-consumer brands, is reshaping distribution and accelerating adoption. While North America leads in market maturity, emerging markets in the Asia-Pacific are witnessing rapid uptake as awareness and accessibility expand.

Key Market Trends & Insights

Increasing prevalence of infertility due to lifestyle changes (stress, obesity, smoking, alcohol consumption, sedentary habits) is driving demand for fertility supplements. Environmental factors like endocrine disruptors and pollution are also contributing to reproductive health issues. This trend is prompting couples to seek preventive and supportive solutions before opting for medical treatments.

Consumers are increasingly preferring natural, herbal, and clean-label fertility supplements over synthetic alternatives. Popular natural ingredients include maca root, chasteberry, ashwagandha, inositols, omega-3 fatty acids, and probiotics. This aligns with the broader nutraceutical trend where "natural origin" and "organic" claims are seen as safer and more holistic.

Market offerings are becoming more specialized, with clear segmentation into male fertility supplements (sperm motility, count, morphology) and female fertility supplements (ovulation, egg quality, hormone balance). Some companies are also targeting unisex formulations or personalized fertility packs tailored to age, hormonal status, and reproductive goals.

North America dominates the fertility supplements market with the largest revenue share of 43.69% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.9% over the forecast period.

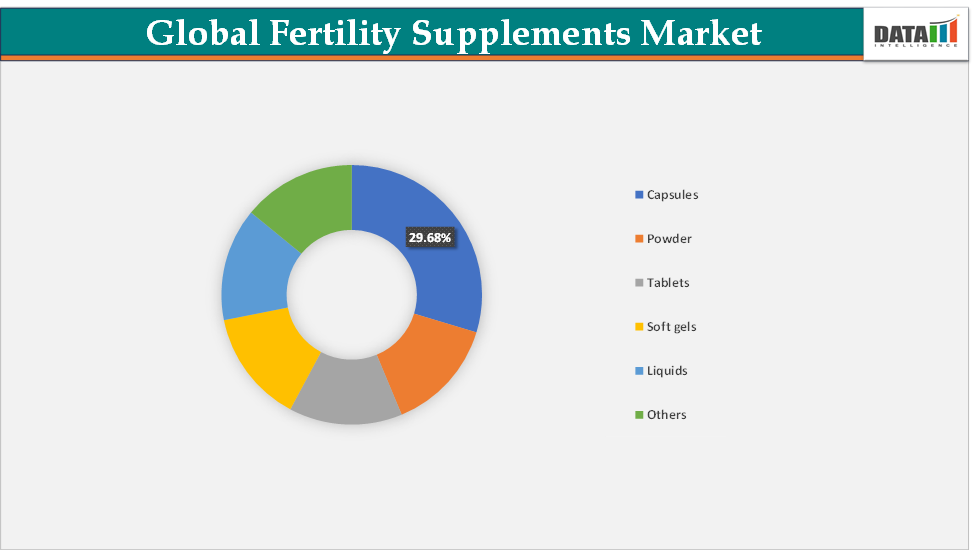

Based on dosage form, the capsules segment led the market with the largest revenue share of 29.68% in 2024.

The major market players in the fertility supplements market are Fairhaven Health, Coast Science, Lenus Pharma, Active Bio Life Science GmbH, Orthomol, Exeltis USA, Inc., Bionova, Ovaterra, Vitabiotics Ltd., and Xena Bio Herbals Pvt. Ltd., among others

Market Size & Forecast

2024 Market Size: US$ 2.23 Billion

2033 Projected Market Size: US$ 4.74 Billion

CAGR (2025–2033): 8.8%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

For more details on this report – Request for Sample

Market Dynamics

Drivers: Lifestyle-linked decline in fertility rates is significantly driving the fertility supplements market growth

The lifestyle-linked decline in fertility rates is one of the most powerful forces fueling growth in the market, as modern habits are increasingly at odds with optimal reproductive health. Rising levels of stress, poor diet, obesity, smoking, alcohol consumption, and prolonged exposure to environmental toxins are all known to negatively impact sperm quality, ovulation, and overall hormonal balance. For instance, studies show that chronic stress can elevate cortisol levels, which in turn disrupts ovulation cycles in women, while obesity and nutrient deficiencies are strongly linked to reduced testosterone levels and lower sperm count in men.

This decline in natural fertility has pushed many couples to look for non-invasive, preventive measures before turning to expensive treatments like IVF, making supplements a convenient first step. Thus, the major and emerging market players are launching fertility supplements, further driving the market growth. For instance, in June 2025, Phytaphix launched an ‘all-in-one’ fertility product designed to support reproductive health in both men and women. Fertility Phix contains 27 key ingredients, including a mix of vitamins, minerals and probiotics with each carefully selected based on the latest clinical evidence.

Specific products have risen in prominence in response to these needs, such as Coenzyme Q10 and antioxidants are widely marketed to combat oxidative stress that damages sperm and egg quality, while myo-inositol and D-chiro-inositol supplements are popular among women with PCOS to help regulate ovulation and restore insulin sensitivity. Similarly, men increasingly turn to L-carnitine, zinc, and selenium supplements to improve sperm motility and morphology, as sperm counts have globally declined over the past few decades due to lifestyle and environmental stressors. Thus, the combination of modern lifestyle-induced fertility declines and consumer demand for accessible, preventive solutions has transformed fertility supplements into an essential part of reproductive wellness, creating strong momentum for continued market expansion.

Restraints: Limited clinical validation & mixed evidence are hampering the growth of the fertility supplements market

One of the major restraints hampering the growth of the market is the limited clinical validation and mixed evidence supporting many products. While certain nutrients such as folic acid, CoQ10, omega-3 fatty acids, zinc, and inositols have credible scientific backing for improving reproductive outcomes, a large portion of herbal and botanical formulations like maca root, ashwagandha, or chasteberry lack large-scale, peer-reviewed clinical trials to confirm their effectiveness. This creates hesitation among healthcare professionals, many of whom are reluctant to recommend supplements without strong data, leaving consumers to rely on online reviews, anecdotal claims, or influencer endorsements.

For instance, women with PCOS are often encouraged to try inositol supplements for ovulation support, but differences in dosage recommendations and inconsistent trial outcomes create uncertainty about real efficacy. Similarly, men’s fertility supplements marketed with L-arginine or herbal blends often promise improved sperm quality, but published evidence remains inconclusive, making them appear more like wellness products than clinically reliable interventions.

These research gaps allow skepticism to grow, especially when some products are marketed with exaggerated “fertility boosting” claims that cannot be substantiated, leading to regulatory pushback in regions like the EU and U.S. FDA warnings against misleading fertility-related marketing. This lack of strong validation not only undermines consumer trust but also limits the ability of brands to secure endorsements from fertility clinics and practitioners, slowing mainstream adoption compared to well-established assisted reproductive technologies like IVF.

Segment Analysis

The fertility supplements market is segmented based on ingredient, dosage form, end-user, distribution channel, and region.

By Dosage Form: The capsules segment is dominating the fertility supplements market with a 29.68% share in 2024

The capsules segment dominates the market primarily due to its convenience, precise dosing, and consumer familiarity, making it the preferred delivery format over tablets, powders, or liquids. Capsules offer better bioavailability and stability of active ingredients such as antioxidants, inositols, vitamins, and herbal extracts, which are often sensitive to environmental factors. Consumers also perceive capsules as easier to swallow and more premium compared to bulky tablets, while softgel capsules allow the inclusion of oil-based ingredients like omega-3 DHA and CoQ10, which are essential for egg and sperm quality.

For women, popular capsule-based products include OvaBoost (Fairhaven Health) and Fertilaid for Women, which blend myo-inositol, CoQ10, and vitamins for ovulation support, while men’s fertility capsules such as Conceive Plus Men’s Fertility Support and Fertilaid for Men combine zinc, L-carnitine, and selenium for improved sperm motility and count. Capsules also align well with subscription models, allowing brands to deliver monthly pill packs tailored for male, female, or couples’ fertility programs, further boosting adherence. With e-commerce growth, capsule supplements are increasingly bundled into fertility kits, reinforcing their dominance. Thus, the capsules segment leads not only because of consumer preference but also due to its versatility in accommodating diverse formulations, its ease of integration into lifestyle routines, and strong representation in recent product innovations.

Geographical Share Analysis

North America is expected to dominate the global fertility supplements market with a 43.69% in 2024

North America remains the dominant region in the market due to a combination of high infertility prevalence, strong consumer awareness, and well-developed distribution networks. Rising infertility rates linked to lifestyle factors such as obesity, delayed pregnancies, and stress have fueled growing demand for preventive fertility solutions in both men and women. The region also benefits from a mature nutraceuticals industry with established players like Fairhaven Health, Coast Science, Lenus Pharma, Exeltis USA, Inc. and others, which consistently introduce evidence-backed formulations.

For instance, Fairhaven Health’s Fertilaid line for both men and women has gained strong traction across U.S. pharmacies and online platforms, while companies like Natalist (backed by Everly Health) have captured millennial consumers with clean-label, capsule-based fertility and prenatal supplements marketed through e-commerce and subscription models. The U.S., in particular, has seen a rise in personalized fertility packs, such as those launched by Bird&Be, offering daily sachets customized for sperm health, egg quality, or preconception wellness.

The Asia Pacific region is the fastest-growing region in the global fertility supplements market, with a CAGR of 8.9% in 2024

The Asia-Pacific region is the fastest-growing market for fertility supplements, driven by rising infertility rates, rapid urbanization, and changing lifestyle patterns that have increased reproductive health challenges. Growing awareness around delayed parenthood, PCOS prevalence, and male infertility is fueling demand for accessible, preventive solutions. Unlike North America, where the market is mature, APAC is witnessing first-time adoption among a large reproductive-age population with rising disposable incomes. Localized product development also plays a key role in India, where brands are increasingly formulating supplements with ayurvedic herbs like shatavari and ashwagandha, while in China and Japan, supplements featuring ginseng and coenzyme Q10 are gaining traction due to the traditional acceptance of herbal medicine.

International players are also expanding in the region such as Vitabiotics has increased its presence in India and Southeast Asia with its Pregnacare and Wellman ranges, while domestic startups like Gynoveda (India) have launched fertility-focused herbal capsules that blend modern science with Ayurveda. The APAC market is further supported by government-led awareness initiatives around reproductive health, creating fertile ground for innovation and adoption. This blend of a large target population, rising health awareness, cultural acceptance of natural remedies, and digital retail growth makes Asia-Pacific the fastest-growing region in the market.

Competitive Landscape

Top companies in the fertility supplements market include Fairhaven Health, Coast Science, Lenus Pharma, Active Bio Life Science GmbH, Orthomol, Exeltis USA, Inc., Bionova, Ovaterra, Vitabiotics Ltd., and Xena Bio Herbals Pvt. Ltd., among others.

Fairhaven Health: Fairhaven Health is a leading player in the market, recognized for its science-backed and gender-specific product portfolio. The company offers popular lines like Fertilaid for Women and Men, OvaBoost, and CountBoost, which address ovulation health, egg quality, and sperm parameters. With strong availability across pharmacies, e-commerce platforms, and fertility clinics, Fairhaven Health has built consumer trust by combining clinically studied ingredients with tailored formulations, positioning itself as a trusted brand for couples on their fertility journey.

Report Scope

Metrics | Details | |

CAGR | 8.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Ingredient | Natural and Synthetic or Blend of Natural & Synthetic |

Dosage Form | Capsules, Powder, Tablets, Soft gels, Liquids and Others | |

End-User | Men and Women | |

Distribution Channel | Retail/Hospital Pharmacies, Specialty & Health-Food Stores, Online Stores and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The market report delivers a detailed analysis with 70 key tables, more than 64 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.