Europe Biosimilars Market Size

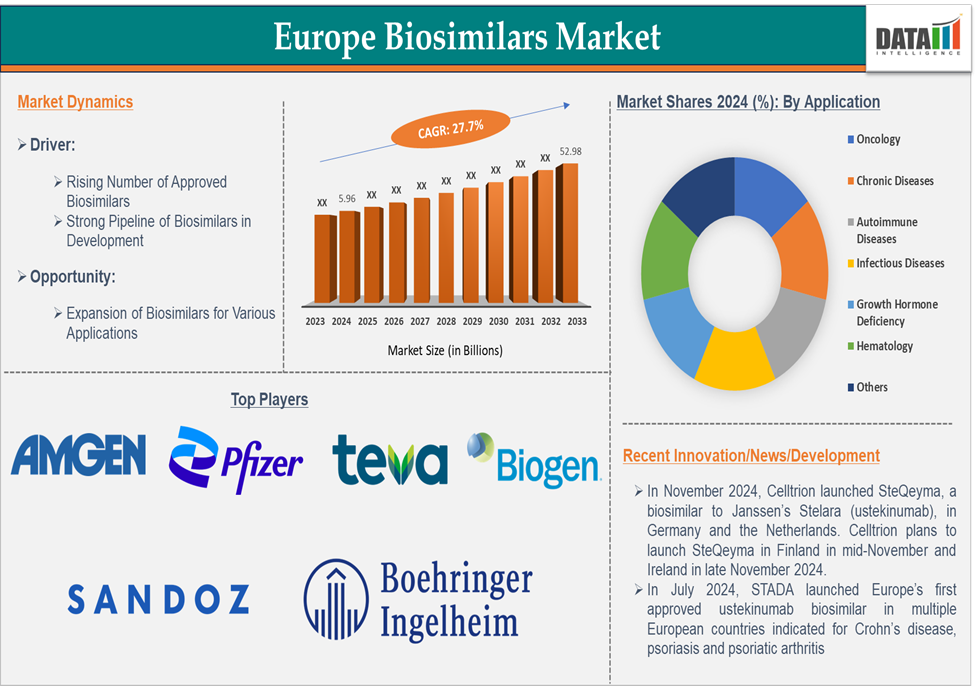

The Europe biosimilars market size reached US$ 5.96 billion in 2024 and is expected to reach US$ 52.98 billion by 2033, growing at a CAGR of 27.7% during the forecast period 2025-2033.

Biosimilars are biologic medical products that are highly similar to an already approved reference biological drug in terms of structure, therapeutic effect, and safety profile but are produced through a different manufacturing process. Unlike generic drugs, which are chemically identical to their reference small-molecule drugs, biosimilars are not exact replicas due to the complexity and variability inherent in biological products. They are intentionally designed to have no clinically meaningful differences from the original biologic, in terms of efficacy, safety, and immunogenicity.

For instance, Humira (adalimumab), a biologic drug used to treat conditions like rheumatoid arthritis and Crohn's disease, has several approved biosimilars, such as Amjevita and Hulio. These biosimilars are designed to be highly similar to Humira, offering patients a more affordable alternative while maintaining the same clinical outcomes.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

The rising number of approved biosimilars significantly driving the Europe biosimilars market growth

The growing portfolio of approved biosimilars across various therapeutic areas such as oncology, autoimmune diseases, and diabetes is providing more affordable alternatives to expensive reference biologics. Biosimilars offer substantial cost savings over reference biologics, which is crucial for healthcare systems in Europe that are under pressure to control costs. Thus, many market players in Europe launching biosimilars, which boosts the biosimilars market growth.

For instance, in January 2025, the European Medicines Agency (EMA) Committee for Medicinal Products for Human Use (CHMP) adopted positive opinions recommending the grant of marketing authorizations for three biosimilar products Amgen’s PAVBLU and SKOJOY, and CuraTeQ Biologics’ DYRUPEG. Additionally, in January 2025, Celltrion launched STEQEYMA, a biosimilar referencing STELARA (ustekinumab), in France. Celltrion launched STEQEYMA in Italy and Spain earlier in January 2025, in the U.K. in December 2024, and in Germany and the Netherlands in November 2024.

Also, in July 2024, STADA and Alvotech launched Uzpruvo, the first approved biosimilar to Stelara in Europe, across a majority of European countries. This includes the largest markets in the region, where pricing and reimbursement approvals have been secured for market entry. The pioneering launch comes immediately upon the expiry of exclusivity rights linked to the European reference molecule patent, offering patients, physicians, and payers expanded access at the earliest possible opportunity to a life-altering medicine used in certain indications within gastroenterology, dermatology, and rheumatology.

The rising number of approved biosimilars in Europe is a powerful driver of the biosimilars market growth, contributing to increased treatment access, lower healthcare costs, enhanced physician confidence, and greater competition in the biologics market. With the expansion of biosimilars in high-demand therapeutic areas like oncology, immunology, and ophthalmology, Europe is poised to continue leading the global biosimilars market, benefiting both healthcare providers and patients.

Physician hesitancy and slow adoption in certain therapeutic areas hamper the biosimilars market growth in Europe

Physicians are often cautious when switching stable patients from a reference biologic to a biosimilar, particularly due to concerns about the long-term safety, immunogenicity, and efficacy of biosimilars. Some biosimilars have only limited clinical experience compared to their reference biologics, leading to skepticism among physicians, particularly in treating chronic conditions or cancer where long-term outcomes are critical.

For instance, Rituximab biosimilars in oncology have been met with slower adoption because, although clinical trials have demonstrated efficacy and safety, the long-term real-world evidence is still limited compared to the reference biologic, Rituxan.

Switching patients from reference biologics to biosimilars can be perceived as a risky strategy by physicians, particularly in patients who are stable on the original drug. The concern is that switching could lead to disease relapse or worsening of symptoms. In Germany, although the use of Infliximab biosimilars (such as Remsima) has increased significantly, many physicians still prefer to maintain patients on Remicade if they have already achieved stable disease control, even though the biosimilar is more cost-effective.

Market Segment Analysis

The Europe biosimilars market is segmented based on product type and application.

Application:

The oncology segment is expected to dominate the Europe biosimilars market with the highest market share

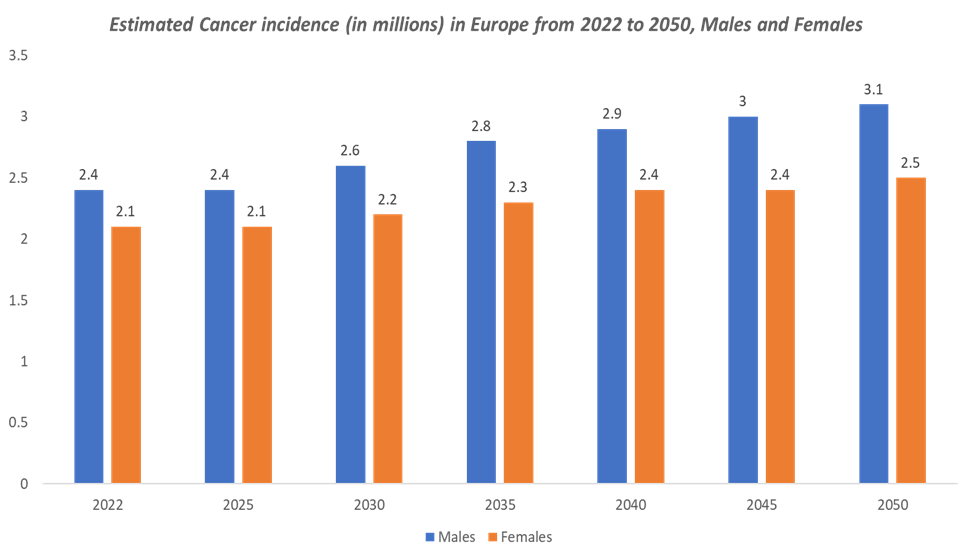

The increasing cancer incidence in Europe, coupled with the rising demand for biological therapies, has created a large and growing patient population in need of affordable treatment options. As the incidence of various cancers rises in Europe, the need for cost-effective cancer treatments, including biosimilars, becomes even more critical.

Cancer treatments account for a significant portion of healthcare expenditure in Europe. Biologic therapies, such as monoclonal antibodies (mAbs), have been central to treating cancers like breast cancer, non-small cell lung cancer, colorectal cancer, and lymphomas. The major players and emerging players in Europe focusing on the launch of cancer biosimilars, which accelerating the oncology segment in Europe.

For instance, in September 2024, Intas Pharmaceuticals Limited announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has issued a positive opinion recommending approval of HETRONIFLY (serplulimab, approved as HANSIZHUANG in China), in European markets. Serplulimab, a recombinant humanized anti-PD-1 monoclonal antibody (mAb) injection, is the first innovative monoclonal antibody developed by Henlius. It has been granted orphan drug status designation by the European Commission (EC) for the treatment of Small Cell Lung Cancer (SCLC).

Several biosimilars for key oncology biologics have gained approval and are seeing significant market uptake in Europe. Trastuzumab biosimilars (e.g., Kanjinti, Ontruzant, Herzuma), Bevacizumab biosimilars (e.g., Mvasi, Zirabev), and Rituximab biosimilars (e.g., Truxima) are widely used in treating different cancers.

Europe Biosimilar Companies

Top Europe biosimilar companies includes Amgen Inc., Pfizer Inc., Sandoz Group AG, Teva Pharmaceuticals Inc., Biogen, Biocon Biologics Inc., Boehringer Ingelheim International GmbH, Samsung Biologics, Dr. Reddy’s Laboratories Ltd., Fresenius Kabi AG and among others.

Market Scope

| Metrics | Details | |

| CAGR | 27.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Monoclonal Antibodies, Recombinant Human Growth Hormone (rhGH), Insulin, Anti-coagulants, Erythropoietin, Granulocyte Colony Stimulating Factor, Follitropin, Interferons and Others |

| Application | Oncology, Chronic Diseases, Autoimmune Diseases, Infectious Diseases, Growth Hormone Deficiency, Hematology and Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Europe biosimilars market report delivers a detailed analysis with 36 key tables, more than 31 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.